India Frozen Finger Chips Market Size, Share, Trends and Forecast by End Use, and Region, 2026-2034

India Frozen Finger Chips Market Summary:

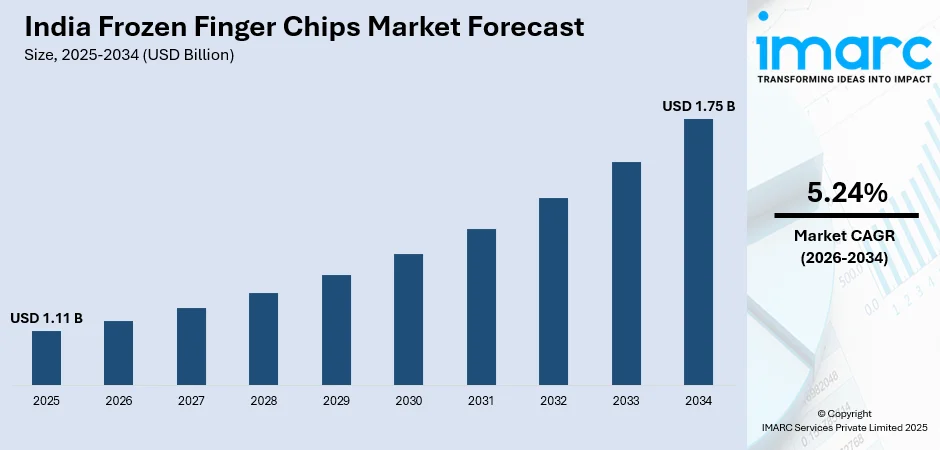

The India frozen finger chips market size was valued at USD 1.11 Billion in 2025 and is projected to reach USD 1.75 Billion by 2034, growing at a compound annual growth rate of 5.24% from 2026-2034.

The India frozen finger chips market is experiencing robust growth driven by rapid urbanization, evolving consumer preferences, and the expansion of quick-service restaurant chains across metropolitan and tier-two cities. The proliferation of nuclear families and hectic work schedules has accelerated demand for convenient ready-to-cook food products. Additionally, the strengthening cold chain infrastructure and increasing penetration of organized retail channels are enhancing product accessibility. The growing influence of Western food culture among younger demographics, coupled with rising disposable incomes, is reshaping snacking patterns and driving India frozen finger chips market share.

Key Takeaways and Insights:

-

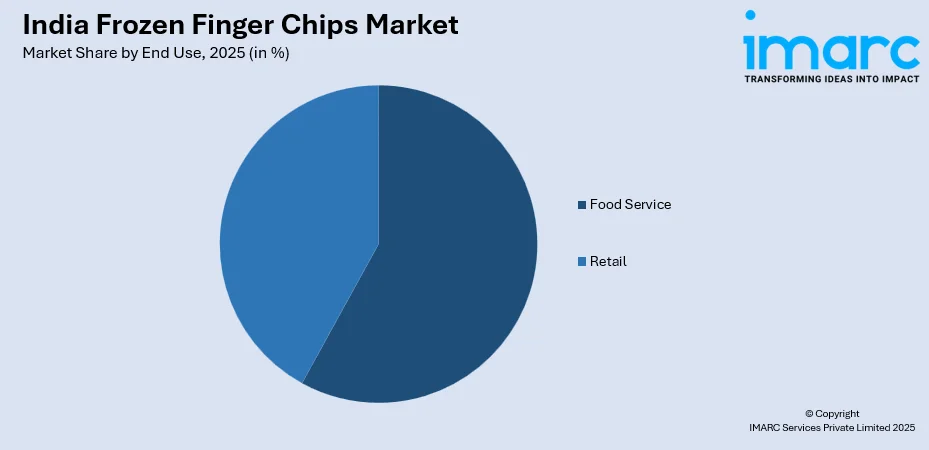

By End Use: Food service dominates the market with a share of 58% in 2025, driven by the rapid expansion of quick-service restaurants, cafes, and hotel chains across India. The segment benefits from standardized quality requirements and bulk procurement practices that favor frozen potato products.

-

By Region: North India leads the market with a share of 32% in 2025, reflecting the concentration of QSR outlets, expanding mall culture, and higher consumption of Western-style snacks in metropolitan areas like Delhi-NCR and Punjab.

-

Key Players: Key players drive the India frozen finger chips market by expanding processing capacity, strengthening cold chain networks, and forming strategic partnerships with QSR chains. Their investments in automation, product innovation, and farmer contract programs enhance supply chain reliability and market penetration.

To get more information on this market Request Sample

The India frozen finger chips market is advancing as manufacturers invest in modern processing facilities and enhance distribution capabilities to meet rising foodservice demand. The transformation of India from a net importer to a significant exporter of frozen potato products underscores the sector's maturation. In 2023-24, India exported approximately 135,877 Tons of frozen French fries valued at INR 1,478.73 Crores, reflecting the robust growth of domestic processing capacity and competitive pricing advantages. The expanding network of quick-service restaurants, growing popularity of Western-style snacking among urban consumers, and improving cold storage infrastructure are collectively supporting market expansion. Furthermore, government initiatives promoting food processing under schemes such as the Production Linked Incentive Scheme are encouraging investments in manufacturing capabilities. The rising penetration of online food delivery platforms is additionally creating new demand channels for frozen potato products across diverse consumer segments.

