India Generic Drugs Market Size, Share, Trends and Forecast by Therapy Area, Drug Delivery, Distribution Channel, and Region, 2025-2033

India Generic Drugs Market Size and Share:

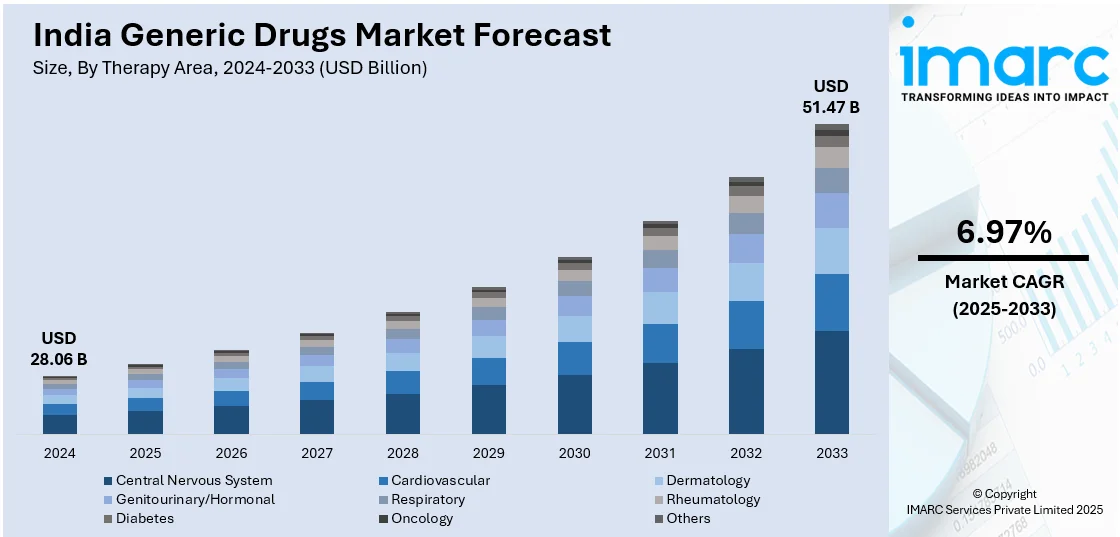

The India generic drugs market size reached USD 28.06 Billion in 2024. The market is expected to reach USD 51.47 Billion by 2033, exhibiting a growth rate (CAGR) of 6.97% during 2025-2033. The market growth is attributed to a strong pharmaceutical manufacturing base, government initiatives like the PLI scheme to boost domestic API production, rising healthcare demand, cost-effective drug production, growing exports, and an increasing prevalence of chronic diseases.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of therapy area, the market has been divided into central nervous system, cardiovascular, dermatology, genitourinary/hormonal, respiratory, rheumatology, diabetes, oncology, and others.

- On the basis of drug delivery, the market has been divided into oral, injectables, dermal/topical, and inhalers.

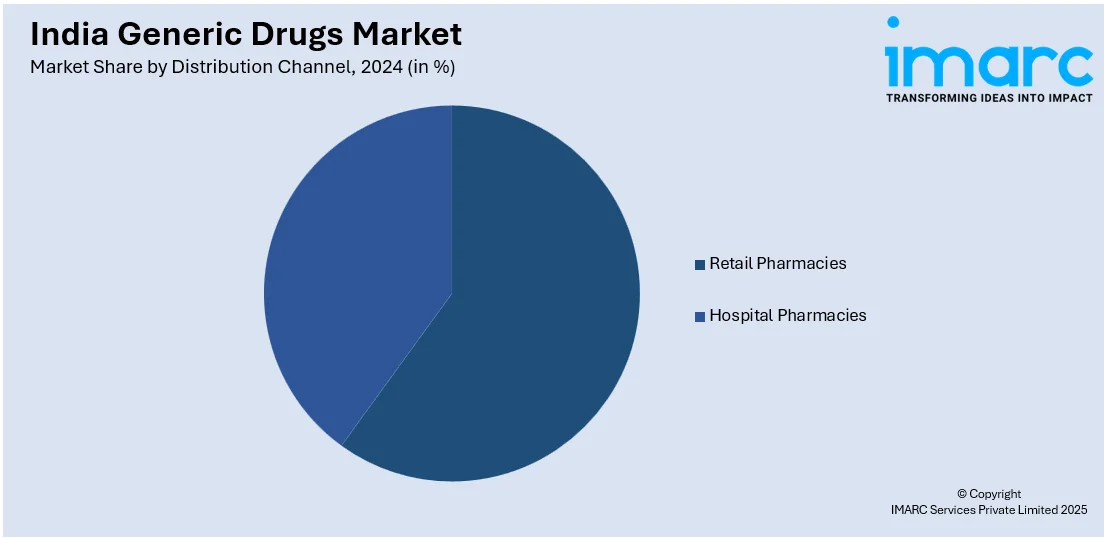

- On the basis of distribution channel, the market has been divided into retail pharmacies and hospital pharmacies.

