India Fortified Dairy Products Market Size, Share, Trends and Forecast by Products, Ingredient, Flavor, Distribution Channel, and Region, 2025-2033

India Fortified Dairy Products Market Overview:

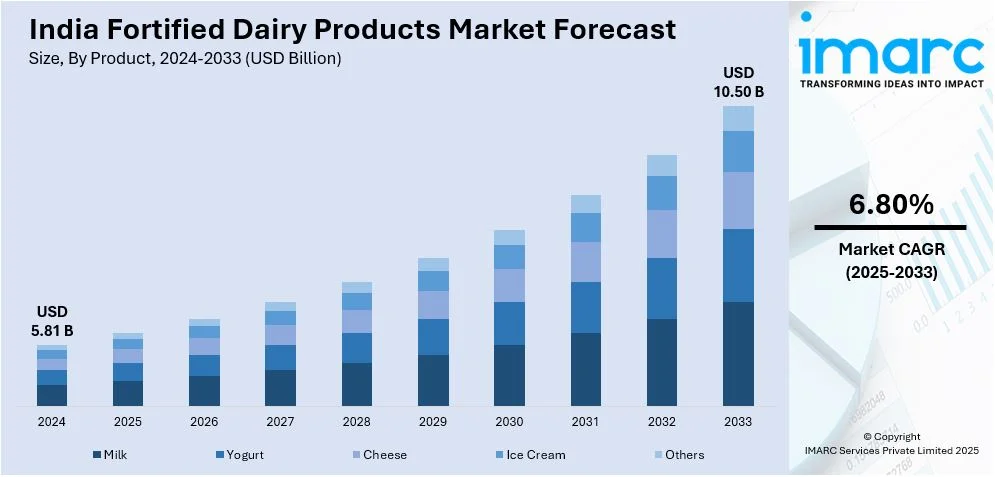

The India fortified dairy products market size reached USD 5.81 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.50 Billion by 2033, exhibiting a growth rate (CAGR) of 6.80% during 2025-2033. Rising health consciousness, increasing micronutrient deficiencies, and government initiatives promoting fortified foods are driving India's fortified dairy products market. Growing urbanization, higher disposable incomes, and expanding retail networks further boost demand. Additionally, endorsements from health organizations and evolving consumer preferences toward functional foods enhance market growth and product innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.81 Billion |

| Market Forecast in 2033 | USD 10.50 Billion |

| Market Growth Rate (2025-2033) | 6.80% |

India Fortified Dairy Products Market Trends:

Expansion of Product Offerings and Innovation in Fortification

Manufacturers in India’s fortified dairy market are expanding their product portfolios to meet diverse consumer needs. Traditional dairy products like milk and curd are being fortified with essential nutrients, while innovative offerings such as fortified flavored milk, probiotic yogurts, and omega-3-enriched cheese are gaining popularity. Companies are leveraging advanced food technology to enhance bioavailability and nutrient absorption. Additionally, fortified plant-based dairy alternatives are emerging to cater to lactose-intolerant and vegan consumers. With growing investments in research and development (R&D), major players like Danone are strengthening their presence, as seen in its €20 million investment to expand its Punjab plant. Dairy brands are also prioritizing taste, texture, and shelf life while ensuring compliance with evolving regulatory standards.

To get more information on this market, Request Sample

Government Initiatives and Regulatory Push for Fortification

India, the world's largest milk producer, recorded 230.58 million tonnes of milk production in 2022-23, ensuring a per capita availability of 459 grams per day. To combat malnutrition and nutrient deficiencies, the Indian government actively promotes food fortification. The Food Safety and Standards Authority of India (FSSAI) has mandated and encouraged dairy fortification with essential vitamins and minerals. Initiatives like Eat Right India and school milk programs are driving fortified dairy adoption, especially in rural areas. Public-private partnerships are fostering innovation in affordable fortified dairy products. With increasing regulatory support and standardization, fortified dairy is becoming mainstream, enhancing nutritional value and addressing dietary gaps across diverse socioeconomic groups.

