India Factory Automation Market Size, Share, Trends and Forecast by Component, Control and Safety System, Industry Vertical, and Region, 2026-2034

India Factory Automation Market Size and Share:

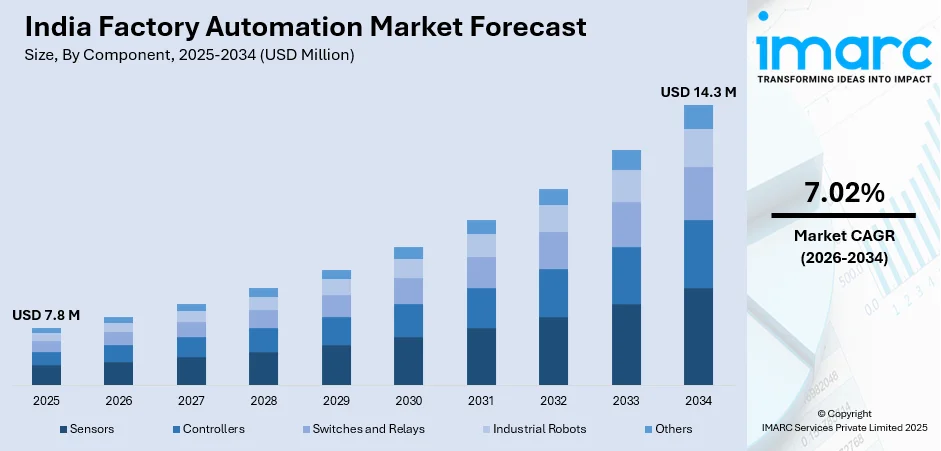

The India factory automation market size reached USD 7.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 14.3 Million by 2034, exhibiting a growth rate (CAGR) of 7.02% during 2026-2034. India’s factory automation sector is expanding due to rising investments, domestic manufacturing growth, and technological advancements. Increasing demand for efficiency, sustainability, and smart production systems is driving adoption across industries, strengthening supply chains, enhancing productivity, and positioning India as a key automation hub.

Key Takeaways

- The India factory automation market was valued at USD 7.8 million in 2025.

- It is projected to reach USD 14.3 million by 2034, representing a compound annual growth rate (CAGR) of about 7.02% between 2026–2034.

- Major growth drivers include rising investments in manufacturing, the influx of domestic production under the “Make in India” push, and adoption of advanced automation technologies to boost operational efficiency, sustainability and productivity.

- Segmentation highlights:

- Components: Sensors, controllers, switches & relays, industrial robots, etc.

- Control & Safety Systems: DCS, SCADA, MES, SIS, PLC, HMI.

- Industry Verticals: Automotive manufacturing, food & beverage, oil & gas processing, mining, others.

- Regional Insights: The report covers major zones within India: North India, South India, East India and West India — signalling growth opportunities across geographies.

To get more information on this market, Request Sample

India Factory Automation Market Trends:

Expansion of Domestic Automation Manufacturing

India’s factory automation sector is witnessing significant growth due to the increasing focus on domestic manufacturing. Companies are shifting towards local production to reduce dependency on imports, enhance supply chain resilience, and meet rising industrial demands. The government’s ‘Make in India’ initiative and favorable policies are driving businesses to establish advanced automation facilities within the country. This shift strengthens India's manufacturing ecosystem, making it more self-sufficient and competitive in the global market. In June 2025, Euronics launched India’s largest washroom automation manufacturing facility in Gurugram, covering 150,000 sq. ft. with an investment of INR 100 Crore. This facility significantly boosts domestic production, ensuring a steady supply of automation products. The move enhances supply chain efficiency and supports employment generation, reinforcing India’s position as a key player in the automation industry. The establishment of such large-scale manufacturing units contributes to improved technological capabilities and cost efficiency in automation solutions. Industries, including infrastructure, construction, and commercial sectors, benefit from locally produced automation products, reducing procurement time and costs. The growing trend of setting up domestic automation plants also encourages collaborations between manufacturers, suppliers, and technology providers, fostering innovation and long-term industrial growth.

Rising Investments in Industrial Efficiency

Automation in Indian manufacturing is accelerating due to the demand for higher efficiency, sustainability, and precision. Industries are increasingly adopting advanced automation solutions to optimize operations, reduce energy consumption, and improve production output. Global companies are investing in India’s automation sector, recognizing its potential as a major industrial hub. This trend is reshaping the manufacturing landscape, enabling businesses to integrate smart automation systems that improve efficiency and sustainability. In April 2025, Mitsubishi Electric inaugurated a 15,400m² factory automation systems plant in Maharashtra with a USD 2.2 Billion investment. The facility focuses on producing inverters and factory automation products for industries such as automotive, pharmaceuticals, textiles, and data centers. By strengthening local production capabilities, this investment supports India’s growing industrial automation needs while aligning with sustainable manufacturing practices. Such large-scale investments lead to the adoption of advanced industrial automation solutions, including robotics, AI-driven production systems, and smart energy management tools. The presence of global players boosts technological advancements and fosters skill development, ensuring a highly capable workforce. Additionally, investments in automation manufacturing improve supply chain reliability and reduce operational costs for industries.

