India Facade Market Size, Share, Trends and Forecast by Product Type, Material, End User, and Region, 2025-2033

India Facade Market Size and Trends:

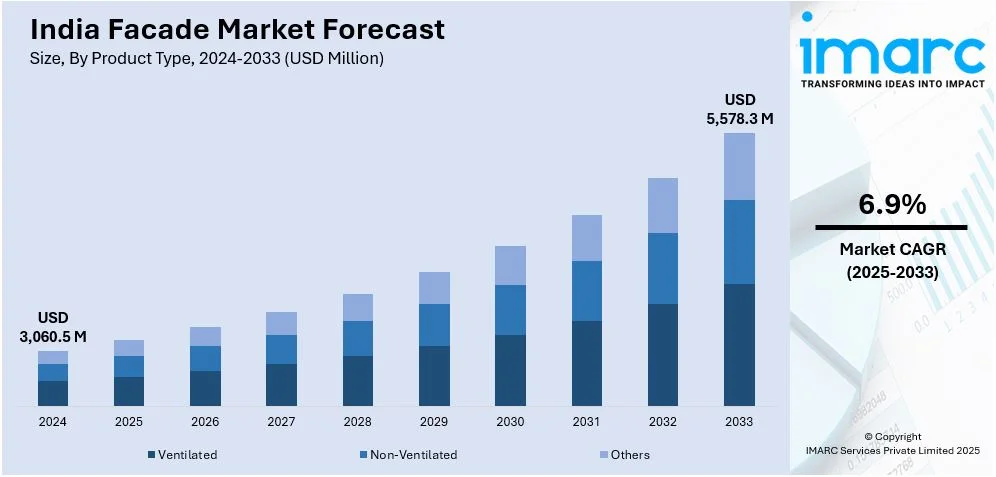

The India facade market size was valued at USD 3,060.5 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 5,578.3 Million by 2033, exhibiting a CAGR of 6.9% from 2025-2033. Rapid urbanization and the shift toward energy-efficient construction are propelling growth in the facade industry. The India facade market share is further supported by technological advancements, sustainable building practices, and increasing investments in residential and commercial infrastructure development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3,060.5 Million |

|

Market Forecast in 2033

|

USD 5,578.3 Million |

| Market Growth Rate (2025-2033) | 6.9% |

The growth of the Indian facade market share is primarily driven by rapid urbanization and a surge in infrastructure development activities within residential, commercial, and industrial sectors. With the increasing need for modern, energy-efficient buildings, facades have become essential in providing thermal insulation, reducing energy consumption and enhancing aesthetic appeal. For instance, in September 2024, VOX India launched Fronto V Black panels, a cutting-edge solution for facades and ceilings. Combining robust durability, weather resistance, and authentic wood aesthetics, these maintenance-free panels offer easy installation and enhanced thermal efficiency, redefining modern architectural design.

To get more information on this market, Request Sample

Technological advancements in facade materials and systems also play a significant role in market expansion. Innovative solutions like ventilated facades and dynamic glazing are gaining immense popularity, providing improved durability and performance. Additionally, growing awareness of green building certifications and energy-saving regulations is encouraging developers to integrate advanced facade solutions into new projects. For instance, the Confederation of Real Estate Developers Association of India (Credai) collaborated with the Indian Green Building Council (IGBC) to develop 1,000 certified green projects by 2026 and 4,000 by 2030, adopting IGBC Green and Net Zero building ratings.

India Facade Market Trends:

Rising Adoption of Energy-Efficient Facades

The Indian facade market is witnessing a significant shift toward energy-efficient solutions due to growing environmental awareness and stricter building regulations. Double-glazed glass, ventilated facades, and dynamic shading systems are becoming preferred choices among developers to reduce energy consumption and enhance thermal performance. The push for green building certifications is further driving the adoption of these technologies. For instance, in September 2024, rat[LAB] Studio unveiled the Head Field Office in Noida, featuring a parametric facade with Tweening Arches, dynamic vertical fins, energy efficiency, advanced lighting systems, and environmental responsiveness, blending sustainability and modern design into an architectural landmark. In addition, as India progresses toward net-zero energy goals, demand for innovative, sustainable facades is expected to surge, particularly in urban centers with high-density construction.

Integration of Smart Technologies

The integration of smart technologies in facades is an emerging trend in India, driven by the need for intelligent building management systems. Smart facades equipped with sensors and IoT-enabled features offer automated shading, climate control, and energy monitoring capabilities. These advancements not only enhance building functionality but also align with India's growing emphasis on digital transformation in infrastructure. For instance, in June 2023, Design Forum International collaborated with the Government of Odisha to design the Odisha Mining Corporation project, featuring AI-powered kinetic facades, dynamic projections, and flexible spaces, blending corporate, commercial, and recreational functions to showcase Odisha's technological and architectural advancements. The incorporation of AI and machine learning into facade systems is paving the way for adaptive designs that respond to real-time environmental conditions, making buildings more efficient and responsive.

