India Furniture Fittings Market Size, Share, Trends and Forecast by Product, Material, Application, Distribution Channel, End User, and Region, 2025-2033

India Furniture Fittings Market Overview:

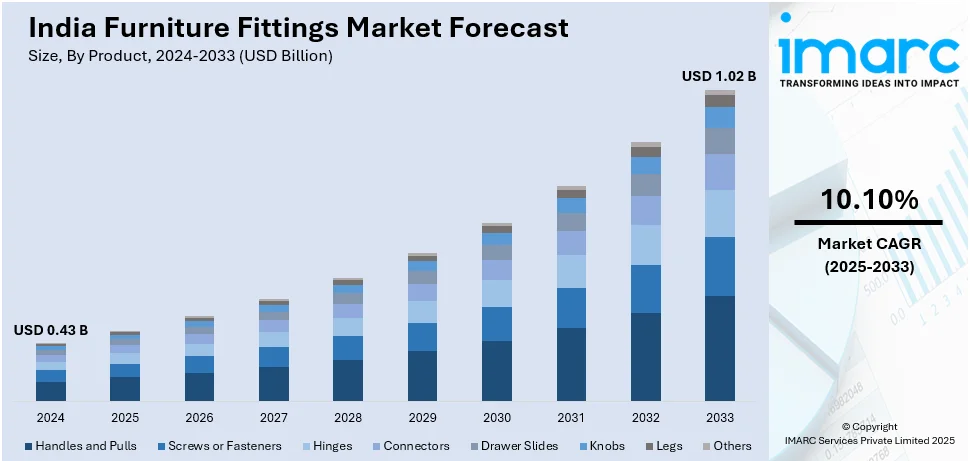

The India furniture fittings market size reached USD 0.43 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.02 Billion by 2033, exhibiting a growth rate (CAGR) of 10.10% during 2025-2033. The Indian furniture fittings market is evolving with innovation in high-performance and aesthetic designs, focusing on durability and seamless integration with modern interiors. Organized retail and e-commerce expansion are also enhancing accessibility, driving competition, and increasing user awareness, encouraging manufacturers to offer advanced, customized, and premium solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.43 Billion |

| Market Forecast in 2033 | USD 1.02 Billion |

| Market Growth Rate (2025-2033) | 10.10% |

India Furniture Fittings Market Trends:

Innovation in Aesthetic and High-Performance Furniture Fittings

The furniture fittings market in India is witnessing rapid innovation as manufacturers focus on developing high-performance, aesthetically appealing solutions to meet evolving consumer preferences. With growing demand for premium furniture, there is an increase in need for fittings that not only enhance durability and functionality but also complement modern interior designs. Individuals and interior designers are seeking fittings that integrate seamlessly with contemporary furniture, encouraging manufacturers to experiment with advanced materials, finishes, and technologies. Silent-closing mechanisms, enhanced durability, and precision-engineered components are becoming standard features in premium fittings, offering improved user experience and long-term reliability. Companies are also prioritizing product differentiation by introducing specialized designs that cater to specific furniture styles, expanding choices for clients. In 2024, Hettich India launched the Onsys Magma Black hinge, designed specifically for dark wood furniture, featuring a sleek black nickel finish. The hinge integrated silent closing and a 105° opening angle, offering durability with a 10-year performance warranty. Manufactured in Indore, this launch aligned with Hettich's commitment to 'Made in India' products. Such innovations highlight the industry’s shift toward high-quality, visually appealing, and technologically advanced fittings that cater to both residential and commercial spaces, driving overall market growth.

To get more information on this market, Request Sample

Expansion of Organized Retail and E-Commerce

The organized retail sector and e-commerce platforms are significantly transforming the furniture fittings market in India by providing individuals with convenient access to a wide array of products. The growing footprint of organized retail chains and dedicated showrooms is enhancing the distribution of premium and customized furniture fittings, making high-quality hinges, drawer slides, locks, handles, and other fittings more accessible to both residential and commercial buyers. For example, in 2024, Blum India opened a new Experience Centre, Dany Martin Associates, in Kochi, Kerala, to strengthen its presence in Southern India. The centre showcased Blum's high-quality furniture fittings, including innovative lift systems and pull-out solutions. The inauguration emphasized Blum’s commitment to offering top-class furniture solutions directly to local customers. Besides this, individuals prioritize not only functionality but also aesthetics, driving the demand for fittings that complement modern interior designs. The ease of online shopping, coupled with doorstep delivery, flexible payment methods, and financing options, is attracting a broader user base, including homeowners, interior designers, and furniture manufacturers. Digital marketing strategies, partnerships with influencers and focused social media marketing efforts are increasing user awareness, allowing brands to engage with potential buyers more effectively. Smaller manufacturers and regional players are leveraging e-commerce platforms to expand their market presence, increasing competition and driving continuous improvements in product innovation and quality.

