India Folding Bike Market Size, Share, Trends and Forecast by Product Type, Drive Type, Size, Price Range, Distribution Channel, and Region, 2026-2034

India Folding Bike Market Summary:

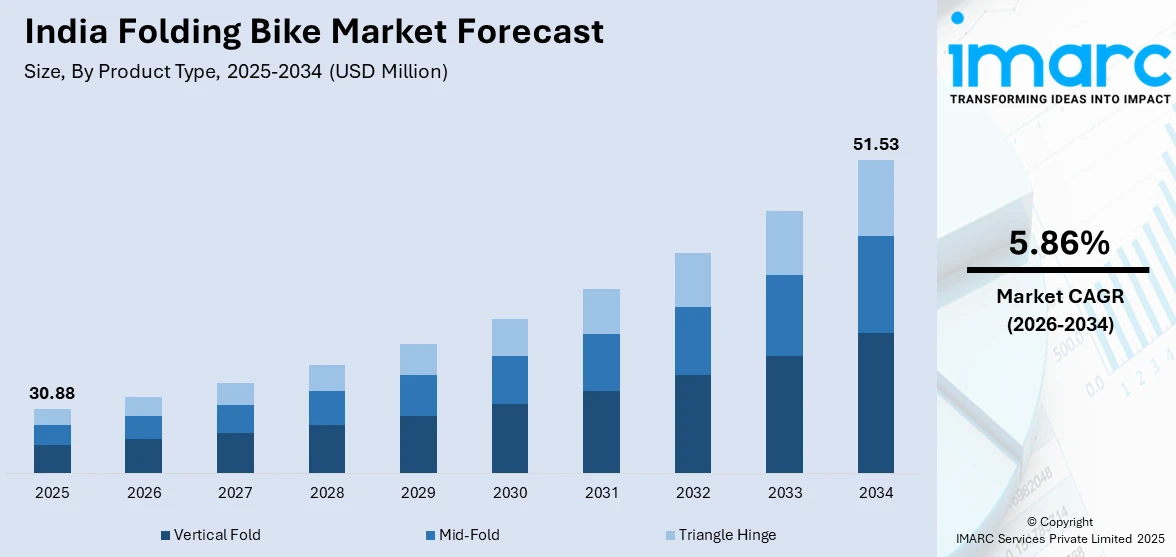

The India folding bike market size was valued at USD 30.88 Million in 2025 and is projected to reach USD 51.53 Million by 2034, growing at a compound annual growth rate of 5.86% from 2026-2034.

The India folding bike market is witnessing strong growth, fueled by rapid urbanization, rising traffic congestion in cities, and increasing demand for sustainable last-mile transportation solutions. Growing health awareness among urban professionals and young consumers, along with the expansion of public transit networks, is driving the adoption of compact and portable bicycles. Supportive government initiatives promoting cycling infrastructure are further encouraging usage, creating favorable conditions for the folding bike segment, and enhancing its appeal as a convenient, eco-friendly, and practical mobility option in urban areas.

Key Takeaways and Insights:

- By Product Type: Vertical fold dominates the market with a share of 40% in 2025, attributed to its straightforward folding mechanism that requires minimal effort, making it ideal for daily commuters who need to fold and unfold bikes multiple times during multimodal journeys.

- By Drive Type: Conventional leads the market with a share of 72% in 2025, owing to its affordability, zero riding costs, and suitability for fitness-conscious consumers seeking manual pedaling options for health benefits.

- By Size: 20" represents the largest segment with a market share of 30% in 2025, driven by superior portability and compact storage capabilities that appeal to urban dwellers with limited living spaces and commuters using public transit.

- By Price Range: Economy dominates the market with a share of 45% in 2025, reflecting the price-sensitive nature of Indian consumers and the growing demand for affordable urban mobility solutions among students and young professionals.

