India Furniture Polish Market Size, Share, Trends and Forecast by Type, Source, Distribution Channel, Application, and Region, 2026-2034

India Furniture Polish Market Summary:

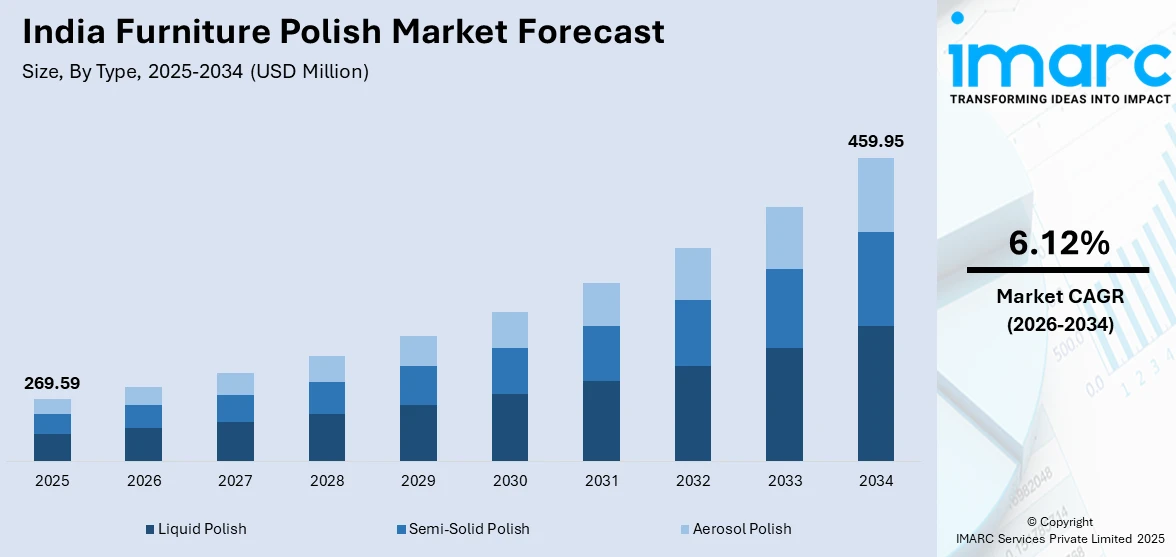

The India furniture polish market size was valued at USD 269.59 Million in 2025 and is projected to reach USD 459.95 Million by 2034, growing at a compound annual growth rate of 6.12% from 2026-2034.

The India furniture polish market is witnessing strong growth, fueled by rapid urbanization, a booming real estate sector, and the rise of middle-class households. Increasing disposable incomes are encouraging consumers to invest in high-quality furniture that requires proper upkeep. Additionally, government programs promoting urban development and housing expansion are driving construction activities, which in turn boost the demand for furniture care products in both residential and commercial spaces. Together, these factors are supporting sustained growth and broader adoption of furniture maintenance solutions across the country.

Key Takeaways and Insights:

- By Type: Liquid polish dominated the market with 49% revenue share in 2025, owing to its popularity among consumers for low-VOC formulations and the convenience it offers for application on a variety of wooden furniture surfaces that need regular care.

- By Source: Polyurethane finish led the market with a share of 30% in 2025, owing to its availability in multiple shades, superior durability, scratch resistance, and ability to provide both matte and glossy aesthetic finishes.