Increased Use of Advanced Materials

The Indian facade market is increasingly employing cutting-edge materials such as high-performance glass, aluminum composites, and fiber-reinforced panels. These materials offer improved durability, design flexibility, and weather resistance, making them ideal for India's diverse climatic conditions. The popularity of lightweight, fire-resistant, and recyclable materials is rising as developers prioritize safety and sustainability. For instance, in November 2024, Studio Dvara unveiled a facade design integrating natural stone, wooden paneling, and metal accents, combining sustainability with modern aesthetics to create a functional and visually striking addition to contemporary Indian architecture. Additionally, innovations in material science, such as self-cleaning and anti-microbial surfaces, are enhancing the functional appeal of facades, catering to the growing demand for low-maintenance and hygienic building solutions.

India Facade Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India facade market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, material, and end user.

Analysis by Product Type:

- Ventilated

- Non-Ventilated

- Others

Ventilated facades are emerging as a leading product type in the India facade market primarily due to their robust energy efficiency and thermal performance. These systems create a natural ventilation layer between the cladding and the building, effectively regulating indoor temperatures and reducing energy consumption. Ventilated facades are highly durable, adaptable to diverse climatic conditions, and align with green building certifications, making them a preferred choice for developers. For instance, in April 2024, Alstone launched the new range of ventilated fin louvers, typically incorporated into building facades, that enhance airflow, improve indoor air quality, and block direct sunlight. These louvers are ideal for modern residential and commercial buildings, offering energy efficiency, durability, and a classic design. Furthermore, as urbanization and sustainable construction demand grow, ventilated facades are integral to high-performance designs, shaping the India facade market outlook with their ability to enhance acoustic insulation and prevent moisture buildup.

Analysis by Material:

- Glass

- Metal

- Plastic and Fibres

- Stones

- Others

Glass dominates as the leading material segment in the India facade market due to its aesthetic appeal, energy efficiency, and versatility. Modern architectural designs increasingly incorporate glass facades, offering benefits such as natural light optimization, noise reduction, and improved thermal insulation. Advanced technologies like double-glazed, laminated, and tempered glass further enhance durability and performance. Glass facades are widely used in commercial, residential, and institutional buildings, aligning with sustainability goals and green building certifications. For instance, in May 2024, Dow India partnered with Glass Wall Systems to supply DOWSIL Facade Sealants, enabling reduced embodied carbon in curtain wall systems and advancing sustainable construction aligned with green-building design goals. The growing preference for energy-efficient materials and high-rise urban projects significantly contributes to India facade market growth, driving demand for glass facades nationwide.

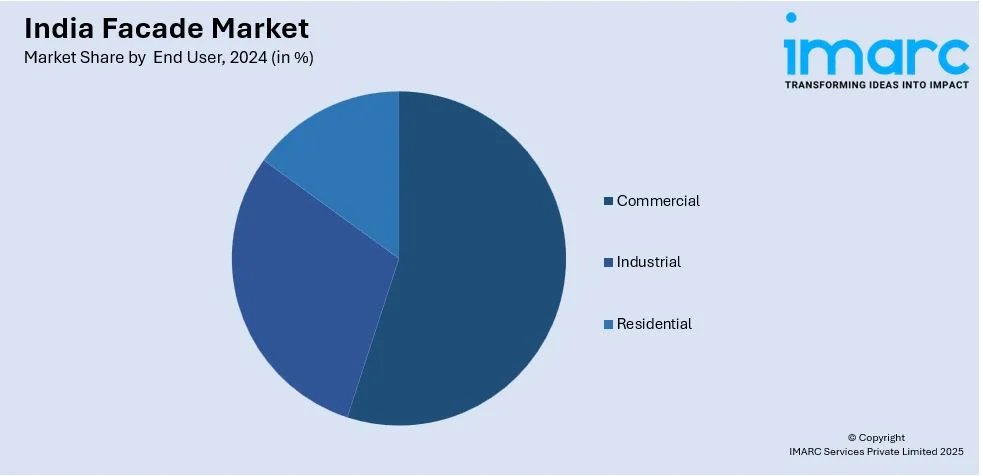

Analysis by End User:

- Commercial

- Industrial

- Residential

The commercial sector is the leading end-user segment as per the India facade market forecast, propelled by the rapid development of office spaces, retail outlets, hotels, and shopping malls. Modern commercial buildings increasingly incorporate advanced facade solutions for enhanced aesthetics, energy efficiency, and sustainability. Features such as natural light optimization, thermal insulation, and noise reduction make facades indispensable in creating functional and visually appealing commercial spaces. With urbanization accelerating and demand for high-rise buildings growing, developers are prioritizing innovative facade systems that meet green building standards. This segment's dominance is further reinforced by corporate investments in sustainable infrastructure and urban expansion projects.

Regional Analysis:

- South India

- North India

- West and Central India

- East and North East-India

South India is the leading regional segment as per the India facade market trends, driven by rapid urbanization, industrialization, and extensive construction activities across major cities. The region's robust IT, commercial, and residential infrastructure development fuels demand for innovative and sustainable facade solutions. For instance, in March 2024, Chennai Metro Rail Limited and Tamil Nadu Industrial Development Corporation (TIDCO) announced a ₹688 crore, 27-story, 10 lakh sq. ft. iconic building near Chennai Central Railway Station to accommodate public sector offices, commercial enterprises, and IT companies. Developers increasingly adopt energy-efficient materials, including glass and ventilated facades, to meet rising environmental and aesthetic standards. With expanding high-rise projects and green building certifications gaining traction, South India remains a key contributor to the country's facade market growth.

