India Fire Protection Systems Market Size, Share, Trends, and Forecast by Component, Type, Application, and Region, 2025-2033

India Fire Protection Systems Market Overview:

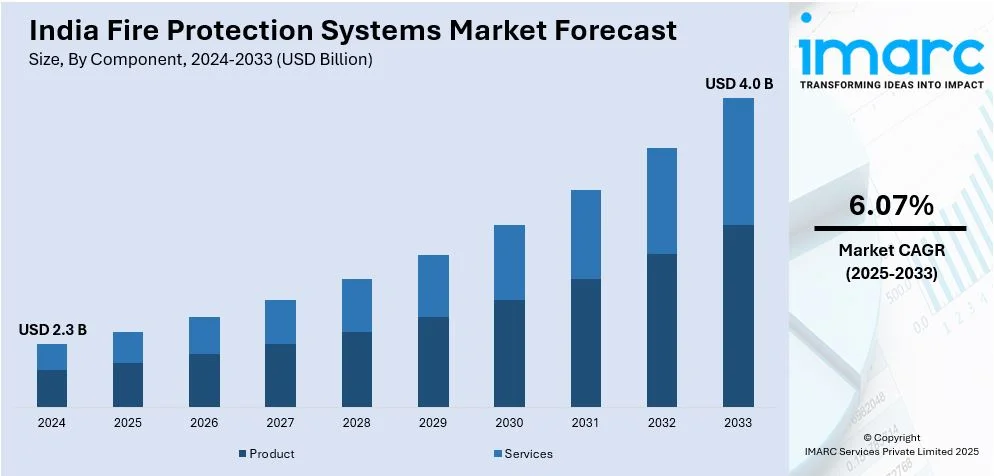

The India fire protection systems market size reached USD 2.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.0 Billion by 2033, exhibiting a growth rate (CAGR) of 6.07% during 2025-2033. The market is witnessing significant growth, driven by the integration of smart fire detection and suppression technologies. Extensive research and development activities and significant product innovations also contribute to the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.3 Billion |

| Market Forecast in 2033 | USD 4.0 Billion |

| Market Growth Rate 2025-2033 | 6.07% |

India Fire Protection Systems Market Trends:

Integration of Smart Fire Detection and Suppression Technologies

The market for fire protection systems in India is trending toward the adoption of multiples smart technologies comprising IoT-based fire detection and suppression systems. Modern fire alarms, automatic sprinklers, and gas-based suppression systems providing real-time monitoring are the new standard in commercial and industrial facilities. The push toward smart technologies is being driven by stringent fire safety regulations, increased consciousness about fire hazards, and the need for rapid incident response. For instance, in June 2024, Bosch Building Technologies announced the launch of its first India assembly line for AVENAR fire detectors, enhancing localization, supply chain efficiency, and market growth with seven advanced fire detection variants now manufactured domestically. Additionally, IoT-based fire safety solutions allow remote monitoring, predictive maintenance, and fast response times by sending immediate alerts through cloud-based platforms. Companies are investing in fire detection systems powered by artificial intelligence (AI) that learn from heat patterns, smoke levels, and real-time sensor data to reduce false alarms and improve accuracy. Government programs, such as the National Building Code (NBC) and updated fire safety regulations, are fast-tracking the adoption of smart fire protection solutions across manufacturing, commercial real estate, and oil & gas industries. Besides, smart cities and high-rise infrastructure projects heighten the need for integrated fire safety systems with central monitoring and automation. Key players in the market are focusing on the development of cost-effective, scalable solutions for varying industrial and residential applications while ensuring compliance with the ever-changing safety standards.

