India Fitness Supplements Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Fitness Supplements Market Overview:

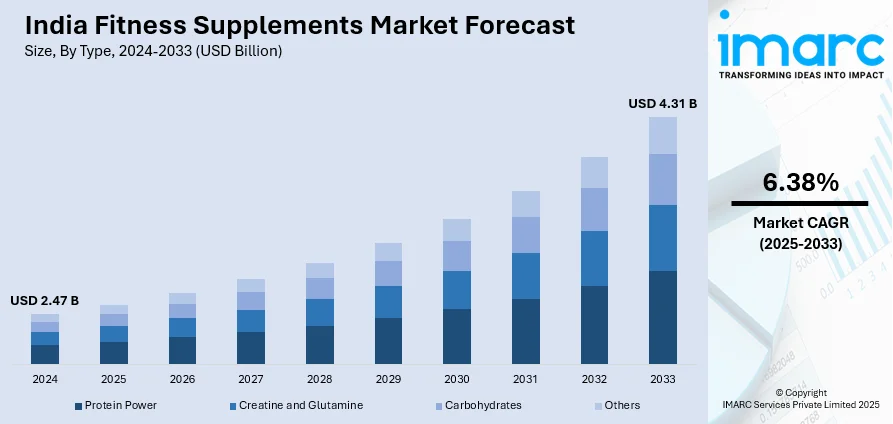

The India fitness supplements market size reached USD 2.47 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.31 Billion by 2033, exhibiting a growth rate (CAGR) of 6.38% during 2025-2033. The Indian fitness supplements market is evolving with innovations in product variety, including plant-based and vegan options and an increasing number of international brands that are enhancing product quality and availability. Additionally, specialized supplements catering to dietary restrictions like lactose intolerance, gluten sensitivity, and low-carb preferences are gaining significant demand among health-conscious consumers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.47 Billion |

| Market Forecast in 2033 | USD 4.31 Billion |

| Market Growth Rate (2025-2033) | 6.38% |

India Fitness Supplements Market Trends:

Expanding Product Variety and Innovation in Formulations

The market for fitness supplements in India is experiencing a rise in product diversity and innovations that address various user requirements. Brands are consistently developing new formulations, flavors, and delivery methods to cater to the varied tastes of Indian consumers. Additionally, there is an increase in plant-derived, organic, and vegan protein powders that attract individuals with dietary limitations or ethical issues. Moreover, supplements are being developed to target particular age categories, including products aimed at older adults or young athletes. The incorporation of local ingredients such as turmeric, ashwagandha, and moringa in supplement formulations is becoming increasingly popular as consumers seek products that reflect traditional Ayurvedic practices. The advancements in packaging, like ready-to-drink (RTD) protein shakes or portioned supplement snacks, enhance convenience, rendering fitness supplements more approachable and attractive for the hectic urban lifestyle. In 2024, GHOST introduced a special OREO Mint Whey Protein Powder, offering 25 grams of protein in each serving. The product contained real OREO cookie bits and a sweet mint taste, crafted with a high-quality 100% whey protein mix and digestive enzymes.

To get more information on this market, Request Sample

Increasing Presence of International Brands

International brands are entering the Indian market, bringing with them a wide range of high-quality products that have gained popularity among consumers. These brands are able to offer premium-quality supplements that cater to the increasing demand for superior nutrition and fitness enhancement. The entry of international brands also encourages local brands to improve their product offerings, resulting in better competition and innovation in the market. Additionally, international brands benefit from their established global reputation, creating a sense of trust and credibility with consumers. This influx of international brands is further expanding the choices available to consumers, making fitness supplements more accessible and appealing across a wider demographic. In 2024, Outlast Labz USA launched in India, bringing premium fitness supplements such as protein powders, BCAAs, pre-workout, and mass gainers to cater to the country's growing health and wellness market. The brand emphasized high-quality products free from gluten, soy, and additives.

