India FemTech Market Size, Share, Trends and Forecast by Type, Application, End Use, and Region, 2026-2034

India FemTech Market Summary:

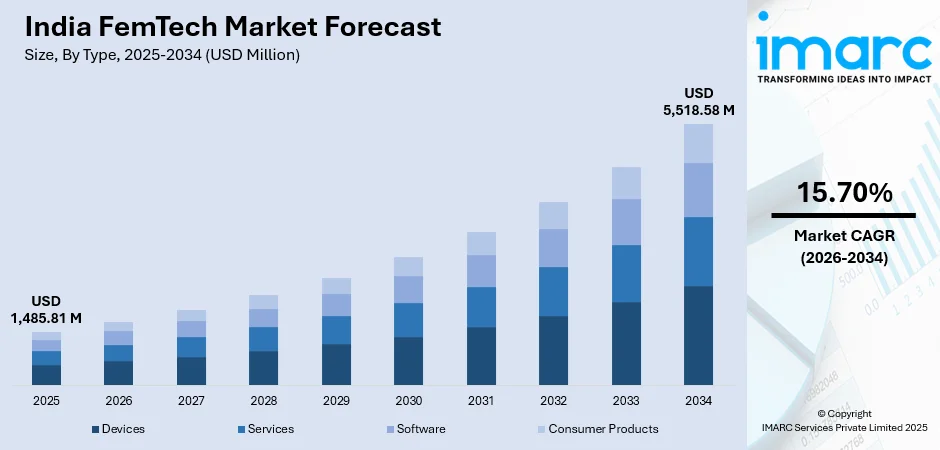

The India FemTech market size was valued at USD 1,485.81 Million in 2025 and is projected to reach USD 5,518.58 Million by 2034, growing at a compound annual growth rate of 15.70% from 2026-2034.

The India FemTech market is experiencing robust growth, propelled by accelerating digital transformation in healthcare delivery systems and increasing recognition of women's health as a priority area. Government initiatives promoting digital health infrastructure, combined with rising smartphone adoption and improving internet connectivity across urban and rural regions, are creating an enabling environment for FemTech solutions. Additionally, the growing participation of women in the workforce and increasing disposable incomes are fueling market expansion.

Key Takeaways and Insights:

-

By Type: Devices dominate the market with a share of 38% in 2025, driven by rising demand for wearable health monitoring devices and connected diagnostic tools enabling real-time fertility tracking and menstrual cycle predictions.

-

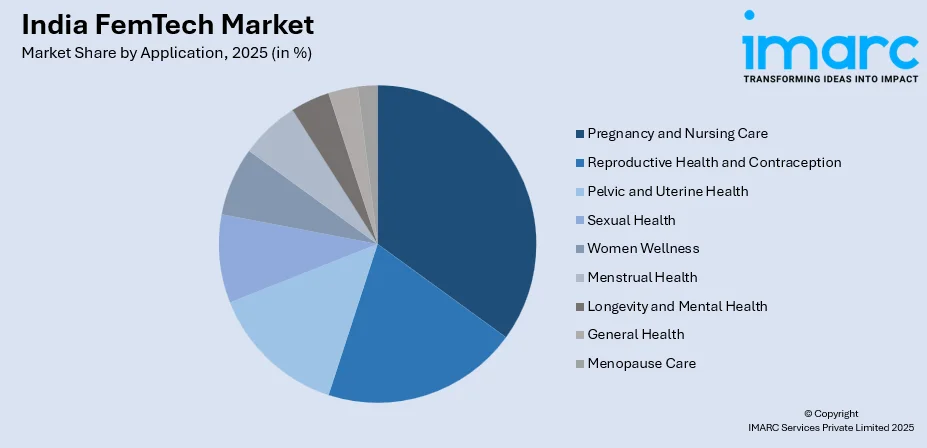

By Application: Pregnancy and nursing care leads the market with a share of 18% in 2025, owing to comprehensive maternal care solutions, AI-powered pregnancy monitoring applications, and growing emphasis on prenatal and postnatal wellness.

