India Fleet Leasing Market Size, Share, Trends and Forecast by Lease Type, Vehicle Type, Lease Duration, End Use Industry, and Region, 2025-2033

India Fleet Leasing Market Overview:

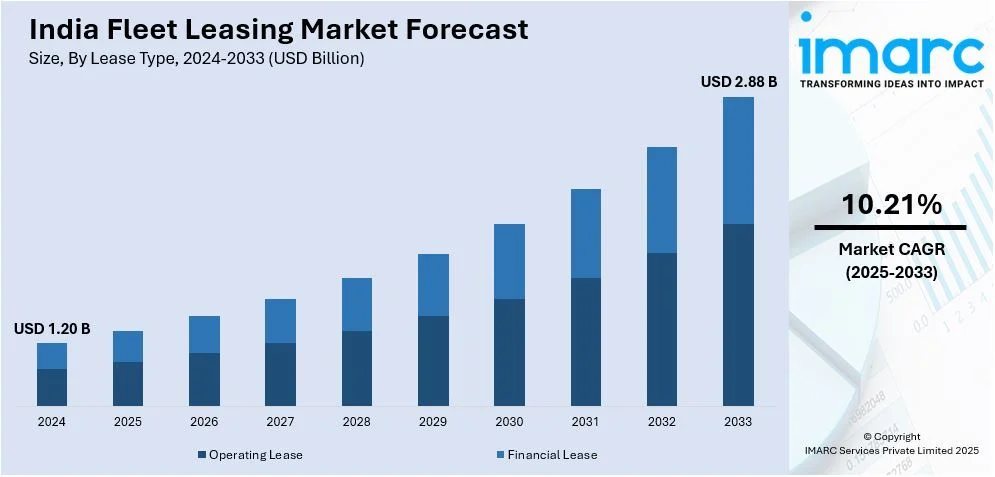

The India fleet leasing market size reached USD 1.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.88 Billion by 2033, exhibiting a growth rate (CAGR) of 10.21% during 2025-2033. The market is driven by rising corporate demand for affordable mobility solutions, increasing EV adoption, and a preference for subscription-based models, while government incentives, tax credits, telematics integration, expanding infrastructure, and digital platforms further enhance accessibility and make leasing a viable alternative to ownership.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.20 Billion |

| Market Forecast in 2033 | USD 2.88 Billion |

| Market Growth Rate 2025-2033 | 10.21% |

India Fleet Leasing Market Trends:

Rise of Electric Vehicle (EV) Leasing

The trend towards sustainable transportation is pushing electric vehicle (EV) uptake within the fleet leasing segment. Corporate fleets and green initiatives by governments have prompted leasing companies to increase EV supply. Lower running costs of EVs, along with state support in the form of subsidies and tax credits, are making EVs appealing to corporate fleets. Increased charging infrastructure and improvements in battery technology are also underpinning this growth. Moreover, leasing EVs enables businesses to avoid high initial expenses while achieving sustainability objectives. Fleet operators are now incorporating EVs into their fleets, resulting in new business models like battery swapping and charging-as-a-service. EV leasing demand is likely to increase as businesses focus on reducing carbon footprints and minimizing costs.

To get more information on this market, Request Sample

Expansion of Telematics and Fleet Management Solutions

The integration of telematics and advanced fleet management solutions is reshaping fleet leasing in India, driven by regulatory mandates like the Automotive Industry Standard 140 (AIS 140). This regulation requires global positioning system (GPS) tracking and emergency buttons in public transport and commercial vehicles, enhancing safety and efficiency. Businesses are leveraging real-time vehicle tracking, predictive maintenance, and driver behavior monitoring to optimize fleet operations. Data analytics is becoming key to route optimization, fuel consumption, and asset utilization, saving costs further. Leasing organizations are integrating telematics-enabled solutions as value-added services to enable businesses to make informed decisions based on data. The connected vehicle and artificial intelligence (AI)-based analytics trends are optimizing fleet operations. As compliance, safety, and operating efficiency take the center stage, telematics adoption in fleet leasing is set to gain a lot of traction in the years to come.

Growth of Subscription-Based Leasing Models

Indian fleet leasing is also moving towards flexible subscription-based solutions, targeting companies and individuals who are looking for cost-saving options other than car ownership. Such solutions offer customizable lease plans with short-term and pay-per-use offerings, cutting long-term commitments. Startups, gig economy drivers, and small businesses are the drivers for this trend due to increasing demand. Leasing services have been made convenient by digital platforms with transparent pricing and hassle-free maintenance. Bundled service providers, such as insurance, servicing, and roadside assistance, are becoming popular. With financial constraints and changing mobility requirements redefining the market, subscription-based leasing is being seen as an attractive solution, fostering affordability and convenience.

