India Food Amino Acids Market Size, Share, Trends and Forecast by Type, Source, Application, and Region, 2025-2033

India Food Amino Acids Market Overview:

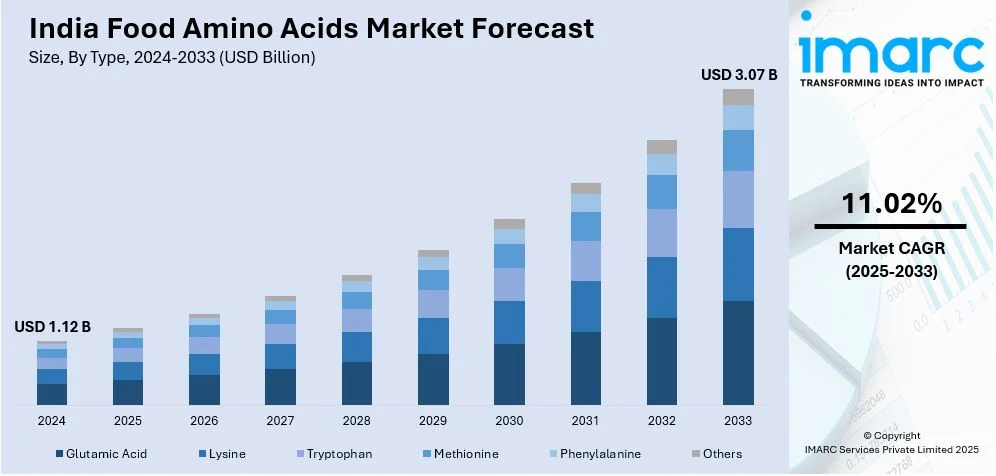

The India food amino acids market size reached USD 1.12 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.07 Billion by 2033, exhibiting a growth rate (CAGR) of 11.02% during 2025-2033. The market is driven by rising demand for protein-rich diets, expanding health and wellness trends, increasing processed food consumption, growing sports nutrition awareness, advancements in food fortification, rising vegetarianism, and supportive government initiatives promoting nutritional enhancement and food safety.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.12 Billion |

| Market Forecast in 2033 | USD 3.07 Billion |

| Market Growth Rate 2025-2033 | 11.02% |

India Food Amino Acids Market Trends:

Rising Demand for Plant-Based and Fermented Amino Acids

The India food amino acids market growth is transitioning toward plant-based and fermented amino acids because consumers are increasingly choosing natural and sustainable ingredients. Food manufacturers are exploring plant-based amino acid sources, which include soy products, peas, and algae. In addition to this, the market favors fermentation-based production systems because consumers find them eco-friendly and non-genetically modified organisms (GMOs). Through microbial fermentation, businesses produce high-quality amino acids, enabling them to replace synthetic and animal-derived raw materials. For instance, in September 2024, Fermenta Biotech Ltd. partnered with NIFTEM-K to advance food science research, drive innovation in food technology, and strengthen industry-academia collaborations at World Food India 2024, further supporting advancements in fermentation-based amino acid production. Moreover, the rise in clean-label consumer preferences drives increased demand for food ingredients from natural and minimally processed sources. Furthermore, the Indian regulatory agencies, which concentrate on food safety alongside sustainability, encourage industry participants to undertake research and development (R&D) initiatives to boost production technologies. Apart from this, the growing dairy alternative and nutritional supplement markets and functional foods drive the continuous expansion of plant-based protein industries, which is boosting the India food amino acids market share.

To get more information on this market, Request Sample

Increasing Use of Amino Acids in Functional and Fortified Foods

The rising consumer demand for health-oriented food products is significantly driving manufacturers to incorporate amino acids into functional and fortified foods throughout India. Amino acids, including lysine, glutamine, and leucine are now widely used in products that support immunity function and muscle recovery, along with general health improvement. Moreover, the fast-paced urban lifestyle and growing consumer interest in nutritious food options are fueling the adoption of protein-enriched snacks, beverages, and dietary supplements. For example, in November 2024, SuperYou introduced protein-infused wafers, aiming to incorporate protein into everyday Indian snacks. This innovation caters to consumers seeking convenient, protein-enriched options. Additionally, the Food Safety and Standards Authority of India (FSSAI), through its food fortification guidelines, is encouraging manufacturers to enhance their product offerings as part of the government's nutritional security efforts. Furthermore, the active nutrition market for sports and fitness plays a crucial role in market growth, as athletes and fitness enthusiasts seek amino acid-enriched protein powders and recovery drinks. Apart from this, continuous advancements in food science have enabled businesses to develop innovative formulations that improve bioavailability, further strengthening the India food amino acids market outlook.