Market Size and Forecast:

- 2024 Market Size: USD 28.06 Billion

- 2033 Projected Market Size: USD 51.47 Billion

- CAGR (2025-2033): 6.97%

India Generic Drugs Market Trends:

Robust Pharmaceutical Manufacturing Infrastructure

India's pharma sector has a well-developed and large manufacturing base, making it a central force in the international generic medicines market. The nation has a wide network of over 10,000 drug manufacturing facilities and over 3,000 pharmaceutical firms. The well-established industrial base facilitates mass production of generic drugs, providing a stable and affordable supply to domestic and foreign markets. One of the high points of such infrastructure is having many plants based on international standards of regulation. India boasts of having the second-largest number of U.S. FDA-approved manufacturing plants outside of the United States, which points to its concern for keeping rigorous quality checks in place and holding up to world standards. It not only opens up the availability of generic medicines for export purposes but also contributes to the growing credibility of Indian pharmaceuticals internationally. Access to a talented human resource pool still enhances India's manufacturing capacity further. The nation graduates many science and engineering professionals every year, which gives a consistent supply of talent to the pharmaceutical industry. This talent plays a key role in ensuring the efficient functioning of production units, research and development efforts, and regular process improvement for production. Another factor for the success of generic drugs was that the cost of production was low in India. This aspect, coupled with economies of scale, makes the Indian producers develop high-quality drugs at a minimal price. Their affordability has thus been a prominent reason for the widespread usage of generic drugs, primarily in developing nations where healthcare expenditures are minimal.

To get more information on this market, Request Sample

Supportive Government Policies and Initiatives

The active policies and efforts of the Indian government have been instrumental in developing the generic drugs market. Seeing the potential of the pharmaceutical industry, the government has put in place steps to encourage local production, research and development, and export of generic drugs. One such initiative is the 'Pharma Vision 2020,' whose purpose is to position India as a world leader in end-to-end drug manufacturing. This vision includes several strategies, ranging from infrastructure development, regulatory reforms, and financial incentives, to support the development of the pharmaceutical sector. The government's dedication to this vision has provided a favorable environment for the growth of pharmaceutical companies. The formation of the Pharmaceuticals Export Promotion Council (Pharmexcil) has been a crucial step in aiding generic drug export. Pharmexcil offers support in the form of guidance, funds, and market information to Indian pharmaceutical companies so that they can successfully access global markets. This has resulted in the escalating exports of Indian pharmaceuticals with generic drugs constituting a high percentage of such exports. The government has also concentrated on enhancing healthcare accessibility through schemes such as the Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP). The program has provided quality generic drugs at lower costs to ordinary citizens through a network of dedicated retail shops named Janaushadhi Kendras. Over 7,500 Janaushadhi Kendras were functional in the nation as of March 2021, increasing the access and acceptability of generic drugs among citizens. Apart from this, the reform of Goods and Services Tax (GST) has streamlined the taxation system and reduced the tax burden on pharmaceutical goods. The supply chain has become easier and reduced the cost of generic drugs both for the consumer and manufacturer following the reform.

Rising Prevalence of Chronic Diseases and Aging Population

The increasing burden of chronic diseases across India is significantly driving demand for affordable generic medications and creating a positive India generic drugs market outlook. With lifestyle changes, urbanization, and dietary shifts, conditions such as diabetes, cardiovascular diseases, hypertension, and cancer are becoming more prevalent among the Indian population. The aging demographic further amplifies the rising need for long-term medication management. Generic drugs offer a cost-effective solution for patients requiring continuous treatment, as they provide the same therapeutic efficacy as branded medications at significantly lower prices. This trend is particularly important in a price-sensitive market such as India, where out-of-pocket healthcare expenditure remains high. The India generic drugs market forecast indicates sustained growth driven by this demographic shift and disease burden. Healthcare providers and government initiatives increasingly recommend generic alternatives to ensure wider accessibility to essential medications. The rising awareness among healthcare professionals and patients about the bioequivalence and safety of generic drugs has contributed to their greater acceptance and adoption across various therapeutic areas.

