India Forged Steel Market Size, Share, Trends and Forecast by Component, Material Type, End Use Industry, and Region, 2025-2033

India Forged Steel Market Overview:

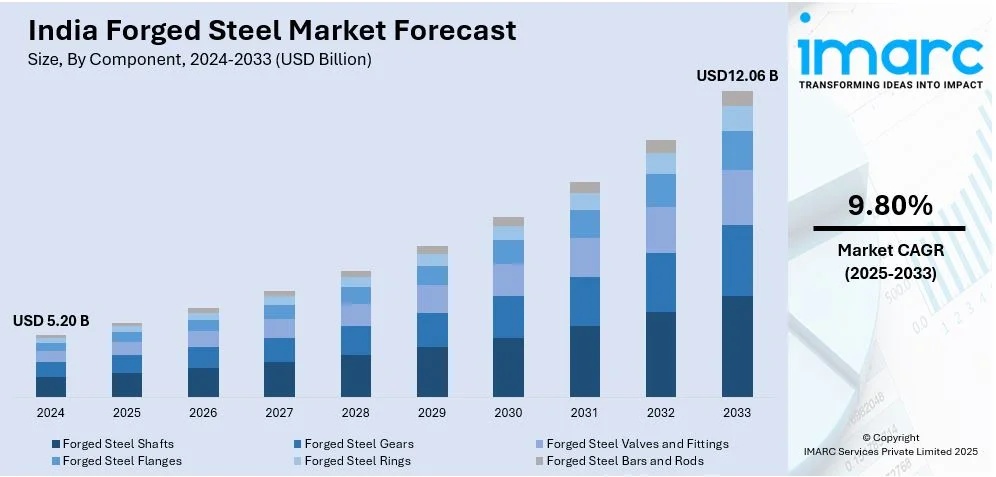

The India forged steel market size reached USD 5.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.06 Billion by 2033, exhibiting a growth rate (CAGR) of 9.80% during 2025-2033. The market is driven by infrastructure development, growing automotive production, and advancements in forging technology, with government initiatives like Make in India and PLI schemes boosting domestic manufacturing, while rising demand from construction, aerospace, and defense industries further accelerates growth and innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.20 Billion |

| Market Forecast in 2033 | USD 12.06 Billion |

| Market Growth Rate 2025-2033 | 9.80% |

India Forged Steel Market Trends:

Rising Demand from the Automotive Sector

The growth of the Indian automobile sector, spurred by rising production of vehicles and commercial and passenger vehicle sales, has resulted in a boom in demand for forged steel parts. Forged steel is used by automakers to make crankshafts, connecting rods, gears, and axles due to its strength and longevity. High-performance forged steel components that improve vehicle efficiency and safety are in greater demand as a result of the push towards electric cars (EVs). Additionally, policies like the PLI scheme for the automotive industry are promoting investments in sophisticated manufacturing capacities, such as forging technologies. As the auto industry is growing, forged steel producers are experiencing steady demand from vehicle manufacturers and component suppliers.

To get more information on this market, Request Sample

Growth in Infrastructure and Construction Activities

India's infrastructure expansion and urbanization are significantly driving the demand for forged steel. The Ministry of Steel reported that total finished steel consumption surged from 100.171 million tonnes in 2019-20 to 136.291 million tonnes in 2023-24, highlighting strong domestic demand. Government initiatives like the Smart Cities Mission, Bharatmala, and Sagarmala projects have escalated the need for durable steel components in bridges, highways, and rail networks. The growing development of high-rise buildings and manufacturing units has also increased the demand for high-strength forged steel in structural structures, heavy machinery, and reinforcing bars. Foreign direct investments in the Indian real estate market are also supporting the industry. Rapid urban transformation continues to drive strong demand for high-quality forged steel components, reinforcing steel's importance in India's infrastructure and construction sectors.

Technological Advancements in Forging Processes

The Indian forging steel industry is experiencing technological development in forging technology, which has resulted in enhanced product quality, efficiency, and cost savings. Implementation of automation, computer-aided design (CAD), and precision forging technologies has raised the level of manufacturing processes to produce high-strength, blemish-free steel parts. Defense, aerospace, and heavy engineering industries are now demanding precision-forged components, prompting innovation in forging processes. Furthermore, the adoption of environmentally friendly forging methods, such as energy-saving heating systems and waste minimization practices, is picking up speed. These advances are not only enhancing productivity but also making Indian forged steel producers competitive in overseas markets by satisfying high quality and performance requirements.

