India Gaming Console Market Size, Share, Trends and Forecast by Type, Application, End Use, and Region, 2025-2033

India Gaming Console Market Size and Share:

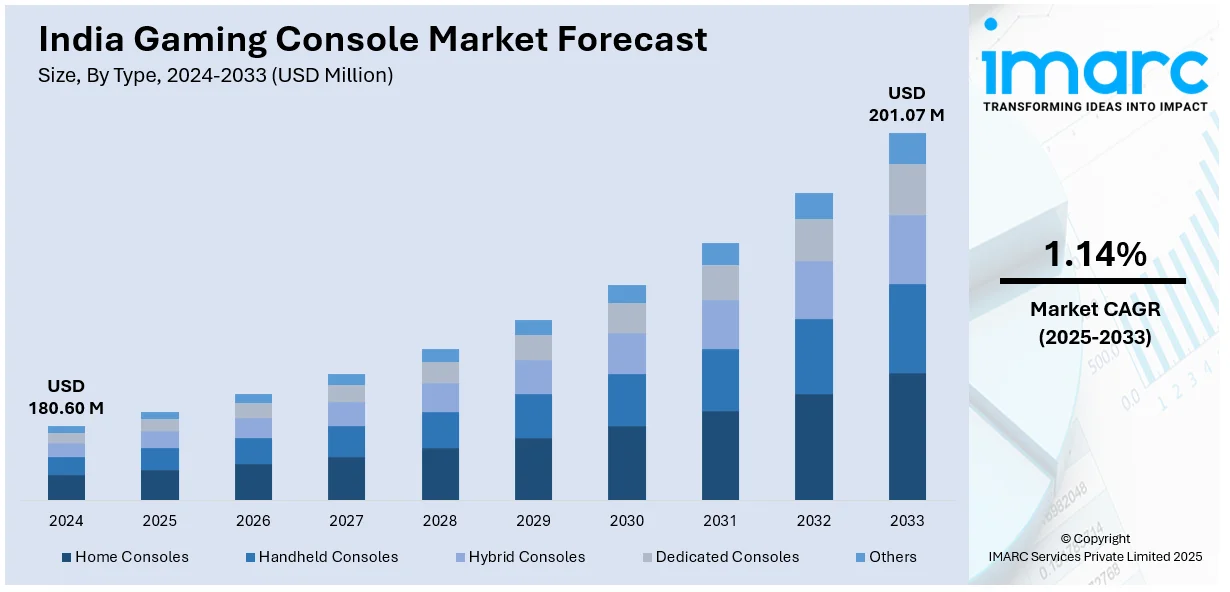

The India gaming console market size was valued at USD 180.60 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 201.07 Million by 2033, exhibiting a CAGR of 1.14% from 2025-2033. The market is propelled by rising disposable incomes, urbanization, and rising populations of tech-savvy youth looking for newer, higher-end entertainment possibilities. Enhanced digital infrastructure, such as high-speed internet access, provides smooth online gaming experiences. Increased popularity of interactive and multiplayer games, in addition to easier availability through retail and online channels, increases market growth even further. Further, changing consumer demands and the adoption of advanced gaming features are among the factors contributing to continued demand in the India gaming console market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 180.60 Million |

| Market Forecast in 2033 | USD 201.07 Million |

| Market Growth Rate 2025-2033 | 1.14% |

India's increasing middle-class population, along with increasing disposable income, is a major driver of the expanding gaming console market. As more families reach the economic level for discretionary expenditure, people are increasingly investing in entertainment and leisure pursuits like video gaming. Gaming consoles, which were once seen as luxury goods, are becoming increasingly affordable for the masses. For instance, in June 2025, Nintendo will release its new gaming console, the Switch 2. The console will have a 7.9-inch LCD display, HDR capability, 120Hz refresh rate, and new interactive chat features. Moreover, this trend is complemented by urbanization and changing lifestyle expectations of young consumers, who desire high-quality and engaging digital entertainment experiences. The improved graphics quality, interactive gaming, and large collections of digital content are inducing a migration towards home-based gaming. The universal availability of low-cost internet services and smart televisions also provides a suitable context for gaming console usage. The convergence of increased economic capacity and enhanced interest in interactive entertainment is fueling the usage of gaming consoles in metropolitan as well as semi-urban areas throughout India.

