India Food Emulsifiers Market Size, Share, Trends and Forecast by Type, Source, Functionality, Application, and Region, 2026-2034

India Food Emulsifiers Market Size and Share:

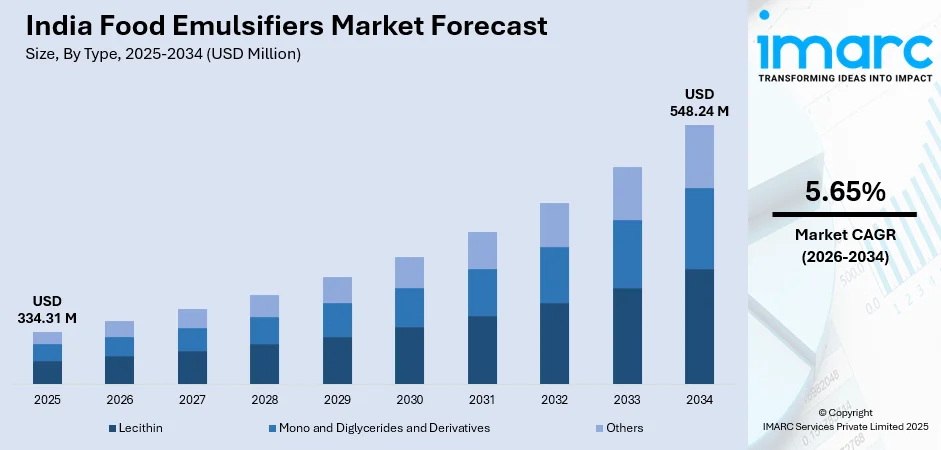

The India food emulsifiers market size was valued at USD 334.31 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 548.24 Million by 2034, exhibiting a CAGR of 5.65% from 2026-2034. The rising health consciousness among consumers, the escalating demand for processed and packaged foods requiring enhanced texture and stability, and the growing requirement for functional ingredients that improve nutritional quality while maintaining taste and convenience are the primary factors propelling the India food emulsifiers market share.

Key Takeaways:

- The India food emulsifiers market was valued at USD 334.31 million in 2025.

- It is projected to reach USD 548.24 million by 2034, representing a compound annual growth rate (CAGR) of about 5.65% between 2026–2034.

- Major growth drivers include rising demand for processed and convenience foods, growing awareness of food texture and quality enhancement, expanding bakery and confectionery industries, and increasing adoption of natural and clean-label emulsifiers across India’s food manufacturing sector.

- Segmentation Highlights:

- Type: Lecithin, Mono and Diglycerides and Derivatives, Others.

- Source: Plant, Animal.

- Functionality: Emulsification, Starch Complexing, Protein Interaction, Others.

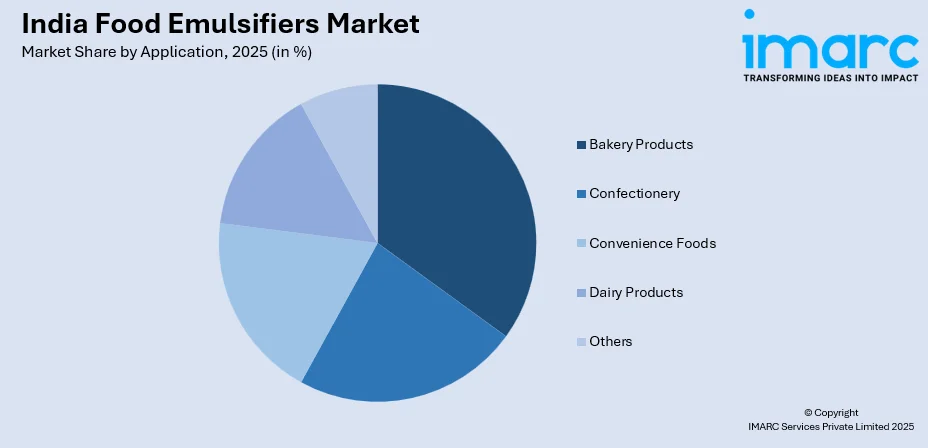

- Application: Bakery Products, Confectionery, Convenience Foods, Dairy Products, Others.

- Regional Insights: The report covers major zones within India: North India, South India, East India and West India — signalling growth opportunities across geographies.