-

By End Use: Direct to consumer represents the largest segment with a market share of 26% in 2025, fueled by increasing digital literacy among women, preference for discreet purchasing options, and expanding e-commerce infrastructure across urban and rural areas.

-

By Region: North India dominates the market with 29% revenue share in 2025, supported by higher concentration of healthcare infrastructure, greater digital adoption rates, and presence of major metropolitan centers driving demand for technology-enabled women's health solutions.

-

Key Players: The India FemTech market exhibits a moderately fragmented competitive structure, characterized by a diverse mix of domestic startups and established healthcare companies competing through product innovations, user experience design, clinical efficacy, and integration of traditional wellness practices with modern technology.

To get more information on this market Request Sample

The India FemTech market is witnessing remarkable transformation driven by convergence of digital innovation, heightened health consciousness, and supportive policy frameworks. The ecosystem has evolved beyond basic period tracking applications to encompass comprehensive solutions addressing fertility planning, PCOS management, pregnancy care, postpartum recovery, and menopause support. Technology integration through artificial intelligence and machine learning is enabling personalized healthcare experiences through advanced pattern recognition algorithms and predictive analytics. AI-powered solutions are facilitating early detection of conditions while virtual health assistants leverage natural language processing to offer accessible, judgment-free consultations. The startup ecosystem is flourishing with innovative companies developing solutions across the entire spectrum of women's health, combining cutting-edge technologies with culturally relevant approaches including integration of Ayurvedic practices with modern diagnostic tools.

India FemTech Market Trends:

Integration of Artificial Intelligence in Personalized Health Monitoring

FemTech platforms are increasingly incorporating artificial intelligence to provide personalized health recommendations for users. These tools analyze data from wearable devices, applications, and user inputs to detect patterns related to menstrual health, fertility cycles, mood changes, and chronic conditions. AI-driven analytics for symptoms and menstrual cycles aid in early diagnosis while applications improve awareness and education, enabling primary prevention strategies and redefining early intervention approaches for women's healthcare across diverse demographics. For instance, in September 2025, Madhya Pradesh announced the launch of SUMAN SAKHI, an AI-powered chatbot aimed at enhancing access to women’s health information. The initiative has been developed jointly by the state’s National Health Mission (NHM) and the Madhya Pradesh State Electronics Development Corporation (MPSeDC), providing a technology-driven solution to support informed healthcare decisions for women across the state.

Convergence of Traditional Wellness Practices with Modern Technology

The market is witnessing the unique integration of Ayurvedic practices with digital health platforms, creating culturally relevant healthcare solutions that resonate with Indian consumers. These platforms combine traditional medicine formulations with technology-enabled consultations, personalized treatment protocols, and community-driven support systems. This approach addresses the specific cultural sensitivities surrounding women's health while providing accessible, holistic care that speaks both the language of technology and tradition. For instance, in November 2025, Vardhman Mahavir Medical College (VMMC) and Safdarjung Hospital partnered with the Central Ayurveda Research Institute (CARI), under the Ministry of Ayush, to develop scientific, Ayurveda-based solutions aimed at improving access and effectiveness for women undergoing menopause.

Expansion of Direct-to-Consumer Digital Engagement Models

Digital-first brands are revolutionizing how women access healthcare products and services through direct-to-consumer channels. E-commerce platforms and digital payment systems enable convenient, discreet purchasing of feminine care products and health services, reducing stigma associated with buying such items in physical stores. The India e-commerce market size was valued at USD 129.72 Billion in 2025 and is projected to reach USD 651.10 Billion by 2034, growing at a compound annual growth rate of 19.63% from 2026-2034. The expansion of vernacular language support and intuitive interfaces is improving accessibility across urban and rural regions, while subscription-based models and personalized product recommendations enhance customer engagement and retention.

