India Gearbox Market Size, Share, Trends and Forecast by Type, Gear Type, End User and Region, 2025-2033

India Gearbox Market Size and Share:

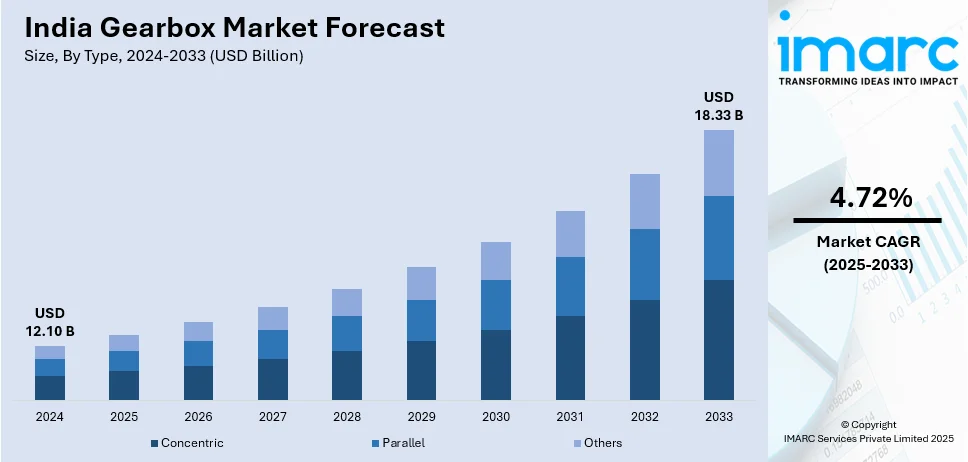

The India gearbox market size reached USD 12.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 18.33 Billion by 2033, exhibiting a growth rate (CAGR) of 4.72% during 2025-2033. The market is fueled by speedy industrialization, growing need for energy-saving systems, and expansion in the automotive and manufacturing industries. Additionally, advancements in technology, like robotics and automation, and government policies encouraging the development of infrastructure contribute to the India gearbox market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.10 Billion |

| Market Forecast in 2033 | USD 18.33 Billion |

| Market Growth Rate 2025-2033 | 4.72% |

India Gearbox Market Trends:

Adoption of Electric Vehicles (EVs) and Hybrid Systems

The increasing use of electric vehicles (EVs) and hybrid systems across the country is heavily impacting the India gearbox market growth. Conventional internal combustion engine (ICE) vehicles need sophisticated gearboxes to ensure efficient performance, while electric vehicles tend to utilize simple transmission systems or single-speed gearboxes. Yet, hybrid vehicles, which integrate electric and ICE systems, need specialized gearboxes to achieve maximum energy transfer between the two power sources. As the Indian government speeds up efforts to get cleaner, greener cars with incentives and policies such as the FAME scheme (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles), the need for gearboxes adapted to EVs and hybrids will rise. This trend offers gearbox manufacturers the opportunity to innovate and design new transmission systems while propelling the adoption of energy-efficient and performance-improving technologies in the auto industry.

To get more information on this market, Request Sample

Focus on Automation and Industrial Gearboxes

As India's industrial economy grows, with special emphasis on the manufacturing industry, automation is an emerging trend providing a positive impact on the India gearbox market outlook. Automatic systems are finding acceptance in various industries like conveyors, pumps, crushers, and machinery of cement, mining, and steel. This needs gearboxes to be more specialized and robust and ready to function under high loads and high speed. Manufacturers are emphasizing the production of industrial gearboxes with enhanced efficiency, durability, and accuracy, meeting the changing demands of automated production lines. According to the IMARC Group, the India industrial gearboxes market size reached USD 1.02 Billion in 2024 and is further expected to reach USD 1.46 Billion by 2033. Moreover, the advent of Industry 4.0, which incorporates intelligent sensors and IoT technologies in equipment, further increases the demand for gearboxes that can facilitate real-time monitoring and remote diagnostics. This trend makes sure that gearboxes are becoming intelligent and energy-efficient, in accordance with the current industrial revolution in India.