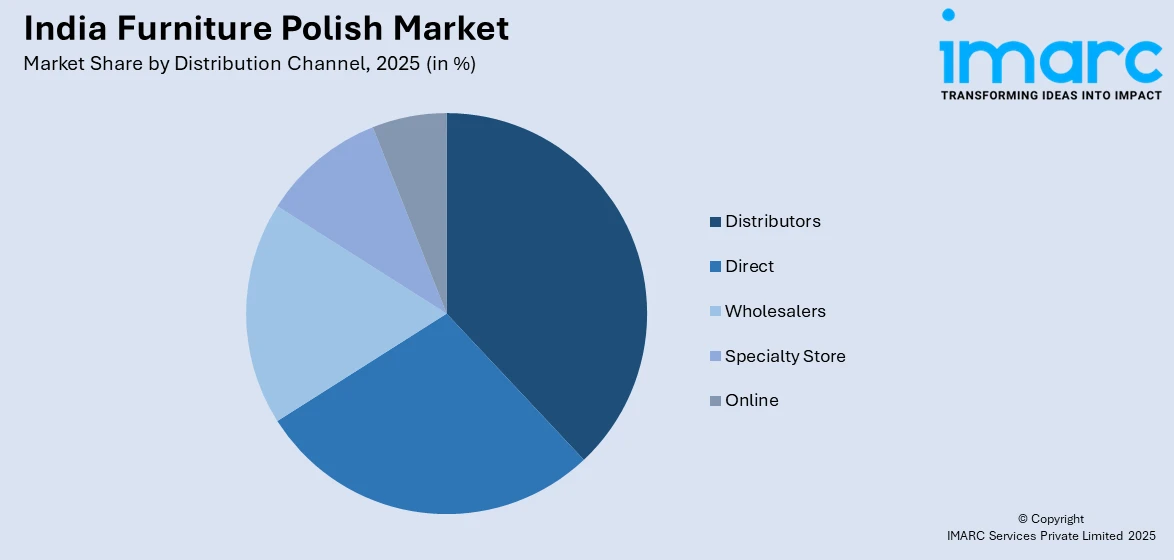

- By Distribution Channel: Distributors represented the largest revenue share of approximately 25% in 2025, attributed to their established networks connecting manufacturers with retail outlets, specialty stores, and commercial contractors across urban and semi-urban regions.

- By Application: Residential dominated with a share of 66% in 2025, fueled by rising homeownership rates, increasing nuclear family formations, and growing consumer inclination toward premium furniture maintenance.

- By Region: North India represented the largest segment with 32% market share in 2025, driven by high population density, accelerated urbanization in Delhi-NCR, and concentration of organized furniture retail infrastructure.

- Key Players: The India furniture polish market exhibits moderate competitive intensity, characterized by established multinational coating manufacturers competing alongside regional specialty polish producers. Key players are increasingly focusing on product innovation, low-VOC formulations, and expanding distribution networks to strengthen market positioning.

To get more information on this market Request Sample

The India furniture polish market is propelled by the convergence of robust construction activity and evolving consumer preferences for furniture maintenance. The country's furniture industry has witnessed a significant transformation, with organized retail gaining prominence over traditional, unorganized carpentry-driven models. India's e-commerce penetration has democratized access to furniture polish products, with online platforms enabling nationwide product availability, doorstep delivery, and consumer reviews. For instance, in December 2024, Japanese furniture retailer Nitori entered the Indian market by opening its first store at R City Mall in Mumbai, offering comprehensive furniture care products, including leather care kits and textile maintenance solutions. The expanding middle class, coupled with heightened awareness about furniture longevity and aesthetic preservation, continues to drive sustained demand for quality furniture polish products across both residential and commercial segments.

India Furniture Polish Market Trends:

Rising Adoption of Low-VOC and Water-Based Formulations

Environmental consciousness among Indian consumers is driving a significant shift toward eco-friendly furniture polish formulations with reduced volatile organic compound content. This trend aligns with growing awareness about indoor air quality and its health implications. Manufacturers are responding by developing water-based polish alternatives that maintain performance while minimizing environmental impact. Leading producers such as Asian Paints have introduced water-based furniture polish products, meeting the evolving preferences of environmentally aware consumers seeking sustainable home care solutions without compromising on furniture protection and aesthetic enhancement.

Expansion of E-Commerce and Digital Distribution Channels

The digital transformation of India's retail landscape has revolutionized furniture polish distribution, enabling consumers to access diverse product offerings through online marketplaces. E-commerce platforms like Amazon, Flipkart, and specialized home improvement websites have democratized product availability beyond traditional hardware stores and neighborhood markets. The India e-commerce market size was valued at USD 129.72 Billion in 2025 and is projected to reach USD 651.10 Billion by 2034, growing at a compound annual growth rate of 19.63% from 2026-2034. This shift provides consumers with comprehensive product information, customer reviews, and convenient doorstep delivery options. India's e-commerce market is expanding rapidly, creating substantial opportunities for furniture polish manufacturers to reach previously underserved markets through digital channels.

