India Gear Market Size, Share, Trends and Forecast by Gear Type, End User Industry, and Region, 2025-2033

India Gear Market Overview:

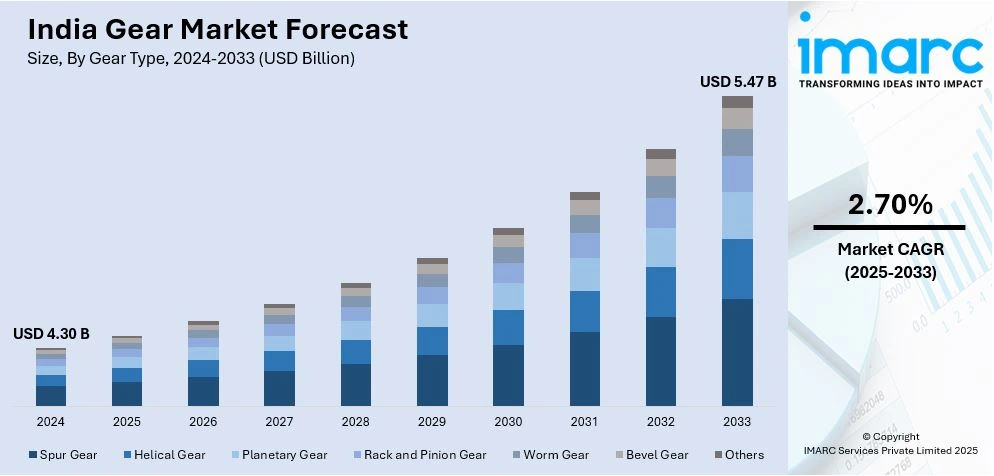

The India gear market size reached USD 4.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.47 Billion by 2033, exhibiting a growth rate (CAGR) of 2.70% during 2025-2033. The market is driven by industrial growth, increasing automation, and amplifying demand for high-performance transmission solutions in various industries, with improvements in material technology and precision engineering further improving efficiency and durability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.30 Billion |

| Market Forecast in 2033 | USD 5.47 Billion |

| Market Growth Rate 2025-2033 | 2.70% |

India Gear Market Trends:

Rising Demand for Smart and Connected Gear

The India gear market is under the grip of a dramatic paradigm shift towards connected and smart gear systems due to technological progress in digitalization, automation, and sensorization. Automotive, industrial machinery, and manufacturing industries are highly adopting smart gear solutions equipped with Internet of Things (IoT) driven sensors, real-time monitoring facilities, and prediction-based maintenance services. Furthermore, such improved systems optimize functional efficiency by providing better performance, reducing downtime, and ensuring safer operations. With the increasing uptake of Industry 4.0 and intelligent manufacturing practices, the need for gear systems that can easily share data with digital control networks increases every day. Remote monitoring of performance parameters and making analytical changes guarantees improved accuracy, dependability, and durability. With industries focusing more and more on efficiency and automation, smart gear technologies are likely to be at the forefront of industrial transformation, innovation, and development of high-performance mechanical systems in India's vibrant market.

To get more information on this market, Request Sample

Increased Preference for Lightweight and High-Performance Materials

India gearing industry is finding mounting demand for lightweight and high-performance materials in a bid for greater efficiency, longer lifespan, and sustainability across industries. Heavy metal gears are increasingly being found to be supplanted by enhanced materials like high-strength alloys, carbon fiber-reinforced composites, and engineered polymers. Such materials provide high strength-to-weight ratios, elevated heat resistance, and reduced friction, resulting in amplified energy efficiency and lessened wear. The automobile and aviation industries, in turn, are spearheading this movement as they value fuel efficiency and improved mechanical performance. Industrial uses also gain from these developments as they are able to carry higher loads with reduced material usage. For example, in December 2023, Mill Gears Pvt. Ltd. commissioned one of the world's biggest three-stage inline planetary gearboxes for the sugar industry, ensuring efficiency and longevity at Jarandeshwar Sugar Mill in Maharashtra. Moreover, the shift to high-performance materials also fits in with sustainability programs as light materials help reduce energy usage and minimize environmental footprint. With continuous progress in material technology and precision engineering, the use of lightweight and high-performance gear materials is likely to gain speed, determining the destiny of India's gear manufacturing sector.

