India Extruded Snack Food Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

India Extruded Snack Food Market Summary:

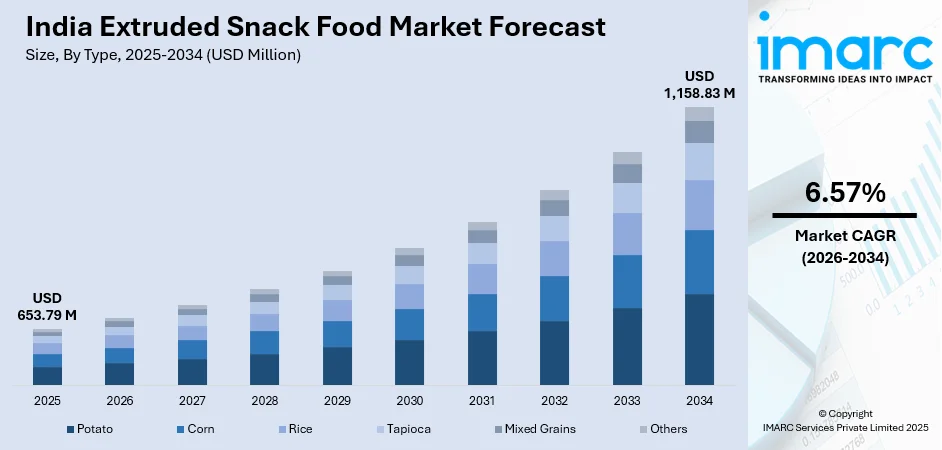

The India extruded snack food market size was valued at USD 653.79 Million in 2025 and is projected to reach USD 1,158.83 Million by 2034, growing at a compound annual growth rate of 6.57% from 2026-2034.

The market is driven by rapid urbanization, changing consumer lifestyles, and the rising demand for convenient on-the-go snacking options. Product innovation with diverse flavor profiles catering to regional preferences and the growing influence of western dietary patterns are reshaping consumption habits. The expansion of modern retail formats and e-commerce platforms has enhanced product accessibility across urban and rural markets. Affordable pricing strategies and small packaging formats appeal to price-sensitive consumers, contributing to the India extruded snack food market share.

Key Takeaways and Insights:

- By Type: Potato dominates the market with a share of 31% in 2025, driven by widespread consumer preference for potato-based snacks owing to their familiar taste, crispy texture, and versatility in accommodating diverse regional flavor profiles.

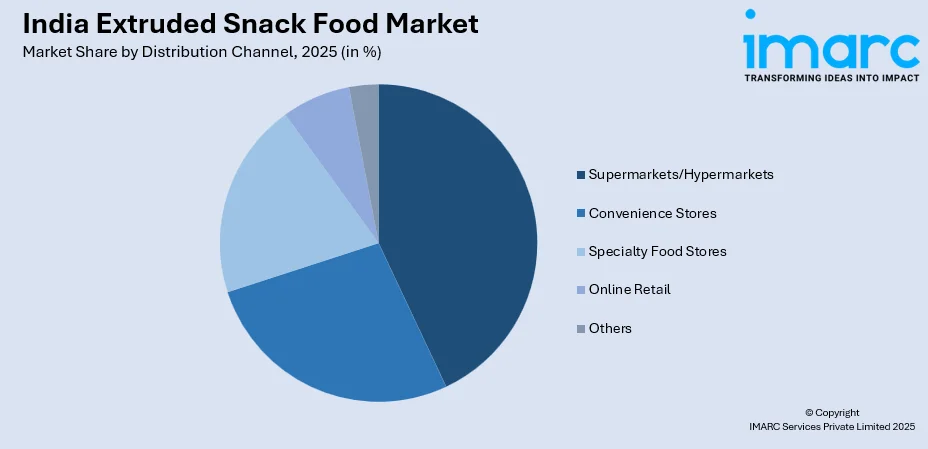

- By Distribution Channel: Supermarkets/hypermarkets leads the market with a share of 43% in 2025, owing to their extensive product assortment, competitive pricing through bulk purchasing, in-store promotions, and one-stop shopping convenience.

- By Region: North India represents the market with a share of 31% in 2025, driven by the concentration of major urban centers including Delhi, higher population density, established distribution networks, and strong consumer preference for packaged convenience foods.

