India Farm Implements Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Farm Implements Market Size and Share:

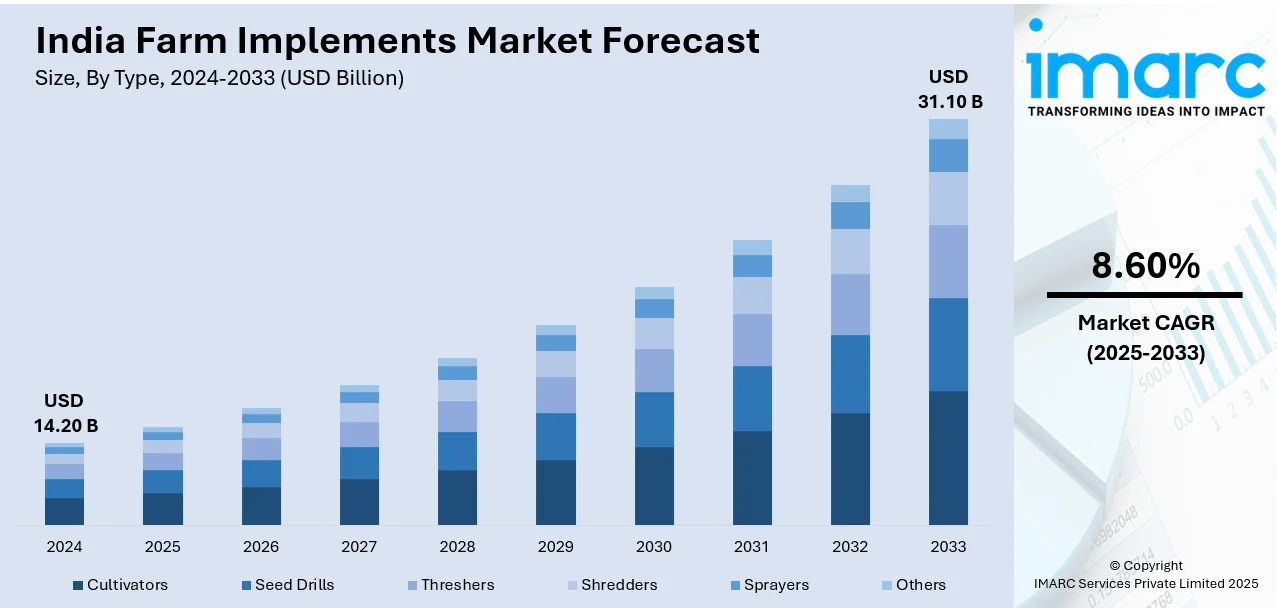

The India farm implements market size reached USD 14.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 31.10 Billion by 2033, exhibiting a growth rate (CAGR) of 8.60% during 2025-2033. The market is expanding due to rising mechanization, increasing tractor sales, and technological advancements. Moreover, government support, strong Rabi harvest projections, and modern equipment adoption are driving demand, thereby enhancing farm productivity, and reducing labor dependency across agricultural operations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.20 Billion |

| Market Forecast in 2033 | USD 31.10 Billion |

| Market Growth Rate (2025-2033) | 8.60% |

India Farm Implements Market Trends:

Rising Equipment Sales Driving Mechanization

The Indian market is witnessing strong growth due to increasing sales of agricultural machinery. Farmers are shifting toward mechanization to improve efficiency and reduce dependency on manual labor. The demand for farm equipment, especially tractors, is rising due to government initiatives, easy financing options, and awareness about modern farming techniques. A strong focus on increasing crop yield and reducing production time is further fueling this trend. For example, in February 2025, Mahindra & Mahindra’s Farm Equipment Sector recorded domestic tractor sales of 23,880 units, reflecting a 19% increase from February 2024. The company’s total tractor sales, including exports, reached 25,527 units. The growth is driven by strong Rabi harvest expectations and government policies promoting farm mechanization. The increasing affordability of farm implements, coupled with growing support from state and central governments, is encouraging small and medium-scale farmers to invest in advanced machinery. Additionally, seasonal demand fluctuations and a shift toward commercial agriculture are playing a significant role in driving sales. Rising tractor adoption is a key indicator of mechanization progress, allowing farmers to complete fieldwork faster and more efficiently. As the agriculture sector continues to evolve, equipment sales will remain a crucial factor in shaping the farm implements market in India.

