India False Ceiling Market Size, Share, Trends and Forecast by Material, Cost Range, Installation, Application, and Region, 2025-2033

India False Ceiling Market Overview:

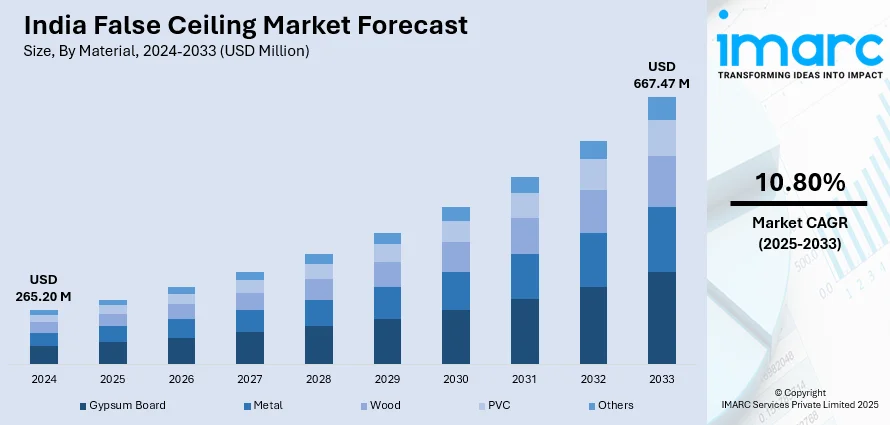

The India false ceiling market size reached USD 265.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 667.47 Million by 2033, exhibiting a growth rate (CAGR) of 10.80% during 2025-2033. India's false ceiling industry is growing through expanding urbanization, rising commercial developments, and the need for energy-efficient interior spaces. The increase comes through the adoption of gypsum ceilings, preference towards modular systems, smart building applications, and the use of environmental-friendly materials. Moreover, organizations concentrate on creative designs, sound control measures, and fire-proof products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 265.20 Million |

| Market Forecast in 2033 | USD 667.47 Million |

| Market Growth Rate (2025-2033) | 10.80% |

India False Ceiling Market Trends:

Rising Demand for Gypsum Ceilings in Urban Spaces

The increasing urbanization across India is accelerating the demand for gypsum false ceilings, especially in metropolitan cities such as Delhi, Mumbai, and Bengaluru. Moreover, gypsum ceilings are light in weight, fire-retardant, and provide high thermal insulation, making them suitable for contemporary residential and commercial places. In addition, gypsum ceilings are the choice of urban people and developers because they can be connected with LED lighting, soundproofing, and climate control systems with the rising trend towards smart homes and energy-efficient buildings. For instance, major commercial complexes such as Phoenix Market city in Mumbai and DLF CyberHub in Gurugram have incorporated gypsum ceilings to enhance aesthetic appeal and functionality. Additionally, rapid infrastructure growth in Tier-II cities such as Pune, Ahmedabad, and Jaipur is further fueling gypsum ceiling adoption in high-rise apartments and corporate offices. Leading companies like Saint-Gobain and Gyproc India are expanding their product portfolios to cater to this rising demand.

To get more information on this market, Request Sample

Growing Preference for Modular Ceiling Systems

Modular false ceiling systems are gaining traction in India because of their aesthetic variety, ease of installation, and low maintenance requirements. Because these ceilings are composed of metal, PVC, and mineral fiber, broken panels are easily replaced, lowering the expense of ongoing maintenance. Modular ceilings are becoming popular in corporate offices, hospitals, and retail chains because of their adaptability in allowing for the installation of fire safety systems, lighting fixtures, and HVAC ducts. For example, AIIMS hospitals and Infosys campuses have adopted modular ceiling solutions for their efficient space management and modern appearance. The growing demand for sustainable and acoustically optimized interiors is also pushing developers to integrate eco-friendly ceiling options. Companies like Armstrong and USG Boral are focusing on innovative modular designs that enhance workplace productivity while maintaining sustainability standards.

India False Ceiling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on material, cost range, installation, and application.

Material Insights:

- Gypsum Board

- Metal

- Wood

- PVC

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes gypsum board, metal, wood, PVC, and others.

Cost Range Insights:

- Low-Cost

- Medium-Cost

- High-Cost

The report has provided a detailed breakup and analysis of the market based on the cost range. This includes Low-Cost, Medium-Cost, and High-Cost.

Installation Insights:

- Drywall

- Suspended

- Stretch Ceilings

- Others

A detailed breakup and analysis of the market based on the installation have also been provided in the report. This includes drywall, suspended, stretch ceilings, and others.

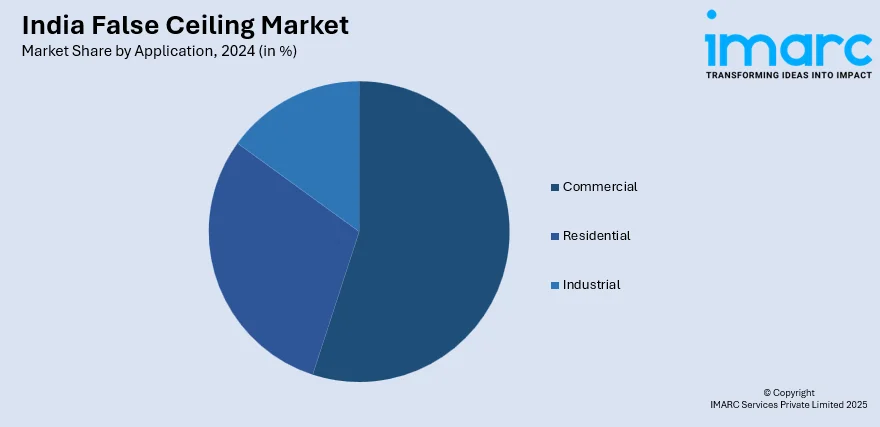

Application Insights:

- Commercial

- Residential

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, residential, and industrial.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India False Ceiling Market News:

- March 2024: Remson Skyward Inc. launched a new aluminum false ceiling product from its manufacturing unit in Rajkot, Gujarat. This development enhances the availability of durable, low-maintenance metal ceilings in India, driving market growth through increased customization options and improved supply chain efficiency.

- November 2024: VOX India expanded its false ceiling market presence with the launch of Infratop Four Lamella SV26, Fronto SV24, and Welo SV22 ceiling panels. These durable, aesthetic, and multi-functional panels enhance architectural flexibility, driving innovation in India's residential and commercial false ceiling segment.

India False Ceiling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Gypsum Board, Metal, Wood, PVC, Others |

| Cost Ranges Covered | Low-Cost, Medium-Cost, High-Cost |

| Installations Covered | Drywall, Suspended, Stretch Ceilings, Others |

| Applications Covered | Commercial, Residential, and Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India false ceiling market performed so far and how will it perform in the coming years?

- What is the breakup of the India false ceiling market on the basis of material?

- What is the breakup of the India false ceiling market on the basis of cost range?

- What is the breakup of the India false ceiling market on the basis of installation?

- What is the breakup of the India false ceiling market on the basis of application?

- What are the various stages in the value chain of the India false ceiling market?

- What are the key driving factors and challenges in the India false ceiling market?

- What is the structure of the India false ceiling market and who are the key players?

- What is the degree of competition in the India false ceiling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India false ceiling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India false ceiling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India false ceiling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)