India Filtration Systems Market Size, Share, Trends and Forecast by Product Type, Filter Media, Technology, End Use Industry, and Region, 2025-2033

India Filtration Systems Market Overview:

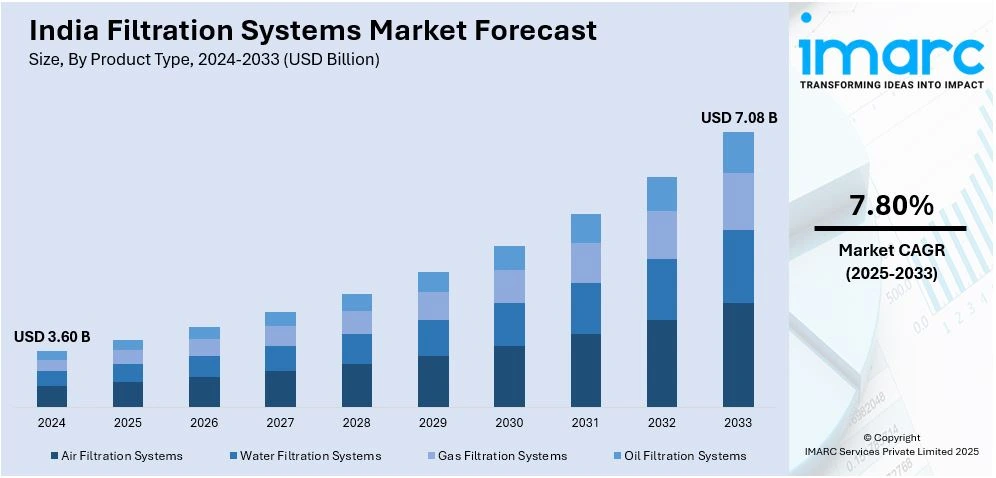

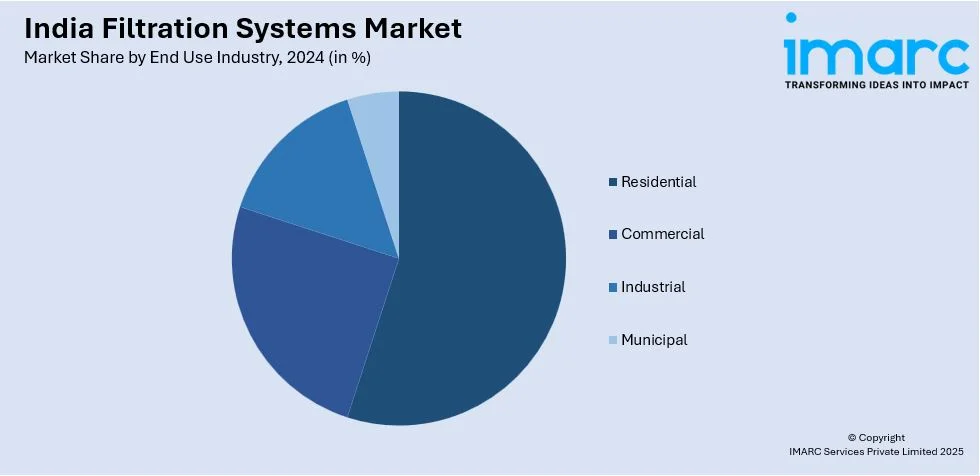

The India filtration systems market size reached USD 3.60 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.08 Billion by 2033, exhibiting a growth rate (CAGR) of 7.80% during 2025-2033. The market is driven with rising demand, regulatory policies, and advances in technology. The growth comes from the demand for sustainability, efficiency, and better public health, with uses in residential, commercial, industrial, and municipal sectors to provide cleaner air and water.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.60 Billion |

| Market Forecast in 2033 | USD 7.08 Billion |

| Market Growth Rate 2025-2033 | 7.80% |

India Filtration Systems Market Trends:

Adoption of Advanced Membrane Filtration Technologies

India's water filtration systems market is experiencing a tremendous change towards advanced membrane filtration technology, especially for treating water and wastewater. As a result of fast urbanization and industrialization, there is a growing demand for effective filtration solutions to provide access to clean and safe water. Ultrafiltration, nanofiltration, and reverse osmosis technologies are gaining popularity as they prove to be effective in eliminating impurities, bacteria, and dissolved solids. In addition, the emphasis on sustainability has also brought about advancements in energy-efficient membranes and more durable filtration materials. Government policies supporting access to clean water are also driving the use of these technologies even faster. Research and development activities are making filtration more efficient, lowering operational expenses, and enhancing system lifespan. Consequently, high-performance water filtration solutions are becoming increasingly available in residential, commercial, and industrial applications. This trend is bound to persist with further technological breakthroughs optimizing filtering capacity while promoting India's conservation and sustainability policies.

