India Fixed Satellite Services Market Size, Share, Trends, and Forecast by Service, Organization Size, End User, and Region, 2025-2033

India Fixed Satellite Services Market Overview:

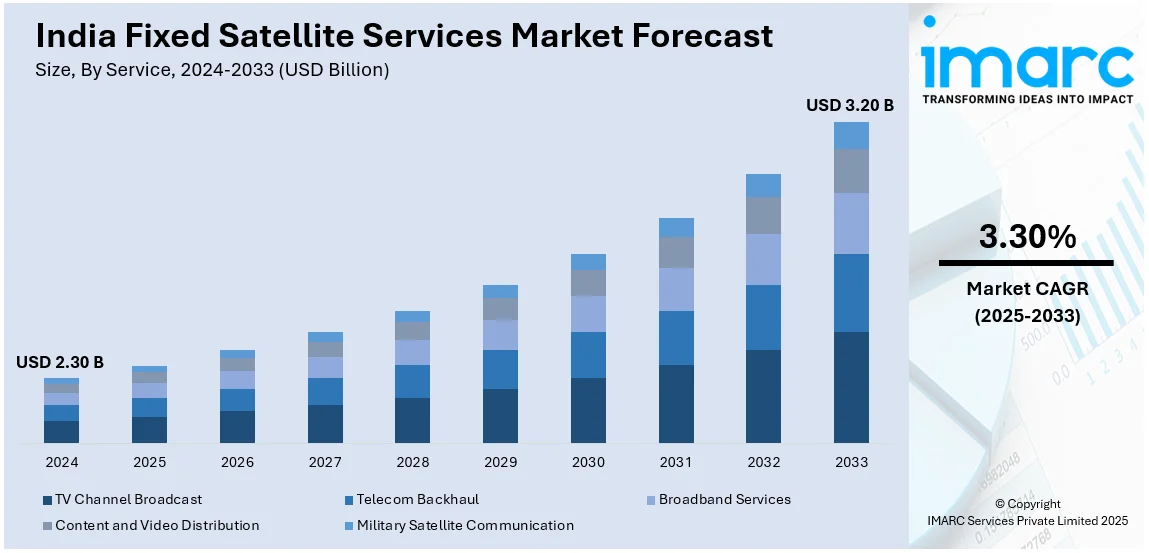

The India fixed satellite services market size reached USD 2.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.20 Billion by 2033, exhibiting a growth rate (CAGR) of 3.30% during 2025-2033. The market is witnessing significant growth, driven by the rising demand for high-throughput satellites and the expansion of satellite-based broadband services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.30 Billion |

| Market Forecast in 2033 | USD 3.20 Billion |

| Market Growth Rate (2025-2033) | 3.30% |

India Fixed Satellite Services Market Trends:

Growing Demand for High-Throughput Satellites (HTS)

The demand for High-Throughput Satellites (HTS) in India’s fixed satellite services market is gaining momentum with their corrected view. Satellite communication is being transformed by HTS's capacity to maximize bandwidth utility more efficiently and cost-effectively. This recent development is fueled by the growing need for assured broadband connectivity in rural and remote areas, alongside increasing demand from diverse applications, such as video broadcasting and the Internet of Things (IoT). For instance, in India during October 2024, Viasat, in association with BSNL, successfully demonstrated direct-to-device satellite connectivity using 3GPP Release 17 standards—thus, proving that satellite personal broadband is feasible for Indian users with smart phones. Also, government initiatives to bridge the digital divide are fostering the switch to HTS in underserved areas. Uninterrupted and high-speed communication services are pressing needs, with the education, e-health, and agricultural segments owing to India's vast population and an equally surging economy. HTS technology will strengthen India's goal of being a global space hub with active collaborations being made by ISRO with companies in the private sector to enhance satellite infrastructure. With growing competition in the subcontinent, the vitees are now investing into the advanced fleet of satellites and innovative service details to adapt to the changing needs of both enterprise and consumer customers; thus, HTS is coming out to be a prominent growth engine in India’s satellite services market.

To get more information on this market, Request Sample

Expansion of Satellite-based Broadband Services

The expansion of satellite-based broadband services is rapidly emerging as a dominant trend within the Indian fixed satellite services market. As India aims to provide affordable and accessible internet connectivity across the nation, satellite broadband is playing a pivotal role, especially in remote and rural areas where terrestrial networks are limited or unavailable. For instance, in March 2025, Bharti Airtel announced partnership with SpaceX to introduce Starlink’s high-speed satellite internet in India, pending regulatory approvals, with a focus on aligning with the country’s policies and objectives. The growing reliance on digital platforms for education, e-commerce, healthcare, and entertainment, along with the government's push for "Digital India," has accelerated the adoption of satellite broadband services. Key market players are introducing innovative solutions to meet the increasing demand for high-speed internet services, which are essential for both personal and professional use. Furthermore, the ongoing advancements in satellite technology are enabling greater bandwidth capacity and lower latency, enhancing the overall quality of service. Companies like SpaceX, OneWeb, and Hughes Communications are entering the Indian market, providing a variety of satellite broadband options to cater to diverse needs. As India's digital economy continues to expand, satellite broadband services are expected to play an increasingly critical role in facilitating connectivity in underserved regions, helping bridge the urban-rural digital divide and enabling inclusive growth. This shift represents a significant opportunity for both new entrants and established satellite service providers in the market.