To get more information on this market, Request Sample

The India food emulsifiers market is primarily driven by the rapid expansion of the bakery and confectionery industry requiring texture enhancement and extended shelf life. In line with this, the burgeoning ice cream and frozen desserts sector necessitating superior stabilization and smooth mouthfeel properties are also providing an impetus to the market. The Indian frozen dessert market was valued at approximately INR 309.86 billion (USD ~3.8 Billion) in 2024, and is projected to grow to INR 624.59 Billion (~USD 7.52 Billion) by 2033, at a CAGR of 7.70%. Moreover, the considerable rise in disposable income levels among the expanding middle-class population enabling greater spending on premium and branded food products is also acting as a significant growth-inducing factor for the market.

In addition to this, the proliferation of quick-service restaurants and fast-food chains across urban and semi-urban areas is resulting in heightened demand for standardized, high-quality processed food ingredients. Besides this, the growing investments in food processing infrastructure and manufacturing capabilities supported by government initiatives such as Make in India and the Production Linked Incentive (PLI) scheme is creating lucrative opportunities in the market. As on 30th June 2024, Ministry has approved 41 Mega Food Parks, 399 Cold Chain projects, 76 Agro-processing Clusters, 588 Food Processing Units, 61 Creation of Backward & Forward Linkages Projects & 52 Operation Green projects under corresponding component schemes of PMKSY. Also, the increasing technological advancements in emulsifier formulations enabling improved functionality, cost-effectiveness, and application versatility is impacting the market positively. Some of the other factors contributing to the market include rapid urbanization, the growing dairy processing industry requiring emulsifiers for product stabilization, and extensive research and development (R&D) activities by domestic and international players.

India Food Emulsifiers Market Trends:

Escalating Health Consciousness and Demand for Functional Foods

Indian consumers demonstrate rapidly evolving health consciousness, actively seeking functional, nutritionally balanced, and health-oriented food choices that align with wellness objectives. This fundamental shift in consumer preferences compels food producers to utilize emulsifiers strategically in developing products satisfying these expanding demands. Emulsifiers prove essential for enhancing nutritional quality across food categories by enabling fat content reduction, texture improvement, and stability assurance while preserving desirable taste characteristics. The ascending popularity of wellness-focused and functional foods enables manufacturers to leverage emulsifiers in creating healthier food alternatives that maintain preferred taste profiles and texture attributes consumers expect. This is one of the prominent India food emulsifiers market trends that are manifesting among urban middle-class populations demonstrating heightened health awareness, catalyzing emulsifier demand across diverse food applications. In 2024, at the Ice Cream Expo in Kolkata, Blendhub showcased innovative stabilizer-emulsifier systems specifically designed to enhance ice cream production capabilities. These advanced systems addressed multiple market trends including low-fat formulations, no-sugar variants, and clean-label options for frozen desserts and ice cream products.

Accelerating Demand for Processed and Packaged Foods Driven by Lifestyle Changes

Intensifying urbanization combined with increasingly hectic lifestyle patterns across India fundamentally transforms consumer behavior, generating pronounced preferences for packaged and processed food products. As growing numbers of individuals prioritize convenience and time-efficient solutions, food manufacturers increasingly utilize emulsifiers to enhance texture characteristics, product stability, and shelf longevity. Emulsifiers fulfill vital functions within the food and beverage industry by facilitating combination of ingredients that would naturally separate, such as oil and water, resulting in uniform and smooth product consistency. The country’s intensifying emphasis on convenience drives substantial India food emulsifiers market growth. According to IMARC Group projections, India's packaged food market is expected to reach USD 210.81 Billion by 2032, exhibiting a robust CAGR of 7.08% between 2024 and 2032. This growth trajectory illustrates escalating packaged food demand, prompting food producers to incorporate emulsifiers ensuring their products satisfy consumer expectations for convenience, flavor, and quality while maintaining nutritional value and extended shelf stability. The expanding working population, particularly dual-income households, generates sustained demand for convenient meal solutions that emulsifiers help optimize.

