India Gaming Market Size, Share, Trends and Forecast by Device Type, Platform, Revenue Type, Type, Age Group, and Region, 2026-2034

India Gaming Market Summary:

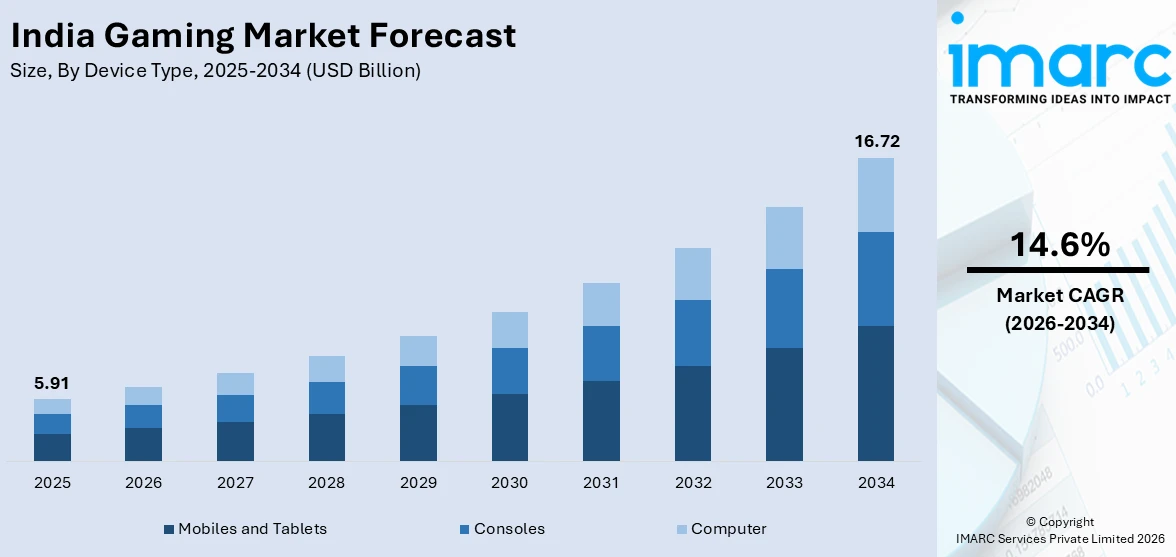

The India gaming market size was valued at USD 5.91 Billion in 2025 and is projected to reach USD 16.72 Billion by 2034, growing at a compound annual growth rate of 14.6% from 2026-2034.

The India gaming market is undergoing expansion, which can be accredited to unprecedented smartphone adoption, affordable data plans, and a young, digitally native population that increasingly favors interactive entertainment. The proliferation of localized content in regional languages, coupled with seamless digital payment infrastructure through UPI, has accelerated player monetization and engagement across tier-two and tier-three cities. Additionally, the formal recognition of esports as an official sport and substantial corporate investments in gaming infrastructure are fostering a vibrant ecosystem that positions the India gaming market share for sustained growth.

Key Takeaways and Insights:

-

By Device Type: Mobiles and tablets dominate the market with a share of 51.46% in 2025, owing to the widespread availability of budget-friendly smartphones and ultra-low data tariffs that enable seamless gaming experiences across demographics.

