India Fire Detection Equipment Market Size, Share, Trends and Forecast by Product Type, Alarm Type, End User, and Region, 2025-2033

India Fire Detection Equipment Market Overview:

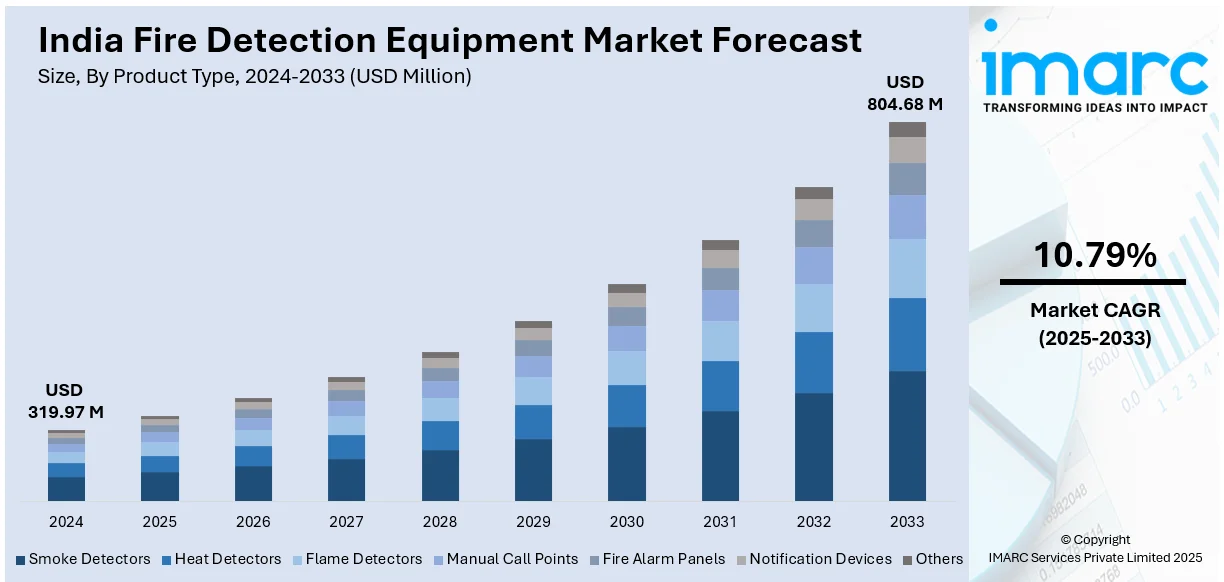

The India fire detection equipment market size reached USD 319.97 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 804.68 Million by 2033, exhibiting a growth rate (CAGR) of 10.79% during 2025-2033. The market is driven by stringent government safety regulations, rapid urbanization, and increasing industrial safety standards. Growth in smart city projects, rising demand for wireless and IoT-enabled systems, and growing awareness of fire safety in residential and commercial sectors are further expanding the India fire detection equipment market share. Technological advancements and infrastructure development also contributes significantly to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 319.97 Million |

| Market Forecast in 2033 | USD 804.68 Million |

| Market Growth Rate (2025-2033) | 10.79% |

India Fire Detection Equipment Market Trends:

Increasing Adoption of Smart Fire Detection Systems

The significant shift toward smart and IoT-enabled fire detection systems is majorly driving the India fire detection equipment market growth. With advancements in wireless technology and artificial intelligence, businesses and residential complexes are increasingly adopting intelligent smoke detectors, heat sensors, and fire alarms that provide real-time alerts via mobile apps. These systems offer remote monitoring, predictive maintenance, and integration with building automation systems, enhancing safety and reducing false alarms. Government regulations, such as the National Building Code (NBC) 2016, are also pushing for advanced fire safety solutions in commercial and high-rise buildings. On 20th November 2024, the Uttar Pradesh government announced deploying all-terrain vehicles, one of the best for fire safety in Mahakumbh 2025. These were equipped with firefighting gear, 9-liter water guns, and eco-friendly foam to allow for rapid responses. Four vehicles, at an investment of INR 2.5 Crore (about USD 304,878.05), were deployed for rapid response in high-density population areas capable of speeds up to around 60 km/h. These initiatives reflect an increasingly critical need for fire safety measures in India and are bolstering demand in the fire detection equipment industry. Additionally, rising urbanization and smart city initiatives are accelerating the demand for automated fire detection systems. Companies are investing in research and development (R&D) activities to introduce cost-effective, cloud-based solutions, making smart fire detection more accessible to mid-sized enterprises and homeowners. This trend is expected to drive market growth over the next five years.

To get more information on this market, Request Sample

Rising Demand for Wireless and Addressable Fire Alarm Systems

Wireless and addressable fire alarm systems are gaining traction in India due to their flexibility, scalability, and ease of installation. Unlike conventional systems, addressable fire alarms pinpoint the exact location of a fire, enabling faster response times a critical factor in large commercial and industrial facilities. The growing emphasis on worker safety and stringent fire safety norms in industries such as oil and gas, manufacturing, and IT parks is creating a positive India fire detection equipment market outlook. According to the National Crime Records Bureau (NCRB), in fire accidents, India recorded significant positive results with the number of incidents from 27,976 in 1999 to 7,566 in 2022. Likewise, deaths have decreased from 27,561 in 1996 to 7,435 in 2022. The decline in fire-related accidents highlights improved awareness, stricter safety regulations, and advancements in fire detection and suppression technologies. Also, there is an increased demand for reliable fire detection systems, including advanced fire alarms, which is expected to increase in India's safety-centric market. In addition, wireless systems eliminate the need for complex wiring, reducing installation costs and downtime and making them ideal for retrofitting older buildings. Furthermore, integration with centralized monitoring systems enhances operational efficiency. As infrastructure development and industrial expansion continue across India, the adoption of advanced fire detection solutions is expected to rise, positioning wireless and addressable systems as key growth drivers in the market.