India Forged Steel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component, material type, and end use industry.

Component Insights:

- Forged Steel Shafts

- Forged Steel Gears

- Forged Steel Valves and Fittings

- Forged Steel Flanges

- Forged Steel Rings

- Forged Steel Bars and Rods

The report has provided a detailed breakup and analysis of the market based on the component. This includes forged steel shafts, forged steel gears, forged steel valves and fittings, forged steel flanges, forged steel rings, and forged steel bars and rods.

Material Type Insights:

- Carbon Steel

- Alloy Steel

- Stainless Steel

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, alloy steel, and stainless steel.

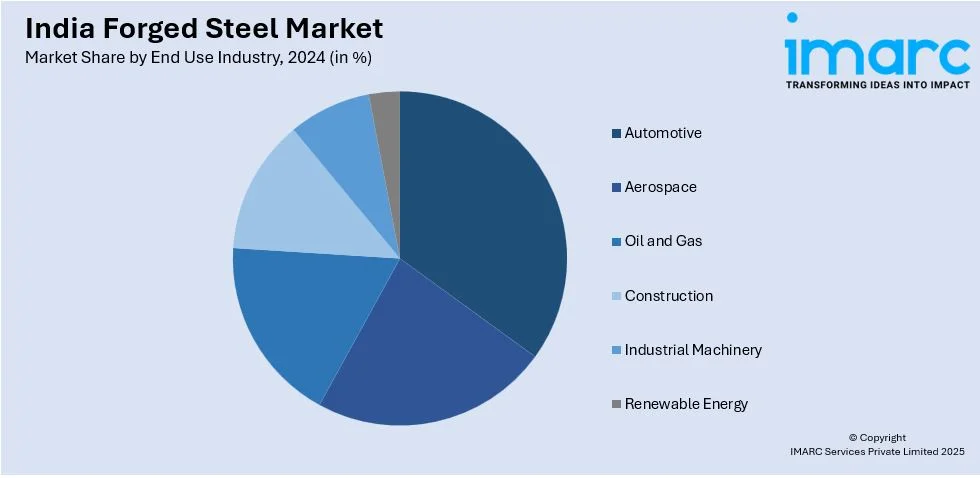

End Use Industry Insights:

- Automotive

- Aerospace

- Oil and Gas

- Construction

- Industrial Machinery

- Renewable Energy

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, aerospace, oil and gas, construction, industrial machinery, and renewable energy.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Forged Steel Market News:

- In October 2024, Bharat Forge signed a definitive agreement to acquire AAM India Manufacturing for Rs 544.5 crore. AAMIMCPL, a subsidiary of American Axle & Manufacturing, specializes in axles for commercial vehicles. This acquisition strengthens Bharat Forge’s presence in axle manufacturing, expanding its offerings in India’s automotive sector.

- In March 2024, Indian Railways (IR) and Ramkrishna Forgings Limited (RFL) formed a joint venture to establish a forged steel wheel manufacturing plant in Tamil Nadu. With an INR 6.5 billion investment, the plant will produce 250,000 wheels annually, supplying 80,000 to IR and exporting 170,000. This marks India’s first steel forged wheel exports, ending decades of dependence on imports. Production is set to begin within 16-18 months, supporting semi-high-speed passenger trains.

India Forged Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Forged Steel Shafts, Forged Steel Gears, Forged Steel Valves and Fittings, Forged Steel Flanges, Forged Steel Rings, Forged Steel Bars and Rods |

| Material Types Covered | Carbon Steel, Alloy Steel, Stainless Steel |

| End Use Industries Covered | Automotive, Aerospace, Oil and Gas, Construction, Industrial Machinery, Renewable Energy |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India forged steel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India forged steel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India forged steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The forged steel market in India was valued at USD 5.20 Billion in 2024.

The India forged steel market is projected to exhibit a CAGR of 9.80% during 2025-2033, reaching a value of USD 12.06 Billion by 2033.

The India forged steel market is primarily influenced by factors such as escalating infrastructure and construction efforts, heightened demand from the automotive and defense industries, and an increasing application in oil, gas and power generation sectors. Advancements in manufacturing technology and an emphasis on developing high-strength, lightweight components are further driving the demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)