India Food Disinfectant Market Size, Share, Trends and Forecast by Type, Technology, Application, and Region, 2025-2033

India Food Disinfectant Market Overview:

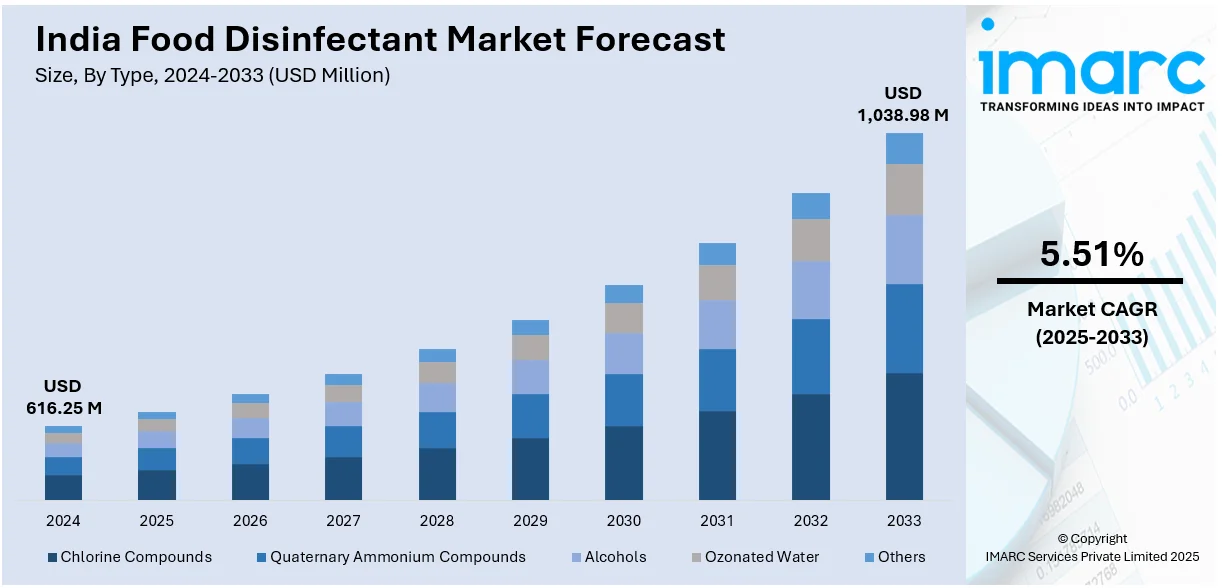

The India food disinfectant market size reached USD 616.25 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,038.98 Million by 2033, exhibiting a growth rate (CAGR) of 5.51% during 2025-2033. The rapid expansion of food processing sector and the rise of modern retail formats, such as online grocery stores and supermarkets, are driving the India food disinfectant market as businesses prioritize hygiene to meet consumer expectations, prevent contamination, and comply with stringent food safety regulations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 616.25 Million |

| Market Forecast in 2033 | USD 1,038.98 Million |

| Market Growth Rate 2025-2033 | 5.51% |

India Food Disinfectant Market Trends:

Expansion of Food Processing Industry

The swift expansion of the food processing sector in India is a vital factor impelling the growth of the market. As the population grows and urbanization advances, the need for packaged and processed foods is on a rise. Shoppers are looking for convenience while ensuring safety, thus prioritizing products that are free from contamination. According to the India Brand Equity Foundation (IBEF), the food processing sector's market size in India is projected to grow to US$ 1,274 billion by 2027. This notable expansion underscores the necessity of strict hygiene measures throughout the supply chain. To satisfy consumer demands and guarantee regulatory adherence, food manufacturers are significantly investing in cutting-edge technology and infrastructure, integrating effective cleaning and sanitizing methods. Disinfectants are essential for upholding product integrity by removing pathogens and stopping cross-contamination. From managing raw materials to processing, packaging, and storage, upholding strict hygiene standards is crucial to prevent foodborne diseases and product recalls. Furthermore, with the rise of international food trade, Indian food processors are progressively complying with international safety standards, which is fueling the need for efficient disinfectant solutions. The increasing dependence on food-safe disinfectants guarantees not just product safety but also bolsters consumer trust in processed and packaged foods.