India Frozen Finger Chips Market Trends:

Expansion of Quick-Service Restaurant Chains

The rapid proliferation of quick-service restaurant chains across India is significantly driving frozen finger chips consumption. Major international and domestic QSR brands are aggressively expanding their footprints into tier-two and tier-three cities, creating substantial demand for standardized frozen potato products. In May 2025, Devyani International Ltd. launched the first New York Fries outlet in India at Mumbai Airport, bringing globally popular loaded fries to Indian consumers and exemplifying the India frozen finger chips market growth trajectory through premium snacking formats.

Cold Chain Infrastructure Development

The steady development of cold chain infrastructure across India is enhancing the distribution and shelf life of frozen finger chips products. Temperature-controlled logistics networks are expanding from metropolitan centers to emerging urban clusters, enabling consistent product availability. In June 2025, DP World inaugurated a 110,000 square feet temperature-controlled warehouse in Taloja, Navi Mumbai, featuring 11,000 pallet positions across multiple temperature zones. This facility expansion strengthens frozen food logistics capabilities across western India.

Rising Online Food Delivery Platform Penetration

The exponential growth of online food delivery platforms is creating new consumption channels for frozen finger chips through restaurant partners and cloud kitchens. Digital ordering ecosystems are enabling quick-service restaurant brands to reach broader consumer segments beyond traditional dine-in customers. The increasing urban population and busy lifestyles are driving demand for convenient food options through aggregator platforms that integrate seamlessly with frozen potato product supply chains across metropolitan and emerging urban centers.

Market Outlook 2026-2034:

The India frozen finger chips market outlook remains positive as manufacturers continue capacity expansion and distribution network enhancement. The market generated a revenue of USD 1.11 Billion in 2025 and is projected to reach a revenue of USD 1.75 Billion by 2034, growing at a compound annual growth rate of 5.24% from 2026-2034. Rising urbanization, increasing disposable incomes, and growing preference for convenient ready-to-cook products will sustain demand growth across foodservice and retail segments. The expansion of quick-service restaurant chains into tier-two and tier-three cities is expected to create substantial procurement demand. Strengthening cold chain infrastructure and improving retail penetration will further enhance product accessibility. Additionally, the growing popularity of online food delivery platforms and evolving consumer snacking preferences toward Western-style foods will continue supporting market expansion throughout the forecast period.

India Frozen Finger Chips Market Report Segmentation:

Segment Category |

Leading Segment |

Market Share |

|

End Use |

Food Service |

58% |

|

Region |

North India |

32% |

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Food Service

- Retail

Food service dominates with a market share of 58% of the total India frozen finger chips market in 2025.

The food service segment maintains its dominant position in the India frozen finger chips market, driven by the rapid expansion of quick-service restaurants, cafes, and hotel chains across metropolitan and emerging urban centers. QSR operators prefer frozen finger chips for their consistent quality, extended shelf life, and ease of preparation that ensures standardized product delivery. The Indian QSR market is projected to grow at a CAGR of 7.22% during 2025-2033, directly supporting frozen potato product demand.

The segment benefits from established supplier relationships, streamlined logistics arrangements, and growing consumer preference for dining out experiences. Major QSR chains including international brands and domestic players are continuously expanding their outlet networks into tier-two and tier-three cities, creating new demand pockets. The proliferation of food delivery platforms has further amplified food service demand by enabling restaurants to serve broader customer bases beyond physical store footprints. Cloud kitchen operations are additionally contributing to segment growth by utilizing frozen finger chips for menu diversification without significant infrastructure investments, allowing operators to efficiently scale operations while maintaining product consistency.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India leads with a share of 32% of the total India frozen finger chips market in 2025.

North India maintains its leadership position driven by high urban density, evolving consumer preferences, and strong retail infrastructure supporting both dine-in and delivery formats. The region hosts the highest concentration of QSR outlets with major metropolitan areas like Delhi-NCR serving as primary demand centers. The expansion of mall culture and growing popularity of fusion variations of finger chips among urban consumers sustain consumption growth. Online meal delivery platforms are experiencing rapid adoption across cities including Delhi, Chandigarh, Jaipur, and Lucknow, creating additional demand channels for frozen potato products.

The region's robust transportation networks and developed cold chain connectivity enhance product distribution efficiency from manufacturing hubs. Rising smartphone penetration and increasing disposable incomes among younger demographics are accelerating demand for convenient fast-food options. The concentration of institutional buyers including hotels, corporate canteens, and educational institutions further supports bulk consumption patterns throughout the region. North India's strategic proximity to processing facilities in Gujarat and emerging manufacturing centers in Punjab strengthens supply chain reliability for frozen finger chips distribution, ensuring consistent product availability and competitive pricing advantages for foodservice operators.