-

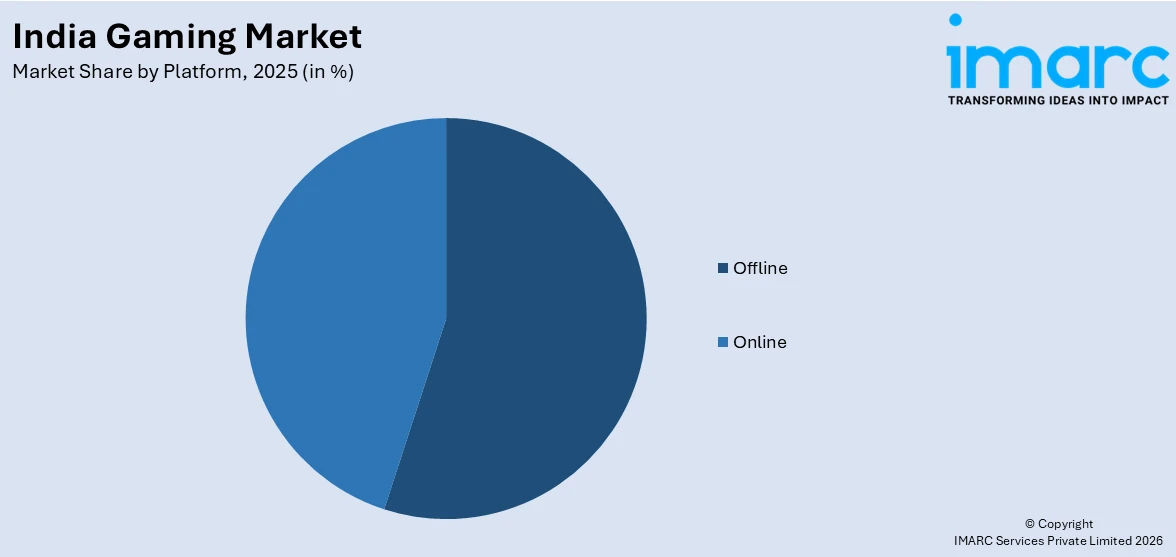

By Platform: Offline leads the market with a share of 53.65% in 2025, driven by consumer preference for downloadable games that offer uninterrupted gameplay without reliance on continuous internet connectivity.

-

By Revenue Type: In-game purchase represents the largest segment with a market share of 63.49% in 2025, reflecting the growing acceptance of microtransactions and virtual goods purchases among Indian gamers seeking enhanced gameplay experiences.

-

By Type: Adventure/role playing games dominate the market with a share of 41.2% in 2025, on account of immersive storytelling, strategic gameplay mechanics, and deep character progression systems that resonate with engaged gaming audiences.

-

By Age Group: Adult exhibits a clear dominance in the market with 75.19% share in 2025, driven by higher disposable incomes, increased leisure time, and a willingness to spend on premium gaming experiences and in-app purchases.

-

By Region: North India is the largest region with 32% share in 2025, fueled by high population density in metropolitan areas like Delhi-NCR, robust digital infrastructure, and the proliferation of esports tournaments.

-

Key Players: Key players drive the India gaming market by expanding game portfolios, investing in localized content, and strengthening esports infrastructure. Their strategic partnerships with telecom providers and digital payment platforms enhance accessibility and monetization capabilities across diverse consumer segments.

To get more information on this market Request Sample

The Indian gaming market is going through a vastly different time, with a tremendous number of gamers being engaged exponentially. The advent of affordable smartphones, widespread availability of 4G/5G networks, as well as innovative monetization strategies, has built a juggernaut of a gaming ecosystem, with casual users increasingly turning into regular spenders. The Indian gaming sector is already recognized as one of the largest mobile gaming markets in the world in terms of downloads, and many stakeholders both domestic and global are keenly focusing on this nation. The gaming demographics of India have changed vastly, with women joining in droves, while most gamers come from non-metro cities. The fact that Indian gamers have increasingly shown interest in shelling out hard-earned cash for high-quality gaming experiences marks a massive change in entertainment viewing patterns.

India Gaming Market Trends:

Rise of Esports as Mainstream Entertainment

Esports has transitioned from a niche pursuit to a mainstream entertainment category, attracting substantial viewership and brand sponsorships. The formal recognition of esports as an official sport has unlocked new avenues for government support and institutional development. Tournament participation has crossed two Million players for the first time, while the number of professional esports teams has expanded to 36. Major brands across consumer electronics, beverages, and telecommunications are actively sponsoring tournaments, driving prize pools and elevating the competitive gaming ecosystem.

Vernacular Content Driving Regional Adoption

Game makers are now giving more importance to localized content and languages to appeal to audiences in tier-two and tier-three cities. Games related to Hinglish conversations and chat, indo-futuristic concepts, and gameplay related to their culture have shown better retention and engagement compared to English alternatives. The game makers have also introduced festival-themed events and regional avatars that appeal to the audience at home. The vernacular shift has penetrated gaming to tier-two and tier-three cities and has received well among gamers who feel that it is related to their culture and entertainment abilities.

Cloud Gaming Expansion Through Telecom Partnerships

Cloud gaming is emerging as a transformative trend, enabling players to access premium titles without expensive hardware investments. Telecom operators are launching subscription-based gaming platforms that leverage expanding 5G infrastructure to deliver console-quality experiences on smartphones. These platforms eliminate traditional barriers to entry by removing the need for costly consoles or high-performance computers. In April 2024, Vodafone Idea partnered with CareGame to launch a cloud gaming platform offering premium games to subscribers, exemplifying the industry's trajectory toward infrastructure-light gaming solutions that maximize accessibility.