To get more information on this market, Request Sample

Technological Advancements Enhancing Farm Productivity

The market is evolving with continuous technological upgrades, improving efficiency and productivity in farming operations. Advanced farm equipment is enabling precision agriculture, reducing input costs, and enhancing crop management. With automation and digital integration, modern implements are transforming traditional farming methods. Features like real-time monitoring, GPS-enabled equipment, and intelligent hydraulics are enhancing farm efficiency while minimizing labor efforts. For example, in October 2023, VST Tillers Tractors Ltd and HTC Investments launched VST ZETOR Private Limited, introducing VST ZETOR 4211, 4511, and 5011 (40-50 HP) tractors in India. These tractors come with advanced hydraulics, a digital dashboard, and power steering, providing improved control and efficiency in farming operations. Technological advancements in farm implements are particularly beneficial for small and marginal farmers, making modern equipment more accessible and user-friendly. Innovations in precision farming tools, automation, and sensor-based equipment are driving a shift toward smarter agricultural practices. As technology continues to evolve, the farm implements market in India is set to expand, making farming more efficient and sustainable. The adoption of advanced machinery is expected to accelerate, strengthening the agricultural sector and improving overall farm productivity.

India Farm Implements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Cultivators

- Seed Drills

- Threshers

- Shredders

- Sprayers

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes cultivators, seed drills, threshers, shredders, sprayers, and others.

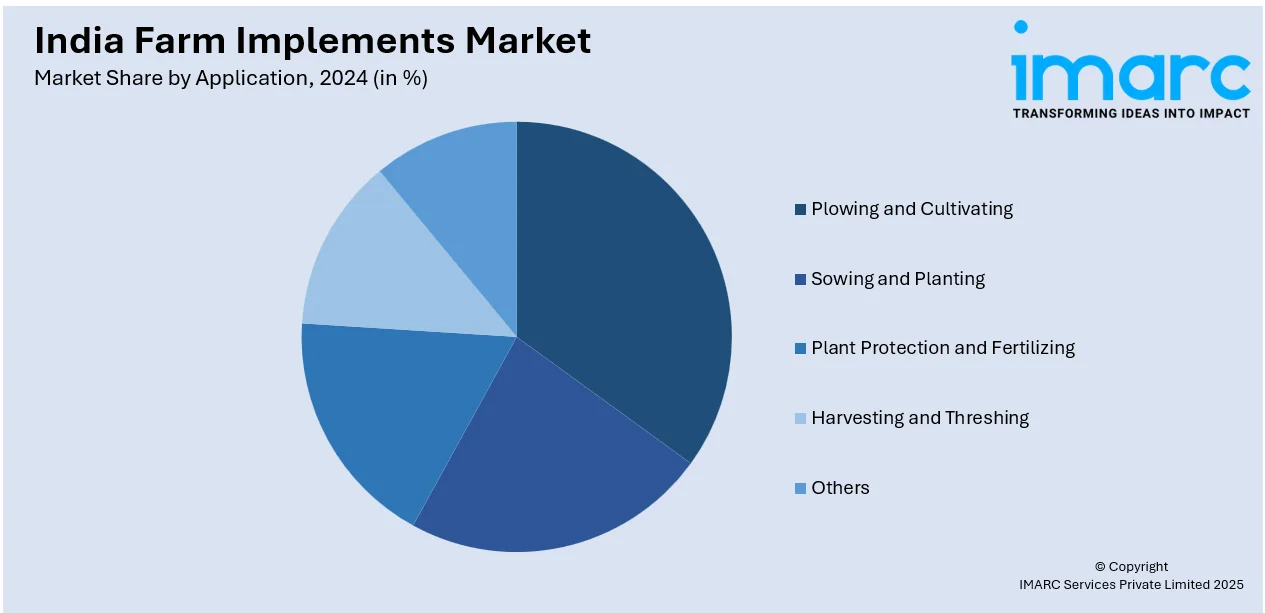

Application Insights:

- Plowing and Cultivating

- Sowing and Planting

- Plant Protection and Fertilizing

- Harvesting and Threshing

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes plowing and cultivating, sowing and planting, plant protection and fertilizing, harvesting and threshing, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Farm Implements Market News:

- February 2025: Gromax Agri Equipment expanded its tractor lineup to 40+ models (20-50 HP) under Trakstar, Hindustan, and Trakmate brands. As a Mahindra & Gujarat Government joint venture, this move strengthens India's farm implements industry, boosting mechanization and accessibility for farmers.

- January 2025: AutoNxt Automation launched India’s first electric tractor (45 HP), targeting agriculture and industry. With 15-ton hauling capacity, 50 km range, and 60-70% fuel savings, it enhances sustainability and cost efficiency, accelerating electric farm equipment adoption.

India Farm Implements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Cultivators, Seed Drills, Threshers, Shredders, Sprayers, Others |

| Applications Covered | Plowing and Cultivating, Sowing and Planting, Plant Protection and Fertilizing, Harvesting and Threshing, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India farm implements market performed so far and how will it perform in the coming years?

- What is the breakup of the India farm implements market on the basis of type?

- What is the breakup of the India farm implements market on the basis of application?

- What are the various stages in the value chain of the India farm implements market?

- What are the key driving factors and challenges in the India farm implements market?

- What is the structure of the India farm implements market and who are the key players?

- What is the degree of competition in the India farm implements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India farm implements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India farm implements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India farm implements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)