India Food Additives Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

India Food Additives Market Size and Share:

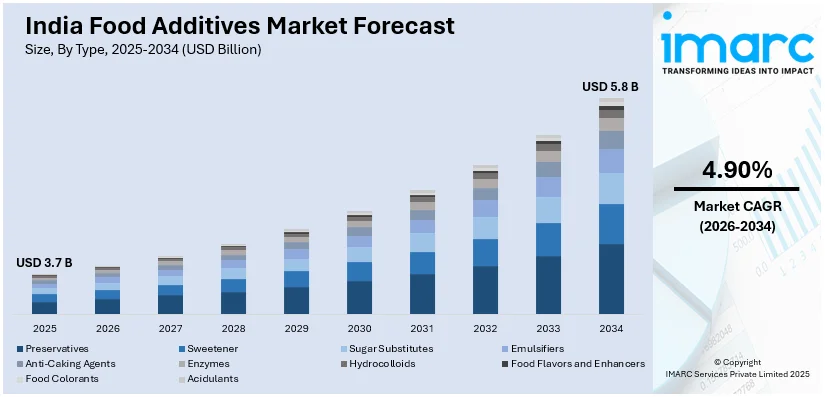

The India food additives market size reached USD 3.7 Billion in 2025. The market is expected to reach USD 5.8 Billion by 2034, exhibiting a growth rate (CAGR) of 4.90% during 2026-2034. The market growth is attributed to the expansion of the regional food supply chain since it has led to increased demand for food additives for ensuring the safety and quality of products during transportation and storage.

Market Insights:

- On the basis of region, the market has been divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of type, the market has been divided into preservatives, sweetener, sugar substitutes, emulsifiers, anti-caking agents, enzymes, hydrocolloids, food flavors and enhancers, food colorants, and acidulants.

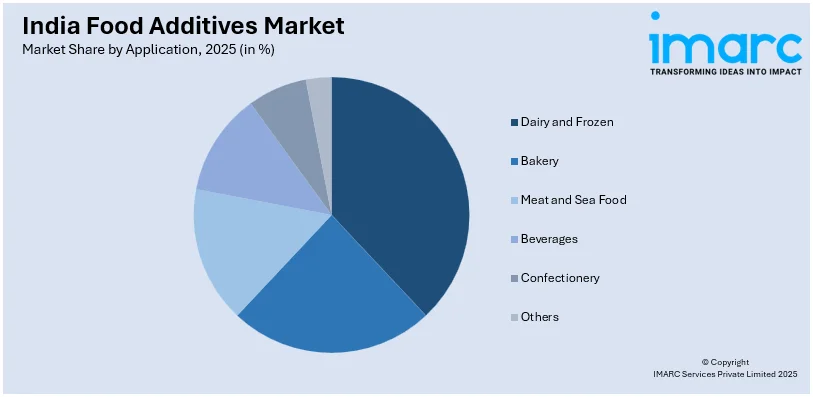

- On the basis of application, the market has been divided into dairy and frozen, bakery, meat and sea food, beverages, confectionery, and others.

Market Size and Forecast:

- 2025 Market Size: USD 3.7 Billion

- 2034 Projected Market Size: USD 5.8 Billion

- CAGR (2026-2034): 4.90%

Food additives are substances added to food during processing to enhance its flavor, appearance, texture, or shelf life. These can include preservatives, colorings, flavor enhancers, emulsifiers, and stabilizers. The primary purpose of food additives is to improve the overall quality of processed foods, ensuring they meet consumer expectations and regulatory standards. While many additives are safe and undergo rigorous testing before approval, concerns have been raised about potential health risks associated with some. Common examples include antioxidants to prevent spoilage, sweeteners to enhance taste without adding calories, and emulsifiers to maintain a consistent texture. It is essential to regulate and monitor the use of food additives to safeguard consumer health while balancing the need for innovation and convenience in the food industry.

To get more information on this market Request Sample

India Food Additives Market Trends:

The food additives market in India is experiencing robust growth, driven by several key factors. Firstly, the increasing regional population and changing dietary preferences have fueled the demand for processed and convenience foods, necessitating the use of food additives for preservation and flavor enhancement. Moreover, the rising awareness among consumers regarding the importance of food safety and shelf-life extension has further propelled the market. Additionally, advancements in food processing technologies have led to a surge in the utilization of additives for enhancing the texture, color, and overall appeal of packaged foods. Furthermore, the ever-evolving food industry regulations and standards have played a pivotal role in shaping the food additives market. Stringent guidelines from regulatory bodies have mandated the use of certain additives to ensure product quality and safety, driving manufacturers to adopt innovative solutions. The growing trend towards clean-label and natural products has also influenced market dynamics, prompting manufacturers to develop additives derived from natural sources. In essence, the food additives market in India is dynamically evolving, and these interconnected factors underscore its trajectory towards sustained growth and innovation.

Rising Demand for Functional Foods and Nutraceuticals

The growing emphasis on functional foods and nutraceuticals is significantly transforming the Indian food additives landscape. Food products that have vitamins, minerals, probiotics, and also antioxidants are being increasingly sought by consumers for health benefits which go beyond basic nutrition. Due to this shift, functional additives have been incorporated in various food categories more and more. These additives consist of omega-3 fatty acids, dietary fibers, and plant-based protein enhancers. The India food additives market growth is being propelled by rising health consciousness among urban populations and the growing prevalence of lifestyle-related diseases. Manufacturers are responding by developing specialized additives that cater to specific dietary requirements, including sugar-free, low-sodium, and gluten-free formulations, thereby expanding their market reach and consumer base.