Growing Preference for Clean-Label and Plant-Based Emulsifier Solutions

The clean-label movement is gaining substantial momentum across India's food industry, driving manufacturers to reformulate products using natural, recognizable ingredients that resonate with transparency-conscious consumers. This trend significantly impacts the emulsifier market, as food producers increasingly replace synthetic emulsifiers with plant-derived alternatives sourced from soybeans, sunflower seeds, and other botanical origins. Consumer scrutiny of ingredient lists intensifies, particularly among educated urban populations seeking minimal processing and natural formulations. The expanding vegetarian and vegan consumer base amplifies demand for plant-based emulsifiers that align with dietary preferences and religious considerations. The Indian vegan food market is valued at USD 1,468.3 million in 2024, expected to grow at around 10% CAGR up to 2033, reflecting the rising ethical, health, and environmental motivations driving veganism and clean-label demand. Food manufacturers respond by reformulating existing products and developing new offerings featuring prominently labeled natural emulsifiers like lecithin and plant-derived mono- and diglycerides. This clean-label emphasis extends beyond health motivations to encompass environmental sustainability concerns, as consumers increasingly associate plant-based ingredients with reduced environmental impact compared to synthetic alternatives. Leading food companies invest in transparent sourcing practices and clear communication strategies highlighting natural emulsifier usage. Regulatory support for clean labeling and ingredient transparency further reinforces a positive India food emulsifiers market outlook.

India Food Emulsifiers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India food emulsifiers market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type, source, functionality, and application.

Analysis by Type:

- Lecithin

- Mono and Diglycerides and Derivatives

- Others

Lecithin represents one of the most widely utilized food emulsifier types, derived predominantly from soybeans, sunflower seeds, and egg yolks, offering natural emulsifying properties highly valued in health-conscious market segments. This natural emulsifier facilitates oil and water component mixing, proving indispensable in chocolate manufacturing, baking applications, and various dairy product formulations. Lecithin's clean-label appeal and natural origin align perfectly with consumer preferences for recognizable ingredients without synthetic additives. Mono and diglycerides, along with their derivatives, constitute another significant segment, functioning as versatile emulsifiers across extensive food applications including baked goods, ice cream, margarine, and numerous processed foods. These emulsifiers enhance product texture, extend shelf life, and improve overall quality characteristics. The category's technical versatility and cost-effectiveness sustain robust demand across diverse food manufacturing operations. Other emulsifier types including sorbitan esters, polyglycerol esters, and various synthetic variants serve specialized applications requiring specific functional characteristics, catering to niche market requirements and technical formulation challenges.

Analysis by Source:

- Plant

- Animal

Plant-based emulsifiers command substantial market presence, sourced from soybeans, sunflower seeds, rapeseed, and other botanical origins, benefiting from strong consumer preference trends favoring plant-derived ingredients. The vegetarian and vegan population expansion across India, combined with religious dietary considerations prevalent among significant consumer segments, generates pronounced demand for plant-sourced emulsifiers. Environmental sustainability concerns and ethical consumption patterns further reinforce plant-based emulsifier adoption. These ingredients align with clean-label movement objectives and natural product positioning strategies employed by progressive food manufacturers. Animal-sourced emulsifiers, derived primarily from egg yolks and dairy components, maintain relevance in traditional food applications and specific product categories where their unique functional properties prove irreplaceable.

Analysis by Functionality:

- Emulsification

- Starch Complexing

- Protein Interaction

- Others

Emulsification represents the primary and most essential functionality, enabling stable mixture formation between immiscible substances like oil and water, fundamentally important across numerous food product categories. This core function ensures product uniformity, texture consistency, and stability throughout shelf life, proving indispensable in producing mayonnaise, salad dressings, baked goods, and dairy products. Starch complexing functionality assumes critical importance in bakery applications, where emulsifiers interact with starch molecules to improve dough handling characteristics, enhance bread volume, and extend freshness by retarding staling processes. This functionality proves particularly valuable in commercial baking operations seeking consistent quality and extended shelf life. Protein interaction capabilities enable emulsifiers to modify protein functionality, improving foam stability, texture development, and moisture retention across applications including cakes, whipped toppings, and processed meats.