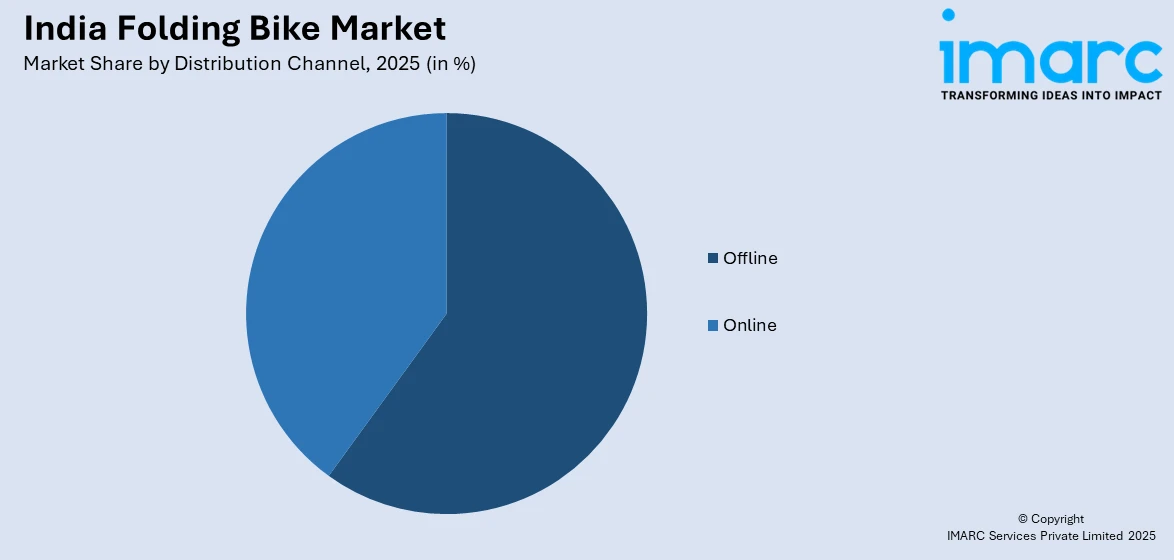

- By Distribution Channel: Offline represents 58% market share in 2025, benefiting from consumers' preference for physical inspection, test rides, and immediate purchase completion at retail stores and specialty bicycle shops.

- By Region: North India dominates with 30% market share in 2025, led by high demand from the Delhi-NCR metropolitan region, where extensive metro networks and severe traffic congestion drive adoption of folding bikes for last-mile connectivity.

- Key Players: The India folding bike market exhibits a moderately fragmented competitive landscape with both domestic manufacturers and international brands competing across premium and economy segments. Key players are focusing on lightweight materials, innovative folding mechanisms, and expanding distribution networks to capture the growing urban commuter segment.

To get more information on this market Request Sample

The India folding bike market is witnessing transformative growth as urban mobility patterns evolve across the country's rapidly expanding metropolitan areas. With India's metro rail network now spanning over 1,000 kilometers across 23 cities and serving more than one crore daily passengers, folding bikes have emerged as an ideal solution for seamless first and last-mile connectivity. Folding bikes offer city dwellers the convenience of being easily carried on public transit and stored in compact living spaces, addressing key urban mobility challenges. Supportive infrastructure, including dedicated cycle tracks and public bicycle programs, is fostering greater adoption of cycling as a practical transportation option. Initiatives to improve last-mile connectivity through integrated urban mobility solutions further complement cycling usage. Additionally, increasing disposable incomes, along with growing health consciousness and environmental awareness among urban populations, are driving the expansion of the folding bike market into smaller cities and emerging urban areas.

