India Fragrances Market Size, Share, Trends and Forecast by Type, Application, Distribution Channel, and Region, 2025-2033

India Fragrances Market Size:

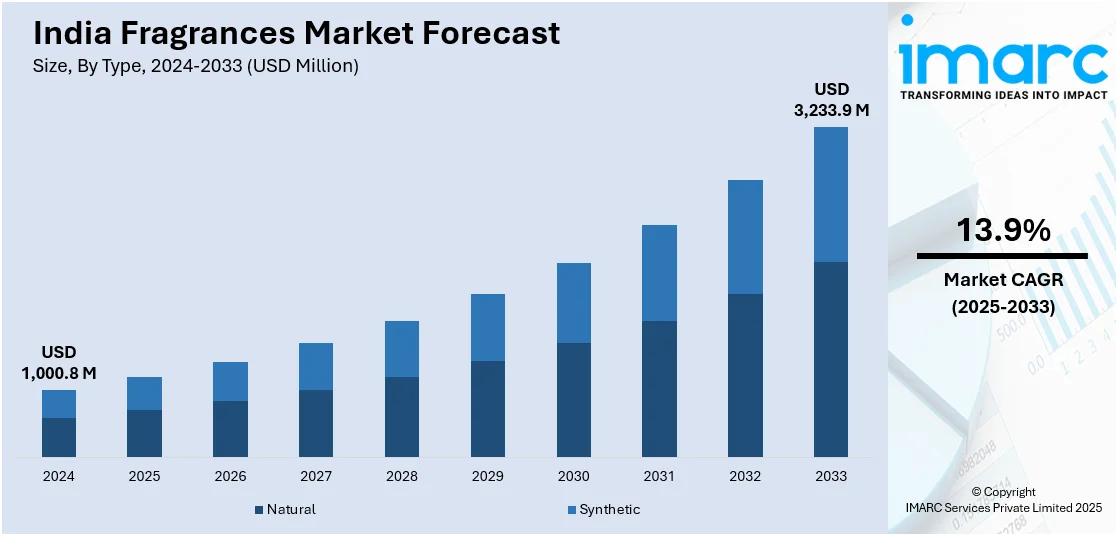

India fragrances market size reached USD 1,000.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,233.9 Million by 2033, exhibiting a growth rate (CAGR) of 13.9% during 2025-2033. The rising disposable incomes, increasing inclination of the population toward personal grooming, emerging global beauty trends influenced by social media, proliferating international brands, the introduction of sustainable product variants, and ongoing product innovations are primarily driving the market toward growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,000.8 Million |

| Market Forecast in 2033 | USD 3,233.9 Million |

| Market Growth Rate (2025-2033) | 13.9% |

India Fragrances Market Analysis:

- Major Market Drivers: The India fragrances market is being propelled by a growing middle-class population in the country, inflating disposable incomes, the extensive influence of Western fashion and beauty trends, a flourishing e-commerce sector, and increasing consumer awareness about personal grooming and wellness.

- Key Market Trends: The India fragrances market is experiencing strong growth, driven by an increasing demand for fragrances made from natural and organic ingredients, the rising personalization and customization trends, the expanding popularity of premium fragrances due to inflating disposable incomes, and a spike in fragrances endorsed by celebrities and other influencers.

- Competitive Landscape: Some of the major market players in the India fragrances industry include Avon Products, Inc, Firmenich SA, Givaudan, International Flavors & Fragrances Inc., Oriental Aromatics Limited, Symrise, Veera Fragrances, and Wikka Fragrance Solutions, among many others.

- Challenges and Opportunities: Some of the challenges faced by the India fragrances market include regulatory compliance, competitive market landscape, new entrants, and counterfeit products. On the other, opportunities involve a growing middle-class population, rising inclination towards personalized and luxury fragrances, and expanding e-commerce platforms that enhance accessibility.

