India Extended Warranty Market Size, Share, Trends and Forecast by Coverage, Application, Distribution Channel, End User, and Region, 2026-2034

India Extended Warranty Market Summary:

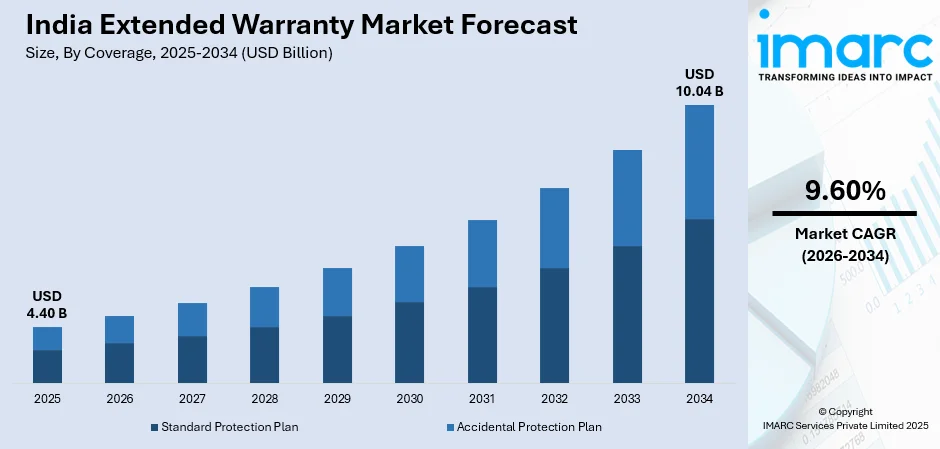

The India extended warranty market size was valued at USD 4.40 Billion in 2025 and is projected to reach USD 10.04 Billion by 2034, growing at a compound annual growth rate of 9.60% from 2026-2034.

The India extended warranty market is experiencing strong expansion driven by increasing consumer awareness regarding product protection and rising adoption of high-value electronics, automobiles, and home appliances. Growing preferences for hassle-free post-purchase experiences, digital claims processing advancements, and expanding e-commerce penetration are strengthening market dynamics. Enhanced warranty coverage offerings and value-added services continue to attract customers seeking comprehensive asset protection.

Key Takeaways and Insights:

- By Coverage: Standard protection plan dominates the market with a share of 61% in 2025, owing to its comprehensive coverage for mechanical and electrical failures, cost-effectiveness compared to accidental plans, and widespread applicability across consumer electronics and automobiles. Rising consumer preference for basic protection options fuels segment growth.

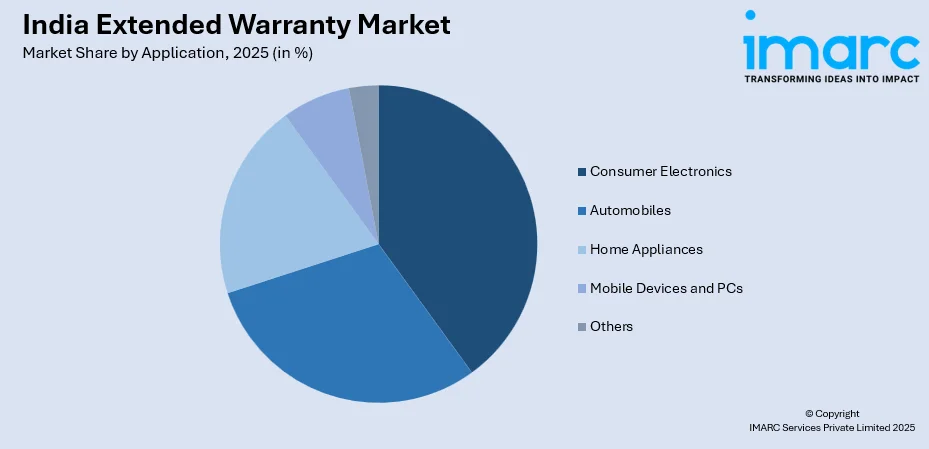

- By Application: Consumer electronics lead the market with a share of 29% in 2025. This dominance is driven by the proliferation of smartphones, tablets, laptops, and wearable devices requiring extended protection beyond manufacturer warranties. Increasing premiumization trends and rising repair costs strengthen segment expansion.