To get more information on this market, Request Sample

Improved digital infrastructure in India is serving as the key driver of expansion of the gaming console sector. Rising availability of robust broadband services and increase in fiber optic networks have greatly improved internet penetration all across India. Such advances enable seamless online gaming experiences, effective digital delivery of games, and access to interactive entertainment hubs. For example, in August 2024, ASUS India introduced the ROG ALLY X handheld gaming console with an AMD Z1 Extreme CPU, 1TB storage, 24GB RAM, 120Hz FHD display, enhanced cooling system, and better gaming performance. Furthermore, the large-scale adoption of smartphones and electronic payment systems has created a technologically savvy customer base that is open to digital offerings, ensuring console gaming a natural evolution. The new ecosystem of online gaming, encompassing social media activity, game streaming services, and virtual communities, is contributing to the creation of a rich and diverse gaming culture. With growing digital literacy and increasing internet penetration in hitherto underserved markets, the market size for gaming consoles continues to grow. The availability of stable and quality internet connectivity continues to be vital to support and drive the India gaming console market growth.

India Gaming Console Market Trends:

Surging Gaming Culture

The gaming console market in India is experiencing a surge in popularity, driven by a burgeoning gaming culture, increased disposable income, and advancements in technology. These specialized computing devices, designed primarily for playing video games, have become a focal point in the entertainment landscape of the country. The market has witnessed a notable evolution, with consoles offering an array of features, including internet connectivity, digital content downloads, and integration with social media platforms. This transformation positions gaming consoles as multifaceted entertainment hubs that cater to a broad spectrum of consumer preferences. One significant factor contributing to the growth of the gaming console market in India is the rise of online gaming communities and esports. According to estimates by the India Brand Equity Foundation (IBEF), in 2025, the number of individuals who play esports in India is expected to surpass 1.5 million. Additionally, the presence of exclusive ecosystems, comprising unique games, online services, and specialized accessories, adds to the allure of gaming consoles in the Indian market. Besides this, consumers, both casual and dedicated gamers, are drawn to the convenience, plug-and-play capability, and curated game libraries offered by these devices. As a result, India was the largest gaming market in the world in 2023, with 568 million gamers and a record 9.5 billion downloads of gaming apps, as per the India Brand Equity Foundation (IBEF).

Increase in Disposable Income Among Urban and Semi-Urban Households

One of the primary drivers of the gaming console market in India is the noticeable rise in disposable income among urban and semi-urban populations. As per industry observations, a growing number of Indian households now have a higher level of discretionary spending, particularly in metro cities and tier-2 towns. This has enabled consumers to allocate more funds toward non-essential items, including entertainment electronics such as gaming consoles. With double-income households becoming more common and entry-level salaries increasing in service-based sectors, like information technology (IT), finance, and e-commerce, young professionals and families are more willing to invest in leisure and technology-driven experiences. Gaming consoles, once considered a luxury purchase, are increasingly viewed as valuable entertainment devices that offer immersive and engaging experiences for both individuals and families. This shift in spending patterns is also supported by the availability of flexible payment options such as equated monthly installments (EMI) and financing schemes offered by both offline retailers and e-commerce platforms.