India Fixed Satellite Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on service, organization size, and end user.

Service Insights:

- TV Channel Broadcast

- Telecom Backhaul

- Broadband Services

- Content and Video Distribution

- Military Satellite Communication

The report has provided a detailed breakup and analysis of the market based on the service. This includes TV Channel Broadcast, Telecom Backhaul, Broadband Services, Content and Video Distribution, and Military Satellite Communication.

Organization Size Insights:

- Small Offices and Home Offices (SOHO)

- Small and Medium Businesses (SMB)

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes Small Offices and Home Offices (SOHO), Small and Medium Businesses (SMB), and Large Enterprises.

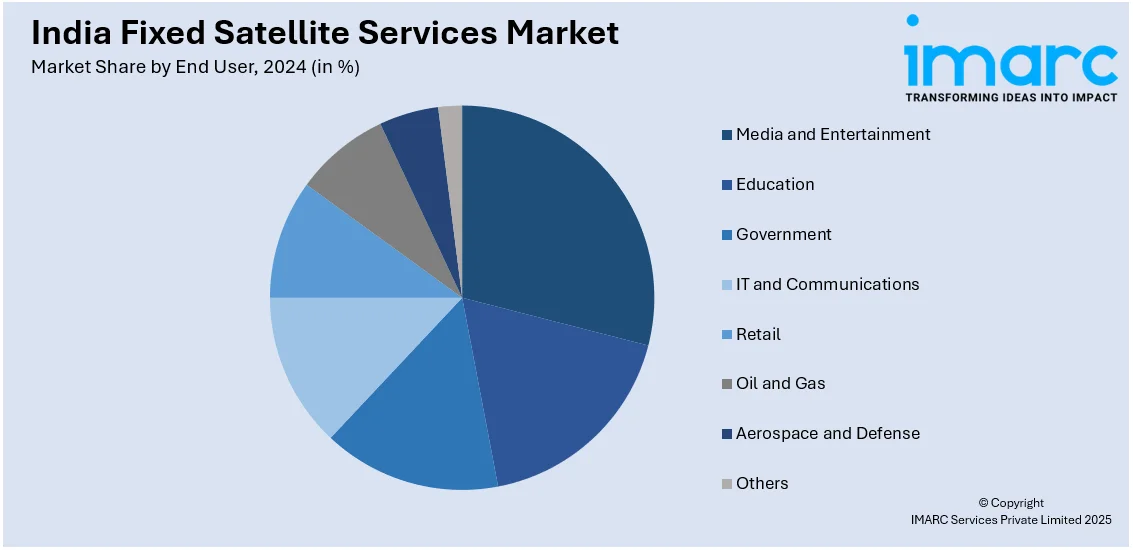

End User Insights:

- Media and Entertainment

- Education

- Government

- IT and Communications

- Retail

- Oil and Gas

- Aerospace and Defense

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes Media and Entertainment, Education, Government, IT and Communications, Retail, Oil and Gas, Aerospace and Defense, and Others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fixed Satellite Services Market News:

- For instance, in March 2025, Jio Platforms announced a partnership with SpaceX to launch Starlink satellite internet in India, pending regulatory approvals. The collaboration aims to enhance Jio’s services and complement SpaceX’s offerings to consumers and businesses.

India Fixed Satellite Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | TV Channel Broadcast, Telecom Backhaul, Broadband Services, Content and Video Distribution, Military Satellite Communication |

| Organization Sizes Covered | Small Offices and Home Offices (SOHO), Small and Medium Businesses (SMB), Large Enterprises |

| End Users Covered | Media and Entertainment, Education, Government, IT and Communications, Retail, Oil and Gas, Aerospace and Defense, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fixed satellite services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fixed satellite services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fixed satellite services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India fixed satellite services market was valued at USD 2.30 Billion in 2024.

The India fixed satellite services market is projected to exhibit a CAGR of 3.30% during 2025-2033, reaching a value of USD 3.20 Billion by 2033.

The India fixed satellite services market is driven by increasing demand for reliable communication in remote areas, expansion of broadcasting and DTH services, and growing use in defense and disaster management. Government initiatives for digital inclusion and rural connectivity also contribute to rising adoption of satellite-based communication solutions across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)