India Factory Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on component, control and safety system, and industry vertical.

Component Insights:

- Sensors

- Controllers

- Switches and Relays

- Industrial Robots

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes sensors, controllers, switches and relays, industrial robots, and others.

Control and Safety System Insights:

- Distributed Control System (DCS)

- Supervisory Control and Data Acquisition System (SCADA

- Manufacturing Execution System (MES)

- Systems Instrumented System (SIS)

- Programmable Logic Controller (PLC)

- Human Machine Interface (HMI).

The report has provided a detailed breakup and analysis of the market based on the control and safety system. This includes distributed control system (DCS), supervisory control and data acquisition system (SCADA), manufacturing execution system (MES), systems instrumented system (SIS), programmable logic controller (PLC), and human machine interface (HMI).

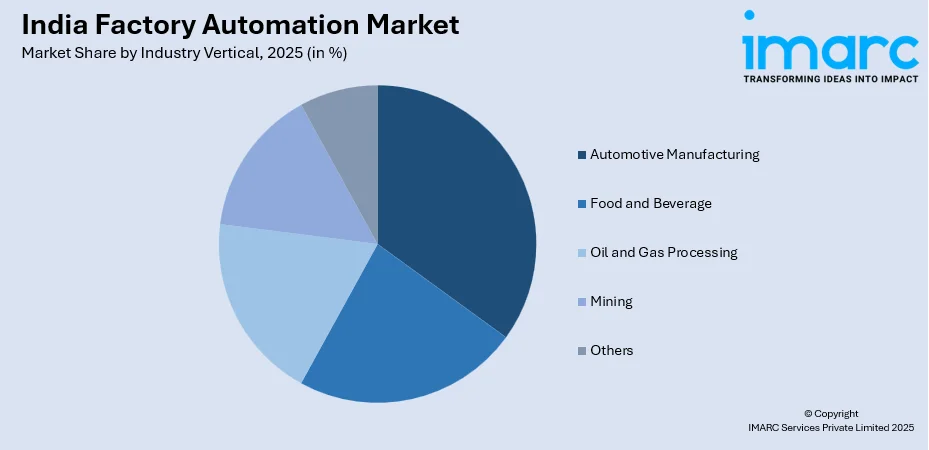

Industry Vertical Insights:

- Automotive Manufacturing

- Food and Beverage

- Oil and Gas Processing

- Mining

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes automotive manufacturing, food and beverage, oil and gas processing, mining, and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Factory Automation Market News:

- February 2025: Delta Electronics introduced D-Bot series collaborative robots at ELECRAMA 2025, advancing India’s factory automation market. These 6-axis cobots (6kg-30kg payload, 200°/s speed) enhance electronics assembly, packaging, and welding. Integration with SCADA, digital twins, and machine vision boosts efficiency, safety, and smart manufacturing adoption.

- April 2025: Rockwell Automation is establishing a 98,000 sq. ft. facility in Chennai, set to open in H1 2025, enhancing local manufacturing, automation, and supply chain resilience. This expansion strengthens production efficiency, technological advancement, and employment opportunities, accelerating industrial growth and innovation in India.

India Factory Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Sensors, Controllers, Switches and Relays, Industrial Robots, Industrial Robots, Others |

| Control and Safety System Covered | Distributed Control System (DCS), Supervisory Control and Data Acquisition System (SCADA), Manufacturing Execution System (MES), Systems Instrumented System (SIS), Programmable Logic Controller (PLC), Human Machine Interface (HMI) |

| Industry Vertical Covered | Automotive Manufacturing, Food and Beverage, Oil and Gas Processing, Mining, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India factory automation market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India factory automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India factory automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India factory automation market was valued at USD 7.8 Million in 2025.

The India factory automation market is projected to exhibit a CAGR of 7.02% during 2026-2034, reaching a value of USD 14.3 Million by 2034.

Key factors driving the India factory automation market include rising demand for efficiency and productivity, government initiatives like "Make in India," growing adoption of Industry 4.0, labor cost concerns, technological advancements (AI, IoT), and increased focus on quality, safety, and energy efficiency in manufacturing processes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)