Expansion of a Tech-Savvy Middle Class

The expansion of India’s tech-savvy middle class is playing a crucial role in shaping the demand for gaming consoles. Over the last decade, the middle-income segment has grown not just in numbers but also in digital literacy and technology adoption. This segment typically includes young professionals, students, and urban families who are familiar with digital devices and actively engage with technology for work, education, and entertainment. Many of these consumers have prior exposure to digital gaming through smartphones and PCs and are now exploring more premium experiences offered by consoles such as the PlayStation, Xbox, and Nintendo Switch. Their awareness of game titles, streaming platforms, and multiplayer ecosystems makes them a natural target for console manufacturers. The middle class also represents a stable and scalable market because of its consistent purchasing behavior and aspirational lifestyle choices. Console makers are increasingly tailoring marketing efforts toward this group, emphasizing value, entertainment, and quality experiences, which is creating a positive outlook for the market growth.

India Gaming Console Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India gaming console market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, application, and end use.

Analysis by Type:

- Home Consoles

- Handheld Consoles

- Hybrid Consoles

- Dedicated Consoles

- Others

The home console segment is driven by the rising demand for immersive entertainment experiences, growing adoption of large-screen televisions (TVs), and increased disposable income among urban families. Enhanced graphics, online multiplayer capabilities, and family-friendly games appeal to both youth and adults. Additionally, the convenience of digital game libraries and streaming services has strengthened consumer interest in setting up home-based gaming environments.

The handheld console segment is driven by portability, affordability, and increasing demand from younger gamers and casual players. Indian consumers appreciate the convenience of gaming on the go, especially during travel or commute. The segment also benefits from strong nostalgia value and simple game mechanics. Growing smartphone familiarity has helped users easily transition to portable consoles, further supported by localized content and accessible pricing options.

The hybrid console segment is driven by consumer preference for versatility, offering both home and handheld gaming in a single device. This appeals to tech-savvy users who value flexibility and seamless transitions between mobile and stationary play. Nintendo Switch’s success has sparked interest in this segment, which benefits from modern game designs, family-oriented features, and growing awareness of multi-use entertainment platforms in the Indian market.

The dedicated console segment is driven by interest in retro gaming experiences and simple plug-and-play setups. These devices often target nostalgic consumers or parents introducing children to gaming without the complexity of modern systems. Cost-effective pricing, preloaded games, and minimal setup make them appealing for casual users. This segment also benefits from occasional spikes in demand during festive seasons and gifting periods.

The others segment is driven by emerging innovations and niche preferences, including micro consoles, cloud gaming devices, and streaming-based platforms. These products attract early adopters and tech enthusiasts looking for alternatives to mainstream consoles. Growth is influenced by increasing internet bandwidth, rising curiosity about new formats, and expanding interest in digital-first gaming ecosystems.

