India Generic Drug Manufacturing Market Size, Share, Trends and Forecast by Drug Type, Therapeutic Area, Dosage Form, Manufacturing Type, Distribution Channel, End User, and Region, 2025-2033

India Generic Drug Manufacturing Market Overview:

The India generic drug manufacturing market size reached USD 28.07 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 51.61 Billion by 2033, exhibiting a growth rate (CAGR) of 7.00% during 2025-2033. The market is driven by cost-effective production, government incentives like the PLI scheme, and rising global demand for affordable medicines. Increasing regulatory compliance, domestic API production, and strong contract manufacturing partnerships further boost growth. Expanding exports to regulated markets strengthens India’s role as a key pharmaceutical supplier.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 28.07 Billion |

| Market Forecast in 2033 | USD 51.61 Billion |

| Market Growth Rate 2025-2033 | 7.00% |

India Generic Drug Manufacturing Market Trends:

Focus on Regulatory Compliance and Quality Standards

With increasing scrutiny from global regulatory bodies such as the US FDA, EMA, and WHO, Indian generic drug manufacturers are prioritizing stringent quality control measures. Several companies are enhancing their compliance frameworks, investing in advanced analytical technologies, and improving Good Manufacturing Practices (GMP) to meet evolving regulatory expectations. Since import bans and warning letters from regulatory bodies have historically resulted from noncompliance, this change is essential. Businesses are implementing more staff training, automated data management systems, and artificial intelligence (AI) for quality monitoring in order to reduce risks. Strengthening regulatory adherence not only ensures seamless exports to highly regulated markets but also enhances India’s reputation as a trusted supplier of high-quality, affordable medicines worldwide.

.webp)

To get more information on this market, Request Sample

Expansion of Domestic Production Capabilities

India’s generic drug manufacturing sector is expanding rapidly, supplying 20% of global generic exports and meeting 40% of the U.S. generic drug demand. Rising global demand for affordable medicines is driving pharmaceutical companies to invest in infrastructure upgrades, enhanced manufacturing efficiency, and regulatory compliance. Government initiatives, including the Production Linked Incentive (PLI) scheme, are boosting domestic Active pharmaceutical ingredient (API) production, reducing import dependence, particularly on China. Manufacturers are also adopting backward integration strategies to strengthen supply chains. The development of pharmaceutical clusters and advanced manufacturing hubs is improving economies of scale, cutting costs, and ensuring supply resilience. These advancements reinforce India’s position as a global leader in generic drug exports, catering to both regulated and emerging markets with high-quality, cost-effective medicines.

Growth in Contract Manufacturing and Partnerships

The growth of contract manufacturing and strategic alliances is transforming India's generic pharmaceutical market. Multinational drug firms are increasingly outsourcing production to Indian drug makers because of cost benefits and regulatory know-how. Contract Development and Manufacturing Organizations (CDMOs) are at the forefront of this movement, providing complete services from drug formulation to commercialization. Collaborations with Indian companies and multinational pharma majors facilitate access to new markets, technology transfer, and greater economies of scale. As biotech corporations and domestic businesses collaborate to expand into complicated generics, biosimilars, and specialty pharmaceuticals, India is becoming the preferred location for high-value drug production in the global value chain.

India Generic Drug Manufacturing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on drug type, therapeutic area, dosage form, manufacturing type, distribution channel, and end user.

Drug Type Insights:

- Simple Generic Drugs

- Super Generic Drugs

- Biosimilars

The report has provided a detailed breakup and analysis of the market based on the drug type. This includes simple generic drugs, super generic drugs, and biosimilars.

Therapeutic Area Insights:

- Cardiovascular Diseases

- Diabetes and Metabolic Disorders

- Oncology

- Neurology (CNS Disorders)

- Infectious Diseases

- Antibiotics

- Antivirals

- Respiratory Disorders

- Gastrointestinal Disorders

- Dermatology

- Pain Management

A detailed breakup and analysis of the market based on the therapeutic area have also been provided in the report. This includes cardiovascular diseases, diabetes and metabolic disorders, oncology, neurology (CNS disorders), infectious diseases (antibiotics and antivirals), respiratory disorders, gastrointestinal disorders, dermatology, and pain management.

Dosage Form Insights:

- Tablets and Capsules

- Injectables

- Topical

- Liquid Orals and Syrups

- Inhalers and Nasal Sprays

The report has provided a detailed breakup and analysis of the market based on the dosage form. This includes tablets and capsules, injectables, topical, liquid orals and syrups, and inhalers and nasal sprays.

