India Fuel Injection Systems Market Size, Share, Trends and Forecast by Fuel Type, Vehicle Type, Injection Type, Fuel Pressure, Control Strategy, and Region, 2025-2033

India Fuel Injection Systems Market Overview:

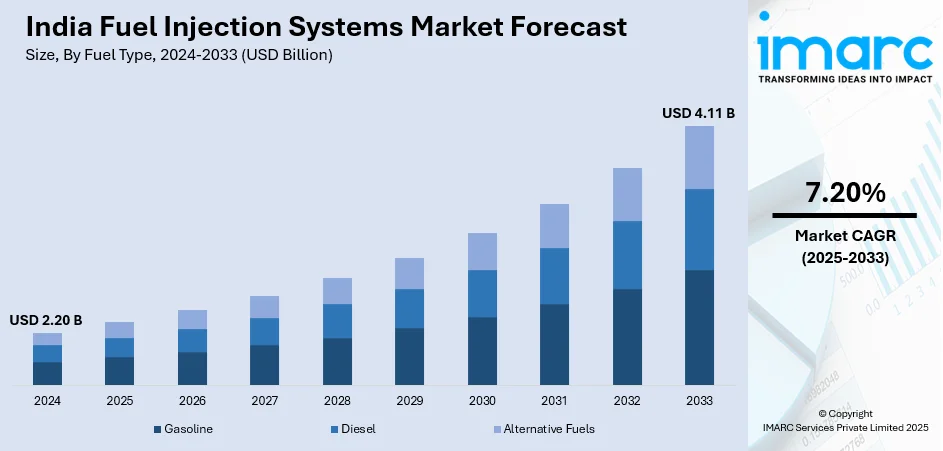

The India fuel injection systems market size reached USD 2.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.11 Billion by 2033, exhibiting a growth rate (CAGR) of 7.20% during 2025-2033. The market is expanding due to rising automobile production, stringent emission norms, and increasing fuel efficiency demands. Key players focus on advanced injection technologies, including direct and common rail systems, to enhance performance and reduce emissions across passenger and commercial vehicles.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.20 Billion |

| Market Forecast in 2033 | USD 4.11 Billion |

| Market Growth Rate (2025-2033) | 7.20% |

India Fuel Injection Systems Market Trends:

Increasing Adoption of Electronic Fuel Injection (EFI) Systems

The India fuel injection systems industry is currently undergoing an intense inclination towards electronic fuel injection (EFI) systems from traditional carburetor-based systems. This shift is principally influenced by strict emission standards that mandate minimized vehicular emissions. For instance, in January 2025, the Government of India (GoI) announced working on the formation of BS-VII emission policies, after around 4 years of the implementation of Bharat Stage (BS)-VI norms. EFI systems provide precise fuel delivery, improving combustion efficiency and reducing carbon emissions. Additionally, these systems enhance fuel economy, making them a preferred choice among automakers and consumers seeking cost-effective and environmentally sustainable solutions. Rising demand for two-wheelers and passenger vehicles, particularly in urban areas, is further accelerating the adoption of EFI technology. Key manufacturers are investing in research and development to integrate advanced electronic control units (ECUs) and sensor-based mechanisms to optimize fuel injection, contributing to improved engine performance and reliability. As the Indian automotive industry continues to align with global environmental standards, the demand for EFI systems is projected to grow significantly in the coming years.

To get more information on this market, Request Sample

Growth in Diesel Fuel Injection Systems for Commercial Vehicles

The increasing demand for commercial vehicles in India is driving the adoption of advanced diesel fuel injection systems. For instance, as per industry reports, the commercial vehicle segment in India recorded sales of 97, 411 units during October 2024, in comparison to sales of 74,324 units during September in same year, exhibiting a month-on-month growth. Commercial vehicles, including trucks and buses, rely on high-performance fuel injection technologies to enhance fuel efficiency and meet emission regulations. Common rail direct injection (CRDI) systems have gained significant traction due to their ability to improve power output, reduce noise levels, and lower particulate emissions. The expansion of infrastructure projects, rapid urbanization, and growth in logistics and e-commerce sectors have increased the need for heavy-duty and light commercial vehicles, fueling demand for efficient fuel injection systems. Leading manufacturers are focusing on innovations in fuel injection technology, incorporating high-pressure fuel pumps and precision-engineered injectors to optimize engine efficiency. Additionally, government initiatives promoting fuel efficiency and alternative fuel adoption, including biodiesel and compressed natural gas (CNG), are influencing advancements in fuel injection systems tailored to support multiple fuel types.