- Key Players: The India extruded snack food market exhibits moderate to highly competitive dynamics, with established multinational corporations competing alongside regional manufacturers across various price segments. The market features organized players with extensive distribution networks and numerous regional brands catering to localized taste preferences.

To get more information on this market Request Sample

The India extruded snack food market is experiencing robust growth driven by fundamental shifts in consumer behaviour and lifestyle patterns. Rapid urbanization has created a substantial consumer base seeking convenient, ready-to-eat snacking solutions that align with their fast-paced lifestyles. In January 2025, PepsiCo India partnered with Tata Consumer Products’ Ching’s Secret to introduce a Schezwan-flavoured Kurkure, reflecting how leading brands are innovating with fusion tastes to cater to evolving Indian palates. Moreover, the increasing participation of women in the workforce and the rise of nuclear family structures have accelerated demand for packaged convenience foods. Rising disposable incomes across urban and semi-urban areas enable consumers to explore premium and branded snack options. The diverse Indian palate has encouraged manufacturers to introduce innovative flavor combinations that blend traditional spices with contemporary taste profiles. Younger demographics, particularly millennials and Gen-Z consumers, demonstrate strong affinity toward trendy snacking options, influencing product development strategies. The expansion of modern retail infrastructure and digital commerce platforms has significantly enhanced product accessibility and visibility across geographic regions.

India Extruded Snack Food Market Trends:

Rising Demand for Health-Conscious Snacking Options

The extruded snack food market is witnessing significant transformation as consumers increasingly prioritize nutritional value alongside taste and convenience. Manufacturers are reformulating products to incorporate nutrient-dense ingredients such as millets, legumes, and whole grains that align with wellness-focused consumption patterns. As per sources, in September 2025, PepsiCo India’s Kurkure brand entered the millet-based snacks category with its baked Kurkure Jowar Puffs, blending traditional jowar with modern snack formats to meet demand for healthier options. Furthermore, baked alternatives and multigrain variants are gaining substantial traction among health-aware demographics seeking reduced-fat and lower-calorie snacking solutions. Clean labeling practices emphasizing natural ingredients without artificial additives are becoming essential product differentiators.

Fusion Flavors and Regional Taste Innovation

Indian consumers demonstrate strong appreciation for innovative flavor profiles that combine traditional culinary heritage with contemporary taste experiences. Manufacturers are experimenting with unique seasoning blends that incorporate regional spices and locally sourced ingredients to create distinctive product offerings. In November 2025, PepsiCo India launched Red Rock Deli gourmet chips, introducing kettle-cooked, baked, and popped variants with globally inspired flavours, reflecting rising consumer demand for premium, innovative snacking experiences. Moreover, the blending of authentic Indian flavors with western-inspired taste profiles creates fusion variants that appeal to adventurous palates. Regional customization strategies enable brands to develop state-specific flavor variants that resonate with local preferences.

Digital Commerce and Direct-to-Consumer Expansion

The proliferation of e-commerce platforms and digital retail channels is fundamentally reshaping product distribution and consumer engagement strategies. According to reports, quick commerce platforms like Blinkit, Zepto, Instamart, and BBnow accounted for 35 percent of FMCG e-commerce revenue, with Nestlé reporting 60 percent of domestic online sales via this channel. Moreover, online grocery platforms have achieved remarkable reach across tier-two and tier-three cities, extending market penetration beyond traditional urban strongholds. Social media marketing and influencer collaborations have emerged as powerful tools for brand building and consumer engagement among younger demographics. Direct-to-consumer business models eliminate intermediaries, enabling competitive pricing while maintaining profitability.

Market Outlook 2026-2034:

The India extruded snack food market demonstrates strong growth potential, with market revenue expected to expand significantly during the forecast period. Rising urbanization rates combined with increasing disposable income levels across demographic segments create favorable conditions for sustained market expansion. The continuous evolution of consumer preferences toward convenient, flavorful, and increasingly healthier snacking options drives product innovation and market development. Expansion of organized retail infrastructure and accelerating e-commerce adoption enhance product accessibility across geographic regions. Manufacturers are investing in production capacity expansion and distribution network optimization. The market generated a revenue of USD 653.79 Million in 2025 and is projected to reach a revenue of USD 1,158.83 Million by 2034, growing at a compound annual growth rate of 6.57% from 2026-2034.