Manufacturing Type Insights:

- Contract Manufacturing Organizations (CMOs)

- In-House Manufacturing

A detailed breakup and analysis of the market based on the manufacturing type have also been provided in the report. This includes contract manufacturing organizations (CMOS) and in-house manufacturing.

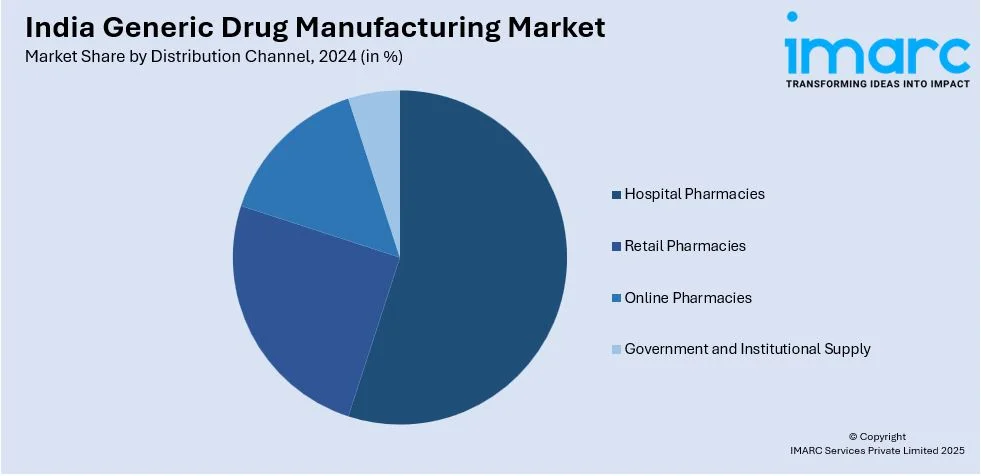

Distribution Channel Insights:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Government and Institutional Supply

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hospital pharmacies, retail pharmacies, online pharmacies, and government and institutional supply.

End User Insights:

- Hospitals and Clinics

- Diagnostic and Specialty Centers

- Individual Consumers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, diagnostic and specialty centers, and individual consumers.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Generic Drug Manufacturing Market News:

- In March 2025, Dr. Reddy’s Laboratories’ MD GV Prasad stated that large mergers and acquisitions in India’s pharmaceutical sector are unlikely in the near future due to market uncertainties. Instead, the company is diversifying its portfolio, investing in branded generics and expanding into consumer health. With ₹28,000 crore revenue in FY24, Dr. Reddy’s is also exploring opportunities in obesity treatment, addressing emerging healthcare challenges in India.

- In January 2025, The Indian government is accelerating the expansion of Jan Aushadhi Kendras, opening one every two hours to enhance access to affordable generic medicines. These stores source drugs from WHO-certified Indian manufacturers adhering to Good Manufacturing Practices (GMP). The initiative aims to ensure widespread availability of quality medicines, with the expansion drive set to continue until 2027, strengthening India’s commitment to affordable healthcare.

India Generic Drug Manufacturing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Types Covered | Simple Generic Drugs, Super Generic Drugs, Biosimilars |

| Therapeutic Areas Covered |

|

| Dosage Forms Covered | Tablets and Capsules, Injectables, Topical, Liquid Orals and Syrups, Inhalers and Nasal Sprays |

| Manufacturing Types Covered | Contract Manufacturing Organizations (CMOs), In-House Manufacturing |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Government and Institutional Supply |

| End Users Covered | Hospitals and Clinics, Diagnostic and Specialty Centers, Individual Consumers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India generic drug manufacturing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India generic drug manufacturing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India generic drug manufacturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The generic drug manufacturing market in India was valued at USD 28.07 Billion in 2024.

The generic drug manufacturing market in India is projected to exhibit a (CAGR) of 7.00% during 2025-2033, reaching a value of USD 51.61 Billion by 2033.

India's generic pharmaceutical manufacturing industry is expanding as a result of cheap production, qualified manpower, and encouraging regulatory processes. India is a world supplier of active pharmaceutical ingredients (APIs) and cheap drugs. Rising prevalence of chronic illnesses, government health programs, and export demand for generics are persistently strengthening the pharmaceutical manufacturing capabilities of India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)