To get more information on this market, Request Sample

Rising Demand for Fire Protection in Data Centers and Industrial Facilities

The expansion of India’s data center and industrial sectors is driving significant demand for advanced fire protection systems. With increasing investments in hyperscale and colocation data centers, operators are prioritizing fire safety to prevent potential disruptions and data loss. Fire suppression technologies such as clean agent systems, water mist systems, and early warning smoke detection systems (EWSD) are gaining traction to protect sensitive equipment. The industrial sector, including oil & gas, chemical processing, and manufacturing, is also witnessing heightened fire safety compliance. Companies are adopting high-performance fire protection solutions, including foam-based suppression, industrial-grade sprinklers, and explosion-proof fire alarms to mitigate fire hazards in hazardous environments. For instance, in April 2024, Tesla Power India and E-Ashwa Automotive announced the launch of India’s first electric two-wheeler with a built-in fire suppressant system, enhancing EV safety. The government’s push for improved workplace safety regulations, combined with rising insurance requirements, is compelling enterprises to invest in comprehensive fire safety infrastructure. Increasing public-private partnerships in infrastructure projects further contribute to the demand for robust fire protection systems. Key industry players are offering tailored fire suppression solutions with advanced fire-resistant materials and automated fire control technologies. As industrial operations become more complex, enterprises are integrating multi-layered fire protection strategies to ensure operational continuity and compliance with safety mandates.

India Fire Protection Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component, type, and application.

Component Insights:

- Product

- Detection

- Suppression

- Response

- Analysis

- Sprinkler System

- Services

- Engineering

- Installation

- Maintenance

- Others

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes product (detection, suppression, response, analysis, sprinkler system) and services (engineering, installation, maintenance, and others).

Type Insights:

- Active Fire Protection System

- Passive Fire Protection System

The report has provided a detailed breakup and analysis of the market based on the type. This includes active fire protection system and passive fire protection system.

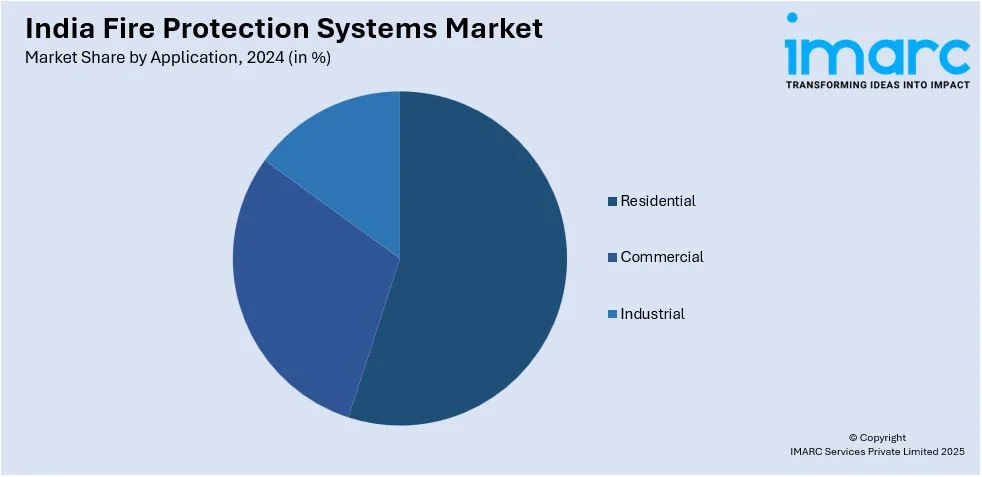

Application Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fire protection systems Market News:

- In June 2024, Pench Tiger Reserve, Maharashtra, implemented India’s first AI-based forest fire detection system, covering over 350 sq km. Equipped with a high-resolution camera with a 15-km range and integrated with 15 satellite services, this advanced system enhances fire detection efficiency and response, setting a new benchmark in forest management.

India Fire protection systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Types Covered | Active Fire Protection System, Passive Fire Protection System |

| Applications Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fire protection systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fire protection systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fire protection systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India fire protection systems market was valued at USD 2.3 Billion in 2024.

The India fire protection systems market is projected to exhibit a CAGR of 6.07% during 2025-2033, reaching a value of USD 4.0 Billion by 2033

Key drivers of the India fire protection systems market include rapid urban development, increasing industrialization, and growing focus on workplace and residential safety. Stricter enforcement of building safety regulations and fire codes has pushed adoption of modern fire detection and suppression systems. Additionally, smart city projects and infrastructure investments continue to boost demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)