India Galvanization Market Size, Share, Trends, and Forecast by Type, Combustion Chamber Type, Application, End Use Industry, and Region, 2025-2033

India Galvanization Market Overview:

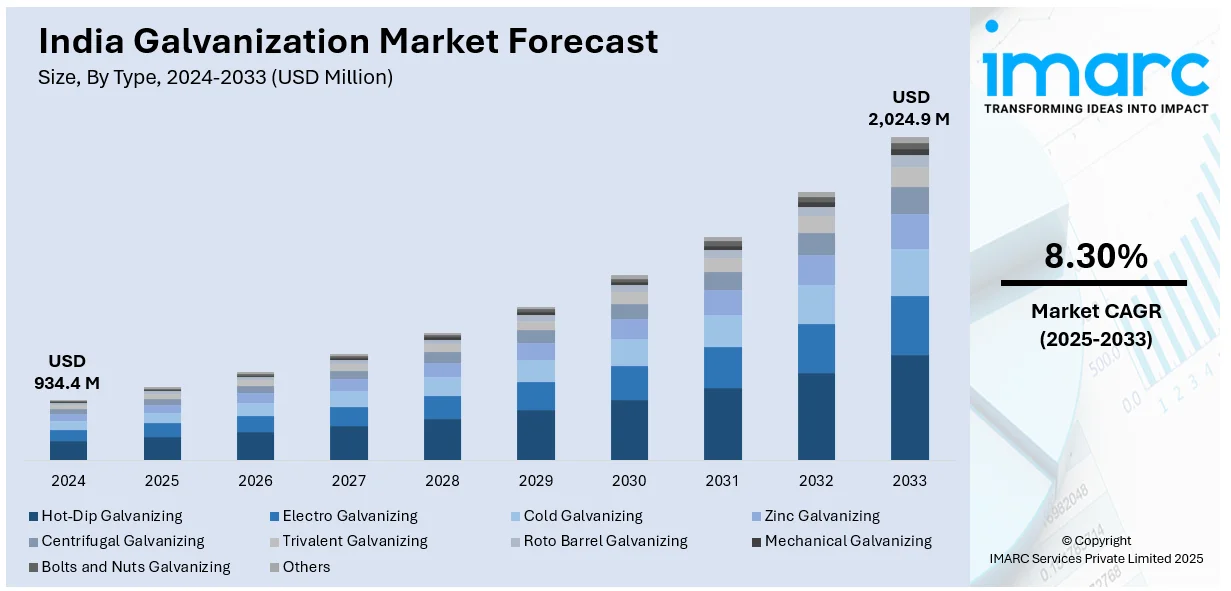

The India galvanization market size reached USD 934.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,024.9 Million by 2033, exhibiting a growth rate (CAGR) of 8.30% during 2025-2033. The market is witnessing consistent growth due to growing infrastructure projects, mounting demand for corrosion-resistant steel, and growing construction and automotive industries. Government policies encouraging the use of steel and galvanization process technology advancements are also contributing to market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 934.4 Million |

| Market Forecast in 2033 | USD 2,024.9 Million |

| Market Growth Rate 2025-2033 | 8.30% |

India Galvanization Market Trends:

Rising Demand for Galvanized Steel in Infrastructure and Construction

The India galvanization market is experiencing notable expansion, chiefly propelled by the heightening need for galvanized steel in the infrastructure and construction sector. Government-led initiatives such as Bharatmala, Smart Cities Mission, and Make in India are accelerating investments in roads, bridges, metro rail projects, and urban infrastructure, boosting the need for corrosion-resistant steel. For instance, as per industry reports, the government allocated USD 32.68 Billion fund under the 2024-2025 union budget to the Ministry of Road Transport and Highways. In line with this, during FY 2023 to 2024, a heavy investment of USD 24.79 Billion given to the National Highways Authority of India. Galvanized steel offers enhanced durability, lower maintenance costs, and superior structural integrity, making it a preferred choice for high-exposure applications. Additionally, India's rapid urbanization and growing industrialization are driving the expansion of commercial and residential construction, where galvanized steel is used in roofing, fencing, and structural frameworks. The widespread adoption of high-strength galvanized steel in pre-engineered buildings and modular construction further supports market expansion. Moreover, global supply chain disruptions have increased domestic production capacity, leading to a greater reliance on locally manufactured galvanized products, fostering market growth in the long term.

To get more information on this market, Request Sample

Technological Advancements and Adoption of Sustainable Galvanization Processes

The Indian galvanization market is experiencing a shift toward sustainable and advanced coating technologies to enhance efficiency and reduce environmental impact. Hot-dip galvanization remains the dominant process; however, innovations such as thermal diffusion galvanizing and zinc-aluminum-magnesium (ZAM) coatings are gaining traction due to their superior corrosion resistance and reduced material consumption. These advancements cater to industries requiring extended service life and high-performance coatings, such as automotive, renewable energy, and power transmission. Environmental regulations are also driving manufacturers to adopt eco-friendly galvanization methods, such as minimizing lead and cadmium in zinc baths and implementing closed-loop recycling for byproducts like zinc ash and dross. The push for green steel and circular economy initiatives is encouraging market participants to develop energy-efficient galvanizing techniques. For instance, as per the Press Information Bureau, in December 2024, the Ministry of Steel announced the launch of the Taxonomy of Green Steel in India to boost the decarbonization in the steel segment to cater to the net-zero emission aim by 2070. Moreover, with increasing awareness of sustainability and regulatory compliance, companies are investing in automation and process optimization to achieve higher throughput while reducing emissions and waste generation.

India Galvanization Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, combustion chamber type, application, and end use industry.

