India Foundry Equipment Market Size, Share, Trends and Forecast by Equipment Type, Foundry Process, Application, and Region, 2025-2033

India Foundry Equipment Market Overview:

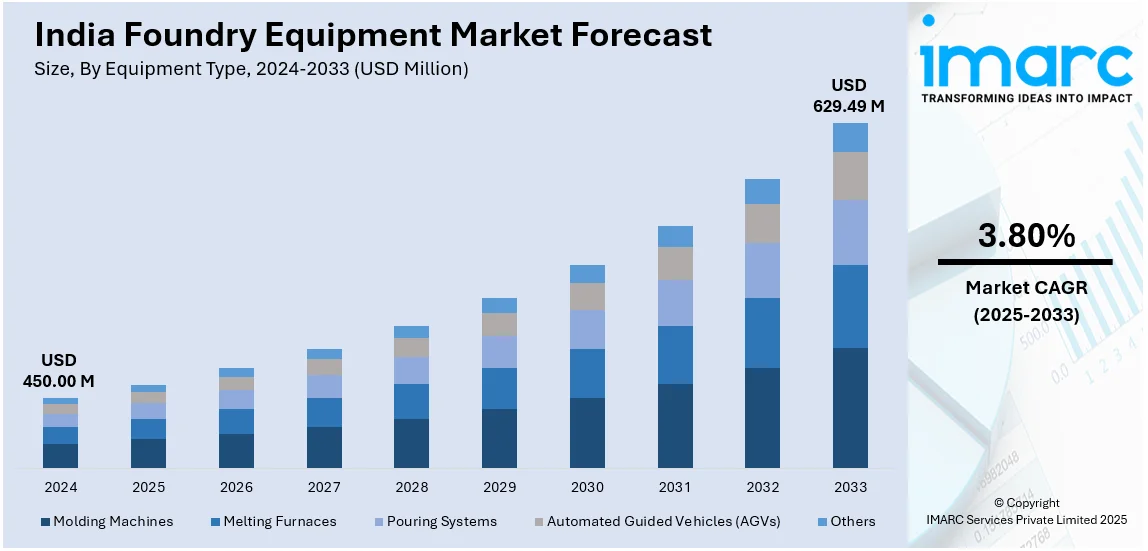

The India foundry equipment market size reached USD 450.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 629.49 Million by 2033, exhibiting a growth rate (CAGR) of 3.80% during 2025-2033. The market is driven by rising demand from automotive, construction, and heavy machinery sectors, coupled with government initiatives like Make in India. Technological advancements in automation, energy efficiency, and sustainable casting methods are further fueling growth. Increasing infrastructure projects and defense manufacturing expansion also contribute to market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 450.00 Million |

| Market Forecast in 2033 | USD 629.49 Million |

| Market Growth Rate (2025-2033) | 3.80% |

India Foundry Equipment Market Trends:

Rising Demand for Sustainable and Energy-Efficient Foundry Equipment

Sustainability is becoming a key focus for foundries as energy costs rise and environmental regulations tighten. There is an increasing adoption of energy-efficient melting furnaces, automated sand reclamation systems, and low-emission casting technologies to reduce carbon footprints. Electric induction furnaces are replacing traditional coke-fired cupolas, significantly lowering emissions while improving energy efficiency. Furthermore, water recycling systems and eco-friendly binder technologies are gaining traction in sand casting processes. The push for green manufacturing is also leading foundries to implement waste heat recovery systems and adopt alternative raw materials that minimize environmental impact. As industries align with global sustainability goals, demand for environmentally compliant foundry equipment continues to rise. For instance, in February 2025, Rhino Machines showcased its sustainable foundry solutions at IFEX 2025, India’s largest foundry exhibition. Rhino Machines, known for innovative foundry solutions, has evolved from a traditional equipment manufacturer to an ecosystem developer. With patented green technologies, it promotes circular economy initiatives and value chain growth. At IFEX 2025, Rhino Machines led a symposium on sustainability, demonstrating how MSMEs drive industrial innovation and contribute to environmentally responsible manufacturing in the foundry sector.

To get more information on this market, Request Sample

Expansion of Automotive and Heavy Engineering Sectors

India's booming automotive, construction, and heavy engineering sectors are major consumers of cast metal components, driving demand for advanced foundry equipment. The transition to electric vehicles (EVs) has led to increased investment in lightweight, high-strength cast components. For instance, in December 2024, Jaya Hind Industries Pvt Ltd installed India's largest 4400-tonne high-pressure die-casting machine from Buhler-Switzerland at its Urse plant near Pune. This technological milestone enhances production capabilities for complex aluminum structural components, particularly for EVs and heavy-duty vehicles. Additionally, rapid infrastructure development and railway modernization projects are fueling demand for precision castings in structural components, railway wheels, and industrial machinery. The government's push for local defense manufacturing under Atmanirbhar Bharat has further boosted foundry investments, leading to the modernization of casting facilities. As industries demand high-performance alloys and complex geometries, foundries are upgrading their equipment to accommodate advanced casting techniques such as vacuum casting and investment casting to meet evolving market needs.