Competitive Landscape:

The competitive landscape of the India facade market is shaped by a mix of established players and emerging manufacturers offering diverse materials and innovative solutions. The increasing India facade market demand for energy-efficient, sustainable, and customizable facades drives competition, prompting manufacturers to focus on advanced technologies and green building standards. Moreover, technological advancements, including smart facades and innovative material applications, are key focus areas for gaining market share. Intense competition has led to greater emphasis on research and development initiatives, as companies are striving to enhance product performance. Additionally, key partnerships and investments in advanced technologies are influencing market trends, encouraging innovation, and propelling growth. For instance, in November 2024, Adani Infra announced the acquisition of a 30.07% stake in PSP Projects for ₹6.85 billion (USD 81.2 million), valuing the company at ₹575 per share, with plans for an open offer.

The report provides a comprehensive analysis of the competitive landscape in the India facade market with detailed profiles of all major companies, including:

- Ajit Glafa India Pvt Ltd

- Alfa Facade Systems Pvt. Ltd.

- Alstone International

- Alufit International Pvt Ltd (Schüco International KG)

- Alumayer

- Aluplex

- Alutech Panels

- Argo Facades

- FG Glass

- Finilex Laminates India (OPC) Private Limited

- Glass Wall Systems

- Innovators Facade Systems Limited

- Kingspan Jindal Pvt. Ltd. (Kingspan Group)

- Plectra Facade Industries LLP

- RK Facade Pvt. Ltd.

- Saint-Gobain Glass India (Saint-Gobain Group)

- Siddhivinayakcreations Facade Pvt. Ltd

- Skyshade Daylights Private Limited

- Windorz India Private Limited

Latest News and Developments:

- In January 2024, EUROBOND and RHEINZINK launched EUROBOND ZINC in India, introducing sustainable, self-healing facades with naturally pre-patinated Zinc. This innovative solution ensures pristine appearance for up to 100 years while reducing CO2 emissions by 50%.

- In March 2024, Wallmakers unveiled the Toy Storey Residence in Vadakara, Kerala, transforming over 6,200 discarded toys into a sustainable home. The project aims to promote circular design, natural ventilation, and environmental consciousness through its latticework facade, CSEB walls, and ferrocement roof.

- In November 2024, Innovators Facade Systems secured a ₹110 crore work order from Prestige Mulund Realty for the Prestige Trade Centre, involving facade design, supply, fabrication, and installation within 5 months, boosting its shares by 6.41% to ₹191.

India Facade Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ventilated, Non-Ventilated, Others |

| Materials Covered | Glass, Metal, Plastic and Fibres, Stones, Others |

| End Users Covered | Commercial, Industrial, Residential |

| Regions Covered | South India, North India, West and Central India, East and North East-India |

| Companies Covered | Ajit Glafa India Pvt Ltd, Alfa Facade Systems Pvt. Ltd., Alstone International, Alufit International Pvt Ltd (Schüco International KG), Alumayer, Aluplex, Alutech Panels, Argo Facades, FG Glass, Finilex Laminates India (OPC) Private Limited, Glass Wall Systems, Innovators Facade Systems Limited, Kingspan Jindal Pvt. Ltd. (Kingspan Group), Plectra Facade Industries LLP, RK Facade Pvt. Ltd., Saint-Gobain Glass India (Saint-Gobain Group), Siddhivinayakcreations Facade Pvt. Ltd, Skyshade Daylights Private Limited, and Windorz India Private Limited. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India facade market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India facade market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India facade industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India facade market was valued at USD 3,060.5 Million in 2024.

The India facade market is driven by rapid urbanization, increasing construction activities, and growing demand for energy-efficient and sustainable building solutions. Technological advancements, green building certifications, and rising investments in high-rise and commercial projects further propel the market. Aesthetic appeal and innovative materials enhance adoption across residential and commercial sectors.

IMARC estimates the India facade market to reach USD 5,578.3 Million in 2033, exhibiting a CAGR of 6.9% during 2025-2033.

South India accounted for the largest facade market in India.

Some of the major players in the India facade market include Ajit Glafa India Pvt Ltd, Alfa Facade Systems Pvt. Ltd., Alstone International, Alufit International Pvt Ltd (Schüco International KG), Alumayer, Aluplex, Alutech Panels, Argo Facades, FG Glass, Finilex Laminates India (OPC) Private Limited, Glass Wall Systems, Innovators Facade Systems Limited, Kingspan Jindal Pvt. Ltd. (Kingspan Group), Plectra Facade Industries LLP, RK Facade Pvt. Ltd., Saint-Gobain Glass India (Saint-Gobain Group), Siddhivinayakcreations Facade Pvt. Ltd, Skyshade Daylights Private Limited, and Windorz India Private Limited., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)