Market Outlook 2026-2034:

The India FemTech market is poised for steady growth over the forecast period, driven by rapid digitalization in healthcare and heightened focus on women’s health at both policy and societal levels. Expanding smartphone penetration and affordable data plans are enabling millions of users across urban and rural areas to access the internet, while the rise of telemedicine platforms is making digital health consultations increasingly mainstream. These trends are collectively creating a favorable environment for the adoption and expansion of FemTech solutions nationwide. The market generated a revenue of USD 1,485.81 Million in 2025 and is projected to reach a revenue of USD 5,518.58 Million by 2034, growing at a compound annual growth rate of 15.70% from 2026-2034.

India FemTech Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Devices | 38% |

| Application | Pregnancy and Nursing Care | 18% |

| End Use | Direct to Consumer | 26% |

| Region | North India | 29% |

Type Insights:

- Devices

- Services

- Software

- Consumer Products

Devices dominate with a market share of 38% of the total India FemTech market in 2025.

The devices segment maintains market leadership driven by rising consumer demand for wearable health monitoring technologies and connected diagnostic tools. Advanced fertility tracking devices, smart menstrual cups, and pregnancy monitoring wearables are gaining widespread adoption as women increasingly prioritize proactive health management. The segment benefits from technological advancements enabling real-time health data collection, seamless integration with mobile applications, and enhanced accuracy in predicting ovulation cycles and detecting health anomalies.

Growing awareness about preventive healthcare, coupled with the improving affordability of smart devices, is expanding market penetration beyond metropolitan areas. Internet of Medical Things integration is enabling remote patient monitoring capabilities while facilitating seamless data sharing between users and healthcare providers. The segment continues to witness innovation through miniaturization of sensors, improved battery technologies, and development of non-invasive diagnostic capabilities that address diverse aspects of women's health from reproductive wellness to chronic condition management.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Pregnancy and Nursing Care

- Reproductive Health and Contraception

- Pelvic and Uterine Health

- Sexual Health

- Women Wellness

- Menstrual Health

- Longevity and Mental Health

- General Health

- Menopause Care

Pregnancy and nursing care leads with a share of 18% of the total India FemTech market in 2025.

Pregnancy and nursing care applications command the largest market share owing to comprehensive solutions addressing prenatal monitoring, gestational health tracking, and postnatal support services. AI-powered pregnancy monitoring platforms are enabling expectant mothers to track fetal development, receive personalized health recommendations, and access telemedicine consultations from qualified healthcare professionals. The segment benefits from a strong cultural emphasis on maternal health and growing awareness about the importance of comprehensive prenatal care.

Digital postpartum programs are reducing hospital readmission risks while community-based platforms provide emotional support and educational resources for new mothers. Technology-enabled solutions are bridging gaps in maternal healthcare access, particularly in underserved regions where specialist availability remains limited. The integration of wearable contraction monitors, IoT-based fetal monitoring systems, and AI-driven risk assessment tools is enhancing clinical outcomes and empowering women with real-time insights throughout their pregnancy journey.

End Use Insights:

- Fertility Clinics

- Direct to Consumer

- Hospitals

- Surgical Centers

- Diagnostic Centers

- Others

Direct to consumer exhibits clear dominance with a 26% share of the total India FemTech market in 2025.

The direct-to-consumer channel maintains market leadership driven by evolving consumer preferences for convenient, discreet, and personalized healthcare solutions. Digital-first brands are revolutionizing how women access health products through seamless e-commerce experiences, subscription-based delivery models, and AI-powered product recommendations. This channel addresses cultural sensitivities by enabling private purchasing of intimate care products while providing educational content that reduces stigma around women's health topics.

The segment benefits from expanding digital payment infrastructure, improving logistics networks enabling last-mile delivery, and growing comfort with online health consultations. Mobile applications with vernacular language support are enhancing accessibility across diverse demographics, while community-driven platforms create engagement through peer support networks. The direct-to-consumer model enables companies to gather valuable user insights, personalize offerings, and maintain continuous engagement throughout customer health journeys.

Regional Insights:

- North India

- South India

- East India

- West India

North India dominates with 29% share of the total India FemTech market in 2025.