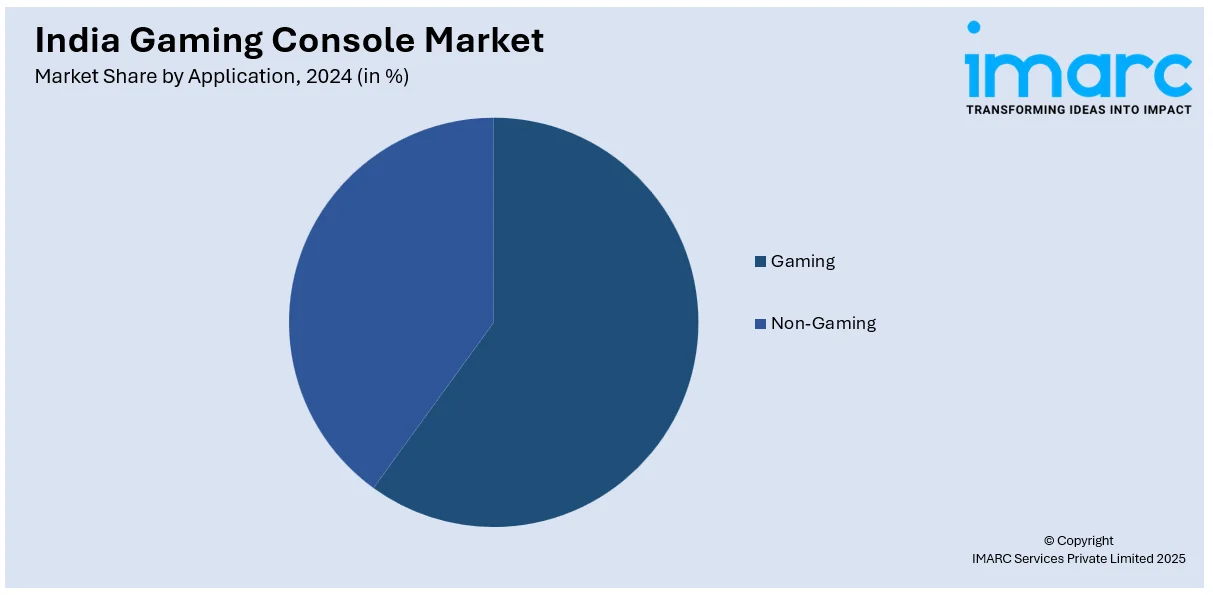

Analysis by Application:

- Gaming

- Non-Gaming

The gaming segment is driven by the growing popularity of gaming culture, bolstered by the increasing youth population and their engagement with digital content. Factors like the rise of esports, global gaming trends, and localized content tailored to Indian preferences contribute to its growth. Furthermore, the shift towards digital downloads and subscription models, as well as the adoption of high-speed internet for online gaming, are key drivers in expanding the gaming segment in India.

The non-gaming segment is driven by the increasing use of consoles for a variety of multimedia functions, such as streaming movies, music, and digital content. With the rise of over-the-top (OTT) platforms like Netflix, Amazon Prime, and Disney+, consoles are becoming central hubs for home entertainment. The convenience of all-in-one systems that offer gaming, media, and browsing capabilities is significantly enhancing the appeal of consoles beyond just gaming enthusiasts.

Analysis by End Use:

- Residential

- Commercial

The residential segment is driven by increasing disposable incomes, the growing adoption of digital entertainment, and the rise of tech-savvy households. With young professionals and families prioritizing home entertainment, gaming consoles are becoming a preferred choice. Additionally, the availability of affordable financing options, regional game content, and enhanced internet connectivity further fuels demand for consoles, making them a significant aspect of home entertainment setups across India.

The commercial segment is driven by the rise in gaming cafes, esports tournaments, and entertainment centers. Increasing interest in esports and multiplayer gaming events has led to a surge in demand for high-performance gaming consoles in public venues. Additionally, the growing investment in immersive entertainment by gaming centers and arcades, coupled with the increasing popularity of gaming as a social activity, has significantly boosted the commercial segment in India.

Regional Analysis:

- North India

- West and Central India

- South India

- East and Northeast India

India gaming console forecast indicates strong growth in the North India region, driven by rapid urbanization in cities such as Delhi, Chandigarh, and Jaipur. This area boasts a large, youthful population that is quick to adopt global entertainment trends. Rising disposable incomes in metropolitan centers, coupled with growing tech-savviness, are key contributors to the surging demand for gaming consoles. The crossover interest from mobile gaming, enhanced access to high-speed internet, and the rising impact of social media and esports events have all accelerated console adoption. Furthermore, the region benefits from close proximity to global brands and a steadily improving retail infrastructure, making gaming consoles increasingly accessible to consumers.

The West and Central India region is driven by the high number of tech-savvy consumers in cities such as Mumbai, Pune, and Ahmedabad, where disposable income levels are higher. These urban centers have a young, aspirational demographic that is increasingly drawn to high-tech entertainment options, including gaming consoles. Strong mobile penetration, favorable data pricing, and the presence of major gaming events and tournaments further fuel demand. Additionally, the region benefits from a growing middle-class population, increasing interest in home entertainment systems, and consistent internet connectivity that facilitates online gaming and digital game purchases.