Digitalization and E-commerce Impact on Food Additives

The rapid digitalization and e-commerce expansion in India's food sector is creating new opportunities for specialized food additives. Online food delivery platforms and direct-to-consumer brands are demanding additives that can maintain food quality during extended transportation periods and varying storage conditions. This has accelerated innovation in packaging-compatible additives, moisture control agents, and temperature-stable preservatives. The India food additives market outlook appears promising as manufacturers adapt to the evolving distribution channels and consumer purchase patterns. Additionally, the integration of blockchain technology and smart packaging solutions is driving demand for additives that can work synergistically with these technologies to ensure food traceability and safety. The market shows sustained growth as companies invest in research and development to create next-generation additives that meet the demands of digital-first food businesses.

Growth, Opportunities, and Challenges in the India Food Additives Market:

- Growth Drivers: The expanding food processing industry and increasing urbanization remain key market growth drivers, as per India food additives market forecast. Rising consumer demand for convenience foods, coupled with growing awareness about food safety and shelf-life extension, continues to fuel market expansion. Government initiatives promoting food processing and export capabilities are further accelerating market development across various regional sectors.

- Market Opportunities: Significant opportunities exist in developing natural and organic food additives to meet the growing clean-label trend among health-conscious consumers. The expanding export market for processed foods presents additional growth prospects for innovative additive solutions. Investment in research and development of plant-based and sustainable additives can capture the emerging premium market segment.

- Market Challenges: Stringent regulatory frameworks and lengthy approval processes for new additives pose significant challenges for market players. Consumer skepticism regarding synthetic additives and potential health risks creates barriers to market acceptance. Price volatility of raw materials and intense competition from international players further complicate market dynamics.

India Food Additives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Preservatives

- Sweetener

- Sugar Substitutes

- Emulsifiers

- Anti-Caking Agents

- Enzymes

- Hydrocolloids

- Food Flavors and Enhancers

- Food Colorants

- Acidulants

The report has provided a detailed breakup and analysis of the market based on the type. This includes preservatives, sweetener, sugar substitutes, emulsifiers, anti-caking agents, enzymes, hydrocolloids, food flavors and enhancers, food colorants, and acidulants.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Dairy and Frozen

- Bakery

- Meat and Sea Food

- Beverages

- Confectionery

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes dairy and frozen, bakery, meat and sea food, beverages, confectionery, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The companies in the market are adopting various strategic initiatives including new product launches and business alliances to gain a significant India food additives market share.

Latest News and Developments:

- In July 2025, Informa Markets announced the 19th edition of Fi India, held from September 3–5 at India Expo Mart, Greater Noida, bringing together 250+ exhibitors, 1,200 brands, and 15,000 visitors from 50+ countries. The event focuses on India’s growing food additives market, valued to reach USD 8.3 billion by 2033, featuring specialty ingredients, clean-label trends, start-up funding sessions, chef demos, and the Fi India Awards.

- In April 2025, Godrej Industries’ Chemicals Business completed the acquisition of the Food Additives business of Savannah Surfactants Limited (Goa). The deal adds 5,200 MTPA manufacturing capacity to Godrej’s portfolio and strengthens its specialty chemicals segment, expanding offerings to the global food and beverages industry.

- In March 2025, Cargill showcased its full portfolio of food innovations at AAHAR 2025 in Delhi-NCR, highlighting solutions for snacks, bakery, confectionery, dairy, and ice cream. The company introduced new products like pectin alternatives, bake-stable fillings, and trans fat-free vanaspati, while live demos and R&D sessions gave industry professionals a hands-on look at ingredient innovation tailored to India’s evolving food landscape.

- In October 2024, the Food Safety and Standards Authority of India (FSSAI) notified wide-ranging amendments to the Food Products Standards and Food Additives Regulations, effective from May 2025. These include updated ingredient permissions for products such as khoa and mozzarella cheese, stricter standards for rice fortification, new vitamin-mineral premix norms, and refined classifications for oils.

India Food Additives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Preservatives, Sweetener, Sugar Substitutes, Emulsifiers, Anti-Caking Agents, Enzymes, Hydrocolloids, Food Flavors and Enhancers, Food Colorants, Acidulants |

| Applications Covered | Dairy and Frozen, Bakery, Meat and Sea Food, Beverages, Confectionery, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India food additives market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India food additives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India food additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The food additives market in India was valued at USD 3.7 Billion in 2025.

As more people are shifting towards convenient and ready-to-eat (RTE) meals, the need for preservatives, flavor enhancers, colorants, and emulsifiers is rising steadily. Health-conscious people are also driving the demand for natural and functional additives that improve nutritional value without compromising taste or shelf life. Additionally, advancements in food processing technologies are encouraging manufacturers to use additives for better texture, appearance, and longevity of products.

The India food additives market is projected to exhibit a CAGR of 4.90% during 2026-2034, reaching a value of USD 5.8 Billion by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)