- By Distribution Channel: Manufacturers represent the biggest segment with a market share of 46% in 2025, reflecting strong OEM-driven warranty programs that build customer trust and brand loyalty. Direct manufacturer involvement ensures authentic spare parts availability, standardized service quality, and seamless claim processing experiences.

- By End User: Individuals exhibit a clear dominance in the market with 70% share in 2025, driven by rising disposable incomes enabling household investments in protected electronics and appliances. Growing awareness regarding warranty benefits and desire for financial security against unexpected repairs accelerate individual adoption.

- By Region: North India is the largest region with 33% share in 2025, driven by the concentration of technology hubs, higher consumer purchasing power in metropolitan areas like Delhi-NCR, and robust retail networks promoting extended warranty uptake across electronics and automobile segments.

- Key Players: Key players drive the India extended warranty market by expanding coverage portfolios, improving digital claims processing technologies, and strengthening nationwide service networks. Their investments in AI-powered platforms, strategic partnerships with e-commerce channels, and innovative warranty-as-a-service models boost awareness, accelerate adoption, and ensure consistent service delivery.

To get more information on this market Request Sample

The India extended warranty market is advancing rapidly as manufacturers, retailers, and third-party providers recognize the growing consumer demand for comprehensive post-purchase protection services. Rising ownership of high-value products including smartphones, automobiles, and smart home appliances is creating substantial opportunities for warranty service expansion. The increasing complexity of modern electronic devices, coupled with escalating repair costs, motivates consumers to invest in extended protection plans that mitigate unexpected financial burdens. The expanding base of premium electronics and vehicles across urban and semi-urban regions demonstrates growing demand for comprehensive warranty coverage. Digital transformation initiatives across the warranty ecosystem are enhancing customer experiences through online registration, real-time claim tracking, and AI-powered chatbots for faster resolutions. Additionally, the growing middle-class population with rising disposable incomes is increasingly prioritizing asset protection. Strategic collaborations between warranty providers and e-commerce platforms are expanding market reach while enabling convenient point-of-purchase warranty additions for customers seeking hassle-free protection solutions.

India Extended Warranty Market Trends:

Digital Transformation of Warranty Claims Processing

The India extended warranty market growth is being propelled by rapid digitization of warranty management systems and claims processing platforms. Providers are increasingly adopting AI-powered solutions, mobile applications, and QR-based registration systems to streamline customer onboarding and reduce claim settlement times. These technological advancements enable real-time status tracking, automated eligibility verification, and personalized service recommendations, significantly enhancing customer satisfaction and operational efficiency across the warranty ecosystem. Digital platforms also facilitate faster communication between customers and service providers, reducing resolution timeframes. The shift towards paperless warranty documentation and cloud-based management systems further improves accessibility and record-keeping for consumers.

Growing Emphasis on Accidental Damage Protection Coverage

Consumer preferences are increasingly shifting towards accidental damage protection plans that extend beyond traditional mechanical and electrical failure coverage. Modern lifestyles involving frequent device handling, travel, and outdoor usage elevate risks of drops, spills, and physical damage to smartphones, laptops, and portable electronics. Warranty providers are responding by developing comprehensive accidental protection offerings covering cracked screens, liquid damage, and impact-related failures. This trend reflects changing consumer expectations for holistic protection addressing real-world usage scenarios rather than limited defect-only coverage. Younger demographics particularly favor accidental protection plans, recognizing their value for expensive portable devices susceptible to everyday mishaps and handling incidents.

Rising Adoption of Brand-Authorized Warranty Programs

Consumers are increasingly preferring brand-authorized extended warranty programs that guarantee authentic spare parts and standardized service quality. Manufacturers are responding by launching comprehensive warranty offerings directly or through strategic partnerships with service aggregator platforms. In January 2023, Voltas partnered with OneDios to roll out a nationwide extended warranty program, enabling customers to purchase brand-backed warranties through the application and retailer networks. These brand-first approaches provide customers enhanced peace of mind while ensuring consistent service delivery and genuine component availability across India.