Market Outlook 2026-2034:

The India gaming market outlook remains exceptionally promising as technological advancements, regulatory clarity, and sustained investment converge to accelerate growth. The expansion of 5G networks will enable seamless cloud gaming and real-time multiplayer experiences. The market generated a revenue of USD 5.91 Billion in 2025 and is projected to reach a revenue of USD 16.72 Billion by 2034, growing at a compound annual growth rate of 14.6% from 2026-2034. The proliferation of homegrown game development studios, coupled with increasing foreign direct investment, positions India as both a consumption hub and an emerging content creation center for global audiences.

India Gaming Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Device Type | Mobiles and Tablets | 51.46% |

| Platform | Offline | 53.65% |

| Revenue Type | In-Game Purchase | 63.49% |

| Type | Adventure/Role Playing Games | 41.2% |

| Age Group | Adult | 75.19% |

| Region | North India | 325 |

Device Type Insights:

- Consoles

- Mobiles and Tablets

- Computer

Mobiles and tablets dominate with a market share of 51.46% of the total India gaming market in 2025.

The dominance of mobiles and tablets in India's gaming landscape reflects the country's mobile-first digital ecosystem, where affordable smartphones and extensive 4G/5G coverage have democratized gaming access. Entry-level devices now ship with sufficient RAM to enable mid-core gameplay without thermal throttling, while competitively priced data plans eliminate download friction. India has established itself as a primary market for mobile gaming experiences, ranking among the world's largest smartphone markets and attracting significant publisher attention. According to industry data, India had 659 Million smartphone owners in 2024, establishing the nation as a primary market for mobile gaming experiences.

Key players have strategically optimized their offerings for the mobile ecosystem by tailoring file sizes for quick downloads and integrating seamless digital payment solutions that significantly lift first-purchase conversion rates. The proliferation of budget-friendly 5G-capable smartphones further strengthens mobile gaming's position as the primary platform for both casual and competitive gaming audiences across urban and rural geographies. This mobile-centric approach enables developers to reach diverse demographics while maintaining accessible entry points for first-time gamers.

Platform Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline leads with a share of 53.65% of the total India gaming market in 2025.

The offline gaming segment maintains market leadership due to Indian consumers' preference for downloadable games that offer uninterrupted gameplay without dependence on continuous internet connectivity. This preference is particularly pronounced in tier-two and tier-three cities where network reliability remains inconsistent, prompting players to favor games that function seamlessly without active data connections. The segment benefits from games optimized for single-player experiences and local multiplayer modes that enable social gaming without requiring internet access. Additionally, many consumers prefer offline titles to manage their monthly data consumption more effectively, allocating bandwidth to essential activities while enjoying gaming without connectivity concerns.

Publishers have responded by developing hybrid models that allow core gameplay offline while syncing progress and unlocking additional content when connectivity becomes available. This approach satisfies consumer demand for flexibility while maintaining engagement through periodic online features. India recorded 8.45 Billion mobile game downloads in FY 2024-25, with a substantial portion representing offline-capable titles that players can enjoy during commutes, in areas with limited connectivity, or to conserve mobile data allocations. The continued expansion of offline-optimized games reflects publishers' understanding of diverse infrastructure realities across the country.

Revenue Type Insights:

- In-Game Purchase

- Game Purchase

- Advertising

In-Game purchase exhibits a clear dominance with a 63.49% share of the total India gaming market in 2025.

In-game purchases have emerged as the fastest-growing monetization model, driven by Indian gamers' preference for microtransactions over upfront payments. The free-to-play model with optional purchases has proven particularly effective in a price-sensitive market where consumers resist full-price game purchases but willingly spend on incremental enhancements. The proliferation of UPI and digital payment systems has accelerated monetization, enabling seamless one-tap purchases that reduce checkout abandonment and lower barriers to first-time spending. According to industry reports, in-app purchases grew by 41% year-on-year in FY 2024, reflecting the increasing acceptance of virtual goods and premium experiences among paying users.

The segment's growth is further amplified by strategic pricing that resonates with price-sensitive consumers, with INR 29 emerging as the preferred entry price point for first-time payers. This accessible threshold encourages conversion from free users to paying customers. High-engagement genres deploy season passes, limited-time skins, and gacha mechanics that elevate average revenue per daily active user. The number of paying gamers in India increased to 148 Million in FY 2024, demonstrating the expanding base of monetized players willing to invest in enhanced gaming experiences.

