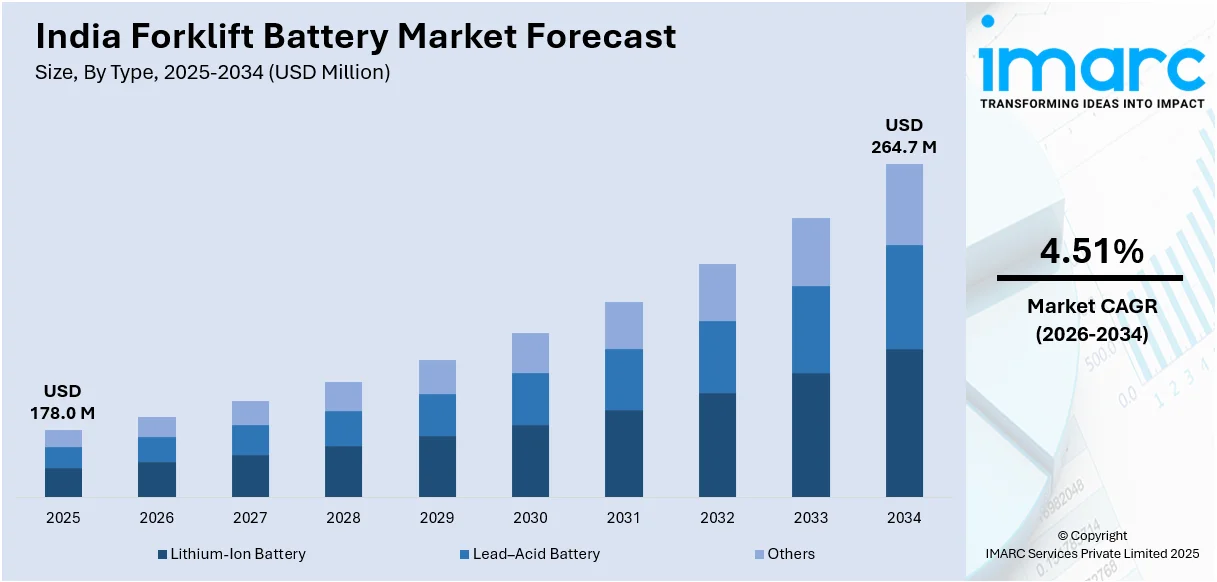

India Forklift Battery Market Size, Share, Trends, and Forecast by Type, Sales Channel, Application, and Region, 2026-2034

India Forklift Battery Market Overview:

The India forklift battery market size reached USD 178.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 264.7 Million by 2034, exhibiting a growth rate (CAGR) of 4.51% during 2026-2034. The market is witnessing steady growth, driven by an increasing demand for material handling equipment in sectors like logistics, manufacturing, and warehousing. Additionally, technological advancements in battery efficiency, coupled with the rise of electric forklifts, are fostering market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 178.0 Million |

| Market Forecast in 2034 | USD 264.7 Million |

| Market Growth Rate 2026-2034 | 4.51% |

India Forklift Battery Market Trends:

Rising Adoption of Lithium-Ion Forklift Batteries

The India forklift battery market is shifting towards lithium-ion (Li-ion) technology, propelled by the need for higher efficiency and lower maintenance. For instance, in January 2025, IBC, in partnership with Mahanagar Gas Limited, announced an establishment of a battery manufacturing facility in Devanahalli, Karnataka. The unit will export 20% of production, strengthen the local economy, and reduce dependence on Chinese imports within nine months. In line with this, Li-ion batteries charge faster, have longer lifespans, and eliminate the need for frequent water refills, unlike traditional lead-acid batteries. Furthermore, sectors like e-commerce, warehousing, and manufacturing increasingly use Li-ion-powered forklifts in order to raise productivity and decrease operational expenses. The declining lithium-ion technology cost, combined with improved energy density and performance, is also driving this shift forward. With more companies focusing on sustainability and saving costs, Li-ion forklift batteries are poised to gain popularity at the expense of traditional lead-acid solutions in a range of industrial sectors.

