India Fintech Blockchain Market Size, Share, Trends and Forecast by Industry, Application, End User, and Region, 2025-2033

India Fintech Blockchain Market Overview:

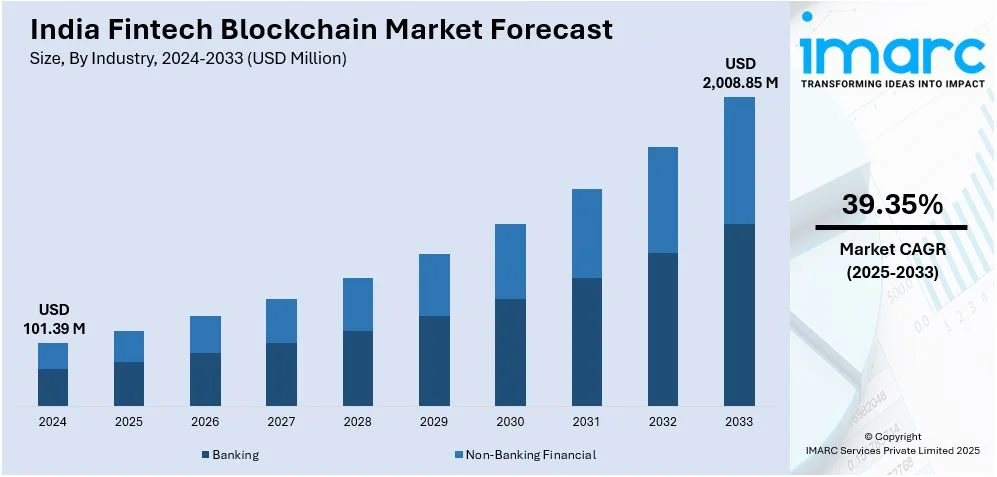

The India fintech blockchain market size reached USD 101.39 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,008.85 Million by 2033, exhibiting a growth rate (CAGR) of 39.35% during 2025-2033. The market is fueled by increasing digital payments, official backing for blockchain adoption, rising investment in financial technology, and expanding demand for safe and transparent transactions. Moreover, the role of blockchain in diminishing fraud, making operations more efficient, and promoting financial inclusion further propels its adoption throughout the fintech ecosystem.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 101.39 Million |

| Market Forecast in 2033 | USD 2,008.85 Million |

| Market Growth Rate 2025-2033 | 39.35% |

India Fintech Blockchain Market Trends:

Regulatory Advancements and Government Support

The Indian government and regulatory bodies have shown increasing interest in fostering blockchain technology within the financial sector. Initiatives like the Reserve Bank of India’s (RBI) Central Bank Digital Currency (CBDC) pilot projects and the establishment of regulatory sandboxes facilitate blockchain experimentation in fintech applications. Additionally, in September 2024, the Ministry of Electronics and Information Technology (MeitY) launched the Vishvasya-Blockchain Technology Stack, a Blockchain-as-a-Service (BaaS) framework to enhance digital trust and governance. Alongside, NBFLite, a lightweight blockchain for startups and academia, and Praamaanik, a blockchain-enabled app verification platform, were introduced. Such regulatory advancements create a secure and compliant environment, promoting the growth of blockchain in digital payments, cross-border transactions, and financial services. The proactive regulatory framework is expected to stimulate blockchain integration across financial institutions, enhancing transparency and operational efficiency.

To get more information on this market, Request Sample

Adoption of Decentralized Finance (DeFi) and Tokenization

The growth of Decentralized Finance (DeFi) platforms in India is expanding blockchain use cases within the financial ecosystem. DeFi enables peer-to-peer lending, asset management, and cross-border payments without intermediaries, providing a more accessible financial infrastructure. Additionally, tokenization of real-world assets like real estate, commodities, and securities is gaining traction. Through blockchain-based tokens, financial assets become divisible, tradeable, and accessible to a broader investor base. Indian fintech companies are increasingly exploring tokenized financial instruments and digital asset management solutions, offering transparent and secure investment opportunities. This trend marks a shift towards a more inclusive and efficient financial landscape powered by blockchain technology. For instance, according to Startale Labs, India is expected to contribute 20-30% of the next billion Web3 users. Soneium, a consumer-focused blockchain developed by the joint venture between Sony Group and Startale Group, aims to drive blockchain adoption. With India’s expanding digital infrastructure and increasing interest in decentralized technologies, the country is positioned as a key player in the global Web3 ecosystem, supporting further growth in blockchain applications.

