India Food Service Pasta Market Size, Share, Trends and Forecast by Product Type, Food Service Channel, and Region, 2025-2033

India Food Service Pasta Market Overview:

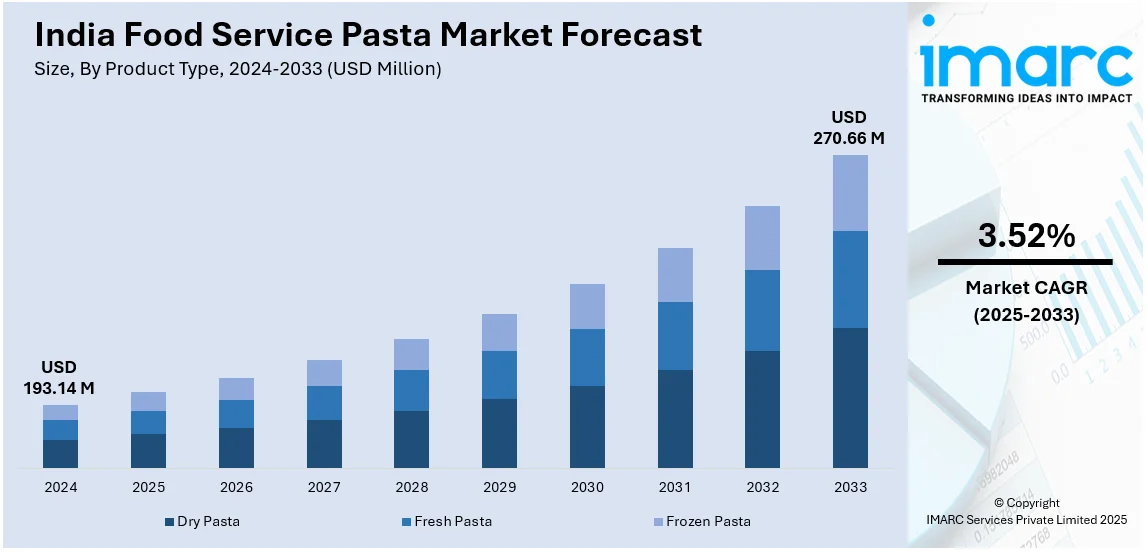

The India food service pasta market size reached USD 193.14 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 270.66 Million by 2033, exhibiting a growth rate (CAGR) of 3.52% during 2025-2033. The rising urbanization, increasing consumer preference for Western cuisine, and the growing presence of quick-service restaurants. Additionally, evolving dining habits, higher disposable incomes, and a surge in café culture contribute to pasta’s popularity, fostering demand across restaurants, hotels, and institutional catering segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 193.14 Million |

| Market Forecast in 2033 | USD 270.66 Million |

| Market Growth Rate 2025-2033 | 3.52% |

India Food Service Pasta Market Trends:

Rising Demand for Fusion Pasta Dishes

One of the fast-rising trends in the India food service pasta market is the increased demand for fusion pasta meals that mix standard Italian recipes with indigenous Indian spices. The market increasingly favors creative additions like tandoori pasta, masala penne, and butter chicken spaghetti, indicating a desire for familiar foods with international flair. Food service outlets are trying out regional spices, gravies, and ingredients to appeal to local tastes while retaining the fundamental character of pasta. This trend is especially common in quick-service restaurants, cafes, and casual dining areas, where personalized pasta dishes are in demand. The fusion food trend assists in drawing a wider consumer base, appealing to consumers looking for novelty without deviating significantly from classic Indian flavor profiles.

To get more information on this market, Request Sample

Expansion of Quick-Service Restaurants (QSRs)

The quick growth of quick-service restaurants (QSRs) in urban and semi-urban India is strongly impacting the Indian food service industry's pasta market. QSR chains are riding the wave of increased demand for affordable, convenient, and speedy meals, with pasta being a central attraction on their menus. Brands are offering pasta dishes in ready-to-eat (RTE) or customizable manner, bundled together with combo meals and value pricing models. Development of cloud kitchens and food platforms also widens the reach of pasta-based offerings. Moreover, QSRs are utilizing online marketing, loyalty programs, and mobile applications to increase customer interactions. This trend is consistent with changing consumer behavior towards quick meals without sacrificing taste or variety.

Growing Emphasis on Health-Conscious Pasta Options

Health and wellness trends are driving the transformation of the India food service pasta market, with a rising preference for whole wheat, multigrain, gluten-free, and high-protein pasta. Consumers are increasingly seeking nutrient-rich, low-calorie, and preservative-free options, prompting food service outlets to adapt their menus. The Ministry of Food Processing Industries has acknowledged the potential of health-centric food segments, highlighting the herbal supplement sector's projected 20% CAGR from 2015 to 2023. This broader shift toward wellness aligns with the growing demand for organic and clean-label pasta offerings. Urban cafés, premium dining restaurants, and health-focused food chains are leading this trend, catering to fitness-conscious consumers. As awareness of balanced diets expands, the market for healthier pasta alternatives continues to rise, reinforcing India's evolving food service landscape.

