India Frequency Converter Market Report by Type (Static Frequency Converter, Rotary Frequency Converter), End Use Industry (Aerospace and Defense, Power and Energy, Oil and Gas, Traction, Marine/Offshore, Process Industry, and Others), and Region 2025-2033

Market Overview:

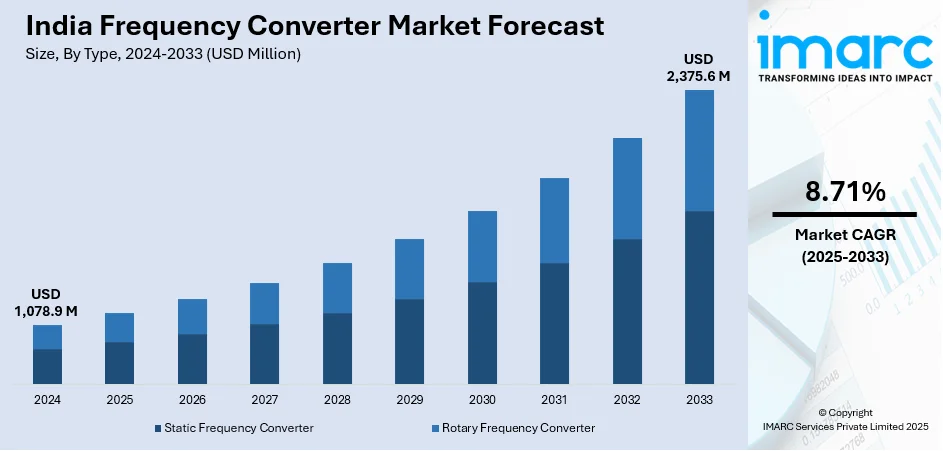

The India frequency converter market size reached USD 1,078.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,375.6 Million by 2033, exhibiting a growth rate (CAGR) of 8.71% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,078.9 Million |

|

Market Forecast in 2033

|

USD 2,375.6 Million |

| Market Growth Rate 2025-2033 | 8.71% |

A frequency converter, or frequency changer, refers to an instrument used to convert the input supply frequency as required by specific machinery or equipment. It feeds the connected machinery with the desired current frequency and voltage level. Frequency converters are also used in renewable energy systems, wherein they form an essential component of doubly-fed induction generators (DFIGs) as used in modern multi-megawatt class wind turbines.

To get more information on this market, Request Sample

India represents one of the largest frequency converter markets in the Asia Pacific region. The market is primarily driven by high investments in the infrastructure and manufacturing sectors. Besides this, India offers a favorable business landscape, administrative setup, attractive policies regarding FDI, and a cheap and skilled labor force. The availability of all these factors has prompted many international companies to set up their manufacturing operations in India. Several automotive companies, such as BMW, Daimler, Volvo, Ford, Hyundai, Suzuki, and Volkswagen, have also initiated various expansion programs. The consequent increase in the demand for AC drives will, thereby, impel the sales of frequency converters across the country.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India frequency converter market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on type and end use industry.

Breakup by Type:

- Static Frequency Converter

- Rotary Frequency Converter

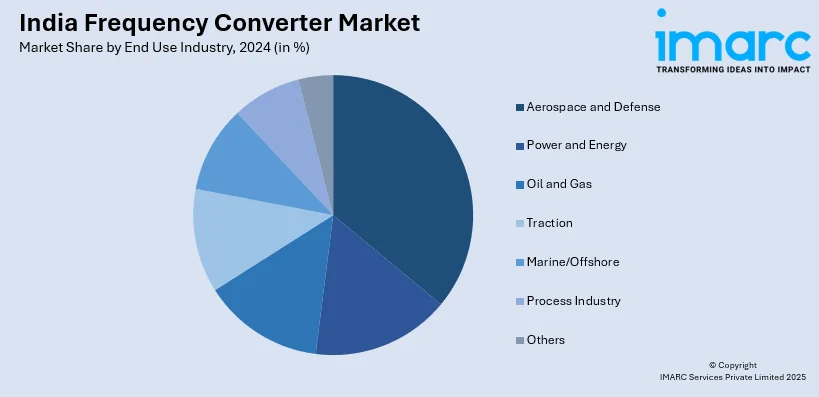

Breakup by End Use Industry:

- Aerospace and Defense

- Power and Energy

- Oil and Gas

- Traction

- Marine/Offshore

- Process Industry

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Type, End Use Industry, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India frequency converter market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India frequency converter market?

- What are the key regional markets?

- What is the breakup of the market based on the type?

- What is the breakup of the market based on the end use industry?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the India frequency converter market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)