India Formaldehyde Market Size, Share, Trends and Forecast by Derivative, End User, and Region, 2025-2033

India Formaldehyde Market Overview:

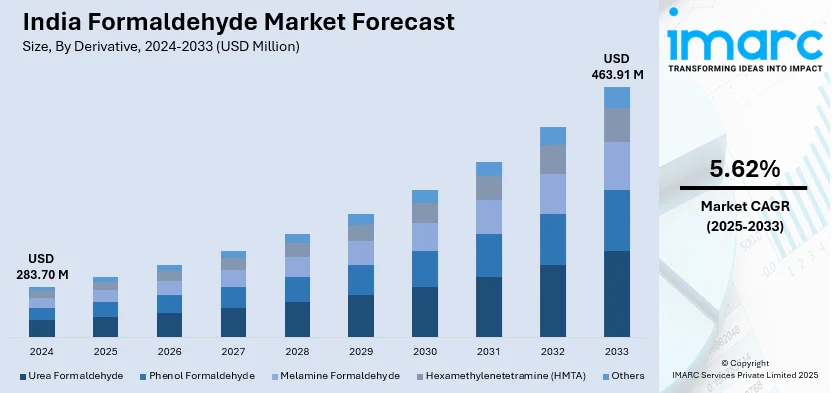

The India formaldehyde market size reached USD 283.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 463.91 Million by 2033, exhibiting a growth rate (CAGR) of 5.62% during 2025-2033. The market is driven by rising demand from the construction, automotive, and furniture industries, where it is used in adhesives, resins, and coatings. Growth is further fueled by expanding plywood and laminate production, increasing industrial applications, and government initiatives promoting infrastructure development and domestic chemical manufacturing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 283.70 Million |

| Market Forecast in 2033 | USD 463.91 Million |

| Market Growth Rate 2025-2033 | 5.62% |

India Formaldehyde Market Trends:

Rising Demand in the Construction and Furniture Industries

Formaldehyde is a key component in producing urea-formaldehyde (UF) and phenol-formaldehyde (PF) resins, which are vital for manufacturing plywood, laminates, and particleboard. With India’s construction sector booming and urbanization accelerating, the demand for these materials is surging. The Indian plywood market is projected to reach ₹387.9 billion by FY 2033-34, growing at a CAGR of 5.44% from FY 2025-26 to FY 2033-34, directly driving formaldehyde consumption. Simultaneously, India’s construction industry is expected to reach $1.4 trillion by 2025, supported by large-scale infrastructure projects such as PM Awas Yojana Urban 2.0, which allocates ₹10 lakh crore ($120.16 billion) to provide housing for 1 crore urban poor and middle-class families, creating a positive outlook for market expansion. Moreover, the rising demand for modular furniture, fueled by increasing disposable incomes, further propels the need for formaldehyde-based adhesives and coatings, with per capita revenue in India's furniture market projected to reach $4.26 by 2025. Additionally, the Make in India initiative is bolstering the domestic manufacturing of engineered wood products, further escalating the consumption of formaldehyde-based resins in the country’s growing industrial landscape.

To get more information on this market, Request Sample

Increasing Use in the Automotive Sector

Formaldehyde plays an important role in the automotive industry, being widely used in high-performance plastics, coatings, and adhesives that enhance durability, heat resistance, and cost efficiency. The rapid expansion of India’s automobile sector, particularly in electric vehicles (EVs) and lightweight vehicles, is fueling demand for formaldehyde-based composite materials. In September 2024, India produced 2,773,039 units of passenger vehicles, three-wheelers, two-wheelers, and quadricycles, highlighting the industry's strong growth. In addition to this, with the government targeting 30% of new vehicle sales to be electric by 2030, initiatives such as the FAME II policy, with a budgetary allocation of ₹10,000 crore (US$1.43 billion) are incentivizing EV adoption and local manufacturing. Formaldehyde-based resins are increasingly utilized in heat-resistant coatings, battery casings, and interior vehicle components, ensuring enhanced performance and cost-effectiveness. As investments in EV production and automotive component manufacturing continue to grow, formaldehyde consumption in India is set to rise significantly, reinforcing its importance in the evolving automotive landscape.

India Formaldehyde Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on derivative and end user.

Derivative Insights:

- Urea Formaldehyde

- Phenol Formaldehyde

- Melamine Formaldehyde

- Hexamethylenetetramine (HMTA)

- Others

The report has provided a detailed breakup and analysis of the market based on the derivative. This includes urea formaldehyde, phenol formaldehyde, melamine formaldehyde, hexamethylenetetramine (HMTA), and others.

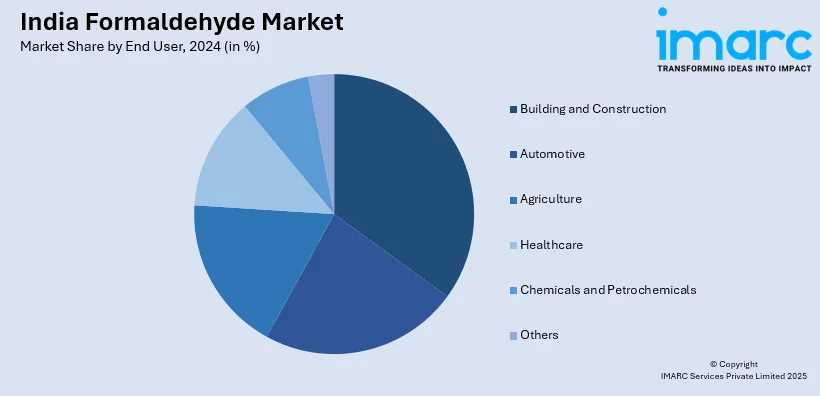

End User Insights:

- Building and Construction

- Automotive

- Agriculture

- Healthcare

- Chemicals and Petrochemicals

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes building and construction, automotive, agriculture, healthcare, chemicals and petrochemicals, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Formaldehyde Market News:

- September 2024: Kanoria Chemicals invested Rs. 69 crores to increase its formaldehyde and hexamine production capacity in Gujarat.The new facility, which used cutting-edge Metal Oxide technology, generated 345 metric tons per day (MTPD) and began commercial production on September 6, 2024. This will meet expanding demand in industries such as automotive, building and construction, agriculture, cosmetics, and chemicals.

- December 2023: Suraj Industries developed a new phenol formaldehyde resin production facility in Gujarat, India.This facility focuses on manufacturing phenol formaldehyde resin, which is a key component in sectors such as plywood, adhesives, and laminates. The factory is equipped with cutting-edge gear and equipment and will take up 350.58 square meters of land.

India Formaldehyde Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Derivatives Covered | Urea Formaldehyde, Phenol Formaldehyde, Melamine Formaldehyde, Hexamethylenetetramine (HMTA), Others |

| End Users Covered | Building and Construction, Automotive, Agriculture, Healthcare, Chemicals and Petrochemicals, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India formaldehyde market performed so far and how will it perform in the coming years?

- What is the breakup of the India formaldehyde market on the basis of derivative?

- What is the breakup of the India formaldehyde market on the basis of end user?

- What are the various stages in the value chain of the India formaldehyde market?

- What are the key driving factors and challenges in the India formaldehyde?

- What is the structure of the India formaldehyde market and who are the key players?

- What is the degree of competition in the India formaldehyde market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India formaldehyde market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India formaldehyde market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India formaldehyde industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)