India Fibre Cement Boards and Sheets Market Size, Share, Trends and Forecast by Raw Material, Application, End Use, and Region, 2025-2033

India Fibre Cement Boards and Sheets Market Size and Share:

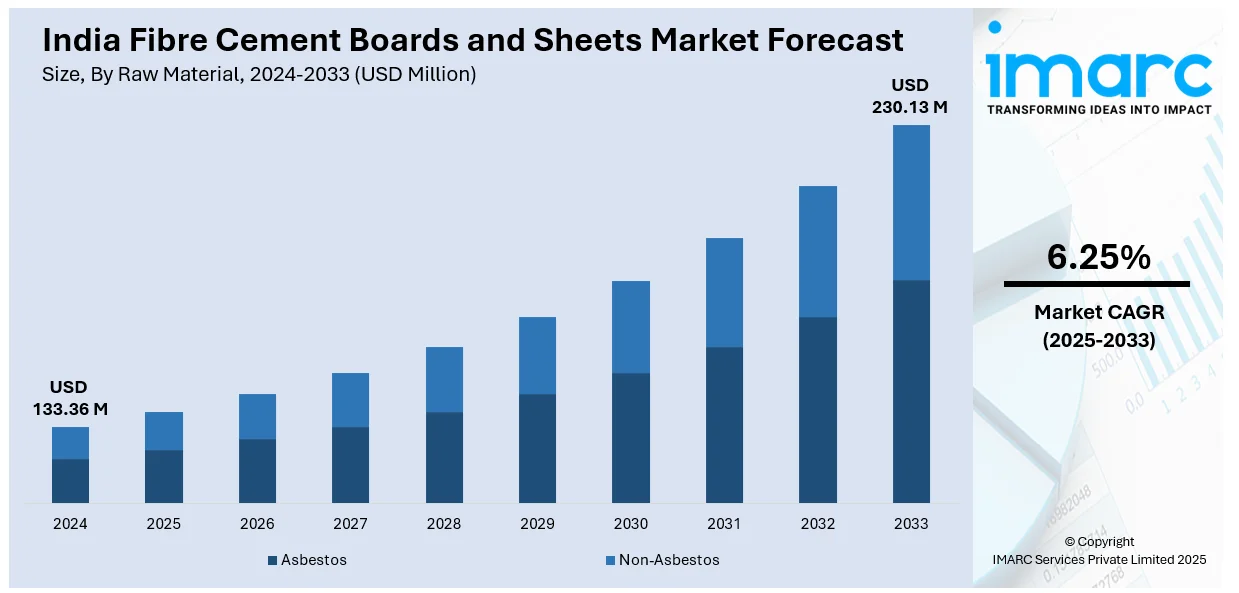

The India fibre cement boards and sheets market size reached USD 133.36 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 230.13 Million by 2033, exhibiting a growth rate (CAGR) of 6.25% during 2025-2033. The market is driven by rising demand for sustainable construction materials, government green building initiatives, and rapid urbanization. Growth in residential and commercial interiors, along with fire-resistant and moisture-proof properties is augmenting the India fibre cement boards and sheets market share. Increased infrastructure development under schemes including Housing for All and Smart Cities Mission further accelerates demand for fibre cement products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 133.36 Million |

| Market Forecast in 2033 | USD 230.13 Million |

| Market Growth Rate (2025-2033) | 6.25% |

India Fibre Cement Boards and Sheets Market Trends:

Rising Demand for Sustainable and Eco-friendly Construction Materials

The rise in demand due to the growing preference for sustainable and eco-friendly construction materials is majorly driving the India fibre cement boards and sheets market growth. With increasing environmental awareness and stringent government regulations promoting green building practices, developers and architects are shifting towards fibre cement products. These boards are made from a blend of cement, cellulose fibres, and sand, making them durable, fire-resistant, and recyclable. Additionally, their low carbon footprint compared to traditional materials, including plywood and asbestos, is driving adoption. The rise in green building certifications such as LEED and IGBC further fuels this trend, as fibre cement boards contribute to energy efficiency and reduce waste. According to an industry report, India is ranked 3rd globally for LEED certifications, with a total of 370 LEED-certified projects covering 8.5 Million GSM. The country is committed to sustainable development and climate actions, which is driving the need for eco-friendly construction materials such as fibre cement boards. The country is aligning its real estate sector with global sustainability goals, making significant inroads with green infrastructure. Urbanization, along with government initiatives such as Housing for All and Smart Cities Mission, is accelerating infrastructure development, enhancing the demand for sustainable construction solutions. As a result, manufacturers are investing in eco-friendly production techniques to cater to this expanding market.