India Foundry Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on equipment type, foundry process, application.

Equipment Type Insights:

- Molding Machines

- Melting Furnaces

- Pouring Systems

- Automated Guided Vehicles (AGVs)

- Others

A detailed breakup and analysis of the market based on the equipment type have been provided in the report. This includes molding machines, melting furnaces, pouring systems, automated guided vehicles (AGVs), and others.

Foundry Process Insights:

- Green Sand Casting

- Investment Casting

- Die Casting

- Permanent Mold Casting

- Centrifugal Casting

A detailed breakup and analysis of the market based on the foundry process have also been provided in the report. This includes green sand casting, investment casting, die casting, permanent mold casting, and centrifugal casting.

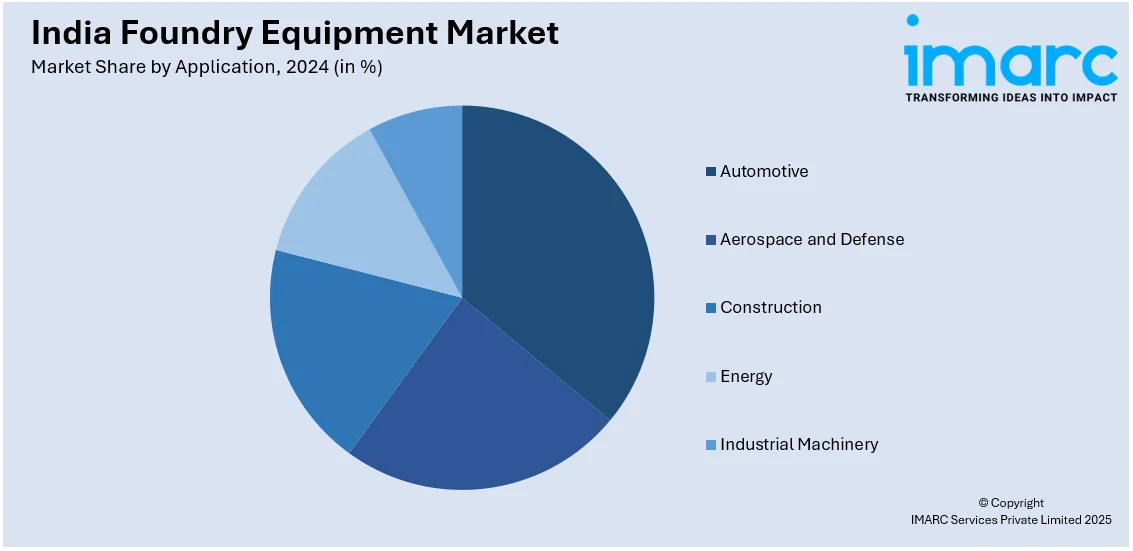

Application Insights:

- Automotive

- Aerospace and Defense

- Construction

- Energy

- Industrial Machinery

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, aerospace and defense, construction, energy, and industrial machinery.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Foundry Equipment Market News:

- In January 2025, SMG Group acquired Hunter Foundry Machinery Corporation, a leading global provider of matchplate molding machines, sand casting technology, and mold handling equipment. The deal strengthens Hunter's global presence while preserving its legacy.

- In April 2024, Savelli Machinery India Pvt. Ltd. announced the installation of advanced foundry equipment at Gautam Casting Group’s new plant in Rajkot, India, including a 40-ton-per-hour sand plant and a high-pressure flask molding line for producing tractor and earth-moving equipment castings. This marks a shift from conventional jolt squeeze lines to modern high-pressure systems. With new installations planned in Gujarat, Jamshedpur, and Mangalore, Savelli aims to enhance India's sand reclamation and recycling efficiency.

India Foundry Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Molding Machines, Melting Furnaces, Pouring Systems, Automated Guided Vehicles (AGVs), Others |

| Foundry Processes Covered | Green Sand Casting, Investment Casting, Die Casting, Permanent Mold Casting, Centrifugal Casting |

| Applications Covered | Automotive, Aerospace and Defense, Construction, Energy, Industrial Machinery |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India foundry equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India foundry equipment market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India foundry equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The foundry equipment market in India was valued at USD 450.00 Million in 2024.

The India foundry equipment market is projected to exhibit a CAGR of 3.80% during 2025-2033, reaching a value of USD 629.49 Million by 2033.

The market is driven by robust demand from the automotive, railways, and construction industries. Growth in metal casting for infrastructure and machinery production supports equipment needs. Increasing preference for automation and precision in manufacturing is promoting advanced foundry technologies. Additionally, domestic production growth and modernization efforts in small- and medium-scale foundries are key drivers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)