Integration of Premium Wood Coatings in Organized Furniture Retail

Organized furniture retailers are increasingly offering furniture polish and protective coatings alongside their products, promoting consistent maintenance practices among consumers. These retailers provide clear guidance on furniture care, educating buyers on the importance of regular polishing for long-lasting upkeep. Enhanced packaging, detailed usage instructions, and strategic branding aimed at informed, quality-conscious customers have strengthened the visibility and appeal of furniture care products. By integrating maintenance solutions into the purchase experience, retailers are elevating the overall market positioning of furniture polish and encouraging routine use among end consumers.

Market Outlook 2026-2034:

The India furniture polish market is set for steady growth over the forecast period, supported by rapid urbanization, increasing household formation, and rising consumer expenditure on home improvement. Government-led infrastructure and housing initiatives are fueling construction activity, which in turn drives demand for furniture care products. Additionally, the growing adoption of premium and visually appealing furniture that requires regular upkeep is further boosting market potential. Together, these factors create a favorable environment for the sustained expansion of furniture polish products across both residential and commercial segments. The market generated a revenue of USD 269.59 Million in 2025 and is projected to reach a revenue of USD 459.95 Million by 2034, growing at a compound annual growth rate of 6.12% from 2026-2034.

India Furniture Polish Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Liquid Polish |

49% |

|

Source |

Polyurethane Finish |

30% |

|

Distribution Channel |

Distributors |

25% |

|

Application |

Residential |

66% |

|

Region |

North India |

32% |

Type Insights:

- Liquid Polish

- Semi-Solid Polish

- Aerosol Polish

Liquid polish dominates with a market share of 49% of the total India furniture polish market in 2025.

Liquid polish maintains its dominant position owing to superior versatility, ease of application, and cost-effectiveness across diverse furniture surfaces. The segment benefits from growing consumer preference for low-VOC formulations that enhance indoor air quality while providing effective furniture protection. Liquid polishes offer flexibility in application methods, enabling both professional contractors and household consumers to achieve desired finishes with minimal equipment requirements. The widespread availability through multiple distribution channels, including hardware stores, supermarkets, and e-commerce platforms, reinforces market accessibility.

The segment's growth trajectory is further supported by continuous product innovation from manufacturers introducing specialized liquid formulations targeting specific wood types and finish requirements. Water-based liquid polishes have gained substantial traction among environmentally conscious consumers seeking sustainable furniture care solutions. The DIY home maintenance trend has particularly benefited the liquid polish segment, with consumers increasingly undertaking furniture care activities independently, driving sustained retail demand across urban and semi-urban markets.

Source Insights:

- Polyurethane Finish

- Melamine Finish

- Polyester

- PU Alkyd Resin

- Nitrocellulose Finish

- Lacquer

Polyurethane finish leads with a share of 30% of the total India furniture polish market in 2025.

Polyurethane finish dominates the source segment owing to its exceptional durability, chemical resistance, and versatility in providing diverse aesthetic finishes ranging from matte to high gloss. The segment benefits from polyurethane's superior scratch and abrasion resistance, making it ideal for high-traffic furniture applications. PU finishes are available in multiple shades, enabling consumers and professional applicators to achieve desired color matching and aesthetic outcomes. The material's non-yellowing properties ensure long-term visual appeal, particularly for light-colored furniture.

India's polyurethane sector has demonstrated robust growth, with flexible foam and coating applications benefiting from expanding end-use industries. For instance, in November 2024, Biesse India allocated INR 200 crore to enlarge its Bengaluru plant, aiming for increased localization in furniture manufacturing equipment. Major manufacturers, including ICA Pidilite, and Sirca Paints, offer comprehensive polyurethane finish portfolios catering to both interior and exterior furniture applications, providing consumers with premium aesthetic solutions for residential and commercial furniture maintenance.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct

- Distributors

- Wholesalers

- Specialty Store

- Online

Distributors exhibits a clear dominance with a 25% share of the total India furniture polish market in 2025.