Type Insights:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Simulation

- Others

Adventure/role playing games represent the leading segment with a 41.2% share of the total India gaming market in 2025.

Adventure and role-playing games captivate Indian audiences through immersive storytelling, strategic gameplay mechanics, and deep character progression systems that encourage extended engagement sessions. The genre's appeal is amplified by titles incorporating Indo-futuristic motifs, festival-themed events, and region-specific avatars that resonate with domestic players while attracting international publisher interest. India has emerged as one of the fastest-growing RPG markets in the Asia Pacific region, driven by a young population that values narrative-driven experiences and character customization options. The fantasy and mythology themes prevalent in RPGs align naturally with India's rich cultural heritage, creating opportunities for both localized international titles and domestically developed content.

The competitive elements embedded in action-adventure titles drive long-term involvement and increased downloads, while creative freedom in simulation-adjacent RPG mechanics encourages deeper player investment and community formation. Homegrown studios are increasingly developing culturally relevant adventure games that portray Indian mythology and traditions, attracting international acclaim while demonstrating the viability of domestically produced content. This emergence of indigenous game development talent positions India as both a consumption market and a potential hub for original intellectual property creation targeting global audiences.

Age Group Insights:

- Adult

- Children

Adult dominates the market with a share of 75.19% of the total India gaming market in 2025.

The adult segment's market dominance reflects the demographic composition of India's gaming population, where young adults and working professionals exhibit the highest engagement and spending propensity. This cohort benefits from disposable incomes that enable premium gaming experiences and in-app purchases, combined with growing leisure time dedicated to interactive entertainment. Indian gamers have significantly increased their weekly gaming hours compared to previous years, with adults driving the majority of this engagement as gaming transitions from casual pastime to primary entertainment choice.

The segment is further characterized by willingness to spend on competitive advantages, cosmetic items, and premium content that enhances gameplay experiences. Mid-core games, which appeal predominantly to adult audiences, have experienced substantial year-on-year growth in in-app purchase revenues, significantly outpacing casual and hyper-casual categories. The rising acceptance of gaming as legitimate entertainment among working professionals and first-time earners continues to expand the addressable market. Additionally, the social aspects of multiplayer gaming resonate strongly with adult players seeking community engagement and competitive experiences, further reinforcing the segment's dominant position within India's evolving gaming ecosystem.

Regional Insights:

- South India

- North India

- West & Central India

- East India

North India leads with a 32% share of the total India gaming market in 2025.

North India's market leadership stems from the concentration of population in metropolitan areas including Delhi-NCR, robust digital infrastructure, and the proliferation of gaming cafes and esports venues. The region benefits from high smartphone penetration and internet connectivity that enables seamless online gaming experiences. Educational institutions in the region have also embraced gaming and esports, establishing dedicated programs and hosting inter-college tournaments that cultivate talent and drive youth engagement with competitive gaming.

The region's dominance is reinforced by a young, tech-savvy population with increasing disposable incomes and preference for interactive digital entertainment. Gaming communities and content creators concentrated in North Indian cities drive awareness and adoption among broader audiences through streaming platforms and social media channels. The presence of major gaming companies' regional offices and marketing operations further accelerates market development through localized campaigns and community engagement initiatives. Additionally, the region's well-developed retail infrastructure supports gaming hardware distribution, while numerous esports tournaments and live gaming events hosted in major venues attract participants and spectators from across the country, cementing North India's position as the nation's gaming hub.

Market Dynamics:

Growth Drivers:

Why is the India Gaming Market Growing?

Accelerating Smartphone Penetration and Affordable Data Plans

The exponential growth in smartphone penetration is one of the main factors contributing to the rapid growth of the gaming market in India. Affordable gadgets allow first-time users from every socioeconomic background to gain access to capable gaming hardware, and thus democratize access to interactive entertainment. This is simultaneously aided by telecom companies' competitive pricing, which has brought down data rates to some of the lowest in the world, making long gaming sessions affordable. India has emerged as one of the largest smartphone markets in the world and is expected to continue to grow over the next few years. The spread of 4G and 5G networks, which promise dependable connectivity for graphics-intensive gaming applications, has contributed to a significant surge in monthly data consumption.

