India Forage Market Size, Share, Trends and Forecast by Crop Type, Product Type, Animal Type, and Region, 2026-2034

Market Overview:

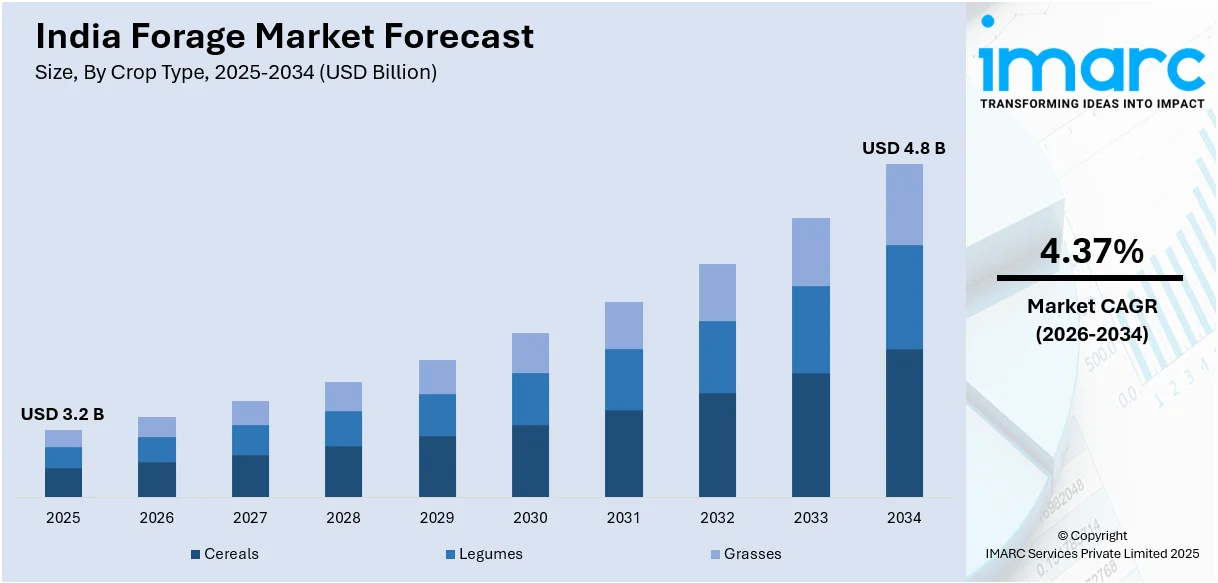

The India forage market size reached USD 3.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.8 Billion by 2034, exhibiting a growth rate (CAGR) of 4.37% during 2026-2034. The increasing demand for meat, milk, and other dairy products among the masses, rising utilization of advanced technologies like precision agriculture, hydroponics, and fodder conservation techniques, and favorable government initiatives to empower farmers represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.2 Billion |

| Market Forecast in 2034 | USD 4.8 Billion |

| Market Growth Rate (2026-2034) | 4.37% |

Forage is a versatile and highly nutritious product extracted from a diverse range of plant materials, typically used as a feed source for livestock and other animals. It is segregated into pasture forage and rangeland forage, which comprises native grasses, shrubs, and herbs that grow naturally in uncultivated areas. It also consists of silage forage that is often made from crops, such as corn, sorghum, or alfalfa. It is essential for the survival and sustenance of wildlife populations as they obtain the necessary nutrients and energy for growth, reproduction, and overall well-being from forage. It helps lower carbon, mitigate climate change, and preserve natural landscapes. It promotes soil fertility and water filtration and reduces the requirement for synthetic fertilizers and pesticides. Forage is more cost-effective than relying solely on purchased feeds. It allows livestock farmers to utilize natural resources and reduce expenses associated with commercial feed. As it is used as a preserved feed source for livestock during periods of low forage availability, such as winter months, the demand for forage is rising in India.