Market Outlook 2026-2034:

The India extended warranty market is poised for sustained expansion as consumer awareness regarding product protection benefits continues rising across urban and semi-urban regions. Increasing adoption of premium electronics, smart home appliances, and high-value automobiles creates substantial demand for comprehensive warranty coverage. The market generated a revenue of USD 4.40 Billion in 2025 and is projected to reach a revenue of USD 10.04 Billion by 2034, growing at a compound annual growth rate of 9.60% from 2026-2034. Technological innovations including AI-driven claims processing, blockchain-enabled fraud prevention, and IoT-integrated predictive maintenance are transforming service delivery models. Strategic partnerships between manufacturers, retailers, and third-party providers are expanding market accessibility while enhancing customer experiences through digital platforms and streamlined service networks.

India Extended Warranty Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Coverage |

Standard Protection Plan |

61% |

|

Application |

Consumer Electronics |

29% |

|

Distribution Channel |

Manufacturers |

46% |

|

End User |

Individuals |

70% |

|

Region |

North India |

33% |

Coverage Insights:

- Standard Protection Plan

- Accidental Protection Plan

Standard protection plan dominates with a market share of 61% of the total India extended warranty market in 2025.

Standard protection plans have emerged as the preferred choice among Indian consumers seeking comprehensive coverage for their high-value products. These plans typically cover mechanical and electrical failures, component defects, and functional breakdowns that occur after manufacturer warranty expiration, providing essential financial protection against unexpected repair costs. The widespread adoption of consumer electronics and home appliances requiring basic defect coverage continues driving demand for standard protection offerings that address common product failures without complex exclusions or conditions.

The widespread preference for standard protection plans stems from their cost-effectiveness and broad applicability across product categories including automobiles, consumer electronics, and home appliances. These plans offer predictable coverage terms, straightforward claim processes, and comprehensive protection without premium pricing associated with accidental damage coverage. Consumers increasingly recognize standard plans as prudent investments that extend product lifecycles while minimizing out-of-pocket expenses for repairs, strengthening sustained demand across India's warranty market. Furthermore, transparent policy terms and simplified documentation requirements enhance consumer confidence in standard protection offerings compared to complex specialized coverage alternatives.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automobiles

- Consumer Electronics

- Home Appliances

- Mobile Devices and PCs

- Others

Consumer electronics lead with a share of 29% of the total India extended warranty market in 2025.

Consumer electronics represents the fastest-growing application segment in India's extended warranty market, driven by increasing penetration of smartphones, tablets, laptops, televisions, and wearable devices across urban and semi-urban regions. The rising average selling prices of premium devices combined with escalating repair costs motivate consumers to seek extended protection beyond manufacturer warranty periods. The ongoing premiumization trend across consumer electronics elevates device values, making warranty coverage increasingly attractive for consumers seeking to protect substantial investments in sophisticated gadgets and smart devices.

The consumer electronics segment benefits from strong e-commerce integration enabling seamless warranty purchases at checkout and growing consumer awareness about protection benefits for expensive gadgets. Technological complexity of modern electronics including advanced displays, sophisticated processors, and integrated sensors increases vulnerability to failures beyond manufacturer coverage periods. Warranty providers are responding with tailored plans covering specific component failures, software issues, and hardware malfunctions, ensuring comprehensive protection that addresses evolving consumer needs across India's electronics market. Additionally, shorter product replacement cycles encourage consumers to maximize device longevity through extended coverage options.

Distribution Channel Insights:

- Manufacturers

- Retailers

- Others

Manufacturers exhibit a clear dominance with a 46% share of the total India extended warranty market in 2025.

Manufacturers maintain leadership in India's extended warranty distribution landscape by leveraging established customer relationships, authorized service networks, and brand trust built through quality products. OEM-provided warranties ensure access to genuine spare parts, trained technicians, and standardized service protocols that third-party providers cannot fully replicate. In July 2024, Maruti Suzuki enhanced its warranty programmes, extending standard coverage to 3 years or 100,000 kilometers and introducing extended warranty options covering vehicles up to 6 years, demonstrating manufacturer commitment to comprehensive protection offerings.

The manufacturer-led distribution channel benefits from integrated sales processes where extended warranties are offered during initial product purchase, achieving higher attachment rates than post-purchase approaches. Direct manufacturer involvement enables seamless warranty activation, efficient claim handling, and consistent service delivery across authorized service centers nationwide. Manufacturers also leverage their extensive dealership networks to educate customers about warranty benefits at point of sale. This channel's dominance reflects consumer preference for brand-backed assurances that guarantee authentic repairs, maintain product value throughout extended coverage periods, and provide peace of mind through reliable after-sales support.

