India Foodservice Packaging Market Size, Share, Trends and Forecast by Material, Packaging Type, Application, and Region, 2025-2033

India Foodservice Packaging Market Overview:

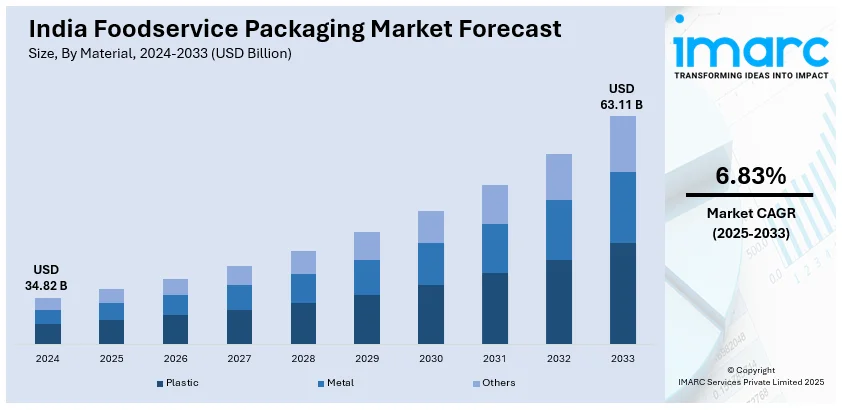

The India foodservice packaging market size reached USD 34.82 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 63.11 Billion by 2033, exhibiting a growth rate (CAGR) of 6.83% during 2025-2033. The market is experiencing significant growth mainly due to rising QSRs, food delivery growth and sustainability trends. Innovations in flexible, rigid and paper-based packaging are shaping market dynamics with key players focusing on cost-effective, eco-friendly and functional solutions to meet evolving consumer preferences.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 34.82 Billion |

| Market Forecast in 2033 | USD 63.11 Billion |

| Market Growth Rate (2025-2033) | 6.83% |

India Foodservice Packaging Market Trends:

Rising Focus on Sustainability

The rise of sustainable packaging in India’s foodservice sector is driven by strict government regulations on plastic waste, rising consumer environmental awareness and corporate sustainability commitments. Businesses are increasingly shifting to biodegradable, compostable and recyclable materials such as bagasse, PLA, paper-based laminates and molded fiber. The ban on single-use plastics has accelerated the demand for ecofriendly alternatives particularly among quick-service restaurants, cloud kitchens and food delivery platforms contributing significantly to India foodservice packaging market growth. Brands are focusing on compostable cutlery, plant-based packaging films and water-resistant paper coatings to maintain functionality while reducing plastic dependency. For instance, in September 2024, CHUK a brand of Pakka launched new 100% compostable tableware including a beverage cup, 4-inch dona and 3cp snack tray aimed at reducing single-use plastic in the food service industry. Made from sugarcane bagasse these products offer sustainable alternatives for QSRs, caterers and event planners. Cost and scalability remain challenges but innovations in material science and local sourcing of sustainable raw materials are addressing these concerns. Consumer preference for hygienic yet sustainable packaging is pushing companies to balance durability, food safety and environmental impact making green packaging a competitive advantage in the industry. India foodservice packaging market share is expected to grow as major players adopt sustainable solutions with paper-based and biodegradable packaging gaining traction over traditional plastic materials driven by regulatory compliance and increasing consumer preference for environmentally responsible options.