To get more information on this market, Request Sample

Impact of Modern Retail Formats

The emergence of contemporary retail formats, such as supermarkets, hypermarkets, and online grocery shops, is influencing the food disinfectant market in India. These retail stores are preferred destinations for buying a variety of food products, such as fresh fruits and vegetables, meats, dairy goods, and processed foods. As consumer demand for convenience and variety rises, contemporary retail stores are encountering increased foot traffic and higher expectations for cleanliness and hygiene. Moreover, the growing number e-commerce channels is highlighting the critical need for ensuring food safety during both storage and delivery. As per the IBEF, the Indian online grocery sector is projected to grow from US$ 3.95 billion in FY21 to US$ 26.93 billion by 2027, exhibiting a CAGR of 33%. As online grocery stores expand, they are also implementing stringent sanitation measures to prevent contamination during packaging and delivery, thereby bolstering the market growth. In addition, brick-and-mortar retail chains face increasing pressure for adhering to stringent hygiene regulations and reducing the risk of foodborne diseases. This is resulting in an increase in the need for specific food disinfectants that are applicable in food contact areas, storage spaces, and refrigerated units. By including these disinfectants in their routine practices, retailers guarantee the safety of food and allow consumers to shop confidently, which further supports the expansion of the food disinfectant market in India.

India Food Disinfectant Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, technology, and application.

Type Insights:

- Chlorine Compounds

- Quaternary Ammonium Compounds

- Alcohols

- Ozonated Water

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes chlorine compounds, quaternary ammonium compounds, alcohols, ozonated water, and others.

Technology Insights:

- UV Radiation

- Ozonation

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes UV radiation, ozonation, and others.

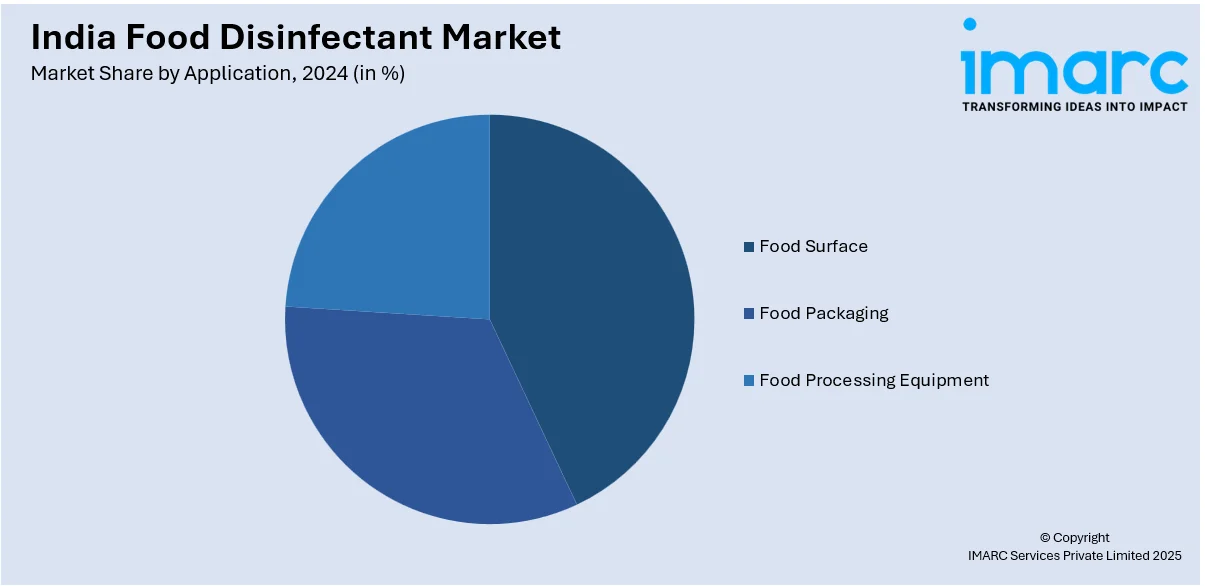

Application Insights:

- Food Surface

- Food Packaging

- Food Processing Equipment

The report has provided a detailed breakup and analysis of the market based on the application. This includes food surface, food packaging, and food processing equipment.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Food Disinfectant Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Chlorine Compounds, Quaternary Ammonium Compounds, Alcohols, Ozonated Water, Others |

| Technologies Covered | UV Radiation, Ozonation, Others |

| Applications Covered | Food Surface, Food Packaging, Food Processing Equipment |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India food disinfectant market performed so far and how will it perform in the coming years?

- What is the breakup of the India food disinfectant market on the basis of type?

- What is the breakup of the India food disinfectant market on the basis of technology?

- What is the breakup of the India food disinfectant market on the basis of application?

- What is the breakup of the India food disinfectant market on the basis of region?

- What are the various stages in the value chain of the India food disinfectant market?

- What are the key driving factors and challenges in the India food disinfectant market?

- What is the structure of the India food disinfectant market and who are the key players?

- What is the degree of competition in the India food disinfectant market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India food disinfectant market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India food disinfectant market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India food disinfectant industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)