To get more information on this market Request Sample

Expanding E-Commerce and Warehousing Infrastructure

India’s booming e-commerce and logistics sectors are driving the demand for efficient material handling equipment, including battery-powered forklifts. For instance, as per industry reports, India's e-commerce market is anticipated to reach approximately USD 147.3 Billion (INR 12.2 Trillion) in 2024, reflecting a 23.8% growth as compared to the previous year. Large-scale warehouse expansions, automated distribution centers, and rising order fulfillment demands require reliable and cost-effective forklift solutions. Battery-powered forklifts, particularly those using advanced energy storage technologies, offer improved operational efficiency with reduced emissions and noise pollution, making them ideal for indoor warehousing applications. The push for automation and smart warehousing solutions is also influencing battery adoption, as businesses seek high-performance power sources to support round-the-clock operations. As logistics hubs and fulfillment centers expand nationwide, the forklift battery market will see steady growth.

India Forklift Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, sales channel, and application.

Type Insights:

- Lithium-Ion Battery

- Lead–Acid Battery

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes lithium-ion battery, lead–acid battery, and others.

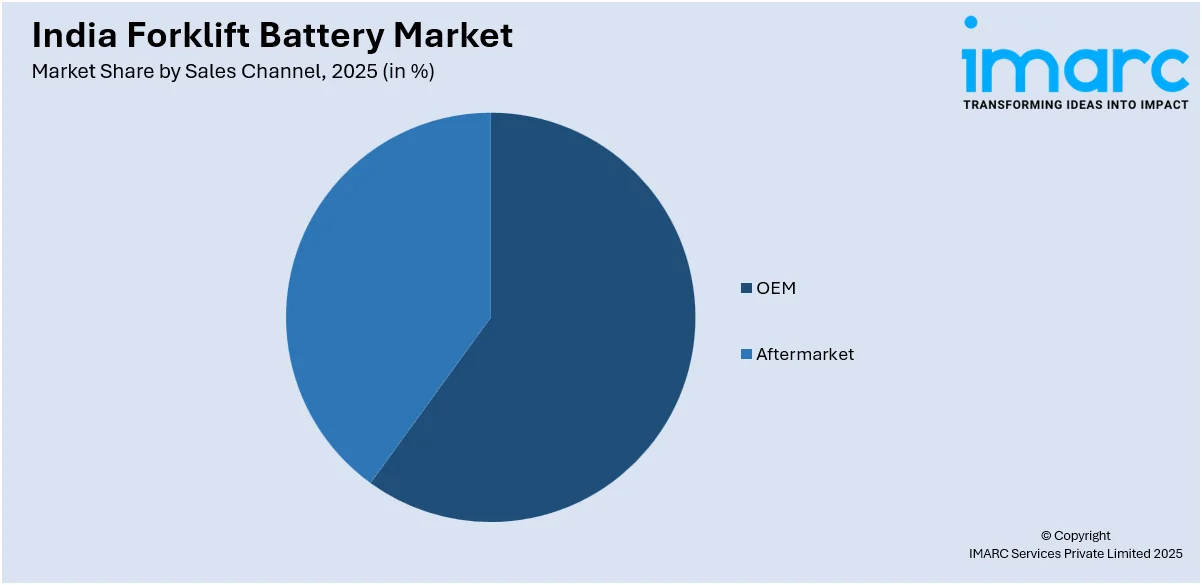

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes OEM and aftermarket.

Application Insights:

- Warehouses

- Manufacturing

- Construction

- Retail and Wholesale Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes warehouses, manufacturing, construction, retail and wholesale stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Forklift Battery Market News:

- In August 2024, Godrej & Boyce announced the launch of the India’s first lithium-ion battery-operated forklift by a domestic manufacturer. It provides a self-reliant and secure Li-ion battery system, which is designed for the material handling sector.

India Forklift Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lithium-Ion Battery, Lead–Acid Battery, Others |

| Sales Channels Covered | OEM, Aftermarket |

| Applications Covered | Warehouses, Manufacturing, Construction, Retail and Wholesale Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India forklift battery market performed so far and how will it perform in the coming years?

- What is the breakup of the India forklift battery market on the basis of type?

- What is the breakup of the India forklift battery market on the basis of sales channel?

- What is the breakup of the India forklift battery market on the basis of application?

- What is the breakup of the India forklift battery market on the basis of region?

- What are the various stages in the value chain of the India forklift battery market?

- What are the key driving factors and challenges in the India forklift battery?

- What is the structure of the India forklift battery market and who are the key players?

- What is the degree of competition in the India forklift battery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India forklift battery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India forklift battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India forklift battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)