India Fintech Blockchain Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on industry, application, and end user.

Industry Insights:

- Banking

- Non-Banking Financial

The report has provided a detailed breakup and analysis of the market based on the industry. This includes banking and non-banking financial.

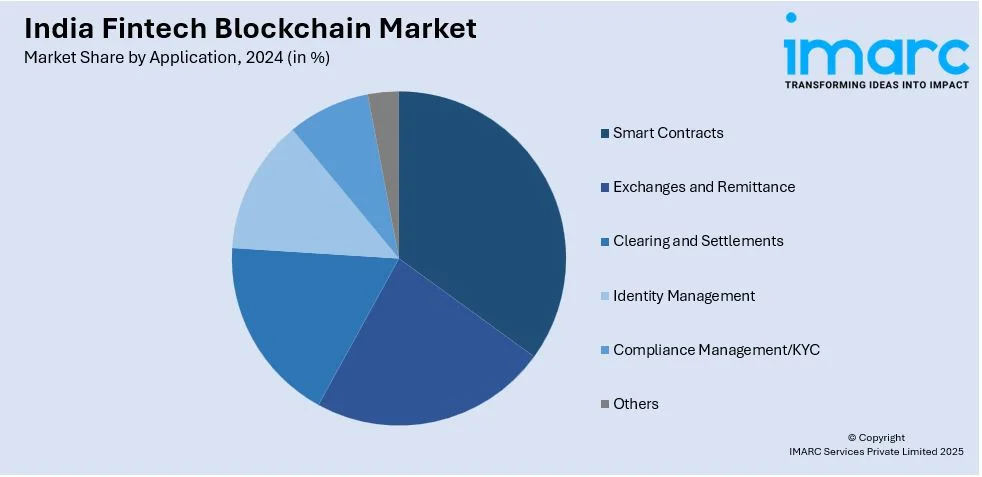

Application Insights:

- Smart Contracts

- Exchanges and Remittance

- Clearing and Settlements

- Identity Management

- Compliance Management/KYC

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes smart contracts, exchanges and remittance, clearing and settlements, identity management, compliance management/KYC, and others.

End User Insights:

- Small and Medium Size Enterprises (SMEs)

- Large Enterprises

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes small and medium size enterprises (SMEs) and large enterprises.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fintech Blockchain Market News:

- In December 2024, Nazara Technologies and Web3 game infrastructure startup Lysto partnered to launch The Growth Protocol, a Layer-1 (L1) blockchain infrastructure for digital marketing and growth applications. The platform, designed to enhance transparency, equity, and monetization in Web3 marketing, debuted at India Blockchain Week in Bengaluru. With input from executives from Microsoft and Google, the initiative also introduced a proof-of-concept loyalty dApp for game marketing, showcasing blockchain’s practical applications in the gaming industry.

- In February 2024, AlgoBharat, an initiative by the Algorand Foundation, partnered with T-Hub to launch a year-long Startup Lab programme for Web3 startups in India. It aims to offer technical and business mentorship and pre-seed funding to 20 selected startups working on blockchain solutions in sectors like healthcare, supply chain, and financial inclusion.

- In March 2025, Zaggle Prepaid Ocean Services acquired a 51% stake in Hyderabad-based Effiasoft for ₹41.31 crore to strengthen its fintech capabilities. Effiasoft, known for its JustBilling platform, serves over 300 merchants across India and Southeast Asia. The acquisition aligns with Zaggle’s strategy to enhance digital payment solutions and accelerate growth.

India Fintech Blockchain Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Industries Covered | Banking, Non-Banking Financial |

| Applications Covered | Smart Contracts, Exchanges and Remittance, Clearing and Settlements, Identity Management, Compliance Management/KYC, Others |

| End Users Covered | Small and Medium Size Enterprises (SMEs), Large Enterprises |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fintech blockchain market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fintech blockchain market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fintech blockchain industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India fintech blockchain market in India was valued at USD 101.39 Million in 2024.

The India fintech blockchain market is projected to exhibit a CAGR of 39.35% during 2025-2033, reaching a value of USD 2,008.85 Million by 2033.

Rising digital payments, supportive government initiatives, regulatory sandboxes, increasing DeFi adoption, asset tokenization, and the push for secure, transparent transactions are boosting blockchain integration in financial services. Blockchain’s role in reducing fraud and enhancing operational efficiency is driving growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)