India Fertility Services Market Size, Share, Trends and Forecast by Cause of Infertility, Procedure, Service, End-User, and Region, 2025-2033

India Fertility Services Market Overview:

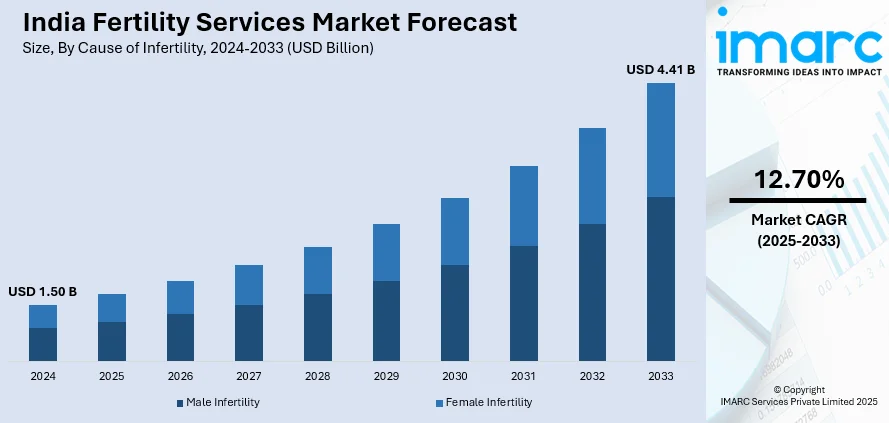

The India fertility services market size reached USD 1.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.41 Billion by 2033, exhibiting a growth rate (CAGR) of 12.70% during 2025-2033. The market is driven by rising infertility rates, delayed pregnancies, and increased awareness of advanced treatments such as IVF. Rapid urbanization, higher disposable incomes, and reduced societal stigma further enhance the India fertility services market share. Government regulations and technological advancements enhance accessibility and affordability, while fertility tourism attracts international patients, positioning India as a global hub for fertility solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.50 Billion |

| Market Forecast in 2033 | USD 4.41 Billion |

| Market Growth Rate 2025-2033 | 12.70% |

India Fertility Services Market Trends:

Increasing Demand for Assisted Reproductive Technologies (ART)

The rise in demand for Assisted Reproductive Technologies (ART), including in vitro fertilization (IVF), intrauterine insemination (IUI), and egg freezing, is significantly supporting the India fertility services market growth. This trend is driven by rising infertility rates, delayed pregnancies due to career-focused lifestyles, and growing awareness about advanced fertility treatments. Approximately 27.5 million Indian couples are facing difficulty in conceiving, leading to a rise in infertility rates among both sexes as per 2024 industry reports. Research suggests that 10-15% of married couples have fertility issues, and 54% of millennials who delay parenthood grapple with difficulties conceiving in their 30s. Rapid urbanization and higher disposable incomes have also made these services more accessible to a larger population. Additionally, societal stigma around infertility is gradually diminishing, encouraging more couples to seek medical assistance. The government’s supportive policies and initiatives to regulate ART clinics have further enhanced confidence in these services. With technological advancements improving success rates and reducing costs, ART is becoming a preferred solution for couples struggling with infertility, positioning India as a hub for affordable and high-quality fertility treatments.

To get more information on this market, Request Sample

Rising Popularity of Fertility Tourism in India

India is emerging as a leading destination for fertility tourism, attracting international patients seeking cost-effective and high-quality fertility treatments. Therefore, this is creating a positive India fertility services market outlook. The country offers world-class medical facilities, highly skilled fertility specialists, and treatments at a fraction of the cost compared to Western countries. This trend is fueled by the availability of advanced technologies, such as genetic screening and cryopreservation, coupled with personalized care. Fertility clinics in major cities such as Mumbai, Delhi, and Bangalore are catering to a growing number of international clients, offering packages that include travel, accommodation, and treatment. The Indian government’s efforts to promote medical tourism, along with streamlined visa processes, have further enhanced its appeal. According to a research report published by the IMARC Group, the Indian medical tourism market was worth USD 21.0 Billion in 2024 which is estimated to reach USD 70.9 Billion by 2033 while growing at a CAGR of 13.78% from 2025 to 2033. As a result, fertility tourism is becoming a key driver of growth in the Indian fertility services market, contributing significantly to the economy and reinforcing India’s position as a global healthcare destination.

India Fertility Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on cause of infertility, procedure, service, and end-user.

