India Food Sweetener Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

Market Overview:

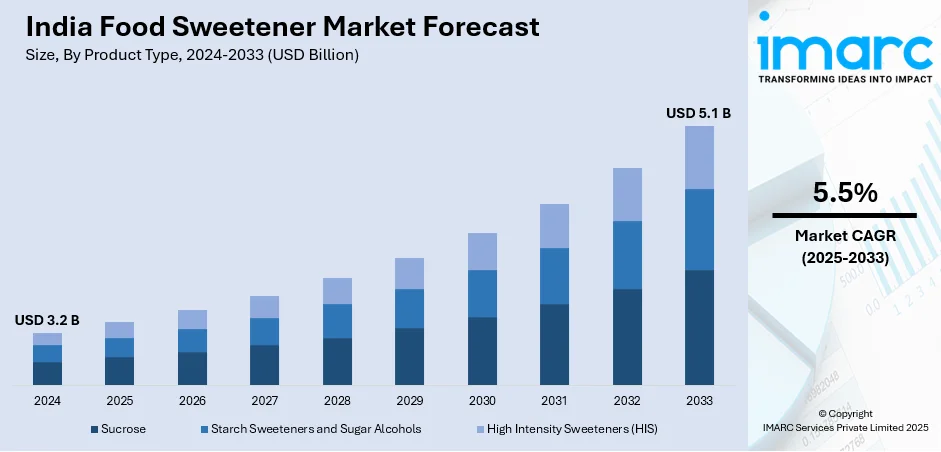

India food sweetener market size reached USD 3.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.5% during 2025-2033. The growing preference for natural sweeteners like stevia, monk fruit, and honey due to their perceived health benefits and natural origins, is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 5.1 Billion |

| Market Growth Rate (2025-2033) | 5.5% |

Food sweeteners are substances used to enhance the sweetness of food and beverages without adding significant calories. They come in various forms, including natural sweeteners like honey and maple syrup, as well as artificial or low-calorie sweeteners such as aspartame, sucralose, and stevia. These sweeteners cater to different dietary needs, including those of diabetics or individuals aiming to reduce calorie intake. Natural sweeteners are derived from plants or natural sources, while artificial sweeteners are chemically synthesized. The use of sweeteners allows food manufacturers to create sweet-tasting products with reduced sugar content, contributing to efforts to address health concerns related to excessive sugar consumption. However, the safety and long-term effects of some artificial sweeteners remain topics of ongoing research and debate within the scientific community. Consumers should exercise moderation and consider individual health conditions when incorporating sweeteners into their diets.

To get more information on this market, Request Sample

India Food Sweetener Market Trends:

The food sweetener market in India is propelled by several key drivers, fostering its robust growth in recent years. Firstly, the escalating regional demand for low-calorie and healthier alternatives to traditional sugar has been a major catalyst. As consumers become increasingly health-conscious, the preference for sweeteners that offer sweetness without the associated calorie load has surged, driving the market forward. Moreover, the burgeoning prevalence of lifestyle-related diseases, such as diabetes and obesity, has fueled the adoption of sugar substitutes, propelling the food sweetener market to new heights. In tandem with this, the food and beverage industry's perpetual quest for innovative ingredients to meet evolving consumer preferences has further intensified the demand for sweeteners. This has led to extensive R&D activities, resulting in the introduction of novel sweetening agents, contributing significantly to market expansion. Furthermore, the emphasis on clean-label products and natural sweeteners has emerged as a pivotal driver, aligning with the growing consumer inclination towards transparent and wholesome food choices. As regulatory bodies increasingly approve and support the use of certain natural sweeteners, the market witnesses an additional impetus, underscoring the interconnected relationship between consumer trends, health considerations, and industry innovation in the dynamic landscape of the food sweetener market.

India Food Sweetener Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and application.

Product Type Insights:

- Sucrose

- Starch Sweeteners and Sugar Alcohols

- Dextrose

- High Fructose Corn Syrup (HFCS)

- Maltodextrin

- Sorbitol

- Xylitol

- Others

- High Intensity Sweeteners (HIS)

- Sucralose

- Aspartame

- Saccharin

- Cyclamate

- Ace-K

- Neotame

- Stevia

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes sucrose, starch sweeteners and sugar alcohols (dextrose, high fructose corn syrup (HFCS), maltodextrin, sorbitol, xylitol, and others) and high intensity sweeteners (HIS) (sucralose, aspartame, saccharin, cyclamate, ace-K, neotame, stevia, and others).

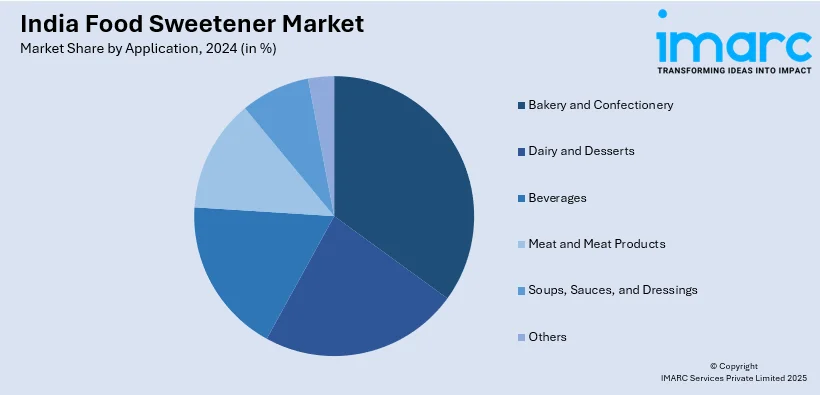

Application Insights:

- Bakery and Confectionery

- Dairy and Desserts

- Beverages

- Meat and Meat Products

- Soups, Sauces, and Dressings

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bakery and confectionery, dairy and desserts, beverages, meat and meat products, soups, sauces, and dressings, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Food Sweetener Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Bakery and Confectionery, Dairy and Desserts, Beverages, Meat and Meat Products, Soups, Sauces, and Dressings, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India food sweetener market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India food sweetener market?

- What is the breakup of the India food sweetener market on the basis of product type?

- What is the breakup of the India food sweetener market on the basis of application?

- What are the various stages in the value chain of the India food sweetener market?

- What are the key driving factors and challenges in the India food sweetener?

- What is the structure of the India food sweetener market and who are the key players?

- What is the degree of competition in the India food sweetener market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India food sweetener market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India food sweetener market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India food sweetener industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)