India Food Service Pasta Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type and food service channel.

Product Type Insights:

- Dry Pasta

- Fresh Pasta

- Frozen Pasta

- Filled Pasta

- Simple Pasta

- Ready Meal Pasta

The report has provided a detailed breakup and analysis of the market based on the food service. This includes dry pasta, fresh pasta, and frozen pasta (filled pasta, simple pasta, and ready meal pasta).

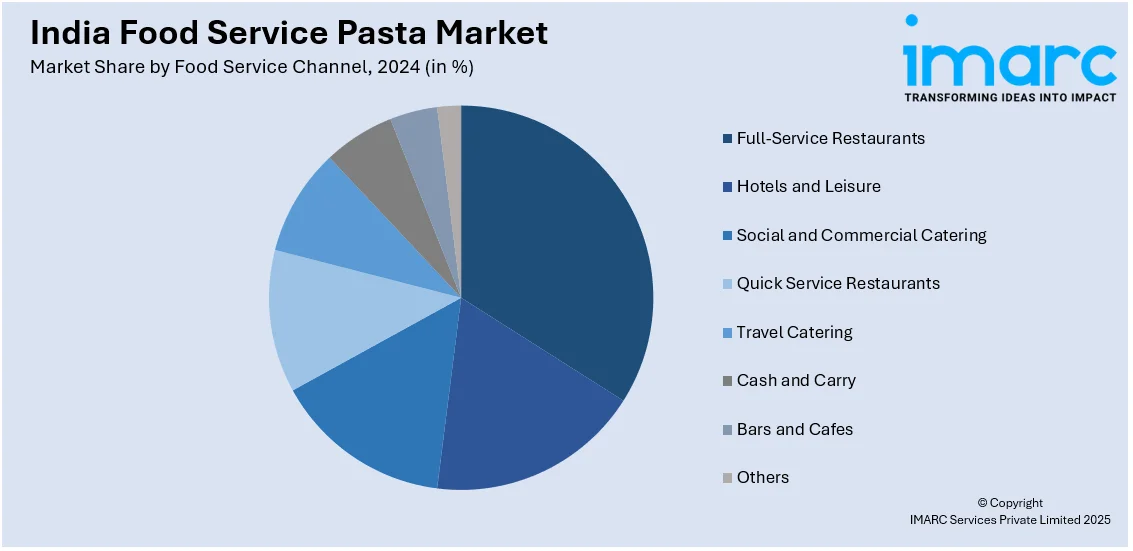

Food Service Channel Insights:

- Full-Service Restaurants

- Hotels and Leisure

- Social and Commercial Catering

- Quick Service Restaurants

- Travel Catering

- Cash and Carry

- Bars and Cafes

- Others

A detailed breakup and analysis of the market based on the food service channel have also been provided in the report. This includes full-service restaurants, hotels and leisure, social and commercial catering, quick service restaurants, travel catering, cash and carry, bars and cafes, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Food Service Pasta Market News:

- In March 2025, Adani Wilmar is acquiring GD Foods, maker of the Tops brand, to boost its kitchen essentials portfolio. It will initially acquire 80% for ₹603 crore, with the remaining 20% over three years. This move strengthens AWL’s product range, including sauces, pickles, and staples like atta and pulses under its Fortune brand. Funded through internal accruals and IPO proceeds, the deal enhances AWL’s presence in the competitive food and consumer goods market.

- In February 2025, ITC signed agreements to acquire Prasuma, a leading Indian frozen and ready-to-cook food brand. Initially, ITC will acquire a 43.8% stake for Rs 131 crore, valuing Prasuma at around Rs 300 crore. The deal, expected to close by March 2025, includes plans to raise ITC's stake to 62.5% by April 2027, eventually reaching full ownership in three years. This marks ITC’s fifth major FMCG acquisition in recent years.

- In January 2025, Swiggy launched a new app, SNACC, for delivering quick bites, beverages, and meals within 15 minutes. Launched on 7 January in parts of Bengaluru, SNACC features categories like Indian Breakfast, Coffee, and Protein, with items from brands like Blue Tokai and The Whole Truth. Unlike its Bolt service, SNACC operates from centralized hubs. This launch underscores Swiggy’s push in fast food delivery and heightens competition in the quick commerce space.

India Food Service Pasta Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Food Service Channels Covered | Full-Service Restaurants, Hotels and Leisure, Social and Commercial Catering, Quick Service Restaurants, Travel Catering, Cash and Carry, Bars and Cafes, Others. |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India food service pasta market performed so far and how will it perform in the coming years?

- What is the breakup of the India food service pasta market on the basis of product type?

- What is the breakup of the India food service pasta market on the basis of food service channel?

- What is the breakup of the India food service pasta market on the basis of region?

- What are the various stages in the value chain of the India food service pasta market?

- What are the key driving factors and challenges in the India food service pasta market?

- What is the structure of the India food service pasta market and who are the key players?

- What is the degree of competition in the India food service pasta market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India food service pasta market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India food service pasta market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India food service pasta industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)