End User Insights:

- Individuals

- Business

Individuals represent the leading segment with a 70% share of the total India extended warranty market in 2025.

Individual consumers constitute the primary demand driver for extended warranty services in India, motivated by desires to protect personal investments in automobiles, smartphones, home appliances, and consumer electronics. Rising disposable incomes across the expanding middle class enable household spending on protection plans that provide financial security against unexpected repair expenses. The growing vehicle ownership base across urban and semi-urban regions, combined with increasing adoption of premium electronics and smart home devices, creates substantial demand for comprehensive warranty coverage among individual buyers seeking to safeguard valuable assets.

The individual segment benefits from growing awareness regarding extended warranty advantages including cost predictability, convenience of authorized service access, and asset value preservation. Changing consumer attitudes increasingly view warranty purchases as prudent financial decisions rather than unnecessary expenses. Digital platforms and e-commerce integration have simplified warranty discovery and purchase processes, enabling individual consumers to conveniently add protection during online shopping experiences, further accelerating adoption rates across demographics. Additionally, nuclear family structures and dual-income households prioritize hassle-free maintenance solutions that extended warranties provide.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India dominates the market with a 33% share of the total India extended warranty market in 2025.

North India commands the largest regional share driven by Delhi-NCR's concentration of technology hubs, higher consumer purchasing power, and robust retail infrastructure promoting extended warranty adoption. The region benefits from dense population centers, established electronics markets like Nehru Place, and strong presence of authorized service networks. Northern states including Punjab, Haryana, and Uttar Pradesh demonstrate growing demand for automobile and appliance warranties as urbanization accelerates and middle-class households expand. Premium and mid-economy appliances dominate metropolitan areas while affordable options find traction in smaller cities.

The region's leadership position reflects strong automotive sales, with passenger vehicle demand remaining robust across Delhi-NCR metropolitan areas where extended warranty programs from manufacturers like Maruti Suzuki and Hyundai find substantial uptake. Consumer electronics warranty demand is equally strong, supported by technology-savvy populations seeking protection for smartphones and computing devices. Additionally, seasonal temperature extremes drive air conditioner and refrigerator adoption, expanding the addressable market for home appliance extended warranties across North India.

Market Dynamics:

Growth Drivers:

Why is the India Extended Warranty Market Growing?

Rising Adoption of High-Value Consumer Electronics and Smartphones

The accelerating adoption of premium smartphones, tablets, laptops, and smart devices across India is significantly driving extended warranty market expansion. Consumers investing in expensive electronics increasingly recognize the value of extended protection against mechanical failures, software issues, and component defects beyond manufacturer warranty periods. The ongoing premiumization trend across consumer electronics elevates average device values, making extended warranties more economically attractive for consumers seeking to protect substantial investments. Rising repair costs for sophisticated components including advanced displays, processors, and integrated circuits further motivate warranty purchases. The growing penetration of next-generation smartphones and advanced wearables expands the addressable market for comprehensive warranty coverage. Additionally, increasing consumer awareness regarding protection benefits and desire for hassle-free post-purchase experiences strengthen demand across India's technology-conscious consumer base seeking financial security against unexpected device failures.

Expanding Automobile Sales and Extended Vehicle Ownership

India's robust automobile market growth is creating substantial demand for extended warranty services as consumers seek protection against costly vehicle repairs and maintenance. Rising vehicle complexity with advanced electronics, infotainment systems, and sophisticated powertrain components increases potential repair expenses, motivating warranty purchases. The expanding vehicle ownership base across urban and semi-urban regions creates sustained opportunities for extended warranty providers seeking market penetration. Modern automobiles incorporate numerous sensors, computerized systems, and precision-engineered components that require specialized expertise and genuine parts for repairs, making manufacturer-backed warranties increasingly valuable. Additionally, growing preference for pre-owned vehicles among cost-conscious buyers drives demand for certified warranty programs that provide assurance regarding vehicle condition and after-sales support. Extended warranty coverage helps maintain vehicle resale values while offering peace of mind to owners concerned about unexpected mechanical breakdowns and expensive component replacements.