Growth in Renewable Energy Sector

The growth of India's renewable energy industry, especially in wind and solar power, is fueling the need for specialized gearboxes. As per the industry reports, India possesses significant potential for renewable energy generation, which reached 21,09,655 megawatts (as of March 2024), and the nation is witnessing consistent and robust growth in both energy supply and usage. According to the Ministry of Statistics and Programme Implementation, the capacity for generating energy from wind power held the largest portion at 11,63,856 megawatts (approximately 55%), followed by solar energy at 7,48,990 megawatts and large hydro at 1,33,410 megawatts. Wind turbines, a major part of India's renewable energy plan, use high-performance gearboxes to harness wind energy and convert it into electricity. The gearboxes must be able to handle extreme environmental conditions, necessitating greater durability and reliability. As India targets ambitious renewable energy goals, the market for wind turbine gearboxes is expanding at a very fast rate. Solar power generation systems also need gearboxes in tracking systems to position solar panels to maximize energy capture. Manufacturers are addressing these requirements by creating customized solutions with improved efficiency, performance in harsh conditions, and extended life cycles. This trend places the gearbox market at the center of India's energy transition as a major enabler, in support of India's pledge for sustainable energy production.

India Gearbox Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, gear type, and end user.

Type Insights:

- Concentric

- Parallel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes concentric, parallel, and others.

Gear Type Insights:

- Spur Gear

- Worm Gear

- Bevel Gear

- Helical Gear

- Others

The report has provided a detailed breakup and analysis of the market based on the gear type. This includes spur gear, worm gear, bevel gear, helical gear, and others.

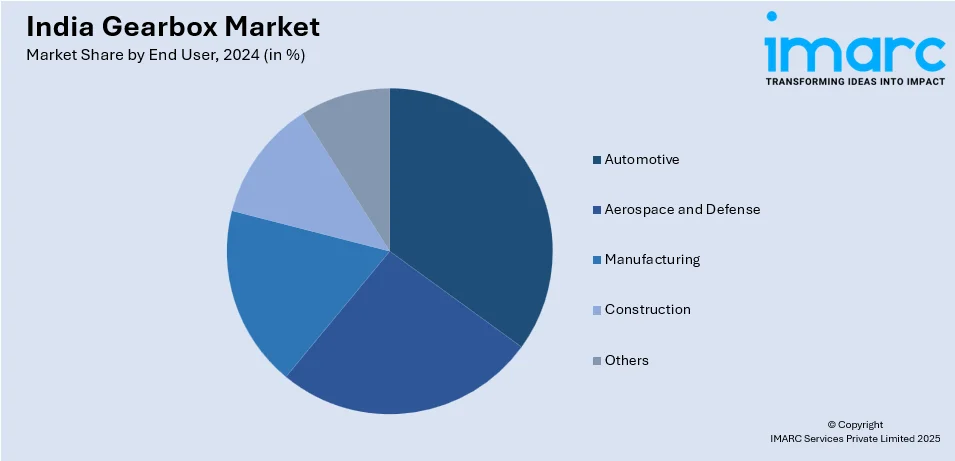

End User Insights:

- Automotive

- Aerospace and Defense

- Manufacturing

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes automotive, aerospace and defense, manufacturing, construction, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Gearbox Market News:

- In March 2023, Elecon Engineering Company Limited (Elecon), a leading manufacturer of industrial gears in Asia, introduced its enhanced EON series gearboxes, equipped with numerous advanced features, during a celebratory event at The Oberoi, Gurugram. The event witnessed eager involvement from clients, stakeholders, the distribution network, and customers.

- In October 2024, Bonfiglioli Transmissions Pvt Ltd, the Indian arm of the Italy-based Bonfiglioli Group and a worldwide supplier of power transmission and drive solutions, declared it is investing ₹320 crore to enhance its operations in India.

India Gearbox Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Concentric, Parallel, Others |

| Gear Types Covered | Spur Gear, Worm Gear, Bevel Gear, Helical Gear, Others |

| End Users Covered | Automotive, Aerospace and Defense, Manufacturing, Construction, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India gearbox market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India gearbox market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India gearbox industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India gearbox market size reached USD 12.10 Billion in 2024.

The India gearbox market is expected to reach USD 18.33 Billion by 2033, exhibiting a CAGR of 4.72% during 2025-2033.

Market growth is driven by rising industrial automation, increasing demand from automotive and manufacturing sectors, technological advancements in gearbox design, and expanding infrastructure development across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)