Distributors maintain their leading position through established networks connecting manufacturers with diverse retail endpoints across India's geographically dispersed market. Their role becomes particularly crucial in reaching Tier II and Tier III cities where direct manufacturer presence remains limited. Distributors provide essential logistics, inventory management, and credit facilities that enable smaller retailers to maintain adequate stock levels. The segment benefits from long-standing relationships with both manufacturers and retailers, ensuring consistent product availability and market coverage.

The distributor network's significance extends to providing market intelligence, enabling manufacturers to understand regional preferences and demand patterns. Professional contractors and commercial buyers frequently rely on distributor relationships for bulk procurement and specialized product requirements. While e-commerce and direct channels continue expanding, distributors remain indispensable for reaching traditional retail outlets, hardware stores, and paint shops that constitute significant sales volumes in semi-urban and rural markets throughout India.

Application Insights:

- Residential

- Commercial

Residential dominates with a market share of 66% of the total India furniture polish market in 2025.

The residential segment dominates the market driven by India's expanding housing sector and rising homeownership rates among the growing middle class. Nuclear family formations have intensified demand for furniture maintenance products as households increasingly invest in premium furniture installations requiring periodic care. The government’s PM Awas Yojana Urban program aims to address housing requirements for one crore urban households, backed by an investment of Rs. 10 lakh crores, continues stimulating residential furniture demand and consequently furniture polish consumption.

Rising disposable incomes have enabled residential consumers to prioritize furniture aesthetics and longevity, driving adoption of quality polish products. The DIY home maintenance trend has particularly benefited the residential segment, with consumers undertaking furniture care independently. Home furniture accounts for over sixty percent of India's furniture market, with living room, dining room, and bedroom furniture requiring regular maintenance. Real estate developers increasingly collaborate with furniture brands, creating awareness about furniture care among new homeowners.

Regional Insights:

- North India

- South India

- East India

- West India

North India represents the largest regional segment with a 32% share of the total India furniture polish market in 2025.

North India dominates the regional landscape driven by high population density, accelerated urbanization in Delhi-NCR, and concentration of organized furniture retail infrastructure. Cities such as Delhi, Jaipur, Chandigarh, and Greater Noida witness robust demand driven by urban expansion, real estate development, and rising incomes. Delhi's Kirti Nagar furniture hub continues attracting both traditional and modern furniture buyers, with new residential and commercial projects across NCR fueling consistent furniture polish demand.

The region benefits from well-developed distributor networks and established retail channels enabling comprehensive market coverage. For instance, in February 2025, IKEA announced its expansion in Delhi-NCR with a small-format store and e-commerce operations, supported by a distribution center in Gurgaon. Student migration and single working professionals drive demand for compact, modular furniture requiring regular maintenance. The growing presence of organized furniture retailers and home improvement stores continues to strengthen North India's dominant market position.

Market Dynamics:

Growth Drivers:

Why is the India Furniture Polish Market Growing?

Rapid Urbanization and Expanding Real Estate Sector

India's accelerating urbanization trajectory represents a fundamental driver propelling furniture polish market expansion. Urban migration for employment and improved lifestyle opportunities has intensified nuclear family formation in metropolitan and Tier II cities, generating sustained demand for residential furniture requiring periodic maintenance. The government's comprehensive housing initiatives, including Smart City Mission and Pradhan Mantri Awas Yojana, are accelerating construction activities across urban and semi-urban regions. Newly constructed residential projects necessitate furniture installations, creating cascading demand for furniture care products. Real estate developers increasingly collaborate with furniture brands to offer fully furnished apartments, establishing furniture maintenance routines among new homeowners. India's real estate sector is expected to reach substantial valuations, with residential housing driving significant market activity and corresponding furniture polish consumption.

Rising Disposable Incomes and Middle-Class Expansion

The expanding Indian middle class and rising disposable income levels have transformed furniture from functional necessity to lifestyle expression. Consumers increasingly invest in premium, aesthetically appealing furniture installations that require periodic maintenance to preserve visual appeal and extend product longevity. This shift has elevated demand for quality furniture polish products that enhance shine, protect surfaces, and maintain furniture value. Higher purchasing power enables consumers to prioritize furniture care as part of regular home maintenance routines rather than occasional necessity. The growing inclination toward spacious and expensive furniture installations necessitates the use of furniture polish for periodic upkeep. Design-conscious consumers exposed to global interior trends through social media and home décor platforms increasingly view furniture maintenance as essential for preserving their investment in premium home furnishings.

