India Fiber Cement Roofing Market Size, Share, Trends and Forecast by Product Type, Material Composition, Application, End Use Sector and Region, 2025-2033

India Fiber Cement Roofing Market Overview:

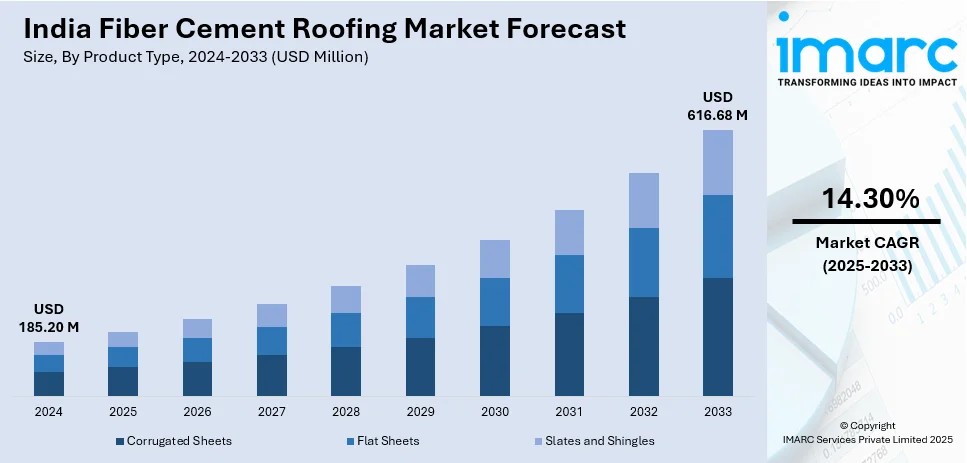

The India fiber cement roofing market size reached USD 185.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 616.68 Million by 2033, exhibiting a growth rate (CAGR) of 14.30% during 2025-2033. The market is fueled by rising urbanization, escalating construction activities, and expanding demand for affordable, long-lasting roofing products. Moreover, government infrastructure developments, increased awareness regarding fire-resistant and green-based products, and climate resilience requirements contribute to the India fiber cement roofing market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 185.20 Million |

| Market Forecast in 2033 | USD 616.68 Million |

| Market Growth Rate 2025-2033 | 14.30% |

India Fiber Cement Roofing Market Trends:

Growing Demand for Sustainable and Eco-friendly Roofing Solutions

One of the most prominent drivers of the fiber cement roofing market in India is the shift toward sustainability. Growing environmental awareness amongst builders and consumers alike has brought fiber cement within the preferred sustainable roofing solutions. Fiber cement is made from the natural non-toxic materials-cement, sand, and cellulose fibers. As a result, it greatly reduces environmental impacts resulting from the use of traditional roofing materials such as metal or asphalt. Furthermore, fiber cement roofing is energy-efficient due to insulation capabilities that minimize energy use in buildings and makes it ideal for use by people seeking certification on green building or limitation of carbon footprints. The Indian government's emphasis on sustainable infrastructure, along with increasing climate change awareness, has further supplemented such products into the markets. Sustainability is now being greatly highlighted by consumers and companies alike, so much so that fiber cement roofing has been adopted widely as the primary material for green construction owing to its sustainable nature.

To get more information on this market, Request Sample

Technological Advancements in Product Development

The development of the India fiber cement roofing market outlook is primarily based on the technological advancements that continue to evolve. Fiber cement products are being enhanced for their performance. These include roofing materials that are resistant to weathering, moisture, fire, and insects. High-end manufacturing techniques enable the creation of such products. Fiber cement is available in all colors and textures, which serves as evidence of their aesthetic appeal, making them adaptable to more architectural styles. Their better quality of resistance and improved insulation are some other major improvements from traditional roofing materials. All this makes fiber cement an attractive option for consumers seeking durable, low-maintenance, and energy-efficient roofing styles for themselves and their constructions. The manufacturers are also seeking research and development so that fiber cement roofing can meet the needs of the Indian construction industry that will continue to expand and diversify.

Increasing Adoption of Prefabricated and Pre-engineered Buildings

The India fiber cement roofing market share is gaining popularity as a result of the rise of prefabricated and pre-engineered buildings (PEBs). The quick installation, low-cost, and multiple-face suitability of PEBs make them an optimal choice for commercial/industrial and residential assignments. As for PEBs, fiber cement roofing systems' lightweight, durability, and easy installation make them perfect for use. With increasing demand for fast-track construction in the commercial and industrial sectors, PEBs for building construction are now gaining traction. Properties of fiber cement, such as fire, weather resistance, and low maintenance, are good reasons for its use in this type of construction. The demand for fiber cement roofing solutions is likely to be further bolstered in India due to the rising initiatives by private and government bodies toward infrastructure development, which have been driving the trend toward PEBs, making it an emerging market segment.

