India Food Logistics Market Size, Share, Trends and Forecast by Transportation Mode, Product Type, Service Type, Segment and Region, 2026-2034

India Food Logistics Market Overview:

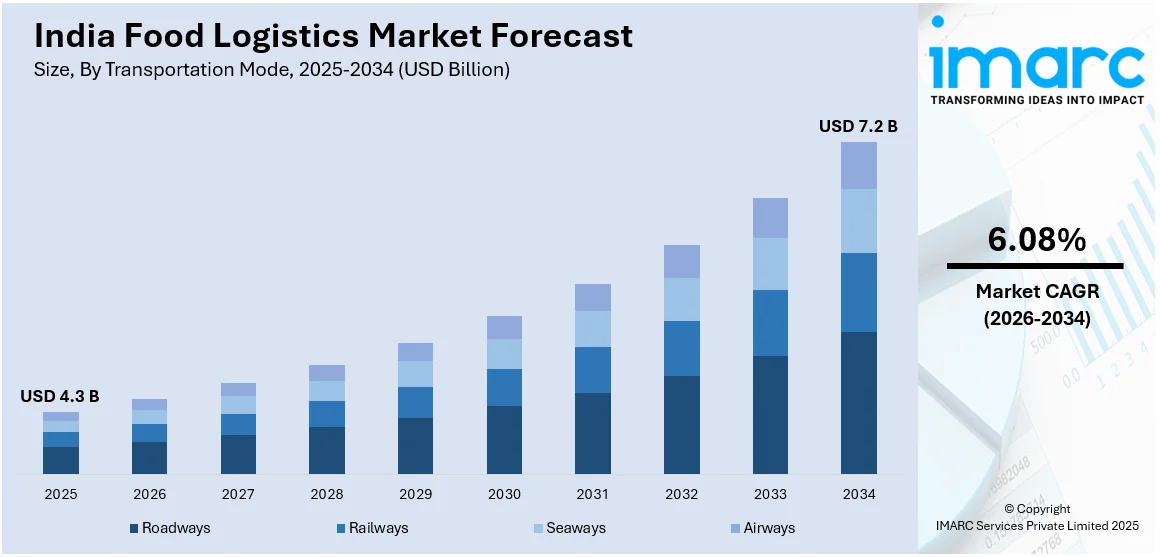

The India food logistics market size reached USD 4.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 7.2 Billion by 2034, exhibiting a growth rate (CAGR) of 6.08% during 2026-2034. The India food logistics market share is being spurred by rising consumer demand for processed and perishable foods, expansion of e-commerce platforms, improvements in cold chain infrastructure, and government policies aimed at enhancing transport networks. Rising urbanization and shifting consumer behavior are also propelling the India food logistics market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.3 Billion |

| Market Forecast in 2034 | USD 7.2 Billion |

| Market Growth Rate 2026-2034 | 6.08% |

India Food Logistics Market Trends:

Cold Chain Infrastructure Development

Cold chain logistics is one of the fast-emerging trends in India's food logistics sector, fueled by the rising demand for perishable items like dairy, fruits, vegetables, and frozen foods. With India's food consumption trends moving toward processed and perishable foods, the demand for an efficient cold chain infrastructure has become imperative. The government has acknowledged this need, providing incentives and subsidies to attract investment in cold storage and chilled transport. Better cold chain facilities reduce food wastage, maintain product quality, and increase shelf life. The increasing trend for online grocery websites has further accentuated the need for effective cold chain logistics to transport fresh products to consumers. The Food and Agriculture Organization (FAO) states that in India, 40% of food gets wasted, while 30% of fruits and vegetables decay due to inadequate storage. This waste endangers food security and also disrupts economic stability. Nonetheless, improvements in cold chain logistics provide a hopeful answer to these problems. According to a study by NABARD Consultancy Services, there are 8,653 cold stores nationwide with a total capacity of 394.17 lakh metric tons (MT), but only 60% of that capacity is utilized effectively. The infrastructure is disjointed, with 60% focused on Uttar Pradesh, Gujarat, West Bengal, and Punjab.

To get more information on this market Request Sample

E-commerce and Online Grocery Growth

The growth of e-commerce and online grocery platforms is a key trend transforming the India food logistics market outlook. With the growing affinity for online purchases, particularly in cities, orders for home delivery of groceries such as fresh produce, packaged food, and ready-to-eat meals have risen sharply. The convenience aspect is crucial, particularly with the increasing penetration of smartphones and the internet – India now has over 850 million smartphone users. Major online players like BigBasket, Grofers, and Amazon Pantry are reaching out further, using sophisticated logistics networks to deliver quickly and safely. To address this need, logistics companies are refining last-mile delivery networks, such as specific fulfillment centers and automated sorting facilities. Businesses are also concentrating on designing efficient delivery routes, minimizing delivery time, and optimizing storage solutions to accommodate a diverse range of food products. The explosion in online grocery purchasing is set to push innovation in packaging, delivery systems, and stock control, generating huge opportunities for food logistics participants in India's transforming digital economy.