India Folding Bike Market Trends:

Growing Direct-to-Consumer and E-commerce Adoption

The expansion of digital commerce platforms is fundamentally reshaping how consumers purchase folding bikes in India. Direct-to-consumer business models enable manufacturers to bypass traditional dealership networks, reducing costs while providing customers access to wider product selections with customization options and doorstep delivery. Major e-commerce platforms, including Amazon and Flipkart, now host extensive folding bike catalogs with detailed product videos, comparison tools, and customer reviews that support informed purchasing decisions. This trend is particularly impactful in tier-2 and tier-3 cities where brick-and-mortar availability remains limited. Financing options, including EMI and buy-now-pay-later schemes, further boost affordability for price-conscious consumers seeking quality urban mobility solutions.

Rising Urban Micro-Mobility Demand Among Professionals

India's rapid urbanization is driving a fundamental shift in commute preferences, particularly among working professionals in metropolitan cities like Bengaluru, Mumbai, and Delhi. India’s urban population is expected to grow substantially, with an estimated addition of about 416 million residents by 2050. Traffic congestion and last-mile connectivity challenges position folding bikes as compelling mobility solutions. The hybrid travel model, where commuters ride to metro stations, fold their bikes for transit, and continue riding to destinations, appeals strongly to technology park employees and green-certified business campus workers. Employers are increasingly promoting cycling through incentives including secure foldable bike parking and locker room facilities, while rising disposable incomes enable investment in premium lightweight models with enhanced portability features.

Integration with Multimodal Public Transit Systems

The continued expansion of metro rail systems across Indian cities is creating strong potential for folding bikes as convenient first- and last-mile mobility solutions. Transit authorities are increasingly encouraging the integration of cycling with public transport by enabling better access and space for non-motorized options at stations. The bike–train–bike commuting approach reduces reliance on private vehicles and app-based transport while improving flexibility and affordability for daily commuters. At the same time, cities are promoting integrated mobility planning that connects rail, bus, and cycling networks, fostering a supportive environment for folding bike adoption.

Market Outlook 2026-2034:

The India folding bike market outlook remains highly positive as urbanization accelerates, infrastructure development continues, and consumer preferences shift toward sustainable mobility solutions. Government initiatives under the Smart Cities Mission and National Urban Transport Policy are creating supportive conditions through dedicated cycling infrastructure and integrated mobility planning. India’s fitness economy is gaining strong traction and is emerging as one of the fastest-growing markets worldwide, with revenues projected to rise sharply from about INR 16,200 crore (US$1.9 billion) in 2024 to nearly INR 37,700 crore (US$4.5 billion) by 2030, highlighting accelerating consumer investment in health, wellness, and active lifestyles. This reflects broader health consciousness trends that benefit cycling adoption. Technological advancements in lightweight materials, improved folding mechanisms, and electric-assist options continue to enhance product appeal across consumer segments. The market generated a revenue of USD 30.88 Million in 2025 and is projected to reach a revenue of USD 51.53 Million by 2034, growing at a compound annual growth rate of 5.86% from 2026-2034.

India Folding Bike Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Vertical Fold | 40% |

| Drive Type | Conventional | 72% |

| Size | 20" | 30% |

| Price Range | Economy | 45% |

| Distribution Channel | Offline | 58% |

| Region | North India | 30% |

Product Type Insights:

- Vertical Fold

- Mid-Fold

- Triangle Hinge

Vertical fold segment dominates with a market share of 40% of the total India folding bike market in 2025.

Vertical-fold bikes have emerged as the preferred choice among Indian consumers due to their straightforward folding mechanism that requires minimal effort and time. This simplicity is particularly attractive to daily commuters and occasional riders who need to fold and unfold their bikes multiple times throughout the day while navigating multimodal transit systems. The vertical folding method results in a more compact and manageable shape that is highly practical in urban environments where space is at a premium, both for storage in small apartments and while navigating crowded public transportation systems.

The segment's dominance is further reinforced by ergonomic designs that enhance rider comfort, lightweight construction that improves portability, and the ability to maintain stability while riding. Manufacturers are increasingly focusing on user-friendly mechanisms and enhanced durability, which have strengthened consumer confidence in vertical-fold designs. The combination of operational simplicity and reliable folding performance under frequent use conditions makes this segment particularly well-suited for India's urban commuting patterns, where efficiency and convenience are paramount considerations.