Rising Demand for Specialized Supplements Catering to Dietary Restrictions

As consumers become more health-conscious and seek products tailored to their specific dietary needs, there is a preference for fitness supplements that accommodate common dietary restrictions like lactose intolerance, gluten sensitivity, and low-carb preferences. Products designed with these requirements in mind are gaining popularity, particularly among those who want to maintain their fitness while adhering to specific dietary choices. The growing understanding about health conditions and allergies is resulting in a shift in the supplement industry, motivating brands to offer more specialized options. Supplements that are lactose-free, gluten-free, and low in sugar are becoming essential for individuals who face digestive issues or are following particular health regimes. The rise of such products demonstrates a shift towards more inclusive offerings, allowing people with varying nutritional needs to engage in fitness and wellness without compromising their health or dietary preferences. In 2024, Protyze launched India's first 99% lactose-free Clear Whey Protein supplement, designed for easy digestion and optimal absorption, especially for those with lactose intolerance. The product offered 24g of protein per scoop, along with 7.2g of BCAAs for muscle growth and recovery. It was gluten-free, low in carbs, and free from added sugars.

India Fitness Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Protein Power

- Creatine and Glutamine

- Carbohydrates

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes protein power, creatine and glutamine, carbohydrates, and others.

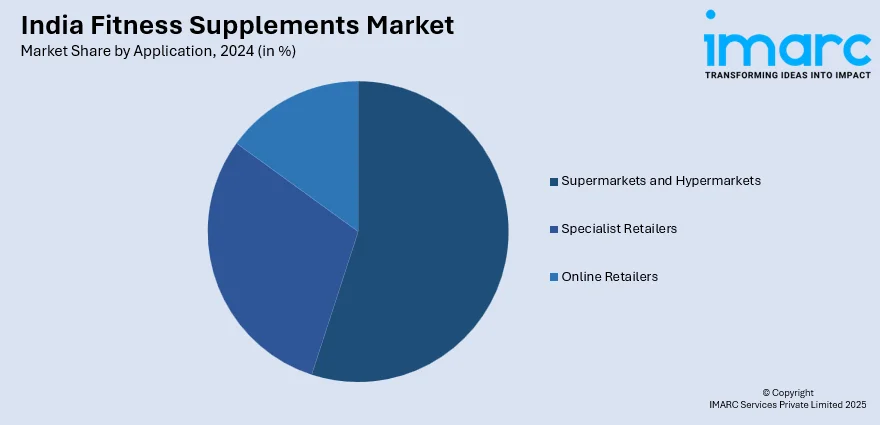

Application Insights:

- Supermarkets and Hypermarkets

- Specialist Retailers

- Online Retailers

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes supermarkets and hypermarkets, specialist retailers, and online retailers.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fitness Supplements Market News:

- In August 2024, Denzour Nutrition expanded into organic nutraceuticals with a new product range aimed at enhancing overall wellness. The range included products like Beetroot Extract, Testo Booster, and Ashwagandha, targeting both athletes and the general population. Denzour emphasized organic, ethically sourced ingredients and high-quality standards.

- In June 2024, Steadfast Nutrition launched two fast-release protein supplements, Whey Protein and LIV Raw, alongside a vegetarian Multivitamin mega pack at the International Health Sports and Fitness Festival. The products aimed to address India's protein deficiency, with Whey Protein offering 24g of protein and LIV Raw providing 27g for athletes. Both supplements were designed for muscle recovery and enhanced strength.

India Fitness Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Protein Power, Creatine and Glutamine, Carbohydrates, Others |

| Applications Covered | Supermarkets and Hypermarkets, Specialist Retailers, Online Retailers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India fitness supplements market performed so far and how will it perform in the coming years?

- What is the breakup of the India fitness supplements market on the basis of type?

- What is the breakup of the India fitness supplements market on the basis of application?

- What is the breakup of the India fitness supplements market on the basis of region?

- What are the various stages in the value chain of the India fitness supplements market?

- What are the key driving factors and challenges in the India fitness supplements market?

- What is the structure of the India fitness supplements market and who are the key players?

- What is the degree of competition in the India fitness supplements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fitness supplements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fitness supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fitness supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)