India Food Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on transportation mode, product type, service type and segment .

Transportation Mode Insights:

- Roadways

- Railways

- Seaways

- Airways

The report has provided a detailed breakup and analysis of the market based on the transportation mode. This includes roadways, railways, seaways, and airways.

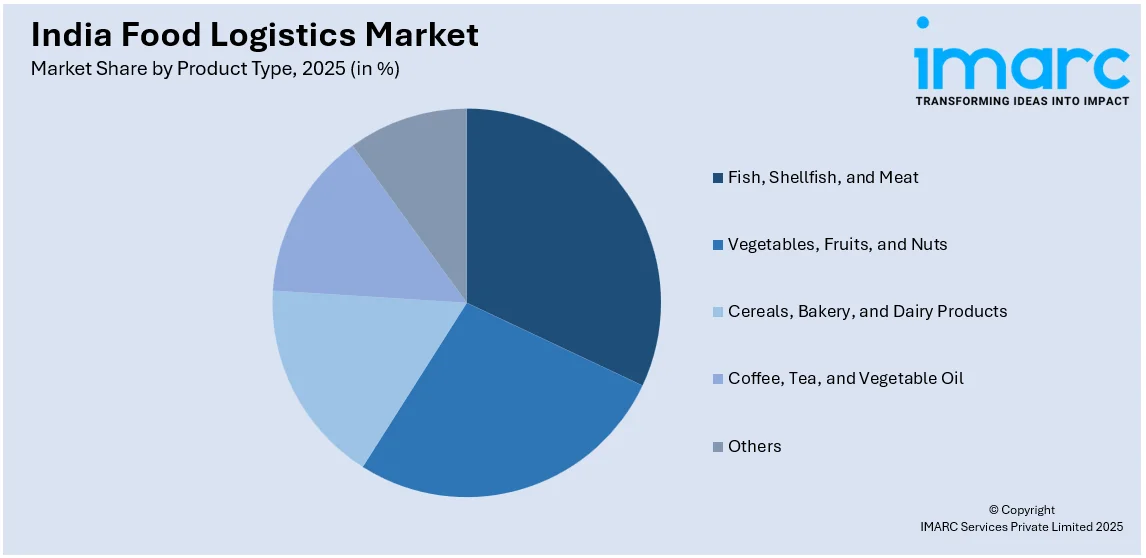

Product Type Insights:

Access the Comprehensive Market Breakdown Request Sample

- Fish, Shellfish, and Meat

- Vegetables, Fruits, and Nuts

- Cereals, Bakery, and Dairy Products

- Coffee, Tea, and Vegetable Oil

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fish, shellfish, and meat, vegetables, fruits, and nuts, cereals, bakery, and dairy products, coffee, tea, and vegetable oil, and others.

Service Type Insights:

- Cold Chain

- Non-Cold Chain

The report has provided a detailed breakup and analysis of the market based on the service type. This includes cold chain, and non-cold chain.

Segment Insights:

- Transportation

- Packaging

- Instrumentation

The report has provided a detailed breakup and analysis of the market based on the segment. This includes transportation, packaging, and instrumentation.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Food Logistics Market News:

- In September 2024, The Food Corporation of India (FCI), a division of the Ministry of Consumer Affairs, Food and Public Distribution, has started a comprehensive digital transformation initiative to update its current supply chain management system, called the "Depot Online System," as part of the Department of Food and Public Distribution's 100 Days Achievements. In this ambitious project, ANNA DARPAN, a new microservices-based integrated supply chain management system, will be implemented.

- In January 2025, logistics company Delhivery launched its newest service, Rapid Commerce, a delivery option that promises to complete orders in under 2 hours to meet the increasing need for extremely quick deliveries.

India Food Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Transportation Modes Covered | Roadways, Railways, Seaways, Airways |

| Product Types Covered | Fish, Shellfish, and Meat, Vegetables, Fruits, and Nuts, Cereals, Bakery, and Dairy Products, Coffee, Tea, and Vegetable Oil, Others |

| Packaging Types Covered | Cold Chain, Non-Cold Chain |

| Segments Covered | Transportation, Packaging, Instrumentation |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India food logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India food logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India food logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India food logistics market was valued at USD 4.3 Billion in 2025.

The India food logistics market is projected to exhibit a CAGR of 6.08% during 2026-2034, reaching a value of USD 7.2 Billion by 2034.

The India food logistics market is driven by rising demand for processed and perishable foods, growth in e-commerce and online grocery platforms, and increasing cold chain infrastructure. Government initiatives, improved transportation networks, and technological advancements in tracking and temperature control systems further enhance efficiency, supporting market expansion across urban and rural areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)