Drive Type Insights:

- Conventional

- Electrical

Conventional leads with a share of 72% of the total India folding bike market in 2025.

Conventional folding bicycles maintain market dominance owing to their easy availability, affordability, and zero ongoing fuel or charging costs. Fitness-conscious riders particularly prefer conventional folding bikes as they support active pedaling that delivers cardiovascular benefits and promotes physical health. The lower purchase price compared to electric alternatives makes conventional models accessible to a broader consumer base, including students, young professionals, and budget-conscious urban commuters seeking practical transportation solutions.

Major manufacturers operating in the market are constantly developing new conventional folding bicycles featuring advanced lightweight materials, innovative designs, and improved features that enhance ride quality and attract more riders. The absence of battery-related concerns such as charging infrastructure requirements, battery degradation, and weight penalties further strengthens consumer preference for conventional models.

Size Insights:

- 20"

- 24"

- 26"

- Others

The 20" represents the largest market share of 30% of the total India folding bike market in 2025.

The 20-inch wheel size segment has emerged as the preferred choice among Indian urban consumers primarily due to superior portability and compact storage characteristics. These bicycles are remarkably convenient to carry and store in confined spaces such as elevators, office areas, small apartment balconies, and storage sheds. The compact dimensions make 20-inch folding bikes particularly popular among school-going students and young professionals, as they are less susceptible to theft and vandalism when stored in shared spaces or carried indoors.

The smaller wheel diameter enables quicker acceleration and easier maneuverability in congested urban traffic conditions, which resonates well with city commuters navigating narrow streets and crowded areas. While larger wheel sizes like 24-inch and 26-inch variants offer better stability on longer rides and varied terrains, the 20-inch segment's combination of ultracompact folded dimensions and adequate riding performance makes it the optimal choice for India's space-constrained urban environments, where multimodal commuting is increasingly common.

Price Range Insights:

- Low

- Economy

- Premium

Economy exhibits clear dominance with a 45% share of the total India folding bike market in 2025.

The economy price segment maintains its leading position reflecting the value-conscious purchasing behavior prevalent among Indian consumers seeking affordable urban mobility solutions. This segment offers an optimal balance between quality and affordability, featuring reliable folding mechanisms, durable frames, and adequate performance specifications that meet daily commuting requirements without premium pricing. Students, entry-level professionals, and cost-conscious urban dwellers form the core consumer base for economy-priced folding bikes.

Manufacturers targeting the economy segment focus on delivering functional designs with essential features while maintaining competitive price points through efficient production processes and selective material choices. The availability of financing options including equated monthly installments and buy-now-pay-later schemes through e-commerce platforms, has further expanded accessibility of economy-segment folding bikes to broader consumer demographics. As disposable incomes rise among the urban middle class, gradual upward migration toward premium segments is anticipated, though economy offerings will continue capturing the largest market share given India's price-sensitive consumer landscape.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

Offline represents the highest revenue with a 58% share of the total India folding bike market in 2025.

Offline channels hold the largest share in the India folding bike market primarily due to the tactile nature of the product. Customers usually demand to check folding bikes physically and evaluate their quality of frame, foldability, weight, and comfort. Demonstrations, test rides, and professional advice are offered in specialized bike stores and showrooms, which enable customers to make reasonable choices. Also, offline retail has real-time availability and post-sale services, which creates confidence and lessens resistance, particularly to first-time customers who might not be conversant with the characteristics of folding bikes.

Another reason offline dominates is the ability to access after-sales services and accessories conveniently. Many offline stores provide on-site maintenance, spare parts, and professional assembly, which enhances the overall ownership experience. Urban consumers often rely on trained staff to explain technical aspects such as gear systems, battery management for e-bikes, and safe folding mechanisms. These personalized services and interactions are difficult to replicate online, making brick-and-mortar stores the preferred choice for purchasing folding bikes, particularly among value-conscious and cautious buyers.