Expansion of Organized Retail and E-Commerce Platforms

The transformation of India's furniture retail landscape from unorganized carpentry-driven models to organized brand-led ecosystems has significantly boosted furniture polish market visibility and accessibility. Large organized furniture retailers bundle polish products with furniture purchases or recommend them as maintenance add-ons, creating standardized consumer awareness channels. The government's decision to allow foreign direct investment in multi-brand retail has attracted global furniture manufacturers introducing international furniture care standards. E-commerce platforms have democratized furniture polish accessibility, enabling nationwide product availability with doorstep delivery, comprehensive product information, and consumer reviews. Online furniture platforms have collectively attracted substantial investments, reflecting strong sector confidence. The digital transformation enables manufacturers to reach previously underserved markets while providing consumers with convenient purchasing options beyond traditional hardware stores and neighborhood retailers.

Market Restraints:

What Challenges the India Furniture Polish Market is Facing?

Competition from Unorganized Sector

The presence of a substantial unorganized sector producing low-cost furniture polish alternatives poses competitive challenges for established manufacturers. Local producers often operate with lower overhead costs and minimal regulatory compliance, enabling aggressive pricing that attracts price-sensitive consumers. This competition limits organized manufacturers' ability to maintain margins while investing in product innovation and quality improvements.

Price Volatility of Raw Materials

Fluctuations in raw material costs, particularly solvents, resins, and petrochemical-based components, create financial strain across the furniture polish supply chain. Unstable pricing of key inputs affects manufacturer margins and complicates pricing strategies. Supply chain disruptions and global commodity price movements introduce uncertainty, requiring manufacturers to maintain adaptive procurement strategies and potentially absorb cost increases.

Limited Consumer Awareness in Rural and Semi-Urban Areas

Consumer awareness regarding furniture polish benefits and application techniques remains limited in rural and smaller semi-urban markets where the majority of India's population resides. Traditional furniture maintenance practices and reliance on local carpenters for furniture care persist in these regions. Limited organized retail presence and distribution infrastructure in remote areas further constrain market penetration and product accessibility.

Competitive Landscape:

The India furniture polish market exhibits moderate competitive intensity, characterized by the presence of established multinational coating manufacturers alongside regional specialty polish producers. Market participants compete across multiple dimensions including product quality, distribution reach, pricing strategies, and brand positioning. Organized players focus on product innovation, developing low-VOC and eco-friendly formulations to meet evolving consumer preferences. Leading manufacturers maintain extensive distribution networks spanning direct sales, distributors, wholesalers, and retail channels. The market witnesses increasing consolidation activity as companies seek to expand market share through strategic acquisitions and partnerships. Investment in manufacturing capacity expansion and technological upgrades remains a priority for major players seeking to strengthen competitive positioning in this growing market.

India Furniture Polish Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liquid Polish, Semi-Solid Polish, Aerosol Polish |

| Sources Covered | Polyurethane Finish, Melamine Finish, Polyester, PU Alkyd Resin, Nitrocellulose Finish, Lacquer |

| Distribution Channels Covered | Direct, Distributors, Wholesalers, Specialty Store, Online |

| Applications Covered | Residential, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India furniture polish market size was valued at USD 269.59 Million in 2025.

The India furniture polish market is expected to grow at a compound annual growth rate of 6.12% from 2026-2034 to reach USD 459.95 Million by 2034.

Liquid polish dominated the market with 49% share in 2025, driven by growing consumer preference for low-VOC formulations, ease of application, and versatility across diverse wooden furniture surfaces.

Key factors driving the India furniture polish market include rapid urbanization and real estate expansion, rising disposable incomes among the middle class, expansion of organized retail and e-commerce platforms, and government housing initiatives stimulating furniture demand.

Major challenges include competition from the unorganized sector offering low-cost alternatives, price volatility of raw materials affecting manufacturer margins, limited consumer awareness in rural and semi-urban areas, and distribution infrastructure gaps in remote regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)