Rising Youth Population and Changing Entertainment Preferences

India's demographic dividend, which is typified by a sizable youth population, offers the gaming industry a natural growth engine. Sustained engagement with mobile and online games is being fueled by young adults' growing preference for interactive, on-demand entertainment over traditional media formats. Beyond urban audiences, tier-two and tier-three cities are now included in the cultural normalization of gaming as a respectable pastime. Rising disposable earnings among the growing middle class coincide with this demographic transition. First-time earners are especially enthusiastic about high-end gaming experiences, which increases average revenue per paying user and speeds up market monetization.

Institutional Support and Esports Recognition

Institutional development and investment flows have been accelerated by the government's recognition of gaming and esports as genuine industries. New opportunities for infrastructure development and policy assistance have been made possible by the creation of task groups specifically for animation, visual effects, gaming, and comics, as well as the official recognition of esports as an official sport. To encourage the export of culturally appropriate games and Indian-made technologies, industry associations and gaming platforms have signed memorandums of understanding with government agencies. These initiatives demonstrate the government's dedication to establishing India as a worldwide center for gaming and developing domestic content production skills.

Market Restraints:

What Challenges the India Gaming Market is Facing?

Regulatory Uncertainty and Taxation Pressures

The gaming industry faces significant headwinds from evolving regulatory frameworks and taxation policies. The implementation of 28% GST on full face value of online games has compressed margins for transaction-based gaming platforms, prompting some operators to pause or exit the market. Regulatory uncertainty regarding skill-based versus chance-based game classifications creates operational challenges for developers and publishers seeking long-term investment certainty.

Platform Dependency and Distribution Costs

Gaming companies face substantial cost pressures from app store commissions, with Google service fees ranging from 15-30% on gaming applications. This platform dependency limits profitability and constrains investment in content development. While companies are exploring alternative distribution channels, scale and discoverability remain ongoing challenges that favor established players over emerging studios.

Infrastructure Gaps in Rural Connectivity

Despite significant progress in network expansion, infrastructure gaps persist in rural and remote regions where fiber optic networks and reliable electricity remain inconsistent. These limitations restrict the addressable market for data-intensive online gaming and cloud streaming services. Digital literacy barriers and device affordability constraints in lower-income households further limit adoption potential in underserved geographies.

Competitive Landscape:

Competition in the India gaming market is dynamic, with a mix of established international publishers and emerging domestic studios competing for market share. Large international players have created significant footprint through localised offerings and strategic partnerships with leading telecom operators and digital payment platforms. Domestic companies, on their part, are making gains by developing culturally relevant content that resonates with regional audiences and by leveraging deep understanding of local preferences. Consolidation is underway, with scale-seeking studios pursuing acquisitions in order to build out their content portfolios and distribution capabilities. Investment flows are increasingly directed toward game development studios, esports platforms, and original intellectual property creation, reflecting a structural shift toward sustainable business models.

Recent Developments:

-

In December 2025, Krafton, the South Korean gaming company behind Battlegrounds Mobile India, announced the launch of a USD 670 Million India-focused Unicorn Growth Fund in partnership with Naver and Mirae Asset. The fund will invest in technology companies across gaming, consumer goods, sports, and media sectors, reinforcing Krafton's long-term commitment to India's digital entertainment ecosystem.

-

In January 2025, realme entered into a collaboration with KRAFTON India to become the official alliance partner for BATTLEGROUNDS MOBILE INDIA PRO and BATTLEGROUNDS MOBILE INDIA series for 2025. KRAFTON India announced an ambitious esports roadmap for the first half of 2025.

India Gaming Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenue Types Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Simulation, Others |

| Age Groups Covered | Adult, Children |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India gaming market size was valued at USD 5.91 Billion in 2025.

The India gaming market is expected to grow at a compound annual growth rate of 14.6% from 2026-2034 to reach USD 16.72 Billion by 2034.

Mobiles and tablets dominated the market with a share of 51.46%, driven by widespread smartphone adoption, affordable data plans, and game optimization for mobile platforms across urban and rural geographies.

Key factors driving the India gaming market include accelerating smartphone penetration, affordable 4G/5G data plans, rising youth population with changing entertainment preferences, seamless digital payment infrastructure through UPI, government recognition of esports, and increasing domestic and international investment in gaming infrastructure.

Major challenges include regulatory uncertainty and taxation pressures including 28% GST on game deposits, high platform dependency and app store commission costs, infrastructure gaps in rural connectivity, digital literacy barriers in underserved regions, and evolving compliance requirements under new gaming legislation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)