Regional Insights:

- North India

- South India

- East India

- West India

North India leads the market with a 30% share of the total India folding bike market in 2025.

The India folding bike market in North India is driven by rapid urbanization, rising traffic congestion, and increasing pressure on urban mobility systems. Large metropolitan areas in the region face space constraints and long commute times, encouraging demand for compact, portable transportation options. Folding bikes offer flexibility by combining easily with public transport, making them suitable for first- and last-mile travel. Growing awareness of environmental sustainability and the need to reduce carbon emissions are further motivating consumers to adopt non-motorized mobility solutions in urban centers.

Health and lifestyle trends are also supporting folding bike adoption across North India. Rising fitness awareness among working professionals, students, and younger consumers is increasing interest in cycling as a convenient form of daily exercise. Expanding metro rail and public transit networks have improved the viability of bike–train–bike commuting, while better cycling infrastructure and urban planning initiatives are encouraging safer usage. Additionally, increasing disposable incomes and the growing influence of cycling communities and events are strengthening consumer acceptance in both metro cities and emerging urban hubs.

Market Dynamics:

Growth Drivers:

Why is the India Folding Bike Market Growing?

Rapid Urbanization and Traffic Congestion Challenges

India’s rapid urbanization is significantly transforming transportation needs as growing city populations and worsening traffic congestion strain major urban centers. Expanding metropolitan areas are placing increased pressure on existing road networks, exposing the limitations of conventional transport options. As a result, there is a rising demand for more efficient, flexible, and space-saving mobility solutions that can better address urban travel challenges and support sustainable movement within cities. Major metropolitan centers including Delhi, Mumbai, Bengaluru, and Hyderabad, regularly experience severe gridlock that extends average commute times substantially beyond optimal levels. Folding bikes offer a compelling alternative by enabling commuters to bypass congested roadways, navigate through narrow lanes inaccessible to cars, and seamlessly integrate with public transit systems. The compact folded dimensions allow storage in offices, apartments, and public transit vehicles, addressing the space constraints that characterize India's densely populated urban environments. Municipal governments are recognizing these benefits and incorporating cycling infrastructure into urban planning frameworks to create supportive ecosystems for folding bike adoption.

Expansion of Metro Rail Networks and Multimodal Connectivity

The rapid expansion of metro rail systems across Indian cities is significantly increasing the need for efficient first- and last-mile connectivity solutions. Commuters often require flexible transport options to travel between metro stations and their homes or workplaces. Folding bikes align well with metro-based travel, as they are portable, easy to carry during transit, and convenient for short-distance mobility at either end of the journey. Transit authorities are gradually encouraging cycling integration through supportive policies, parking provisions, and coordinated mobility services. At the same time, cities are advancing integrated transport planning that emphasizes sustainable, multimodal connectivity, positioning folding bikes as a practical and eco-friendly urban mobility solution.

Rising Health Consciousness and Fitness Culture

India’s fitness industry is undergoing rapid transformation, driven by a growing emphasis on healthier lifestyles and increased awareness of physical well-being, especially in urban areas. More consumers are integrating exercise into their daily routines, seeking activities that fit seamlessly into busy schedules. Cycling has gained popularity as it combines mobility with physical fitness, offering benefits such as improved cardiovascular health, stress relief, and weight management. Folding bikes, in particular, appeal to urban professionals by serving both as a practical transport option and a convenient fitness solution, aligning well with modern, time-efficient lifestyles. Government initiatives like the Fit India Movement launched in 2019 have further emphasized the importance of fitness and active lifestyles in Indian society. Rising disposable incomes enable consumers to invest in quality cycling equipment that supports their health and fitness objectives while addressing daily mobility requirements.

Market Restraints:

What Challenges the India Folding Bike Market is Facing?