India Fire Detection Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, alarm type, and end user.

Product Type Insights:

- Smoke Detectors

- Heat Detectors

- Flame Detectors

- Manual Call Points

- Fire Alarm Panels

- Notification Devices

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes smoke detectors, heat detectors, flame detectors, manual call points, fire alarm panels, notification devices, and others.

Alarm Type Insights:

- Audible Alarms

- Visual Alarms

- Manual Call-Points Alarms

A detailed breakup and analysis of the market based on the alarm type have also been provided in the report. This includes audible alarms, visual alarms, and manual call-points alarms.

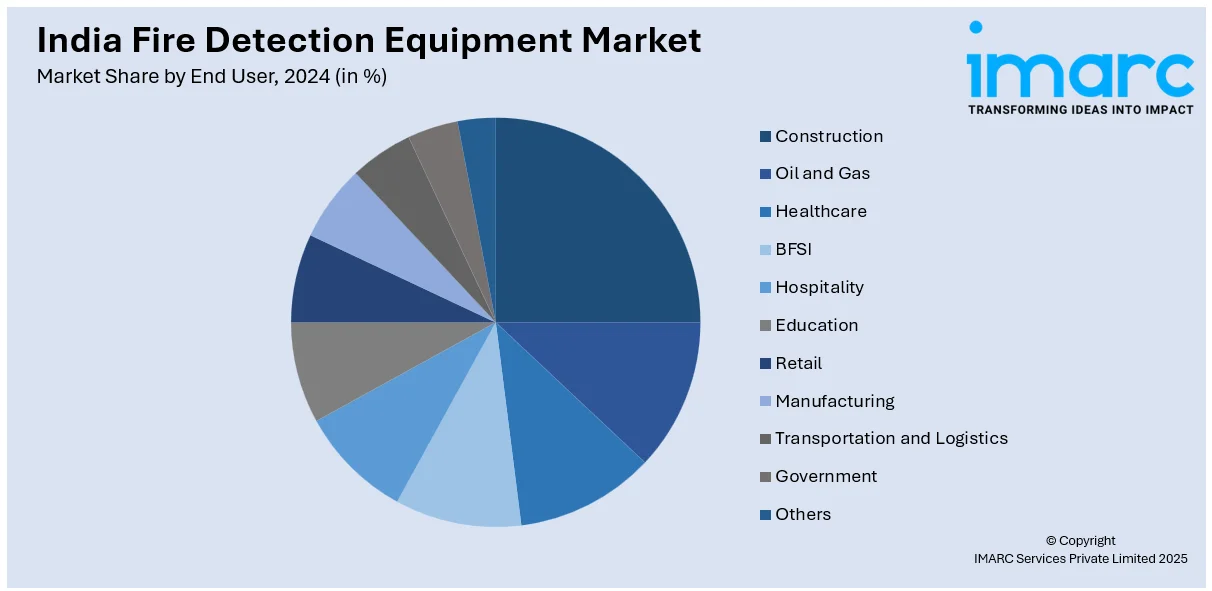

End User Insights:

- Construction

- Oil and Gas

- Healthcare

- BFSI

- Hospitality

- Education

- Retail

- Manufacturing

- Transportation and Logistics

- Government

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes construction, oil and gas, healthcare, BFSI, hospitality, education, retail, manufacturing, transportation and logistics, government, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fire Detection Equipment Market News:

- November 15, 2024: Fusion Enterprises inaugurated its first store in Kohima, Nagaland, where an extensive range of fire safety products, including fire extinguishers, smoke detectors, and automatic suppression systems, are sold. The store also provides products and services, such as fire extinguisher refilling, for which professional training is more specialized, to raise awareness of fire safety in the area. This initiative is reflective of the growing market for fire detection equipment in India, given the increasing regulatory requirement for fire detection equipment as the demand for fire detection equipment grows.

- June 18, 2024: The Bosch Group unveiled its first-ever fire alarm assembly line in India through Bosch Building Technologies, which will generate Avenar fire detectors locally, catering to the country's rising need for advanced safety solutions. With India being one of the fastest growing markets currently, Bosch aims to make India its largest market in the world for fire detection equipment in the next two years. This step is a part of the Make in India initiative. It is going to help enhance indigenous manufacturing along with giving a big push to make the supply chain more efficient.

India Fire Detection Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Smoke Detectors, Heat Detectors, Flame Detectors, Manual Call Points, Fire Alarm Panels, Notification Devices, Others |

| Alarm Types Covered | Audible Alarms, Visual Alarms, Manual Call-Points Alarms |

| End Users Covered | Construction, Oil and Gas, Healthcare, BFSI, Hospitality, Education, Retail, Manufacturing, Transportation and Logistics, Government, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India fire detection equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the India fire detection equipment market on the basis of product type?

- What is the breakup of the India fire detection equipment market on the basis of alarm type?

- What is the breakup of the India fire detection equipment market on the basis of end user?

- What is the breakup of the India fire detection equipment market on the basis of region?

- What are the various stages in the value chain of the India fire detection equipment market?

- What are the key driving factors and challenges in the India fire detection equipment market?

- What is the structure of the India fire detection equipment market and who are the key players?

- What is the degree of competition in the India fire detection equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fire detection equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fire detection equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fire detection equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)