India Extruded Snack Food Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Potato |

31% |

|

Distribution Channel |

Supermarkets/Hypermarkets |

43% |

|

Region |

North India |

31% |

Type Insights:

- Potato

- Corn

- Rice

- Tapioca

- Mixed Grains

- Others

Potato dominates with a market share of 31% of the total India extruded snack food market in 2025.

Potato maintains its leading position in the India extruded snack food market owing to widespread consumer familiarity and preference for potato-based snacking products. The neutral flavor profile of potato serves as an excellent base for diverse seasoning applications, enabling manufacturers to offer extensive flavor variety that caters to regional taste preferences across the country. As per sources, ITC’s Bingo! Snacks launched three new potato-based variants – Crushin’ Himalayan Pink Salt, Bangin’ Butter & Garlic, and Mad Angles Mystery Pickle – strengthening consumer engagement and portfolio appeal.

Potato based extruded snacks benefit from established manufacturing processes and supply chain infrastructure that ensure consistent product quality and availability. The segment attracts both price-sensitive consumers seeking value offerings and premium seekers interested in gourmet variants with sophisticated flavor profiles. Continuous product innovation in textures, shapes, and flavor combinations sustains consumer interest and drives repeat purchases. The versatility of potato as a base ingredient enables manufacturers to develop products across multiple price points.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Retail

- Others

Supermarkets/hypermarkets leads with a share of 43% of the total India extruded snack food market in 2025.

Supermarkets/hypermarkets dominate the distribution landscape by offering consumers comprehensive product assortments from multiple brands within single retail destinations. These modern retail formats provide extensive shelf space for product displays, enabling effective visual merchandising and impulse purchase stimulation. In-store promotions, volume discounts, and competitive pricing strategies attract price-conscious consumers seeking value propositions. The organized shopping environment enhances consumer confidence in product quality and freshness standards maintained by these retail establishments.

The organized retail channel benefits from superior supply chain management ensuring consistent product freshness and availability across store networks. Consumer trust in retail store quality standards and the convenience of combining snack purchases with regular grocery shopping reinforces channel preference. The expansion of supermarket and hypermarket presence in semi-urban areas extends market reach while maintaining dominant position in urban centers. According to reports, in FY25, Reliance Retail opened 2,659 new stores, expanding its FMCG reach in tier-2 and tier-3 cities, while JioMart scaled hyperlocal deliveries through its omni-channel retail network.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India dominates with a market share of 31% of the total India extruded snack food market in 2025.

North India commands the largest regional market share driven by favorable demographic factors including high population density and substantial urban concentration in metropolitan areas. The presence of major commercial centers generates significant demand from working professionals seeking convenient snacking solutions throughout their busy schedules. Established distribution networks and retail infrastructure facilitate comprehensive market coverage across urban and rural areas within the region. The region benefits from proximity to key agricultural zones ensuring steady raw material supply.

Consumer preferences in North India demonstrate strong affinity toward savory and spicy flavor profiles that align well with traditional regional culinary preferences. The concentration of major manufacturing facilities within the region ensures efficient supply chain operations and competitive pricing advantages. Rising income levels and evolving consumption patterns among the region's substantial young population continue driving market expansion. Strong brand presence and extensive marketing activities further reinforce consumer engagement and product adoption rates.

Market Dynamics:

Growth Drivers:

Why is the India Extruded Snack Food Market Growing?

Rapid Urbanization and Changing Lifestyle Patterns

The accelerating pace of urbanization across India is fundamentally transforming consumer behaviour and creating substantial demand for convenient food solutions. Metropolitan expansion and the growth of satellite cities generate significant populations of working professionals with limited time for traditional meal preparation. The hectic schedules characteristic of urban life encourages snacking behaviour as consumers seek quick sustenance between formal meals. In September 2024, a survey found 31 percent of urban Indians used quick commerce for grocery, with 45 percent using it for salty snacks, highlighting the increasing reliance on convenient packaged food in cities. Nuclear family structures prevalent in urban areas reduce home-cooking frequency and increase reliance on packaged convenience foods.

