India Food Robotics Market Size, Share, Trends and Forecast by Type, Payload, Application, and Region, 2025-2033

India Food Robotics Market Overview:

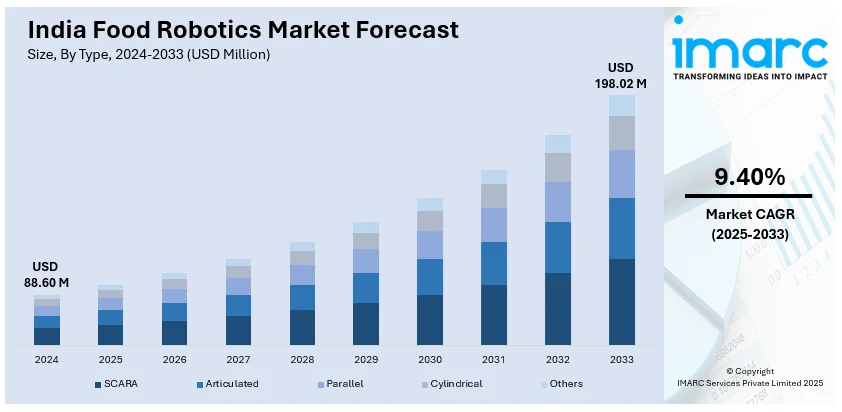

The India food robotics market size reached USD 88.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 198.02 Million by 2033, exhibiting a growth rate (CAGR) of 9.40% during 2025-2033. Rising demand for automation in food processing, increasing labor costs, growing focus on food safety and hygiene, expansion of quick-service restaurants, advancements in AI and robotics, increasing investments in smart kitchens, and the need for efficiency in food production are expanding the India food robotics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 88.60 Million |

| Market Forecast in 2033 | USD 198.02 Million |

| Market Growth Rate (2025-2033) | 9.40% |

India Food Robotics Market Trends:

Rising Adoption of Automation in Food Processing

The India food robotics market growth is driven by the increasing adoption of automation in food processing. With rising labor costs and the need for consistent product quality, food manufacturers are integrating robotic solutions for packaging, sorting, and processing. The growing demand for ready-to-eat meals and packaged food is further driving the use of robotics in the industry. For instance, according to 2024 projections, the ready-to-eat (RTE) market in India is expected to grow by over 45% over the next five years, offering significant investment potential. By building a new plant at Bengaluru's Kempegowda International Airport and hiring some 300 people, SATS Food Solutions India is taking advantage of this expansion. This establishment prioritizes automation and the Internet of Things (IoT) to guarantee uniformity in flavor and quality throughout its product line. Firms are investing in robotic arms, vision-guided technology, and automation with AI to increase efficiency.

To get more information on this market, Request Sample

Increasing Use of Collaborative Robots in Food Manufacturing

Collaborative robots, or cobots, are gaining traction in India’s food robotics market due to their ability to work alongside humans efficiently. These robots are being deployed in tasks such as ingredient handling, quality control, and secondary packaging. The demand for hygienic and contamination-free food processing is pushing manufacturers to integrate robotic systems with minimal human intervention. Notably, the study titled "Micro-and Nano-Plastics as Emerging Food Contaminants: Establishing Validated Methodologies and Understanding the Prevalence in Different Food Matrices" was initiated on August 18, 2024, by the Food Safety and Standards Authority of India (FSSAI) to look into the contamination of the country's food supply with microplastics. The goal of this study, which was started in March 2024, is to create and test analytical techniques for identifying micro- and nano-plastics in a variety of food products, find out how common they are, and gauge consumer exposure levels. FSSAI plans to partner with top research institutions in the country to implement the project. The results should support global efforts to solve this environmental issue and guide regulatory responses, all of which are in line with sustainability goals. Cobots equipped with AI and machine learning are enhancing production accuracy while ensuring compliance with food safety regulations. The rise of quick-service restaurants and e-commerce food delivery platforms is further fueling the adoption of robotic solutions, improving supply chain efficiency and sustainability, which in positively impacting India food robotics market outlook.

India Food Robotics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, payload, and application.

Type Insights:

- SCARA

- Articulated

- Parallel

- Cylindrical

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes SCARA, articulated, parallel, cylindrical, and others.

Payload Insights:

- Low

- Medium

- Heavy

A detailed breakup and analysis of the market based on the payload have also been provided in the report. This includes low, medium, and heavy.

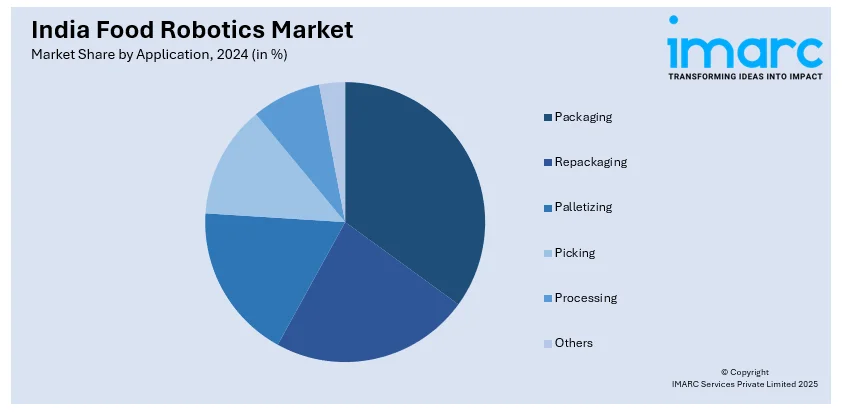

Application Insights:

- Packaging

- Repackaging

- Palletizing

- Picking

- Processing

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes packaging, repackaging, palletizing, picking, processing, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Food Robotics Market News:

- On January 17, 2025, Bangalore-based Nosh Robotics introduced Nosh, an AI-powered robo-chef, to the Indian market, aiming to deliver freshly prepared meals across various cuisines with ease. This innovation enhances home cooking by automating key tasks while maintaining the authenticity of traditional Indian dishes, offering a convenient alternative to fast food, processed meals, and takeout.

India Food Robotics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | SCARA, Articulated, Parallel, Cylindrical, Others |

| Payloads Covered | Low, Medium, Heavy |

| Applications Covered | Packaging, Repackaging, Palletizing, Picking, Processing, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India food robotics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India food robotics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India food robotics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The food robotics market in India was valued at USD 88.60 Million in 2024.

The India food robotics market is projected to exhibit a CAGR of 9.40% during 2025-2033, reaching a value of USD 198.02 Million by 2033.

The market is driven by the need for higher operational efficiency, reduced human error, and improved hygiene in food production. Labor shortages and rising labor costs encourage automation. Growing demand for processed and packaged foods, especially in urban areas, along with technological advancements in robotics, is fostering the adoption of automated systems in food manufacturing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)