Type Insights:

- Hot-Dip Galvanizing

- Electro Galvanizing

- Cold Galvanizing

- Zinc Galvanizing

- Centrifugal Galvanizing

- Trivalent Galvanizing

- Roto Barrel Galvanizing

- Mechanical Galvanizing

- Bolts and Nuts Galvanizing

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes hot-tip galvanizing, electro galvanizing, cold galvanizing, zinc galvanizing, centrifugal galvanizing, trivalent galvanizing, roto barrel galvanizing, mechanical galvanizing, bolts and nuts galvanizing, and others.

Combustion Chamber Type Insights:

- Oil

- Gas

- Electric

- Others

A detailed breakup and analysis of the market based on the combustion chamber type have also been provided in the report. This includes oil, gas, electric, and others.

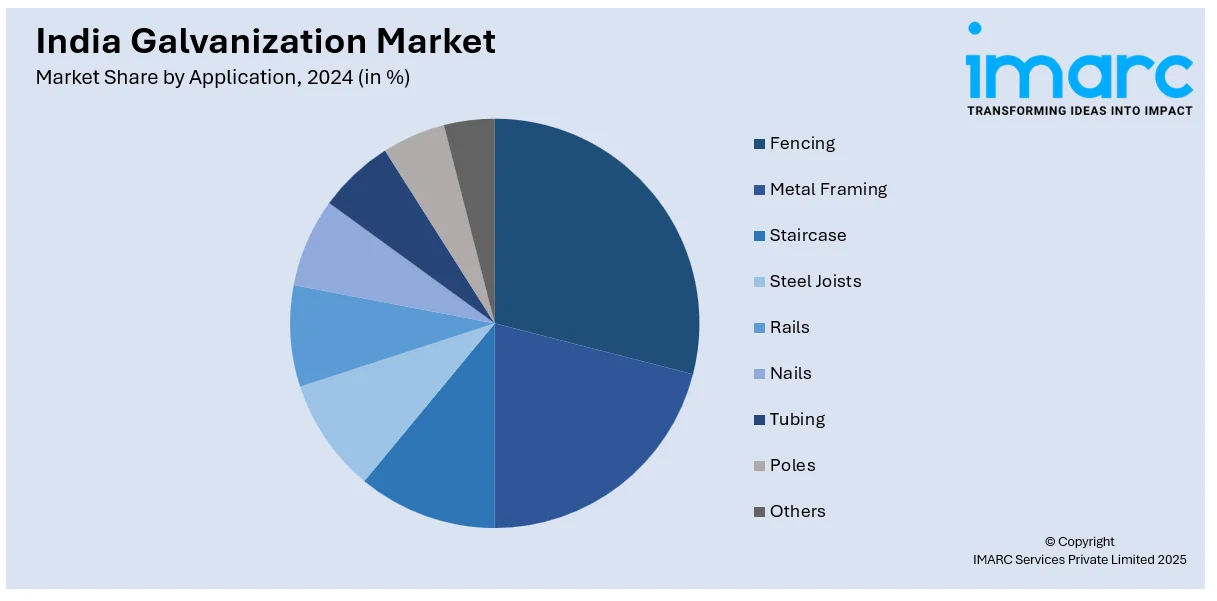

Application Insights:

- Fencing

- Metal Framing

- Staircase

- Steel Joists

- Rails

- Nails

- Tubing

- Poles

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fencing, metal framing, staircase, steel joints, rails, nails, tubing, poles, and others.

End Use Industry Insights:

- Electrical and Electronics

- Wind and Solar Industries

- Energy Industry

- Telecommunications Industry

- Transportation

- Aerospace

- Marine

- Automotive

- Others

- Building and Construction

- Residential Construction

- Commercial Construction

- Industrial

- Infrastructure

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes electrical and electronics, wind and solar industries, energy industry, telecommunications industry, transportation (aerospace, marine, automotive, and others), building and construction (residential construction, commercial construction, industrial, and infrastructure), and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Galvanization Market News:

- In January 2025, Nippon Steel and ArcelorMittal announced that their joint venture, ArcelorMittal Nippon Steel India will commission 2 production lines, including Continuous Galvanizing and Annealing Line and Continuous Galvanizing Line, in 2025. These lines will be leveraged in the production of enhanced products of automotive steel.

- In September 2024, Hindustan Zinc announced the utilization of its premium-quality zinc in the galvanization procedure for the heaviest 400 kV transmission steel pole structure in India. The zinc galvanization process safeguards from corrosion and improve structural integrity of the pole.

India Galvanization Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hot-Dip Galvanizing, Electro Galvanizing, Cold Galvanizing, Zinc Galvanizing, Centrifugal Galvanizing, Trivalent Galvanizing, Roto Barrel Galvanizing, Mechanical Galvanizing, Bolts and Nuts Galvanizing, Others |

| Combustion Chamber Types Covered | Oil, Gas, Electric, Others |

| Applications Covered | Fencing, Metal Framing, Staircase, Steel Joists, Rails, Nails, Tubing, Poles, Others |

| End Use Industries Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India galvanization market performed so far and how will it perform in the coming years?

- What is the breakup of the India galvanization market on the basis of type?

- What is the breakup of the India galvanization market on the basis of combustion chamber type?

- What is the breakup of the India galvanization market on the basis of application?

- What is the breakup of the India galvanization market on the basis of end use industry?

- What is the breakup of the India galvanization market on the basis of region?

- What are the various stages in the value chain of the India galvanization market?

- What are the key driving factors and challenges in the India galvanization market?

- What is the structure of the India galvanization market and who are the key players?

- What is the degree of competition in the India galvanization market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India galvanization market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India galvanization market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India galvanization industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)