India Food Amino Acids Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, source, and application.

Type Insights:

- Glutamic Acid

- Lysine

- Tryptophan

- Methionine

- Phenylalanine

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes glutamic acid, lysine, tryptophan, methionine, phenylalanine, and others.

Source Insights:

- Animal

- Microbial

- Plants

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes animal, microbial, and plants.

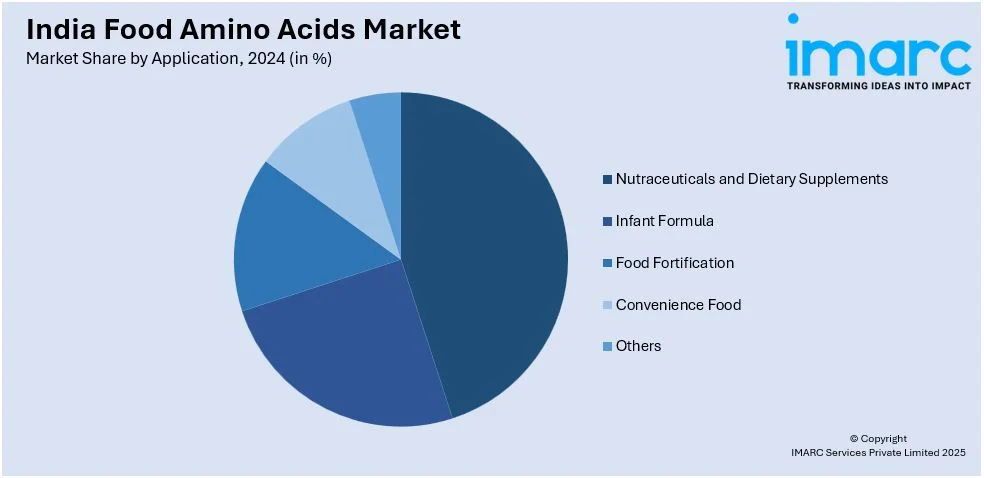

Application Insights:

- Nutraceuticals and Dietary Supplements

- Infant Formula

- Food Fortification

- Convenience Food

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes nutraceuticals and dietary supplements, infant formula, food fortification, convenience food, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Food Amino Acids Market News:

- In October 2024, Danone announced a €20 million investment over four years to expand its existing plant in Punjab, aiming to strengthen its presence in India's fast-growing consumer goods market. This move is expected to enhance the availability of protein-rich dairy products, contributing to the growth of the food amino acids sector.

- In August 2023, Bioway Organic explored a long-term partnership with an Indian buyer, Anurag, to supply plant-based protein powder. This collaboration aims to establish a sustainable supply chain for high-quality organic protein products in India, enhancing the availability of amino acid-rich supplements.

India Food Amino Acids Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Glutamic Acid, Lysine, Tryptophan, Methionine, Phenylalanine, Others |

| Sources Covered | Animal, Microbial, Plants |

| Applications Covered | Nutraceuticals and Dietary Supplements, Infant Formula, Food Fortification, Convenience Food, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India food amino acids market performed so far and how will it perform in the coming years?

- What is the breakup of the India food amino acids market on the basis of type?

- What is the breakup of the India food amino acids market on the basis of source?

- What is the breakup of the India food amino acids market on the basis of application?

- What is the breakup of the India food amino acids market on the basis of region?

- What are the various stages in the value chain of the India food amino acids market?

- What are the key driving factors and challenges in the India food amino acids?

- What is the structure of the India food amino acids market and who are the key players?

- What is the degree of competition in the India food amino acids market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India food amino acids market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India food amino acids market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India food amino acids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)