To get more information on this market, Request Sample

Growth of Quick-Service Restaurants (QSRs)

The rapid expansion of quick-service restaurants (QSRs) and cloud kitchens in India is driving significant demand for efficient foodservice packaging. According to a report published by IBEF, the quick service restaurant (QSR) industry in India is projected to grow by 20-25% in FY24 driven by increasing demand and market expansion. The top five QSR players are expected to open 2,300 stores between FY23 and FY25 with a capital expenditure of approximately US$ 707 million (Rs. 5,800 crore). With changing consumer lifestyles, increasing urbanization and a growing preference for on-the-go meals QSRs require packaging that is lightweight, durable and maintains food freshness. The rise of food delivery platforms like Zomato and Swiggy has further emphasized the need for tamper-proof and spill-resistant packaging to ensure food safety during transit. Many brands are investing in innovative designs such as multi-compartment containers, grease-resistant wraps and insulated packaging to enhance the customer experience. Sustainability is also a focus with QSRs adopting biodegradable and recyclable materials to comply with regulatory standards while catering to eco-conscious consumers. These factors are creating a positive India foodservice packaging market outlook driving demand for advanced, sustainable, and high-performance packaging solutions across the industry.

India Foodservice Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on material, packaging type and application.

Material Insights:

- Plastic

- Polyethylene

- Polyamide

- Ethylene Vinyl Alcohol

- Metal

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes plastic (polyethylene, polyamide and ethylene vinyl alcohol), metal and others.

Packaging Type Insights:

- Paper and Paperboard

- Flexible

- Rigid

- Others

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes paper and paperboard, flexible, rigid and others.

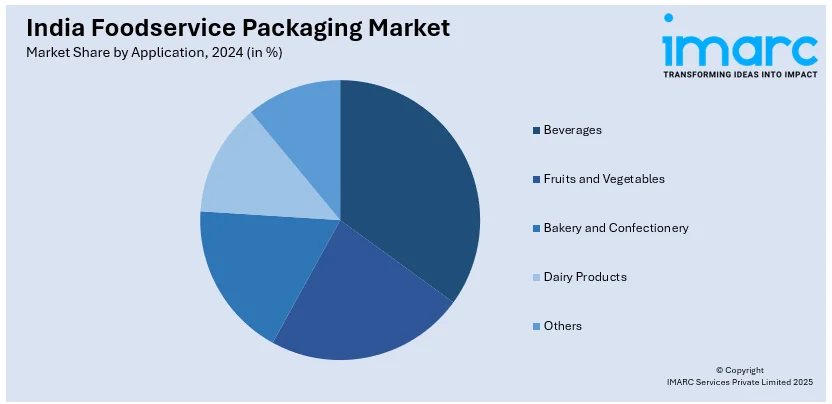

Application Insights:

- Beverages

- Fruits and Vegetables

- Bakery and Confectionery

- Dairy Products

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes beverages, fruits and vegetables, bakery and confectionery, dairy products and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Foodservice Packaging Market News:

- In November 2024, Oddy India launched a new range of food specialty papers for the HoReCa industry, focusing on sustainability and efficiency. Key products include reusable Ecobake paper and Uniwraps, which enhance food safety. The solutions aim to reduce operational costs and improve kitchen performance while catering to health-conscious consumers.

- In January 2023, Adeera Packaging, a leading manufacturer of recycled paper bags, announced plans to launch innovations aimed at enhancing food delivery safety. These innovations include bags with barrier coatings designed for liquid items and aluminum foil-lined bags to maintain warmth. The company supplies major quick-service restaurant (QSR) brands and is planning to expand in the U.S. market.

India Foodservice Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Plastic (Polyethylene, Polyamide, Ethylene Vinyl Alcohol), Metal, Others |

| Packaging Types Covered | Paper and Paperboard, Flexible, Rigid, Others |

| Applications Covered | Beverages, Fruits and Vegetables, Bakery and Confectionery, Dairy Products, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India foodservice packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the India foodservice packaging market on the basis of material?

- What is the breakup of the India foodservice packaging market on the basis of packaging type?

- What is the breakup of the India foodservice packaging market on the basis of application?

- What is the breakup of the India foodservice packaging market on the basis of region?

- What are the various stages in the value chain of the India foodservice packaging market?

- What are the key driving factors and challenges in the India foodservice packaging market?

- What is the structure of the India foodservice packaging market and who are the key players?

- What is the degree of competition in the India foodservice packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India foodservice packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India foodservice packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India foodservice packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)