To get more information on this market, Request Sample

India Fragrances Market Trends:

Increasing Expenditure on Advertisement and Public Figure Endorsements

Key players are investing in advertising to influence consumer purchasing decisions. Moreover, they are increasingly incorporating social media and celebrity endorsements in their marketing and advertising strategies. According to an article published in the Financial Express in 2022, more than 36% of the Indian marketers spend approximately 60% of the marketing budget on digital platforms. Instagram and Facebook ads are the top two platforms used by companies in India fragrances market, with latter having a higher share in terms of usability. Additionally, with the growth of online sales and the expansion of e-commerce platforms, fragrances businesses are increasing investing in digital platforms, incorporating photos and videos, and offering customization and personalization to encourage sales. For instance, L’Oreal has created a tool, dubbed cockpit, which evaluates ROI and productivity of its media investments in real time.

Rising Millennial Population – Indian Trendsetters

Fragrances, earlier deemed to be used for only special occasions, are now a part of everyday grooming. India’s youth population, with its growing disposable income, are focusing more on enhancing personality and using luxury and premium products. As of 2023, millennials comprised around 34% of India’s total population. Together with GenZ, they are anticipated to comprise 50% of the country’s population by 2030. Moreover, as far as digital payments are concerned, 33% of total transactions came from the age group 18-25, with Gen Z holding 31.57% of the total transaction share, followed by Gen X with 7.64%, data by Freo revelead. As a result, brands are focusing on youth-centric marketing strategies and product innovations to capture this demographic.

Enhancing Focus on Natural and Sustainable Ingredients

In lieu of the rising environmental and sustainability awareness in India, there is a growing trend towards products made with natural and sustainable materials, including fragrances. Natural fragrances are made from ingredients like essential oils, organic materials, and plant extracts, which are perceived as safer and healthier alternatives to those with synthetic chemicals. There is also a growing demand for cruelty-free and vegan fragrances that are free from animal-derived products and have not been tested on animals. Brands that adhere to these ethical and sustainable practices, including recyclable packaging, are gaining prominence. For instance, in October 2023, Praan Naturals introduced a line of plant-based fragrance oils made from natural botanical ingredients like essential oils and extracts. These fragrances find applications in clean beauty, soap making, personal care, and home fragrances.

India Fragrances Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and distribution channel.

Breakup by Type:

- Natural

- Synthetic

The report has provided a detailed breakup and analysis of the market based on the type. This includes natural and synthetic.

The natural fragrances market is driven by increasing consumer demand for eco-friendly and health-conscious products, growing awareness of the therapeutic benefits of natural scents, and a surge in clean beauty trends. Additionally, innovations in extraction and preservation technologies are enhancing the availability and appeal of natural fragrances.

The synthetic fragrances market is propelled by cost-effectiveness, consistency in quality, and the ability to replicate a wide range of scents that are not possible with natural ingredients. Advances in chemical synthesis and consumer demand for long-lasting fragrances also significantly contribute to the market's growth.