North India maintains regional leadership driven by higher concentration of healthcare infrastructure, greater digital adoption rates, and presence of major metropolitan centers including Delhi National Capital Region. The region benefits from relatively higher disposable incomes, educated urban population segments comfortable with technology adoption, and established distribution networks facilitating product availability. A strong startup ecosystem in the region contributes to innovation and market development.

Government initiatives promoting digital health infrastructure are particularly effective in northern states, while telemedicine platforms are bridging urban-rural healthcare gaps. The region witnesses strong demand across all product categories including devices, software applications, and consumer products. Growing participation of women in the workforce combined with increasing health awareness is driving sustained market expansion, while evolving social attitudes are reducing cultural barriers to the adoption of women-focused health technologies.

Market Dynamics:

Growth Drivers:

Why is the India FemTech Market Growing?

Government Digital Health Initiatives and Supportive Policy Framework

India's digital transformation in healthcare is being significantly propelled by ambitious government programs creating a conducive ecosystem for FemTech innovations and adoption. Initiatives promoting digitalization of government services and expansion of digital infrastructure are fundamentally changing how healthcare is delivered across the nation. Programs like Ayushman Bharat Digital Mission and Digital India are establishing foundational digital health infrastructure, while telemedicine practice guidelines have normalized digital health consultations and remote monitoring solutions. These policy frameworks reduce entry barriers for FemTech companies while encouraging collaborations between public healthcare systems and private innovators. Government funding bodies provide support for developing affordable FemTech solutions suitable for wider population segments, while regulatory clarity enables companies to scale operations confidently.

Rising Health Awareness and Expanding Technology Infrastructure

Market growth is being propelled by fundamental changes in societal perspectives on women's health, combined with rapid technological advancement and infrastructure development. Women are increasingly proactive about health management, driven by higher educational attainment, workforce participation, and exposure to global health trends through digital media. This growing health consciousness is particularly evident among millennials and younger generations who are comfortable using digital tools for health monitoring and seeking online consultations. India's smartphone penetration has reached unprecedented levels with affordable data plans making internet access available to hundreds of millions of users across urban and rural regions. The expansion of high-speed internet networks enables seamless delivery of FemTech services ranging from telemedicine consultations to real-time health monitoring through wearable devices, creating sustainable market growth. For instance, in May 2025, Redcliffe Labs, a healthcare diagnostics company, introduced Femcliffe, a diagnostic platform specifically designed to cater to women’s health needs throughout various life stages. Launched ahead of Mother’s Day, the platform offers a comprehensive range of preventive, curative, and specialized diagnostic tests addressing health concerns from puberty and fertility to pregnancy, menopause, post-menopause, and active ageing.

Flourishing Investment Ecosystem and Startup Innovation

The FemTech sector is experiencing remarkable growth in entrepreneurial activities and venture capital investments, reflecting increasing confidence in market potential and the critical importance of addressing women's health needs. The startup ecosystem is flourishing with innovative companies developing solutions across the entire spectrum of women's health, from menstrual health management and fertility tracking to maternal care, menopause support, and chronic condition management. These startups leverage cutting-edge technologies including artificial intelligence, machine learning, Internet of Things devices, and data analytics, to create user-centric products and services. Angel investors, venture capital firms, and corporate venture arms are actively funding FemTech ventures, recognizing both social impact and commercial viability. The investment landscape has matured significantly, with early-stage funding supporting ideation and product development, while growth-stage capital enables successful startups to scale operations and expand product portfolios. For instance, in March 2025, the Embassy of Finland and UNICEF launched a global call for early-stage FemTech startups using AI or blockchain, offering grants and one year of mentorship.

Market Restraints:

What Challenges the India FemTech Market is Facing?

Social Stigma and Cultural Barriers Limiting Market Penetration

Deeply rooted social stigma and cultural taboos surrounding women's health, particularly in areas like menstruation, reproductive health, and sexual wellness, restrict market visibility and consumer engagement. Many households continue to hesitate discussing reproductive health topics due to social conditioning, limiting the adoption of FemTech solutions, especially in non-metropolitan regions where awareness remains limited and women often rely on traditional healthcare practices.