India Furniture Fittings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product, material, application, distribution channel, and end user.

Product Insights:

- Handles and Pulls

- Screws or Fasteners

- Hinges

- Connectors

- Drawer Slides

- Knobs

- Legs

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes handles and pulls, screws or fasteners, hinges, connectors, drawer slides, knobs, legs, and others.

Material Insights:

- Stainless Steel

- Aluminium Alloy

- Zinc Alloy

- Plastic

- Iron

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes stainless steel, aluminium alloy, zinc alloy, plastic, iron, and others.

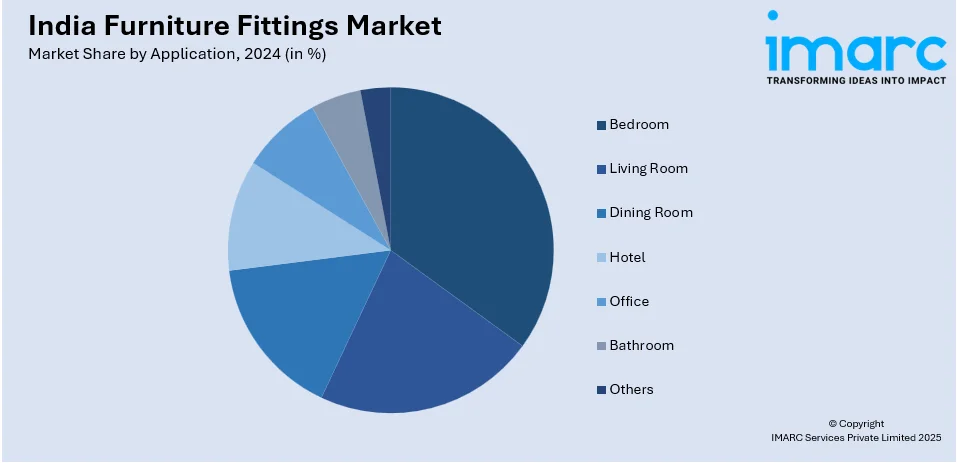

Application Insights:

- Bedroom

- Living Room

- Dining Room

- Hotel

- Office

- Bathroom

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes bedroom, living room, dining room, hotel, office, bathroom, and others.

Distribution Channel Insights:

- Direct

- In-Direct

A detailed breakup and analysis of the market based on distribution channel have also been provided in the report. This includes direct and in-direct.

End User Insights:

- Residential/ Household

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential/ household and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Furniture Fittings Market News:

- In August 2024, Warburg Pincus, a private equity firm, purchased a majority share in Ebco Private Limited, a prominent Indian company specializing in furniture fittings and architectural hardware. This collaboration sought to leverage the expansion opportunities in the Indian market, driven by increasing demand in the real estate and furniture industries.

- In May 2024, Austrian furniture fittings manufacturer Blum announced plans to expand its operations in India by launching 59 branded experience centers across the country. The company aimed to increase user awareness and promote its products, particularly to the premium and mid-market segments. Blum had already opened 15 centers and planned to complete the remaining ones by the end of 2025.

India Furniture Fittings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Handles and Pulls, Screws or Fasteners, Hinges, Connectors, Drawer Slides, Knobs, Legs, Others |

| Materials Covered | Stainless Steel, Aluminium Alloy, Zinc Alloy, Plastic, Iron, Others |

| Applications Covered | Bedroom, Living Room, Dining Room, Hotel, Office, Bathroom, Others |

| Distribution Channels Covered | Direct, In-Direct |

| End Users Covered | Residential/ Household, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India furniture fittings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India furniture fittings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India furniture fittings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The furniture fittings market was valued at USD 0.43 Billion in 2024.

The furniture fittings market is projected to exhibit a CAGR of 10.10% during 2025-2033, reaching a value of USD 1.02 Billion by 2033.

The India furniture fittings market is propelled by the rising urban housing, growing demand for modular kitchens, and increased consumer preference for customized storage solutions. Expansion in real estate and home decor trends, along with advancements in hardware quality and innovative designs from local manufacturers that enhance adoption across urban and semi-urban markets, further accelerate the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)