Analysis by Application:

- Bakery Products

- Confectionery

- Convenience Foods

- Dairy Products

- Others

Bakery products constitute a major application segment where emulsifiers enhance dough stability, improve bread volume and texture, extend freshness, and facilitate consistent quality across production batches. The expanding organized bakery sector and growing consumer preference for packaged baked goods sustain robust emulsifier demand within this category. Confectionery applications utilize emulsifiers for chocolate manufacturing, sugar confections, and chewing gum production, where precise texture control and ingredient compatibility prove essential. Convenience foods, including ready-to-eat meals, instant noodles, and processed snacks, represent rapidly growing application areas as urbanization and lifestyle changes drive demand for time-efficient food solutions. Emulsifiers ensure product stability, texture optimization, and extended shelf life crucial for convenience food success. Dairy product applications span ice cream, yogurt, cheese, and dairy-based beverages, where emulsifiers contribute to smooth texture, prevent fat separation, and enhance overall sensory attributes. The expanding organized dairy sector and premiumization trends will support continued emulsifier adoption, as per the India food emulsifiers market forecast.

Regional Analysis:

- North India

- South India

- East India

- West India

North India commands significant market presence driven by large population concentrations, substantial food processing industry infrastructure, and strong demand across bakery, dairy, and convenience food sectors. The region's well-established food manufacturing base and growing urban consumer markets sustain robust emulsifier consumption. South India demonstrates strong growth driven by expanding food processing industries, particularly in bakery and confectionery segments, combined with health-conscious consumer populations seeking functional food ingredients. The region's progressive adoption of modern food technologies and organized retail expansion support market development. East India presents emerging opportunities as food processing infrastructure develops and urban consumer markets expand, though from relatively smaller base compared to North and West regions. West India, encompassing major urban centers and significant food processing capabilities, exhibits strong market presence supported by advanced manufacturing infrastructure, high urban consumer density, and progressive adoption of international food trends. The region's strategic importance as food industry hub reinforces market growth.

Competitive Landscape:

The market exhibits dynamic competitive intensity as domestic and international players compete across technology innovation, product quality, application support, and pricing strategies. Market participants focus on developing clean-label emulsifiers, plant-based alternatives, and specialized formulations addressing evolving consumer preferences for natural ingredients and health-focused products. Strategic partnerships between emulsifier suppliers and food manufacturers facilitate product development and market expansion. Technical support services, including application laboratories and formulation assistance, constitute important competitive differentiation factors. Companies invest in expanding production capacities, enhancing distribution networks, and strengthening relationships with food manufacturers across diverse segments. Regulatory compliance, quality assurance, and consistent supply capabilities represent critical success factors.

The report provides a comprehensive analysis of the competitive landscape in the India food emulsifiers market with detailed profiles of all major companies.

Latest News and Developments:

- March 2025: Antarctica Equipment collaborated with Valmar to launch the Valmix 20 emulsifier in India. The advanced countertop unit is engineered for precise mixing and dispersion in gelato, ice cream, and pastry production, ensuring superior texture and uniformity. It was well received at AAHAR 2025, where visitors praised its versatility and high-performance efficiency.

- November 2024: Godrej Industries acquired the food ester and emulsifier business of Savannah Surfactants for INR 760 million (USD 9.15 million). The acquisition enhances Godrej’s footprint in the food and beverage segment, broadens its specialty chemicals portfolio, and supports its strategy to deliver value-added, high-performance ingredients for diverse industrial and consumer applications.

India Food Emulsifiers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lecithin, Mono and Diglycerides and Derivatives, Others |

| Sources Covered | Plant, Animal |

| Functionality Covered | Emulsification, Starch Complexing, Protein Interaction, Others |

| Applications Covered | Bakery Products, Confectionery, Convenience Foods, Dairy Products, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India food emulsifiers market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India food emulsifiers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India food emulsifiers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The food emulsifiers market in India was valued at USD 334.31 Million in 2025.

The India food emulsifiers market is projected to exhibit a CAGR of 5.65% during 2026-2034, reaching a value of USD 548.24 Million by 2034.

The rising health consciousness among consumers, escalating demand for processed and packaged foods requiring enhanced texture and stability, and the growing requirement for functional ingredients that improve nutritional quality while maintaining taste and convenience are the primary factors propelling the market growth.

Bakery products constitute a major application segment in the India food emulsifiers market, along with significant presence in dairy products, confectionery, and convenience foods.

North India and West India command significant market presence in the India food emulsifiers market, driven by large population concentrations and substantial food processing industry infrastructure.

Plant-based emulsifiers are gaining substantial prominence, driven by consumer preference trends favoring plant-derived ingredients, vegetarian and vegan population expansion, and religious dietary considerations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)