Growing Consumer Awareness and Demand for Healthier Dairy Options

Increasing health consciousness among Indian consumers is significantly driving the demand for fortified dairy products. Rising cases of micronutrient deficiencies, particularly among children and pregnant women, have heightened awareness about the benefits of fortified milk, yogurt, and cheese. Government campaigns and endorsements from health organizations further educate consumers about the importance of essential vitamins and minerals in daily diets. Additionally, the growing middle-class population with higher disposable income is more willing to pay a premium for nutritionally enhanced dairy products. As a result, brands are increasingly promoting fortified dairy with added vitamins A, D, calcium, and iron, aligning with evolving consumer preferences for functional foods that support overall well-being and immunity enhancement.

India Fortified Dairy Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on products, ingredient, flavor, and distribution channel.

Products Insights:

- Milk

- Yogurt

- Cheese

- Ice Cream

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes milk, yogurt, cheese, ice cream and others.

Ingredient Insights:

- Vitamins

- Minerals

- Probiotics

- Omega-3 Fatty Acids

- Proteins

- Others

A detailed breakup and analysis of the market based on the ingredient have also been provided in the report. This includes vitamins, minerals, probiotics, omega-3 fatty acids, proteins, and others.

Flavor Insights:

- Unflavored/Natural

- Flavored

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes unflavored/natural, and flavored.

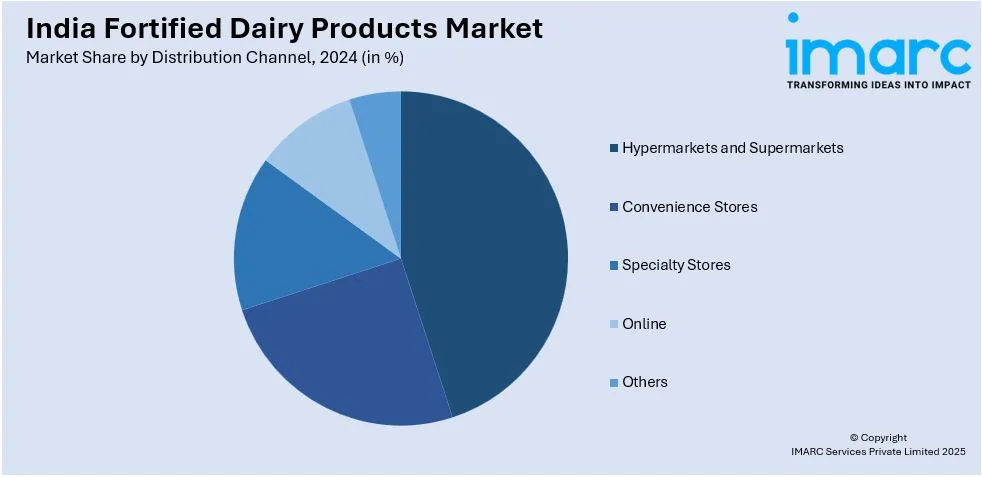

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, convenience stores, specialty stores, online, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fortified Dairy Products Market News:

- In December 2024, Aavin is set to introduce a fortified variant of its Green Magic milk in select Tamil Nadu districts, including Tiruvallur, Kancheepuram, Coimbatore, and Salem. Enriched with vitamins A, D, and added protein, the milk aims to address micronutrient deficiencies found in both urban and rural populations. This initiative, launched as a trial, seeks to enhance children's nutrition while expanding fortified milk availability to uncovered areas, according to Aavin Managing Director S. Vineeth.

- In February 2024, Gokul Dairy launched “Gokul Shakti,” a bio-fortified milk brand targeted at children and elders in Mumbai and Pune. Enriched with vitamins C and D, the milk contains 4.1% fat and 9.2% SNF. Gokul Dairy Chairman Arun Dongale highlighted its nutritional benefits, aiming to enhance consumer health.

India Fortified Dairy Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Milk, Yogurt, Cheese, Ice Cream, Others |

| Ingredients Covered | Vitamins, Minerals, Probiotics, Omega-3 Fatty Acids, Proteins, Others |

| Flavors Covered | Unflavored/Natural, Flavored |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fortified dairy products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fortified dairy products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fortified dairy products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fortified dairy products market in India was valued at USD 5.81 Billion in 2024.

The fortified dairy products market in India is projected to reach USD 10.50 Billion by 2033, exhibiting a CAGR of 6.80% during 2025-2033.

The India fortified dairy products market is driven by rising health awareness, increased incidence of micronutrient deficiencies, and government-backed programs promoting food fortification. Expanding urban populations, growing disposable incomes, and the rising demand for functional foods are also supporting market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)