Cause of Infertility Insights:

- Male Infertility

- Female Infertility

The report has provided a detailed breakup and analysis of the market based on the cause of infertility. This includes male infertility and female infertility.

Procedure Insights:

- In Vitro Fertilization with Intracytoplasmic Sperm Injection (IVF with ICSI)

- Surrogacy

- In Vitro Fertilization Without Intracytoplasmic Sperm Injection (IVF without ICSI)

- Intrauterine Insemination (IUI)

- Others

A detailed breakup and analysis of the market based on the procedure have also been provided in the report. This includes in vitro fertilization with intracytoplasmic sperm injection (IVF with ICSI), surrogacy, in vitro fertilization without intracytoplasmic sperm injection (IVF without ICSI), intrauterine insemination (IUI), and others.

Service Insights:

- Fresh Non-Donor

- Frozen Non-Donor

- Egg and Embryo Banking

- Fresh Donor

- Frozen Donor

The report has provided a detailed breakup and analysis of the market based on the service. This includes fresh non-donor, frozen non-donor, egg and embryo banking, fresh donor, and frozen donor.

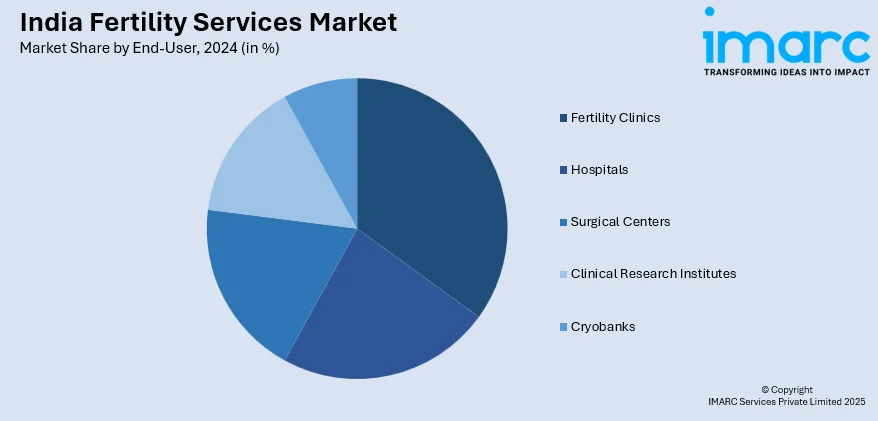

End-User Insights:

- Fertility Clinics

- Hospitals

- Surgical Centers

- Clinical Research Institutes

- Cryobanks

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes fertility clinics, hospitals, surgical centers, clinical research institutes, and cryobanks.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fertility Services Market News:

- March 09, 2025: The RML Institute of Medical Sciences (RMLIMS) Lucknow announced to launch Intrauterine Insemination (IUI) services to help couples suffering from infertility, including unexplained infertility or mild male infertility.

- March 03, 2025: Arva Health raised USD 1 Million in pre-seed funding to launch India's first network of technology-driven fertility clinics, starting in Bangalore. The organization has already helped 4,000 women and built a community of 40,000 individuals and hopes to cover 10 cities, including Mumbai and Delhi, by 2027. Arva is fully dedicated to making reproductive healthcare accessible and stigma-free, and it enables contemporary Indian couples to receive services such as fertility testing, IVF, egg freezing, and pre-conception health support.

India Fertility Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cause of Infertilities Covered | Male Infertility, Female Infertility |

| Procedures Covered | In Vitro Fertilization with Intracytoplasmic Sperm Injection (IVF with ICSI), Surrogacy, In Vitro Fertilization Without Intracytoplasmic Sperm Injection (IVF without ICSI), Intrauterine Insemination (IUI), Others |

| Services Covered | Fresh Non-Donor, Frozen Non-Donor, Egg and Embryo Banking, Fresh Donor, Frozen Donor |

| End-Users Covered | Fertility Clinics, Hospitals, Surgical Centers, Clinical Research Institutes, Cryobanks |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fertility services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fertility services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fertility services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India fertility services market was valued at USD 1.50 Billion in 2024.

The India fertility services market is projected to exhibit a CAGR of 12.70% during 2025-2033, reaching a value of USD 4.41 Billion by 2033.

The India fertility services market is driven by rising infertility rates, delayed parenthood, lifestyle changes, and increased awareness of assisted reproductive technologies. Growing medical tourism, expanding healthcare infrastructure, and supportive government policies also contribute. Urbanization and higher disposable incomes further boost demand for advanced fertility treatments across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)