To get more information on this market, Request Sample

Increasing Popularity in Residential and Commercial Interior Applications

Another key trend in the market is their growing use in residential and commercial interior applications. Residential housing sales in India hit an 11-year high in the first half of 2024 with 1,73,000 units sold, an 11% growth on the same period a year prior, according to an industry report. The share of premium housing increased to 34% in 2024 from just 15% in 2018, due to which the demand for fibre cement boards for sustainable construction materials has been propelled. Mumbai was the number one city in terms of sales, with 47,259 units sold, while affordable housing sales fell by 27%. These boards are increasingly preferred for false ceilings, wall cladding, flooring, and modular kitchens due to their moisture resistance, termite-proof nature, and ease of installation. Besides this, the real estate growth, coupled with rising disposable incomes, has led to higher spending on modern interior designs, where fibre cement boards offer a cost-effective and durable alternative to wood and gypsum. Additionally, the hospitality and retail sectors are adopting these boards for aesthetic and functional benefits, such as sound insulation and thermal regulation. The trend of lightweight, low-maintenance construction materials in urban housing projects further supports market growth. Manufacturers are also introducing innovative designs and textures to enhance visual appeal, making fibre cement boards a preferred choice for contemporary interior solutions. This shift is creating a positive India fibre cement boards and sheets market outlook.

India Fibre Cement Boards and Sheets Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on raw material, application, and end use.

Raw Material Insights:

- Asbestos

- Non-Asbestos

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes asbestos and non-asbestos.

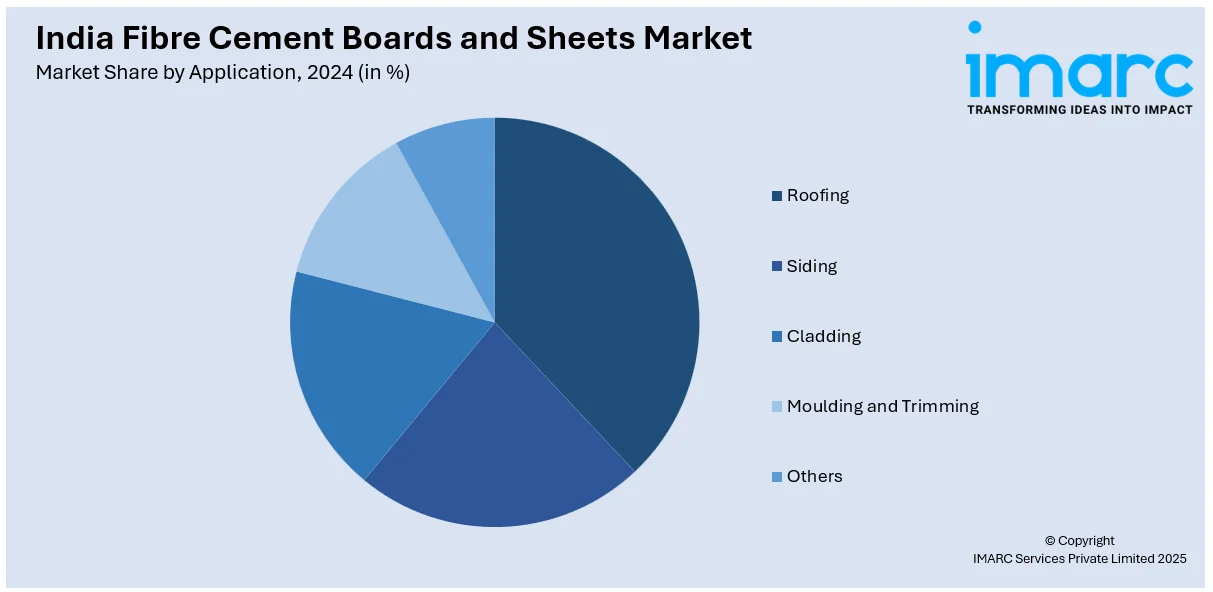

Application Insights:

- Roofing

- Siding

- Cladding

- Moulding and Trimming

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes roofing, siding, cladding, moulding and trimming, and others.

End Use Insights:

- Residential

- Non-Residential

The report has provided a detailed breakup and analysis of the market based on the end use. This includes residential and non-residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fibre Cement Boards and Sheets Market News:

- February 27, 2025: Everest Industries Ltd. signed a Memorandum of Understanding with the Government of Assam to invest INR 138 Crores (approximately USD 16.83 Million) in setting up a new manufacturing facility for fiber cement boards at Matia, Goalpara. This project is expected to add 72,000 Metric Tons per year to Vytal's production capacity. The expansion will strengthen Everest's foothold in the eastern region and help the company deliver its products across all four zones of India.

India Fibre Cement Boards and Sheets Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Asbestos, Non-Asbestos |

| Applications Covered | Roofing, Siding, Cladding, Moulding and Trimming, Others |

| End Uses Covered | Residential, Non-Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India fibre cement boards and sheets market performed so far and how will it perform in the coming years?

- What is the breakup of the India fibre cement boards and sheets market on the basis of raw material?

- What is the breakup of the India fibre cement boards and sheets market on the basis of application?

- What is the breakup of the India fibre cement boards and sheets market on the basis of end use?

- What is the breakup of the India fibre cement boards and sheets market on the basis of region?

- What are the various stages in the value chain of the India fibre cement boards and sheets market?

- What are the key driving factors and challenges in the India fibre cement boards and sheets market?

- What is the structure of the India fibre cement boards and sheets market and who are the key players?

- What is the degree of competition in the India fibre cement boards and sheets market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fibre cement boards and sheets market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fibre cement boards and sheets market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fibre cement boards and sheets industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)