To get more information on this market, Request Sample

Rising Demand for Air Filtration Solutions

The rising fears over air quality and pollution levels in India are triggering an escalating requirement for advanced air filtration systems. With growing urban areas and augmented industrial processes, efficient air filtration has become mandatory in domestic, commercial, and industrial environments. High-efficiency particulate air (HEPA) filters, activated carbon filters, and electrostatic precipitators are now being incorporated in HVAC systems, automobiles, and industrial processes for improving air quality. For example, in March 2025, Acerpure India introduces product lines of latest vacuum cleaners, its seventh grand launch in seven months, and launches Dry-D1, Wet & Dry-WD1, and Pet Groomer models for best-in-class cleaning. Furthermore, progress in filter media and nanotechnology is allowing the creation of more effective and durable filtration systems. Outside cities, air filtration also becomes highly important in healthcare units, pharmaceutical production, and food processing plants, where sterile air quality has to be ensured. Growing public concern and increasingly stringent air pollution laws are also driving the implementation of air filtration systems. As the trend goes on, new air purification technologies will keep on assuming a pivotal role in enhancing indoor and outdoor air quality in India.

Integration of Smart Filtration Systems

The implementation of intelligent filtration systems with automation and IoT-enabled monitoring is a new trend in India's filtration market. For instance, in March 2025, Native, the latest sub-brand of smart RO water purifiers, was rolled out by Urban Company. With two years of service-free running, M1 and M2 have IoT-capable monitoring capabilities along with cutting-edge filtration technology that provides pure drinking water at reduced maintenance cost to Indian households. Moreover, as industries and residential consumers demand more efficient and easy-to-use products, filtration systems with real-time monitoring, predictive maintenance notification, and remote control are gaining popularity. Intelligent systems employ sensors and data analysis to maximize filtration performance, identify clogging, and improve energy efficiency. In industry, automated filtration systems enhance process reliability, decrease downtime, and ensure compliance. Smart filtration is also growing in homes and buildings, where intelligent water and air purifiers provide real-time performance monitoring and added convenience. Digital technology integrated into conventional filtration is leading innovation, lowering operational expense, and optimizing filtration performance. As artificial intelligence (AI) and machine learning (ML) advance further, intelligent filtration systems will keep becoming more complex, further revolutionizing the process of filtration in various industries in India.

India Filtration Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, filter media, technology, and end use industry.

Product Type Insights:

- Air Filtration Systems

- Water Filtration Systems

- Gas Filtration Systems

- Oil Filtration Systems

The report has provided a detailed breakup and analysis of the market based on the product type. This includes air filtration systems, water filtration systems, gas filtration systems and oil filtration.

Filter Media Insights:

- Activated Carbon

- Fiberglass

- Nonwoven Fabrics

- Metals

- Filter Paper

- Combination Filters

- Others

A detailed breakup and analysis of the market based on the filter media have also been provided in the report. This includes activated carbon, fiberglass, nonwoven fabrics, metals, filter paper, combination.

Technology Insights:

- Microfiltration

- Ultrafiltration

- Nanofiltration

- Reverse Osmosis

- Electrodialysis

- Chromatography

- Centrifugation

The report has provided a detailed breakup and analysis of the market based on the technology. This includes microfiltration, ultrafiltration, nanofiltration, reverse osmosis, electrodialysis, chromatography and centrifugation.

End Use Industry Insights:

- Residential

- Commercial

- Industrial

- Municipal

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes residential, commercial, industrial and municipal.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Filtration Systems Market News:

- In November 2024, Atmus Filtration Technologies has opened a cutting-edge technical center in Pune to boost filtration solutions for the commercial vehicle industry. The facility boasts state-of-the-art testing and validation laboratories for filtration products to meet ISO and SAE standards of performance, durability, and environmental efficiency.

- In November 2024, Dyson has introduced the Purifier Hot+Cool Gen1 in India, an innovative all-in-one air purifying, heating, and cooling product. Featuring HEPA filtration, real-time detection of air quality, and Air Multiplier, it automatically senses pollutants and modulates airflow for maximum indoor air quality.

- In March 2024, Hengst Filtration commissioned a state-of-the-art production facility at Yelahanka, Bengaluru, to manufacture advanced filtration solutions for vehicle engines, industrial equipment, medical devices, and hydraulic systems. The plant will improve air and fluid filtration efficiency, lower emissions, and meet India's increasing need for eco-friendly filtration technologies.

India Filtration Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Air Filtration Systems, Water Filtration Systems, Gas Filtration Systems, Oil Filtration Systems |

| Filter Medias Covered | Activated Carbon, Fiberglass, Nonwoven Fabrics, Metals, Filter Paper, Combination Filters, Others |

| Technologies Covered | Microfiltration, Ultrafiltration, Nanofiltration, Reverse Osmosis, Electrodialysis, Chromatography, Centrifugation |

| End Use Industries Covered | Residential, Commercial, Industrial, Municipal |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India filtration systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India filtration systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India filtration systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The filtration systems market in India was valued at USD 3.60 Billion in 2024.

The India filtration systems market is projected to exhibit a CAGR of 7.80% during 2025-2033, reaching a value of USD 7.08 Billion by 2033.

Key factors driving the India filtration systems market include rising urbanization as well as industrialization, the increasing demand for clean air and water, continual advancements in filtration technology (such as membrane filtration), and regulatory policies focusing on sustainability and public health.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)