Market Dynamics:

Growth Drivers:

Why is the India Frozen Finger Chips Market Growing?

Rapid Urbanization and Changing Consumer Lifestyles

India's accelerating urbanization is fundamentally reshaping food consumption patterns and driving demand for convenient ready-to-cook products like frozen finger chips. The proliferation of nuclear families, hectic work schedules, and reduced time for home cooking are collectively increasing reliance on quick-preparation food items. According to the Economic Survey 2023-24, over 40% of the Indian population will live in urban areas by 2030, signaling sustained demand growth for modern snacking options. Urban consumers influenced by global food culture increasingly seek diverse and quality dining experiences that frozen potato products readily fulfill. The demographic shift toward working professionals and younger populations with higher disposable incomes is creating favorable market conditions for convenient food solutions.

Expansion of Quick-Service Restaurant Networks

The aggressive expansion of quick-service restaurant chains across India is creating substantial bulk demand for standardized frozen finger chips products. Major international and domestic QSR brands are extending their footprints beyond metropolitan areas into tier-two and tier-three cities, driving consistent procurement requirements. Jubilant FoodWorks announced plans to open 250 new Domino's stores in India with a capital investment of INR 900 Crore, exemplifying the scale of expansion supporting frozen potato product demand. The standardization requirements of QSR operations favor frozen finger chips for their consistent quality and ease of preparation. Growing consumer preference for branded restaurants over unorganized food outlets is further strengthening market demand.

Government Support for Food Processing Industry

Ongoing government support for the food processing sector is encouraging investments in frozen potato manufacturing and cold chain infrastructure development. Policy initiatives including Make in India and targeted subsidies for processing unit establishment are accelerating capacity expansion across the country. The government has implemented production-linked incentive schemes covering ready-to-cook and ready-to-eat food products including frozen finger chips, providing financial assistance to manufacturers. Additionally, dedicated programs such as the Pradhan Mantri Kisan Sampada Yojana are strengthening cold chain infrastructure through enhanced funding allocations and project approvals. These initiatives are collectively enhancing domestic manufacturing capabilities, reducing import dependency, and creating a favorable investment climate for both domestic and international processors seeking to expand their presence in the Indian market.

Market Restraints:

What Challenges the India Frozen Finger Chips Market is Facing?

Cold Chain Infrastructure Gaps in Rural Areas

Despite ongoing development efforts, inadequate cold chain infrastructure in rural and semi-urban areas limits product accessibility and distribution efficiency. Insufficient cold storage facilities, unreliable power supply, and limited temperature-controlled transportation constrain market penetration beyond major urban centers. These gaps result in product quality degradation and higher wastage rates during distribution.

High Initial Investment Requirements

The establishment of frozen finger chips manufacturing facilities requires substantial capital investment in processing equipment, cold storage infrastructure, and distribution networks. High upfront costs create barriers for small and medium enterprises seeking market entry. Operational expenses including energy consumption for refrigeration and specialized transportation further impact profitability margins.

Raw Material Quality and Supply Variability

Seasonal variations in potato supply and quality challenges affect consistent production of premium frozen finger chips. Specific processing-grade potato varieties with high dry matter content are essential for quality output but face limited cultivation. Erratic monsoon patterns and climate variability impact crop yields, creating supply chain uncertainties for manufacturers dependent on agricultural raw materials.

Competitive Landscape:

The India frozen finger chips market exhibits moderate concentration with established multinational processors operating alongside ambitious domestic manufacturers. Major players are focusing on capacity expansion, technological upgradation, and strategic partnerships with QSR chains to strengthen market positions. Competition intensifies as companies invest in advanced processing facilities featuring automation, AI-driven quality controls, and energy-efficient refrigeration systems. Product innovation through new flavors, cuts, and healthier formulations enables differentiation in the growing market. Strategic collaborations with farmers through contract farming programs ensure raw material quality and supply chain stability. Distribution network enhancement and e-commerce channel development are emerging as competitive priorities.

Recent Developments:

-

In December 2025, McCain Foods announced its largest-ever investment in India with INR 3,800 Crore greenfield facility in Madhya Pradesh. The new plant will produce both French fries, significantly expanding the company's processing capacity and product portfolio in the Indian market.

India Frozen Finger Chips Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Food Service, Retail |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India frozen finger chips market size was valued at USD 1.11 Billion in 2025.

The India frozen finger chips market is expected to grow at a compound annual growth rate of 5.24% from 2026-2034 to reach USD 1.75 Billion by 2034.

Food service dominated the market with a share of 58%, driven by the rapid expansion of quick-service restaurants, cafes, and hotel chains that rely on standardized frozen potato products for consistent quality and operational efficiency.

Key factors driving the India frozen finger chips market include rapid urbanization, expansion of quick-service restaurant chains, improving cold chain infrastructure, changing consumer preferences toward convenient foods, growing online food delivery penetration, and supportive government policies for food processing.

Major challenges include cold chain infrastructure gaps in rural areas, high initial investment requirements for processing facilities, raw material quality variability, seasonal supply fluctuations, and energy cost pressures for refrigeration and storage operations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)