Inadequate Cycling Infrastructure in Many Urban Areas

Despite policy efforts to promote urban development, dedicated cycling infrastructure remains limited in many Indian cities. The lack of protected bike lanes, secure parking options, and cyclist-friendly traffic management raises safety concerns and discourages wider adoption. Inadequate planning around transit hubs further complicates the integration of cycling with public transport, as congestion near station exits restricts smooth movement for alternative mobility modes. These structural challenges continue to hinder the seamless adoption of cycling solutions within urban transportation systems.

Price Sensitivity and Affordability Constraints

Quality folding bikes command premium pricing compared to conventional bicycles, creating affordability barriers for price-sensitive Indian consumers. The sophisticated folding mechanisms, lightweight materials, and compact engineering that enable portability require advanced manufacturing processes that elevate production costs. While financing options have improved accessibility, the higher upfront investment remains a significant consideration for budget-conscious consumers evaluating transportation alternatives.

Climate and Weather Conditions Limiting Year-Round Usage

India's diverse climate presents challenges for consistent cycling adoption across regions and seasons. Extreme summer temperatures exceeding 45 degrees Celsius in northern plains, monsoon rainfall lasting several months, and humidity levels in coastal regions reduce comfortable cycling periods throughout the year. These weather constraints limit the practical utility of folding bikes as primary transportation modes, particularly for professional commuters requiring reliable year-round mobility solutions.

Competitive Landscape:

The India folding bike market exhibits a moderately fragmented competitive structure characterized by the presence of established international brands, domestic manufacturers, and emerging direct-to-consumer players. International brands leverage brand recognition, advanced technology, and premium positioning to capture discerning consumers in metropolitan markets, while domestic manufacturers compete through competitive pricing, localized distribution networks, and an understanding of Indian consumer preferences. The competitive intensity is increasing as new entrants adopt direct-to-consumer business models that bypass traditional retail channels to offer value propositions directly to consumers through e-commerce platforms. Key differentiation strategies include innovations in lightweight materials such as aluminum alloys and carbon fiber, development of user-friendly folding mechanisms, introduction of electric-assist variants, and expansion of after-sales service networks. Strategic partnerships with e-commerce platforms, financing institutions, and corporate clients for employee mobility programs represent important competitive approaches in the evolving market landscape.

Recent Developments:

- January 2025: AOKI Mobility introduced a new range of e-bicycles at the Bharat Mobility Expo 2025, including the Sherpa (Mountain), Flex (Folding), and Cadence (City) models to promote sustainable urban transportation. The Flex model is positioned as one of the lightest 20-inch foldable e-bikes available in India, offering a range of 80 kilometers per charge with features including hydraulic disc brakes, throttle assistance, and colored LED display.

India Folding Bike Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vertical-Fold, Mid-Fold, Triangle Hinge |

| Drive Types Covered | Conventional, Electrical |

| Sizes Covered | 20”, 24”, 26”, Others |

| Price Ranges Covered | Low, Economy, Premium |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India folding bike market size was valued at USD 30.88 Million in 2025.

The India folding bike market is expected to grow at a compound annual growth rate of 5.86% from 2026-2034 to reach USD 51.53 Million by 2034.

The vertical fold dominates the India folding bike market with a 40% share in 2025, driven by its straightforward folding mechanism and compact storage capabilities that appeal to urban commuters requiring frequent folding for multimodal transit integration.

Key factors driving the India folding bike market include rapid urbanization and traffic congestion, expansion of metro rail networks creating demand for last-mile connectivity, rising health consciousness among urban populations, government support for cycling infrastructure through the Smart Cities Mission, and growing environmental awareness promoting sustainable transportation alternatives.

Major challenges include inadequate cycling infrastructure in many urban areas with limited dedicated bike lanes and secure parking, higher price points of quality folding bikes compared to conventional bicycles creating affordability barriers, extreme weather conditions limiting year-round usage, and competition from alternative mobility solutions including e-rickshaws and ride-hailing services.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)