India Fleet Leasing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on lease type, vehicle type, lease duration, and end use industry.

Lease Type Insights:

- Operating Lease

- Financial Lease

The report has provided a detailed breakup and analysis of the market based on the lease type. This includes operating lease and financial lease.

Vehicle Type Insights:

- Passenger Vehicles

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger vehicles, light commercial vehicles (LCVS), and heavy commercial vehicles (HCVS).

Lease Duration Insights:

- Short-Term Leasing (Less than 12 months)

- Medium-Term Leasing (1-3 years)

- Long-Term Leasing (More than 3 years)

The report has provided a detailed breakup and analysis of the market based on the lease duration. This includes short-term leasing (less than 12 months), medium-term leasing (1-3 years), and long-term leasing (more than 3 years).

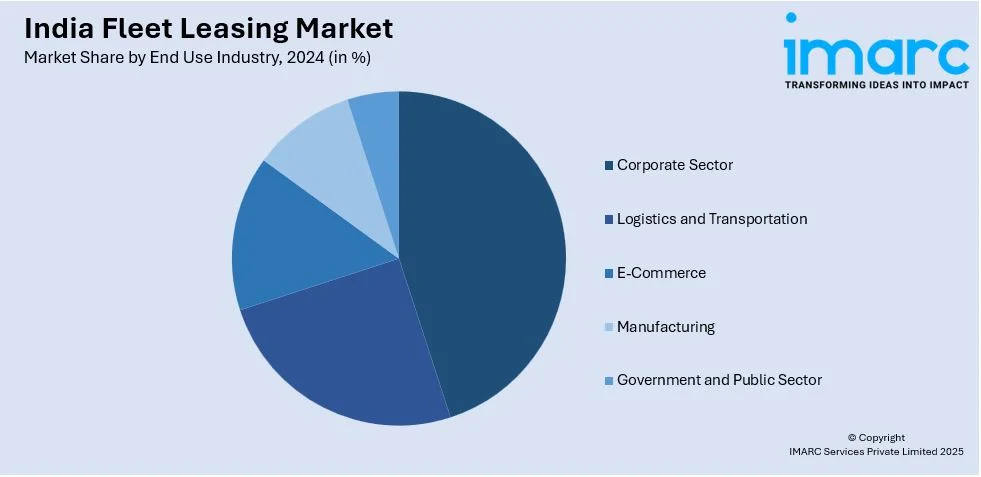

End Use Industry Insights:

- Corporate Sector

- Logistics and Transportation

- E-Commerce

- Manufacturing

- Government and Public Sector

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes corporate sector, logistics and transportation, e-commerce, manufacturing, and government and public sector.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fleet Leasing Market News:

- In January 2025, ZF launched SCALAR, a digital fleet management platform, in India to enhance efficiency, safety, and sustainability in commercial fleet operations. Introduced at the Bharat Mobility Expo 2025, SCALAR optimizes passenger and cargo transport while reducing operational costs. ZF India MD P. Kaniappan highlighted its role as a comprehensive fleet orchestration solution tailored for the Indian market.

- In November 2024, Switch Mobility and Vertelo partnered to deploy 1,000 electric vehicles across India in the next 3-5 years, promoting sustainable fleet leasing. Switch Mobility will supply EVs, while Vertelo will manage leasing and funding, easing adoption for businesses. The collaboration aims to tackle urban congestion and carbon emissions through flexible leasing solutions.

India Fleet Leasing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Lease Types Covered | Operating Lease, Financial Lease |

| Vehicle Types Covered | Passenger Vehicles, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs) |

| Lease Durations Covered | Short-Term Leasing (Less than 12 months), Medium-Term Leasing (1-3 years), Long-Term Leasing (More than 3 years) |

| End Use Industries Covered | Corporate Sector, Logistics and Transportation, E-Commerce, Manufacturing, Government and Public Sector |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fleet leasing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fleet leasing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fleet leasing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fleet leasing market in India was valued at USD 1.20 Billion in 2024.

The India fleet leasing market is projected to exhibit a CAGR of 10.21% during 2025-2033, reaching a value of USD 2.88 Billion by 2033.

The India fleet leasing market is propelled by rising corporate demand for cost-efficient mobility solutions, growing adoption of leasing over ownership, and expansion of logistics and e-commerce sectors. Supportive tax benefits, flexible financing options, and increasing preference for fleet management services further enhance market growth prospects.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)