The South India region is driven by the region's large, diverse, and youthful population, especially in cities like Bangalore, Chennai, and Hyderabad, which are hubs for IT professionals and tech enthusiasts. The strong inclination toward technology adoption, combined with a rising middle class and increased disposable incomes, has propelled the demand for gaming consoles. Moreover, South India boasts a robust gaming culture, with local language content, esports, and digital payments playing an essential role in broadening console gaming appeal. The region’s high-speed internet infrastructure and access to global gaming trends further support console market growth.

The East and Northeast India region is driven by increasing urbanization in cities like Kolkata, Bhubaneswar, and Guwahati, where the growing interest in digital entertainment is fueling the demand for gaming consoles. Despite historically lower disposable incomes compared to other regions, the increasing affordability of consoles, along with the expansion of mobile data services and internet access, has made gaming more accessible. Additionally, the cultural shift toward online and interactive entertainment, the rise of youth interest in gaming, and more localized content have created a more favorable environment for gaming console adoption in this region.

Competitive Landscape:

The competitive dynamics of the Indian gaming console market are distinguished by a blend of well-established global brands and growing consumer interactions with high-quality digital entertainment. Market participants are positioning themselves on providing engaging gaming experiences by way of advanced hardware specifications, exclusive titles, and convenient online connectivity. The presence of next-generation consoles with better graphics, increased processing power, and large libraries of games is drawing a wide range of players, from casual to hardcore fans. Retail channels and online commerce have made access easier, and promotional discounts, localized content, and bundling are being utilized to acquire new customers. The growing adoption of cloud-based functionalities and digital game distribution platforms is also influencing the market. Competitive differentiation is typically fueled by innovation in user experience, ecosystem integration, and content partnerships. As consumer demand continues to grow, the Indian market for gaming consoles is seeing strategic initiatives to bolster market presence and brand loyalty through customized engagement and feature enhancements.

The report provides a comprehensive analysis of the competitive landscape in the India gaming console market with detailed profiles of all major companies.

Latest News and Developments:

- January 2025: Acer launched the Nitro Blaze 11 and the Nitro Blaze 8, its most recent handheld gaming consoles. The devices are equipped with Windows 11 Home and powered by the AMD Ryzen 7 APU, offering a seamless gaming experience for both amateurs and professionals. However, pricing details for the Indian market have yet to be announced.

- December 2024: Backbone officially launched in the Indian gaming console market with the release of Backbone One, a high-end gaming controller that connected to iOS and Android smartphones and turned them into handheld, portable gaming consoles.

- August 2024: Sony Interactive Entertainment announced the release of the PlayStation Portal Remote Player in India, which allowed individuals to enjoy PS5 gameplay on the go. The PlayStation Portal Remote Player could also be connected to the PS5 console using Wi-Fi.

- July 2024: MSI introduced its first handheld gaming console based on Windows 11 in India. Dubbed the Claw, the console is reportedly the first handheld gaming console equipped with the latest Intel Core Ultra processors and features the most recent GPU and BIOS drivers.

- June 2024: The Legion Go, Lenovo's first handheld gaming console, was released in India. The device runs on the Windows 11 operating system and is powered by the AMD Ryzen Z1 Extreme processor with an integrated AMD RDNA graphics processing unit (GPU).

India Gaming Console Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Home Consoles, Handheld Consoles, Hybrid Consoles, Dedicated Consoles, Others |

| Applications Covered | Gaming, Non-Gaming |

| End Uses Covered | Residential, Commercial |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India gaming console market from 2019-2033.

- The India gaming console market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key markets within the region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India gaming console industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gaming console market in the India was valued at USD 180.60 Million in 2024.

The India gaming console market is projected to exhibit a CAGR of 1.14% during 2025-2033, reaching a value of USD 201.07 Million by 2033.

The key drivers of the India gaming console market are increasing disposable incomes, urbanization, better digital infrastructure, rising youth population, and an upsurge in demand for interactive entertainment. Increased internet connectivity and online multiplayer gaming popularity are also driving higher consumption of gaming consoles in the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)