To get more information of this market Request Sample

India Forage Market Trends:

At present, the increasing demand for meat, milk, and other dairy products represents one of the major factors influencing the market positively in India. Moreover, the rising utilization of advanced technologies like precision agriculture, hydroponics, and fodder conservation techniques, is strengthening the growth of the market. Apart from this, the growing adoption of high-yielding forage varieties that offer better nutritional content, disease resistance, and improved digestibility for animals is offering a positive market outlook. Additionally, the rising consumption of protein-rich diets to prevent the occurrence of various chronic diseases, such as arthritis, diabetes, and obesity, is offering lucrative growth opportunities to industry investors in the country. In line with this, the increasing adoption of modern farming practices and utilization of machinery and equipment for activities, such as sowing, harvesting, and storage of forage crops is impelling the market growth in India. Besides this, the Government of India is undertaking initiatives to empower farmers by providing financial support and technical guidance for efficient forage production and management. In addition, the rising awareness among livestock farmers about the significance of animal nutrition for improving productivity and profitability is bolstering the growth of the market in the country. Furthermore, the increasing demand for forage crops that are resilient to changing climatic conditions, such as drought-tolerant varieties, to overcome the impacts of climate change is contributing to the growth of the market in India.

India Forage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India forage market report, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on crop type, product type, and animal type.

Crop Type Insights:

- Cereals

- Legumes

- Grasses

The report has provided a detailed breakup and analysis of the market based on the crop type. This includes cereals, legumes, and grasses.

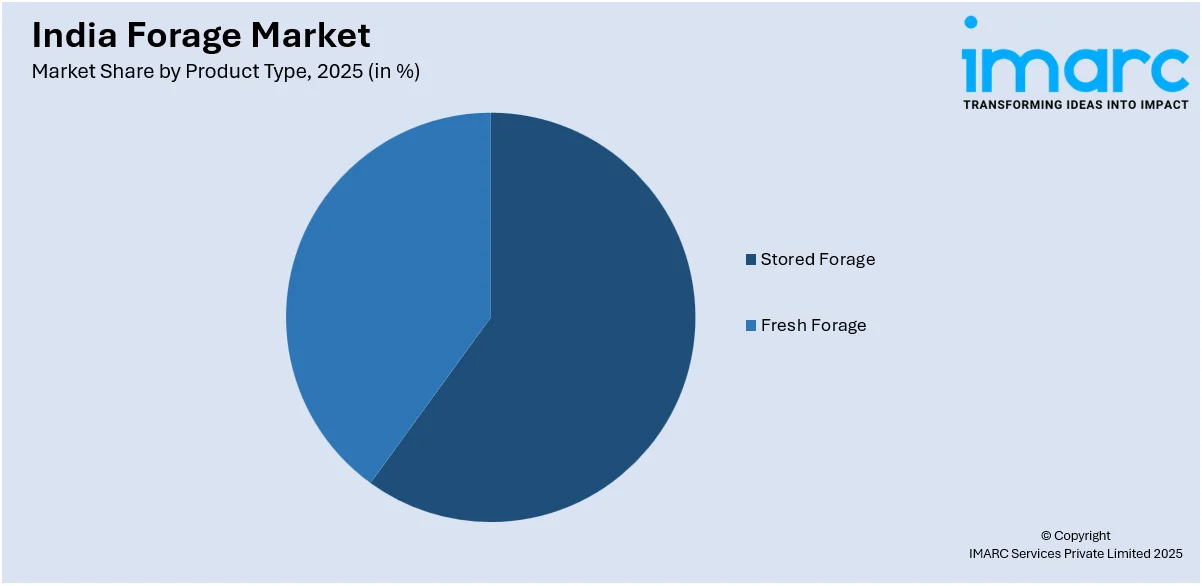

Product Type Insights:

Access the comprehensive market breakdown Request Sample

- Stored Forage

- Fresh Forage

A detailed breakup and analysis of the market based on the product type has also been provided in the report. This includes stored forage and fresh forage.

Animal Type Insights:

- Ruminants

- Swine

- Poultry

- Others

A detailed breakup and analysis of the market based on the animal type has also been provided in the report. This includes ruminants, swine, poultry, and others.

Regional Insights:

- South India

- North India

- West and Central India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include South India, North India, West and Central India, and East India.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the India forage market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Forage Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Crop Types Covered | Cereals, Legumes, Grasses |

| Product Types Covered | Stored Forage, Fresh Forage |

| Animal Types Covered | Ruminants, Swine, Poultry, Others |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India forage market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India forage market?

- What is the breakup of the India forage market on the basis of crop type?

- What is the breakup of the India forage market on the basis of product type?

- What is the breakup of the India forage market on the basis of animal type?

- What are the various stages in the value chain of the India forage market?

- What are the key driving factors and challenges in the India forage market?

- What is the structure of the India forage market and who are the key players?

- What is the degree of competition in the India forage market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India forage market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India forage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India forage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)