Digital Transformation and E-Commerce Integration of Warranty Services

The rapid digitization of warranty services and seamless integration with e-commerce platforms is transforming consumer accessibility and driving market growth across India. Online marketplaces are embedding extended warranty options during checkout processes, enabling convenient point-of-purchase protection additions that increase attachment rates. Digital platforms simplify warranty registration, claims filing, and status tracking through mobile applications and web portals. Technological innovations including AI-powered claims processing, automated eligibility verification, and chatbot-assisted customer support reduce administrative burdens, accelerate claim settlements, and enhance customer experiences. The growing preference for online shopping, particularly among younger demographics, creates opportunities for warranty providers to reach tech-savvy consumers through digital channels. Mobile-first approaches enable customers to manage warranties conveniently from smartphones, while real-time notifications keep them informed about coverage status and renewal reminders, expanding market penetration across India.

Market Restraints:

What Challenges the India Extended Warranty Market is Facing?

Limited Consumer Awareness in Semi-Urban and Rural Regions

Despite growing urban adoption, extended warranty awareness remains limited across semi-urban and rural India where consumers often perceive warranties as unnecessary expenses rather than valuable protection investments. Many potential customers lack understanding regarding coverage benefits, claim processes, and long-term cost savings, resulting in low penetration rates outside metropolitan areas. This awareness gap restricts market expansion into tier-3 cities and villages representing substantial untapped demand.

Price Sensitivity and Affordability Concerns Among Consumers

Price sensitivity among Indian consumers, particularly in middle and lower-income segments, constrains extended warranty adoption rates. Many buyers prioritize minimizing upfront costs when purchasing products and view additional warranty expenses as avoidable. The perception that warranty plans offer limited value compared to self-insuring against potential repairs discourages purchases. Affordability concerns are amplified when warranty costs represent significant percentages of product prices, limiting uptake among cost-conscious demographics.

Availability of Alternative Repair and Self-Service Options

The widespread availability of local repair shops, unauthorized service centers, and self-service options poses challenges for extended warranty market growth. Many consumers in smaller cities rely on neighborhood technicians offering lower-cost repairs compared to authorized service centers. Additionally, readily available online tutorials and spare parts enable technically proficient consumers to perform basic repairs independently. These alternatives reduce perceived necessity for extended warranty coverage, particularly for older products where consumers prioritize minimal maintenance costs.

Competitive Landscape:

The India extended warranty market features a diverse competitive landscape comprising original equipment manufacturers, insurance companies, third-party warranty providers, and e-commerce platforms offering protection services. Market participants are differentiating through digital innovation, expanded coverage options, and strategic partnerships with retail channels. Competition intensifies as players invest in AI-powered claims processing, nationwide service network expansion, and customizable warranty packages. Providers are increasingly focusing on customer experience enhancement through mobile applications, real-time tracking capabilities, and streamlined claim settlement processes. Strategic collaborations between warranty companies and e-commerce marketplaces are reshaping distribution dynamics, enabling convenient point-of-purchase warranty additions that drive attachment rates and market penetration across consumer segments.

Recent Developments:

- In November 2025, Samsung added a wide range of consumer goods to its protection portfolio by expanding its Samsung Care+ service to include extended warranty plans for home appliances. The plans, which are now offered for air conditioners, microwaves, refrigerators, washing machines, and smart TVs, can be extended for one to four years and start at about Rs 2 per day.

India Extended Warranty Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Coverages Covered | Standard Protection Plan, Accidental Protection Plan |

| Applications Covered | Automobiles, Consumer Electronics, Home Appliances, Mobile Devices and PCs, Others |

| Distribution Channels Covered | Manufacturers, Retailers, Others |

| End Users Covered | Individuals, Business |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India extended warranty market size was valued at USD 4.40 Billion in 2025.

The India extended warranty market is expected to grow at a compound annual growth rate of 9.60% from 2026-2034 to reach USD 10.04 Billion by 2034.

Standard protection plan dominated the market with a share of 61%, driven by comprehensive coverage for mechanical and electrical failures, cost-effectiveness, and broad applicability across consumer electronics, automobiles, and home appliances.

Key factors driving the India extended warranty market include rising adoption of premium consumer electronics and smartphones, expanding automobile sales, digital transformation of warranty services, e-commerce integration, and growing consumer awareness regarding product protection benefits.

Major challenges include limited consumer awareness in semi-urban and rural regions, price sensitivity among cost-conscious consumers, availability of alternative local repair options, complex claim processes, and low penetration rates outside metropolitan areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)