India Fluoropolymer Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

India Fluoropolymer Market Overview:

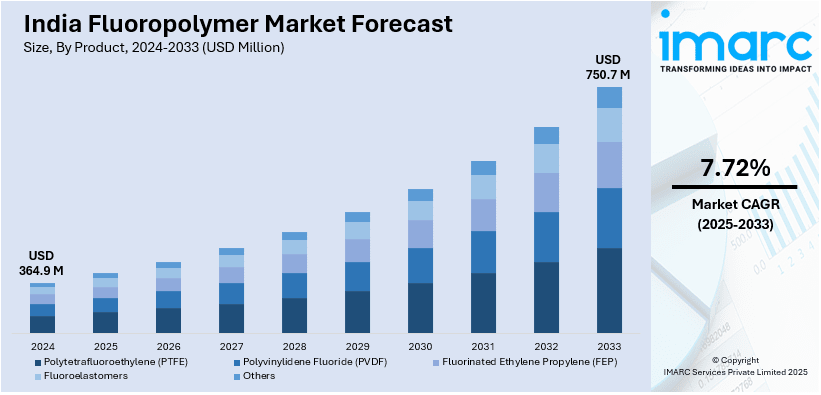

The India fluoropolymer market size reached USD 364.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 750.7 Million by 2033, exhibiting a growth rate (CAGR) of 7.72% during 2025-2033. The market is expanding due to rising demand in automotive, electronics, and industrial applications. Growth is driven by increased adoption of EV batteries, semiconductor manufacturing, and high-performance coatings. In addition, government initiatives promoting domestic production and technological advancements are further supporting market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 364.9 Million |

| Market Forecast in 2033 | USD 750.7 Million |

| Market Growth Rate (2025-2033) | 7.72% |

India Fluoropolymer Market Trends:

Increasing Demand from Automotive Sector

Indian fluoropolymer market is growing robustly with increasing demand from the automotive sector. Fluoropolymers find extensive application in car parts owing to their excellent thermal stability, chemical resistance, and low coefficient of friction. As the Indian automotive market shifts its emphasis towards electric vehicles and fuel economy, fluoropolymers are assuming significance in battery parts, wiring, and coatings. The demand for lighter materials to enhance vehicle performance and reduce emissions is also propelling adoption. Advancements in EV battery technology and charging infrastructure are boosting demand for fluoropolymer-based coatings and insulation materials. Producers are also increasing manufacturing capacity to respond to the demand for high-performance materials in automobiles. Moreover, the application of fluoropolymers in fuel systems, hoses, and gaskets is picking up speed as these compounds are long-lasting and can hold up against severe conditions. Furthermore, the advanced driver assistance systems (ADAS) trend and autonomous vehicles are also likely to spur demand with their high-performance material needs for reliability and endurance. With India's push towards tighter environmental laws and the electrification of vehicles, the use of fluoropolymers to enhance efficiency and safety is set to grow, thus becoming a critical material in contemporary automotive production.

To get more information on this market, Request Sample

Expanding Applications in the Electronics Industry

The growing Indian electronics industry is increasing the demand for fluoropolymers because of their excellent electrical insulation properties and resistance to high temperatures. With the development of 5G technology, semiconductor production, and high-performance electronic devices, fluoropolymers are being applied in circuit boards, connectors, and cables. The efforts of the Indian government to encourage local electronics manufacturing are also fueling this trend. Innovations like heightened investment in semiconductor manufacturing facilities and indigenous production of electronic components are providing greater avenues for fluoropolymer use. Businesses are also emphasizing improving product quality and innovation in order to serve the growing demand in electronics production. The miniaturization of components and the added complexity of circuit design are also placing fluoropolymers in critical roles as determinants of stability and performance. Consumer electronics growth, including smartphones, wearables, and smart home products, is also driving market expansion. With India emerging as a large center for the manufacture and export of electronics, the demand for stable, high-performance materials such as fluoropolymers is likely to rise. The growth of data centers and cloud computing infrastructure is also driving the market growth, with these facilities demanding tough and heat-resistant materials that will support efficient operation over long periods.

India Fluoropolymer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Polytetrafluoroethylene (PTFE)

- Polyvinylidene Fluoride (PVDF)

- Fluorinated Ethylene Propylene (FEP)

- Fluoroelastomers

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes polytetrafluoroethylene (PTFE), polyvinylidene fluoride (PVDF), fluorinated ethylene propylene (FEP), fluoroelastomers, and others.

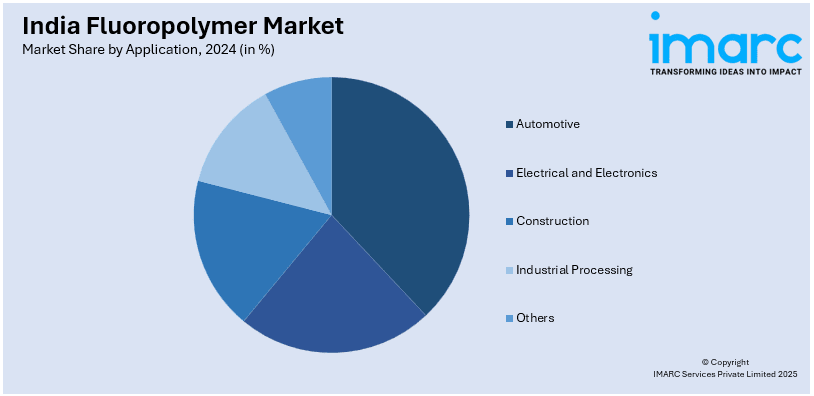

Application Insights:

- Automotive

- Electrical and Electronics

- Construction

- Industrial Processing

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive, electrical and electronics, construction, industrial processing, and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fluoropolymer Market News:

- December 2024: INOXGFL Group strengthened its fluoropolymer business by integrating renewable energy solutions, enhancing demand for high-performance fluoropolymers in solar and wind applications. This strategic move boosts India’s fluoropolymer market, supporting advanced materials for solar modules, wind turbines, and energy storage systems.

- September 2024: Gujarat Fluorochemicals established GFCL EV Products GmbH in Germany to enhance fluoropolymer-based solutions for EV and energy storage systems (ESS). This expansion strengthens India's fluoropolymer market, driving global demand for high-performance materials in advanced battery technologies and sustainable energy applications.

India Fluoropolymer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Polytetrafluoroethylene (PTFE), Polyvinylidene Fluoride (PVDF), Fluorinated Ethylene Propylene (FEP), Fluoroelastomers, Others |

| Applications Covered | Automotive, Electrical and Electronics, Construction, Industrial Processing, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India fluoropolymer market performed so far and how will it perform in the coming years?

- What is the breakup of the India fluoropolymer market on the basis of product?

- What is the breakup of the India fluoropolymer market on the basis of application?

- What are the various stages in the value chain of the India fluoropolymer market?

- What are the key driving factors and challenges in the India fluoropolymer market?

- What is the structure of the India fluoropolymer market and who are the key players?

- What is the degree of competition in the India fluoropolymer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fluoropolymer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fluoropolymer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fluoropolymer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)