Rising Disposable Income and Aspirational Consumption

The steady improvement in household income levels across India is enabling consumers to allocate greater spending toward premium and branded food products. Economic development has expanded the middle-class population, creating a substantial consumer base with purchasing power for discretionary food items. As per sources, in September 2025, premium brands accounted for about 15 percent of FMCG volumes in India, reflecting a broad shift toward higher-quality and aspirational products as household incomes rise. Moreover, higher disposable incomes encourage aspirational consumption patterns where consumers seek quality, brand recognition, and superior taste experiences. The willingness to experiment with new products and premium variants increases as financial constraints diminish for middle-income households.

Growing Youth Population and Evolving Snacking Culture

India's demographic advantage with a substantial young population under thirty years creates a massive consumer base for extruded snack products. Millennials and Gen-Z consumers exhibit higher snacking frequency compared to older generations, driven by changing meal patterns and social consumption habits. In April 2025, Indian snack brand Cornitos targeted Gen-Z with bold, trendy flavours inspired by global pop culture, aiming to grow its youth consumer base and build long-term brand loyalty. Moreover, the influence of global food culture through travel, media exposure, and social networking shapes preferences toward diverse snacking experiences. Young consumers demonstrate brand loyalty while remaining receptive to novel product introductions and innovative flavor offerings.

Market Restraints:

What Challenges the India Extruded Snack Food Market is Facing?

Health and Wellness Concerns Among Consumers

Increasing consumer awareness regarding nutrition and dietary health poses challenges for traditional extruded snack products perceived as unhealthy indulgences. Growing concerns about the sodium content, artificial additives, and trans fats influence purchase decisions among health-conscious consumer segments. The association of snack consumption with lifestyle diseases creates resistance among wellness-oriented demographics.

Raw Material Price Volatility and Supply Chain Challenges

Fluctuations in agricultural commodity prices directly impact production costs and profitability for extruded snack manufacturers. Seasonal variations in crop yields and weather-related disruptions create supply uncertainties for key raw materials including potatoes, corn, and rice. Currency fluctuations affect imported ingredient costs, adding complexity to production cost management and pricing strategies.

Intense Competition from Unorganized Sector

The presence of numerous small-scale and regional manufacturers creates intense competitive pressure on pricing and market share. Local players often operate with lower overhead costs, enabling aggressive pricing strategies that challenge organized sector profitability. Consumer loyalty toward regional brands with familiar taste profiles limits penetration opportunities for national and multinational manufacturers.

Competitive Landscape:

The India extruded snack food market features a diverse competitive structure comprising established multinational corporations, national players, and numerous regional manufacturers operating across different market segments. Large, organized players leverage extensive distribution networks, substantial marketing investments, and continuous product innovation to maintain market leadership positions. Regional manufacturers compete effectively through localized flavor offerings, competitive pricing, and strong relationships with traditional retail channels. Innovation remains a critical competitive differentiator, with manufacturers continuously introducing new flavors, healthier variants, and innovative packaging formats to capture consumer attention.

Recent Developments:

- In February 2024, PepsiCo India launched Lay’s Shapez Heartiez, a new heart-shaped potato chip sub-brand featuring masala and caramel flavors. This initiative marks Lay’s entry into sweet-flavored chips, aiming to cater to evolving Indian consumer preferences for innovative, uniquely shaped, and textured snacks in the growing extruded snack food market.

India Extruded Snack Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Potato, Corn, Rice, Tapioca, Mixed Grains, Others |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Specialty Food Stores, Online Retail, Others |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India extruded snack food market size was valued at USD 653.79 Million in 2025.

The India extruded snack food market is expected to grow at a compound annual growth rate of 6.57% from 2026-2034 to reach USD 1,158.83 Million by 2034.

Potato held the largest market share, driven by widespread consumer preference for potato-based snacks owing to their familiar taste, crispy texture, and versatility in accommodating diverse regional flavor profiles that resonate with Indian palates.

Key factors driving the India extruded snack food market include rapid urbanization, rising disposable incomes, changing consumer lifestyles favoring convenient snacking options, expansion of modern retail and e-commerce channels, and continuous product innovation catering to diverse taste preferences.

Major challenges include increasing health consciousness among consumers leading to scrutiny of processed snacks, raw material price volatility affecting production costs, intense competition from unorganized regional players, regulatory compliance requirements, and distribution infrastructure limitations in rural areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)