India Gas Generator Market Size, Share, Trends, and Forecast by Capacity Rating, End-User, and Region, 2025-2033

India Gas Generator Market Overview:

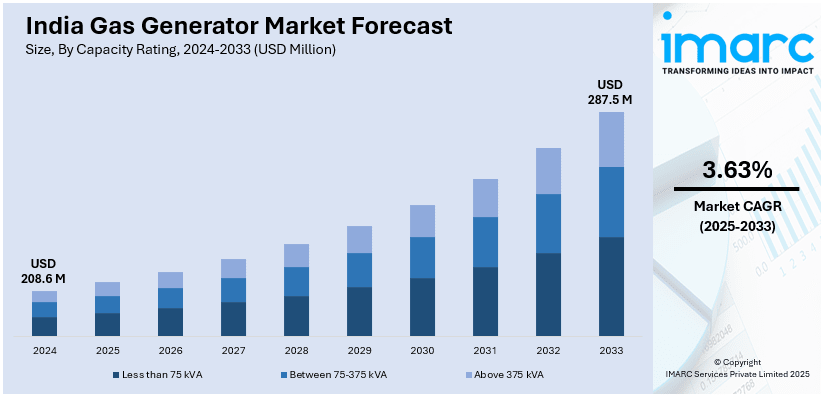

The India gas generator market size reached USD 208.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 287.5 Million by 2033, exhibiting a growth rate (CAGR) of 3.63% during 2025-2033. The market is expanding due to rising industrial demand, clean energy adoption, and grid instability. Additionally, growing investments in natural gas and hydrogen-powered generators are driving innovation. The government policies promoting low-emission alternatives and increasing energy security needs are further shaping the market’s growth trajectory.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 208.6 Million |

| Market Forecast in 2033 | USD 287.5 Million |

| Market Growth Rate 2025-2033 | 3.63% |

India Gas Generator Market Trends:

Rising Demand for Gas Generators in Industrial and Commercial Sectors

The India gas generator market is expanding as industries and commercial establishments seek reliable backup power solutions to address grid instability and power outages. Sectors such as manufacturing, healthcare, data centers, and telecom are driving demand for natural gas and biogas-powered generators due to their lower emissions and operational efficiency compared to diesel alternatives. For instance, as per industry reports, the power plants in India imported approximately 9.58 Million metric standard cubic meters per day (MMSCMD) of gas between April 2024 to January 2025, supporting energy needs and improving the efficiency of gas-based power generation. With industrial expansion and infrastructure projects increasing across urban and semi-urban areas, businesses are adopting gas generators to ensure uninterrupted operations. Additionally, hospitals and pharmaceutical plants require continuous power supply for critical processes, further boosting demand. The Make in India initiative is also supporting local manufacturing of gas-powered gensets, reducing dependency on imports. Furthermore, with companies focusing on energy security and sustainability, gas generator manufacturers are offering high-efficiency, low-maintenance solutions tailored for industrial and commercial applications, making them a preferred choice in the evolving power backup market.

To get more information on this market, Request Sample

Shift Towards Cleaner Energy Solutions and Biogas Generators

As India accelerates its transition towards clean energy, the gas generator market is witnessing a growing shift from diesel to natural gas and biogas-powered gensets. Stricter emission norms, rising fuel prices, and government incentives for renewable energy adoption are encouraging industries and commercial users to invest in low-emission gas generators. For instance, in June 2024, the World Bank announced an approval of USD 1.5 Billion in financing to support India's low-carbon transition, promoting the development of green hydrogen and renewable energy projects. This investment is expected to stimulate finance for low-carbon energy solutions, including advancements in low-emission gas generator technologies. Biogas generators, in particular, are gaining traction in agriculture, food processing, and waste management sectors, where organic waste is converted into sustainable power sources. Furthermore, industries looking to reduce carbon footprints and operational costs are increasingly opting for biogas and LPG generators, which offer higher fuel efficiency and compliance with emission standards. As sustainability goals become a priority, gas generator manufacturers are focusing on advanced combustion technologies and hybrid systems to support India’s decarbonization efforts.

India Gas Generator Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on capacity rating and end-user.

Capacity Rating Insights:

- Less than 75 kVA

- Between 75-375 kVA

- Above 375 kVA

The report has provided a detailed breakup and analysis of the market based on the capacity rating. This includes less than 75 kVA, between 75-375 kVA, and above 375 kVA.

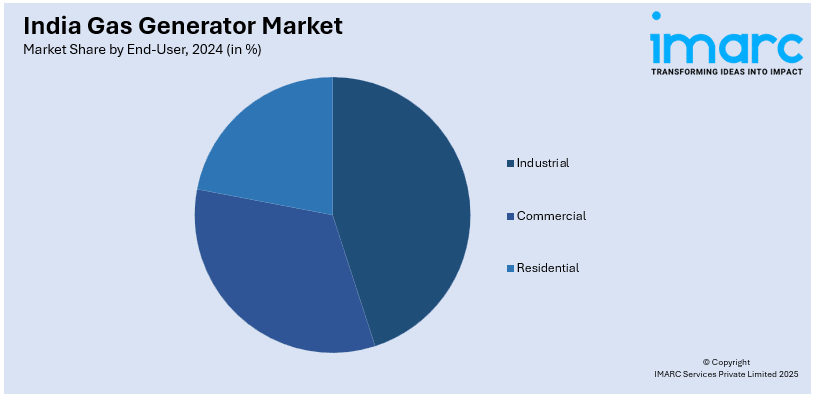

End-User Insights:

- Industrial

- Commercial

- Residential

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes industrial, commercial, and residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Gas Generator Market News:

- In December 2024, Greenzo Energy India Ltd (GEIL) announced collaboration with France's EODev to launch Toyota-powered hydrogen fuel cell generators in India and Nepal. These emission-free systems aim to substitute diesel units, supporting India’s renewable energy transition and efforts to decrease reliance on fossil fuels.

- In February 2025, GAIL (India) Limited and Cummins Inc. announced a Memorandum of Understanding to collaborate on hydrogen production, integration, distribution, and storage. This partnership utilizes GAIL’s vast gas network and Cummins’ proficiency in sustainable energy innovations, striving to accelerate India’s shift toward cleaner energy sources.

India Gas Generator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Capacity Ratings Covered | Less than 75 kVA, Between 75-375 kVA, Above 375 kVA |

| End-Users Covered | Industrial, Commercial, Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India gas generator market performed so far and how will it perform in the coming years?

- What is the breakup of the India gas generator market on the basis of capacity rating?

- What is the breakup of the India gas generator market on the basis of end-user?

- What is the breakup of the India gas generator market on the basis of region?

- What are the various stages in the value chain of the India gas generator market?

- What are the key driving factors and challenges in the India gas generator?

- What is the structure of the India gas generator market and who are the key players?

- What is the degree of competition in the India gas generator market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India gas generator market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India gas generator market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India gas generator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)