India Fuel Injection Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on fuel type, vehicle type, injection type, fuel pressure, and control strategy.

Fuel Type Insights:

- Gasoline

- Diesel

- Alternative Fuels

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes gasoline, diesel, and alternative fuels.

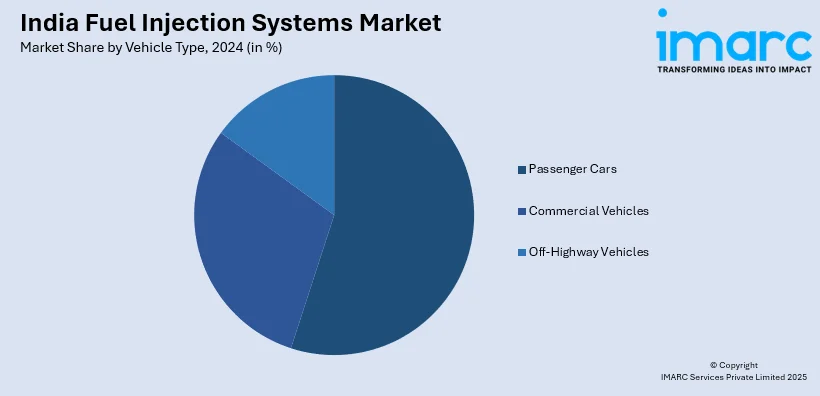

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

- Off-Highway Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, commercial vehicles, and off-highway vehicles.

Injection Type Insights:

- Port Injection

- Direct Injection

A detailed breakup and analysis of the market based on the injection type have also been provided in the report. This includes port injection and direct injection.

Fuel Pressure Insights:

- Low Pressure

- High Pressure

A detailed breakup and analysis of the market based on the fuel pressure have also been provided in the report. This includes low pressure and high pressure.

Control Strategy Insights:

- Electronic Control

- Mechanical Control

A detailed breakup and analysis of the market based on the control strategy have also been provided in the report. This includes electronic control and mechanical control.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Fuel Injection Systems Market News:

- In January 2025, PHINIA Inc. unveiled its line of clean combustion technologies by showcasing direct injection systems at the Bharat Mobility exhibition. These systems are developed to reduce carbon emissions by 25% in comparison to gasoline-based engine, aligning with India's aim to proliferate CNG infrastructure by the year 2032.

- In November 2024, researchers at the Indian Institute of Science constructed a next-gen fuel injector system with high-performance for fighter aircraft. It is planned to be incorporated in Advanced Medium Combat Aircraft that is single-seater, fifth-gen fighter jet of India.

India Fuel Injection Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Gasoline, Diesel, Alternative Fuels |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Off-Highway Vehicles |

| Injection Types Covered | Port Injection, Direct Injection |

| Fuel Pressures Covered | Low Pressure, High Pressure |

| Control Strategies Covered | Electronic Control, Mechanical Control |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India fuel injection systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India fuel injection systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India fuel injection systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India fuel injection systems market was valued at USD 2.20 Billion in 2024.

The India fuel injection systems market is projected to exhibit a CAGR of 7.20% during 2025-2033, reaching a value of USD 4.11 Billion by 2033.

Stricter pollution rules, increased demand for fuel-efficient vehicles, and expanding automotive manufacturing are the main factors propelling the fuel injection systems market in India. The shift toward electric and hybrid vehicles, along with advancements in engine technologies, also supports market growth. Government policies promoting cleaner mobility further encourage the adoption of modern fuel injection systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)