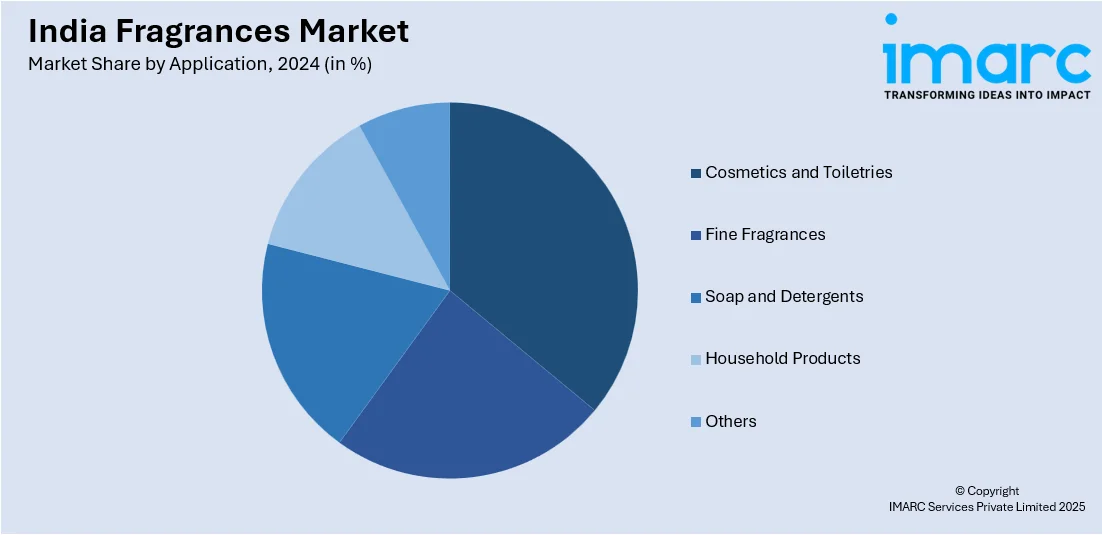

Breakup by Application:

- Cosmetics and Toiletries

- Fine Fragrances

- Soap and Detergents

- Household Products

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cosmetic and toiletries, fine fragrances, soap and detergents, household products, and others.

The demand for fragrances in cosmetics and toiletries is fueled by increased consumer awareness of personal hygiene and the desire for premium grooming products. Rising disposable incomes and urbanization lead consumers to seek products that offer enhanced beauty benefits and personal care, incorporating fragrances that provide a sensory and luxurious experience.

Fine fragrances is growing due to the rising middle class and young consumers who are increasingly drawn to luxury and lifestyle products. Fine fragrances are seen as a symbol of status and personal style, driving their adoption among India’s burgeoning affluent population. The influence of Western culture and fashion also plays a crucial role in this trend.

The necessity for cleanliness and the growing awareness of health and hygiene, especially post-pandemic, have propelled the demand for soaps and detergents. Fragranced cleaning products enhance the user experience by associating cleanliness with pleasant scents, making them more appealing to Indian households.

As living standards improve, there is a growing demand for household products that not only serve functional purposes but also enhance the living environment. Fragranced household products like air fresheners, fabric refreshers, and aromatic cleaning agents are increasingly popular for creating a pleasant home atmosphere.

Others category includes applications in industries, such as automotive (car fresheners), textiles (scented textiles), and more niche markets like aromatherapy products, which are gaining traction due to rising health and wellness trends. The diversification of fragrance applications into these areas reflects broader lifestyle shifts towards personalization and wellbeing.

Breakup by Distribution Channel:

- B2B

- B2C

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes B2B and B2C.

The B2B channel is a significant driver in the India fragrances market primarily due to the large volume demands from industries that incorporate fragrances into their products, such as cosmetics, toiletries, and household items. Companies in these sectors frequently source fragrances in bulk to incorporate into their product lines, driving substantial business in this channel. Additionally, B2B relationships are crucial for businesses looking for customized fragrance solutions tailored to specific products or brands, which fuels ongoing innovation and collaboration between fragrance suppliers and manufacturers.

The B2C channel drives market growth as consumers increasingly seek personal and home fragrance products directly. This trend is supported by rising disposable incomes, urbanization, and a growing middle class, alongside a heightened awareness of personal care and living standards. Retail outlets and e-commerce platforms make it easier for consumers to access a wide range of fragrance products, from luxury perfumes to scented home products. E-commerce, in particular, has seen explosive growth, providing consumers with convenient access to a vast array of fragrance products, often at competitive prices, with the added benefit of consumer reviews and ratings that aid in purchasing decisions.

Breakup by Region:

- South India

- North India

- West & Central India

- East India

The report has also provided a comprehensive analysis of all the major markets in the country, which include South, North, West & Central, and East India.

The fragrances market in South India is driven by a strong cultural affinity for traditional and natural products, such as essential oils and floral extracts, which are deeply embedded in local customs and wellness practices. The region's robust agricultural base provides easy access to natural ingredients used in fragrances. Additionally, cities like Bangalore and Hyderabad are burgeoning tech hubs, where rising affluence and cosmopolitan lifestyles fuel demand for premium and international fragrance brands.