Affordability Constraints and Digital Divide Across Regions

Many FemTech products including fertility solutions, wearables, and diagnostic services, remain priced beyond the reach of middle and lower-income segments. The digital divide further restricts access as women in rural and semi-urban regions face low digital literacy and inconsistent internet connectivity. Language barriers and lack of vernacular content reduce usability for significant population segments, while limited financial independence among women creates additional barriers to adoption.

Regulatory Gaps and Data Privacy Concerns

The FemTech sector faces regulatory ambiguity and a lack of standardized policies governing women's digital health products, particularly in sensitive segments. Data privacy concerns are heightened as platforms handle intimate health information, yet comprehensive frameworks for safeguarding women-focused health data remain evolving. Unclear product classifications between medical devices, wellness products, and consumer goods create compliance complexity, slowing innovation cycles and limiting market expansion.

Competitive Landscape:

The India FemTech market exhibits a moderately fragmented competitive structure characterized by diverse mix of domestic startups, established healthcare companies, and international players entering through partnerships or direct operations. Competition primarily revolves around product innovations, user experience design, clinical efficacy, and brand trust. Key differentiators include breadth of services offered, integration of traditional wellness practices with modern technology, vernacular language support, affordability of solutions, and ability to address specific cultural sensitivities surrounding women's health. Established companies leverage their brand visibility, distribution channels, and financial resources to scale rapidly while emerging startups compete through niche specialization, agile innovations, and direct-to-consumer digital engagement. The market witnesses increasing consolidation through acquisitions and strategic partnerships as larger entities seek to expand product portfolios and market reach.

Recent Developments:

-

In August 2025, M3M partnered with Sirona to unveil India's first menstrual hygiene vending machines across commercial spaces, marking significant advancement in accessibility of feminine care products through innovative distribution channels.

-

In March 2025, Arva Health secured USD 1 million in pre-seed funding to advance its mission of making reproductive healthcare more accessible, affordable, and stigma-free in India, enabling expansion of tech-driven fertility clinics.

-

In May 2024, Gynoveda expanded its physical presence by opening a new fertility clinic in Pune, marking significant milestone in its mission to establish over 100 clinics across India combining Ayurvedic practices with modern digital tools.

India FemTech Market Report Coverage:

|

Report Features |

Details |

|

Base Year of the Analysis |

2025 |

|

Historical Period |

2020-2025 |

|

Forecast Period |

2026-2034 |

|

Units |

Million USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

|

Types Covered |

Devices, Services, Software, Consumer Products |

|

Applications Covered |

Pregnancy and Nursing Care, Reproductive Health and Contraception, Pelvic and Uterine Health, Sexual Health, Women Wellness, Menstrual Health, Longevity and Mental Health, General Health, Menopause Care |

|

End Uses Covered |

Fertility Clinics, Direct to Consumer, Hospitals, Surgical Centers, Diagnostic Centers, Others |

|

Regions Covered |

North India, South India, East India, West India |

|

Customization Scope |

10% Free Customization |

|

Post-Sale Analyst Support |

10-12 Weeks |

|

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India FemTech market size was valued at USD 1,485.81 Million in 2025.

The India FemTech market is expected to grow at a compound annual growth rate of 15.70% from 2026-2034 to reach USD 5,518.58 Million by 2034.

Devices dominated the market with 38% share in 2025, driven by rising demand for wearable health monitoring technologies, connected diagnostic tools, and smart devices enabling real-time fertility tracking and personalized health insights.

Key factors driving the India FemTech market include government digital health initiatives promoting technology-enabled healthcare solutions, rising health awareness among women, expanding smartphone penetration and internet connectivity, flourishing startup ecosystem, and increasing venture capital investments in women's health innovations.

Major challenges include deeply rooted social stigma and cultural taboos limiting open discussions about women's health, affordability constraints for premium FemTech solutions, digital divide restricting access in rural areas, regulatory ambiguity in product classifications, and data privacy concerns surrounding sensitive health information.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)