India Frozen Vegetables Market Size, Share, Trends and Forecast by Product, Distribution Channel, End User, and Region, 2025-2033

India Frozen Vegetables Market Overview:

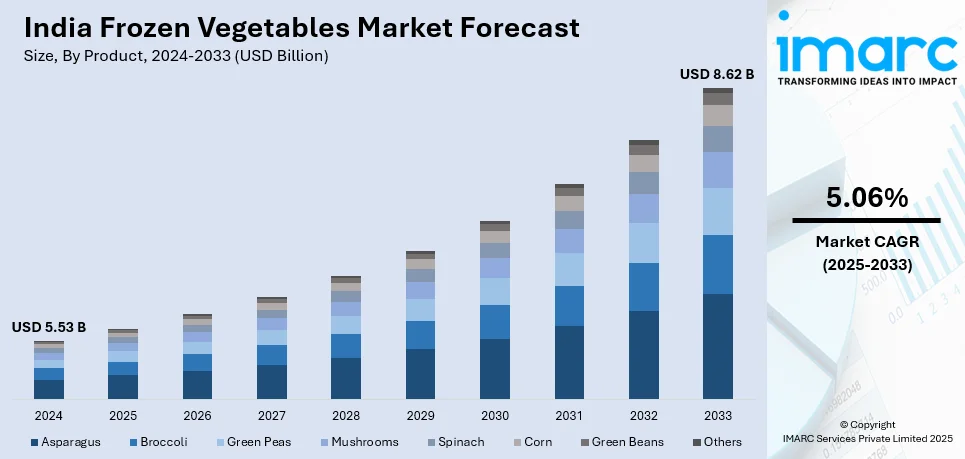

The India frozen vegetables market size reached USD 5.53 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.62 Billion by 2033, exhibiting a growth rate (CAGR) of 5.06% during 2025-2033. The market is fueled by rising urbanization, increasing demand for convenience foods, advancements in cold storage technology, and growing health consciousness. Changing lifestyles, a surge in working professionals, and the expansion of modern retail and e-commerce platforms further contribute to India frozen vegetables market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.53 Billion |

| Market Forecast in 2033 | USD 8.62 Billion |

| Market Growth Rate 2025-2033 | 5.06% |

India Frozen Vegetables Market Trends:

Increasing Demand for Convenience and Ready-to-Cook Foods

Consumers are looking for hassle-free cooking solutions that fit into their busy schedules. Homemakers, along with restaurants and food service providers, find frozen vegetables optimal because they arrive washed and cut already. Ready-to-eat meal providers and quick-service restaurants (QSRs) alongside cloud kitchens drove up the total demand. Technological improvements in freezing methods deliver both better-tasting and more nutritious foods; thus, consumers feel more inclined toward frozen meal substitutions. The expansion of organized retail stores and online grocery platforms has further boosted the availability of frozen vegetables across India, which is creating a positive India frozen vegetables market outlook. For instance, in March 2024, BigBasket, a large online grocery store, teamed up with chef and businessman Sanjeev Kapoor to introduce the frozen food line Precia. Precia will include three product categories: frozen appetizers like momos and french fries, frozen sweets like purani dilli rabdi and gajar ka halwa; and frozen veggies like green peas and mixed vegetables.

To get more information on this market, Request Sample

Advancements in Cold Storage and Freezing Technologies

Innovations in cold chain logistics, freezing techniques, and packaging have significantly improved the quality, shelf life, and nutritional value of frozen vegetables. Technologies such as individual quick freezing (IQF) and vacuum-sealed packaging help retain the freshness and texture of vegetables, making them comparable to fresh produce. Government initiatives and private investments in cold storage infrastructure and refrigeration technology are further strengthening the supply chain. These advancements ensure better distribution, reduced food wastage, and increased consumer confidence in frozen vegetables, which is fueling the India frozen vegetables market share. For instance, in February 2025, ITC finalized arrangements to acquire Prasuma, a prominent participant in India's frozen, chilled, and ready-to-cook food markets. One of the frozen food brands with the quickest rate of growth in India is Prasuma, which is driven by innovation. Lisa Suwal and Siddhant Wangdi, a husband-and-wife team, have expanded their family business and developed a distinctive product line to redefine the frozen food market in India and elevate frozen food above fresh. New and improved freezing technology makes it possible for frozen dishes to keep their freshness longer than meals that are eaten right away after cooking. Prasuma uses state-of-the-art freezing technology to maintain freshness, guaranteeing that every bite has unparalleled flavor and quality.

India Frozen Vegetables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product, distribution channel, and end user.

Product Insights:

- Asparagus

- Broccoli

- Green Peas

- Mushrooms

- Spinach

- Corn

- Green Beans

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes asparagus, broccoli, green peas, mushrooms, spinach, corn, green beans, and others.

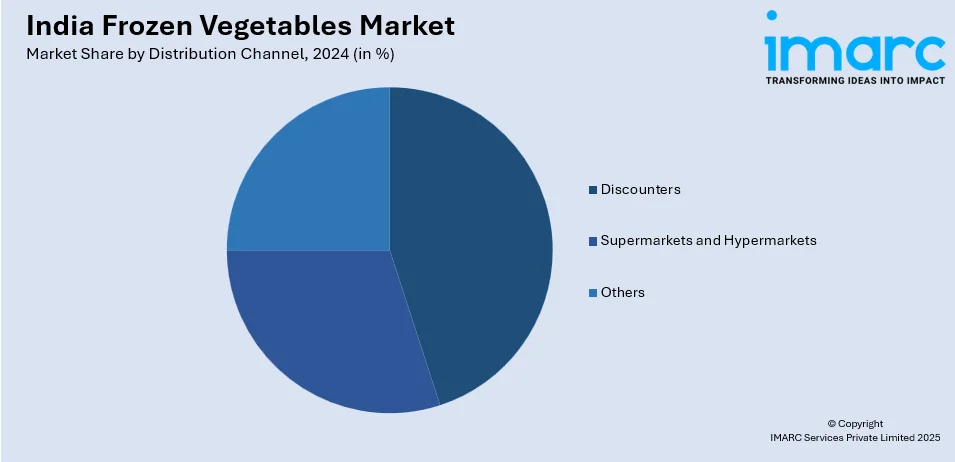

Distribution Channel Insights:

- Discounters

- Supermarkets and Hypermarkets

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes discounters, supermarkets and hypermarkets, and others.

End User Insights:

- Food Service Industry

- Retail Customers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes the food service industry and retail customers.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Frozen Vegetables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Asparagus, Broccoli, Green Peas, Mushrooms, Spinach, Corn, Green Beans, Others |

| Distribution Channels Covered | Discounters, Supermarkets and Hypermarkets, Others |

| End Users Covered | Food Service Industry, Retail Customers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India frozen vegetables market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India frozen vegetables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India frozen vegetables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The frozen vegetables market in India was valued at USD 5.53 Billion in 2024.

The India frozen vegetables market is projected to exhibit a CAGR of 5.06% during 2025-2033, reaching a value of USD 8.62 Billion by 2033.

The India frozen vegetables market is growing due to changing lifestyles, increased preference for ready-to-cook foods, and higher income levels. Advancements in freezing technology, improved cold storage infrastructure, and wider availability through supermarkets and online platforms are also key factors supporting market expansion across urban regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)