The renovation of Chandigarh Railway Station serves as a prime illustration of this building method. Carried out by the Rail Land Development Authority, the Rs 4.62 billion initiative aims to accelerate construction by utilizing prefabricated parts and modular design, marking a first in the railway industry. In addition to this, Multi Decor India Private Limited has recently collaborated with Tata Projects to develop the prefabricated site office at the future Jewar airport, spanning approximately 32,000 square feet. The design is intended to fulfill operational needs and create a versatile setting that addresses the diverse requirements of airport management. In addition, EPACK Prefab has served as a comprehensive pre-engineered building and prefabrication solution supplier for the Darbhanga airport project. It has successfully transferred the Phase II arrival zone of Darbhanga Airport to the Airports Authority of India.

India Fiber Cement Roofing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, material composition, application, and end use sector.

Product Type Insights:

- Corrugated Sheets

- Flat Sheets

- Slates and Shingles

The report has provided a detailed breakup and analysis of the market based on the product type. This includes corrugated sheets, flat sheets, and slates and shingles.

Material Composition Insights:

- Asbestos Fiber Cement

- Non-Asbestos Fiber Cement

The report has provided a detailed breakup and analysis of the market based on the material composition. This includes asbestos fiber cement and non-asbestos fiber cement.

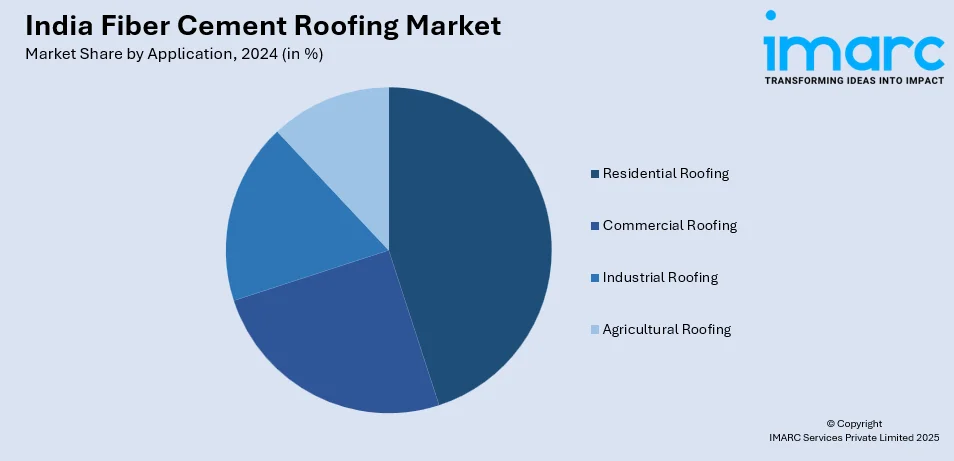

Application Insights:

- Residential Roofing

- Commercial Roofing

- Industrial Roofing

- Agricultural Roofing

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential roofing, commercial roofing, industrial roofing, and agricultural roofing.

End Use Sector Insights:

- New Construction

- Replacement and Renovation

The report has provided a detailed breakup and analysis of the market based on the end use sector. This includes new construction and replacement and renovation.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fiber Cement Roofing Market News:

- In March 2024, HIL Ltd, engaged in the production and distribution of fiber cement roofing, entered into a deal with Crestia Polytech to purchase Topline for an enterprise value of ₹265 crore. The firm revealed plans to purchase Crestia Polytech’s four entirely owned subsidiaries, consisting of Topline Industries, Aditya Industries, Sainath Polymers, and Aditya Polytechnic.

India Fiber Cement Roofing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Sheets, Flat Sheets, Slates and Shingles |

| Material Compositions Covered | Asbestos Fiber Cement, Non-Asbestos Fiber Cement |

| Applications Covered | Residential Roofing, Commercial Roofing, Industrial Roofing, Agricultural Roofing |

| End Use Sectors Covered | New Construction, Replacement and Renovation |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India fiber cement roofing market performed so far and how will it perform in the coming years?

- What is the breakup of the India fiber cement roofing market on the basis of product type?

- What is the breakup of the India fiber cement roofing market on the basis of material composition?

- What is the breakup of the India fiber cement roofing market on the basis of application?

- What is the breakup of the India fiber cement roofing market on the basis of end use sector?

- What is the breakup of the India fiber cement roofing market on the basis of region?

- What are the various stages in the value chain of the India fiber cement roofing market?

- What are the key driving factors and challenges in the India fiber cement roofing market?

- What is the structure of the India fiber cement roofing market and who are the key players?

- What is the degree of competition in the India fiber cement roofing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fiber cement roofing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fiber cement roofing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fiber cement roofing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)