North India, home to the national capital region and several other major cities, sees a significant demand driven by high consumer spending power and a large, diverse population. The region's harsh winters and hot summers also influence fragrance usage, with variations in scent preferences across seasons. Moreover, North India hosts numerous traditional festivals where fragrances play an integral ceremonial role, further bolstering their consumption.

West & Central India region, particularly Maharashtra and Gujarat, is known for its economic prowess, with Mumbai being the financial capital. The high urbanization rates and substantial middle-class population contribute to the increased demand for both personal and household fragrances. The presence of the film and fashion industry in Mumbai also significantly influences fragrance trends and consumption, with a high demand for the latest and most fashionable scents.

The market in East India is influenced by its rich cultural heritage and slower pace of urbanization compared to other regions. However, cities like Kolkata are experiencing gradual economic growth and urban development, which are beginning to stimulate demand for consumer goods, including fragrances. The traditional use of incense and floral scents in daily life and religious practices also permeates the consumer preferences in this region, favoring more traditional and floral fragrance products.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided. Some of the major market players in the India Fragrances industry include Avon Products, Inc, Firmenich SA, Givaudan, International Flavors & Fragrances Inc., Oriental Aromatics Limited, Symrise, Veera Fragrances, and Wikka Fragrance Solutions, among many others.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The competitive landscape of the India fragrances market is dynamic and features a mix of international and domestic players. Leading global brands compete with well-established Indian companies that have a deep understanding of local preferences and trends. The market is also characterized by the presence of numerous small and medium-sized enterprises that cater to niche segments with specialized products. Competition is intense, with companies competing on the basis of product quality, innovation, price, and marketing strategies. The rise of e-commerce has further intensified competition by increasing market reach and accessibility, allowing consumers to choose from a broader array of fragrance products. For instance, in October 2023, Mama earth’s parent company, Honasa Consumer, has submitted the required paperwork to the market regulator in order to raise money through an IPO (initial public offering).

India Fragrances Market News:

- In June 2022, L’Oreal S.A. reintroduced Lancome, its prestigious beauty brand into the Indian market. Lancome, known for its premium and high-quality beauty products, is a strategic move by the company to meet the growing demand for luxury beauty and personal care items in the country.

- In July 2022, Chanel SA introduced two additions to their fragrance lineup, namely the Gabrielle Chanel Eau de Parfum and the Gabrielle Chanel Essence Twist & Spray. These fragrances have been strategically launched to cater to different consumer preferences and market segments.

- In October 2022, Al-Nuaim, a major perfume and attar maker based in India, launched its new sub-brand, EFTINA.

India Fragrances Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Natural, Synthetic |

| Applications Covered | Cosmetics and Toiletries, Fine Fragrances, Soap and Detergents, Household Products, Others |

| Distribution Channels Covered | B2B, B2C |

| Regions Covered | South India, North India, West & Central India, East India |

| Companies Covered | Avon Products, Inc, Firmenich SA, Givaudan, International Flavors & Fragrances Inc., Oriental Aromatics Limited, Symrise, Veera Fragrances, Wikka Fragrance Solutions, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fragrances market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fragrances market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fragrances industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India fragrances market was valued at USD 1,000.8 Million in 2024.

The India fragrances market is projected to exhibit a CAGR of 13.9% during 2025-2033, reaching a value of USD 3,233.9 Million by 2033.

The India fragrance market is driven by rising disposable incomes that fuel demand for premium scents, rapid urbanization shaping grooming habits, and the boom in e-commerce expanding access across tier 2 and 3 cities. Growing youth interest in personalized and gender-neutral fragrances, coupled with a shift toward natural and sustainable formulations, further supports growth.

Some of the major players in the India fragrances market include Avon Products, Inc, Firmenich SA, Givaudan, International Flavors & Fragrances Inc., Oriental Aromatics Limited, Symrise, Veera Fragrances, Wikka Fragrance Solutions, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)