Growth in Demand for Customized and Application-Specific Gear Systems

The India gear industry is witnessing a significant boost in demand for application-specific and bespoke gear systems that respond to the growing demand for precision-engineered solutions that match various industrial requirements. Standardized gear solutions are being replaced increasingly by highly specialized gear systems specifically intended for application in specific torque, speed, and load applications. For instance, in June 2024, Schaeffler India rolled out a planetary gear system (PGS) from its Hosur Plant for dedicated hybrid transmissions (DHT), which optimizes power, efficiency, and performance in hybrid cars. Moreover, industries like robotics, electric vehicles, and industrial automation are leading the way in this trend, where gears need better performance, lesser noise, and better energy efficiency. Improved manufacturing technologies like CNC machining, 3D printing, and CAD have made highly accurate and reliable custom gears a reality. Customization ensures the best performance, longer working lifespan, and increased flexibility to adjust to changing industry demands. As producers make intensifying investments in research and development, the need for application-specific gear systems will rise, fueling innovation and making processes more efficient in various industrial sectors in India.

India Gear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on gear type and end user industry.

Gear Type Insights:

- Spur Gear

- Helical Gear

- Planetary Gear

- Rack and Pinion Gear

- Worm Gear

- Bevel Gear

- Others

The report has provided a detailed breakup and analysis of the market based on the gear type. This includes spur gear, helical gear, planetary gear, rack and pinion gear, worm gear, bevel gear, and others.

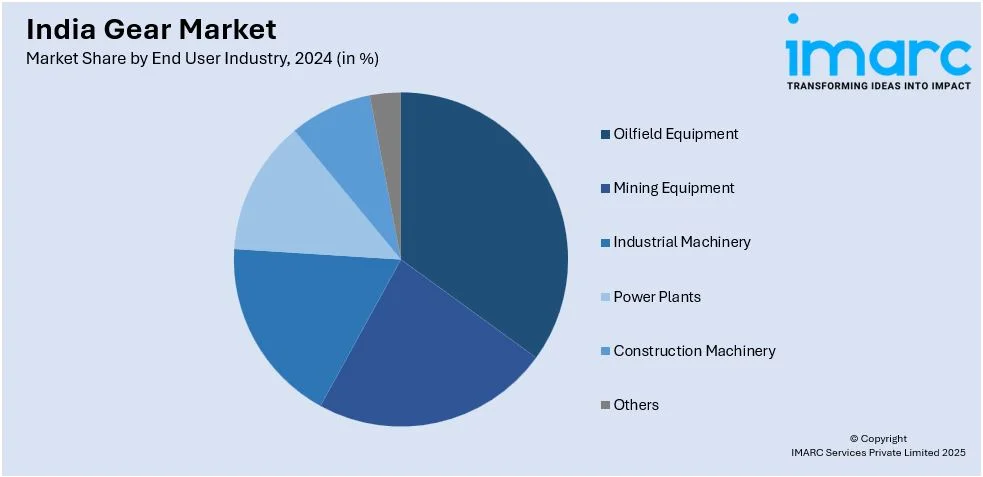

End User Industry Insights:

- Oilfield Equipment

- Mining Equipment

- Industrial Machinery

- Power Plants

- Construction Machinery

- Others

A detailed breakup and analysis of the market based on the end user industry have also been provided in the report. This includes oilfield equipment, mining equipment, industrial machinery, power plants, construction machinery, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Gear Market News:

- In April 2024, RENK Group is growing its footprint in India with a new 7,000 sqm facility in Tamil Nadu's Defense Industrial Corridor. The factory will produce gearboxes, transmissions, couplings, and power-packs for military and industrial use, further enhancing RENK's market position and local production capabilities in the region.

India Gear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Gear Types Covered | Spur Gear, Helical Gear, Planetary Gear, Rack and Pinion Gear, Worm Gear, Bevel Gear, Others |

| End User Industries Covered | Oilfield Equipment, Mining Equipment, Industrial Machinery, Power Plants, Construction Machinery, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India gear market performed so far and how will it perform in the coming years?

- What is the breakup of the India gear market on the basis of gear type?

- What is the breakup of the India gear market on the basis of end user industry?

- What is the breakup of the India gear market on the basis of region?

- What are the various stages in the value chain of the India gear market?

- What are the key driving factors and challenges in the India gear?

- What is the structure of the India gear market and who are the key players?

- What is the degree of competition in the India gear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India gear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India gear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India gear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)