Technological Advancements and Digital Healthcare Integration

The integration of advanced technologies and digital healthcare solutions, such as AI, ML, and IoT is transforming the landscape of the generic drugs market in India. Pharmaceutical companies are increasingly adopting artificial intelligence, machine learning, and data analytics to optimize drug development processes, enhance quality control, and improve supply chain efficiency. Digital platforms are revolutionizing drug distribution, with e-pharmacy services gaining significant traction, especially post-COVID-19. These platforms enable better reach to remote areas and provide convenient access to generic medications. Telemedicine integration has also boosted generic drug prescriptions, as healthcare providers can remotely monitor patients and prescribe cost-effective generic alternatives. Advanced manufacturing technologies, including continuous manufacturing and process analytical technology, are helping Indian pharmaceutical companies improve production efficiency while maintaining quality standards, as per the India generic drugs market analysis. The adoption of blockchain technology for supply chain transparency and anti-counterfeiting measures is enhancing consumer confidence in generic drugs. Furthermore, mobile health applications and digital health monitoring devices are creating new opportunities for personalized medicine and improving medication adherence, thereby supporting the sustained growth of the generic drugs market.

Focus on Research and Development and Biosimilars

Indian pharmaceutical companies are increasingly investing in research and development to develop complex generic formulations and biosimilar products, positioning the country as a global hub for innovative generic drug manufacturing. The India generic drugs market research report reveals a strategic shift towards high-value, complex generics including injectables, oncology drugs, and specialty formulations that offer better profit margins and reduced competition. The biosimilars segment is experiencing remarkable growth, with Indian companies successfully developing and launching biosimilar versions of expensive biologic drugs for cancer, autoimmune diseases, and other chronic conditions. This focus on R&D is supported by favorable regulatory frameworks, including expedited approval processes for biosimilars and complex generics. Collaborations between Indian companies and international pharmaceutical giants are facilitating technology transfer and enhancing capabilities in developing sophisticated drug delivery systems. The emphasis on quality by design (QbD) principles and continuous manufacturing is enabling Indian manufacturers to meet stringent regulatory requirements of developed markets. Investment in state-of-the-art research facilities and hiring of skilled scientists is further strengthening India's position in the global generic drugs landscape, contributing to both domestic healthcare accessibility and export competitiveness.

Growth, Opportunities, and Challenges in the India Generic Drugs Market:

- Growth Drivers of the India generic drugs market: The market is primarily driven by robust pharmaceutical manufacturing infrastructure with over 10,000 facilities and strong government support through PLI schemes. Rising healthcare awareness and increasing prevalence of chronic diseases are creating sustained demand for affordable generic medications. Cost advantages and established export capabilities position India as a global leader in generic drug manufacturing.

- Opportunities in the India generic drugs market: Significant opportunities exist in biosimilars development and complex generic formulations that offer higher profit margins and reduced competition. Digital healthcare integration and e-pharmacy platforms present new distribution channels, particularly for rural market penetration. International market expansion through strategic partnerships and regulatory approvals in developed countries offers substantial growth potential.

- Challenges in the India generic drugs market: Intense price competition and margin pressures from both domestic and international players pose significant challenges to profitability. Stringent regulatory requirements in export markets demand continuous investment in quality infrastructure and compliance systems. Supply chain disruptions and raw material dependency on imports create operational risks and cost volatility.

India Generic Drugs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on therapy area, drug delivery, and distribution channel.

Therapy Area Insights:

- Central Nervous System

- Cardiovascular

- Dermatology

- Genitourinary/Hormonal

- Respiratory

- Rheumatology

- Diabetes

- Oncology

- Others

The report has provided a detailed breakup and analysis of the market based on the therapy area. This includes central nervous system, cardiovascular, dermatology, genitourinary/hormonal, respiratory, rheumatology, diabetes, oncology, and others.

Drug Delivery Insights:

- Oral

- Injectables

- Dermal/Topical

- Inhalers

A detailed breakup and analysis of the market based on the drug delivery have also been provided in the report. This includes oral, injectables, dermal/topical, and inhalers.

Distribution Channel Insights:

- Retail Pharmacies

- Hospital Pharmacies

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes retail pharmacies and hospital pharmacies.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Generic Drugs Market News:

- July 2025: Biocon announced plans to launch generic Wegovy (semaglutide) for obesity treatment in India and Canada within the next two years. The company aims to tap into the growing USD 150 Billion global obesity drug market, with filings expected by late 2026 or early 2027.

- March 2025: Alkem Laboratories launched generic empagliflozin and its combinations in India under the brand name Empanorm, offering prices approximately 80% lower than innovator products. This move targets the treatment of type-2 diabetes, chronic kidney disease, and chronic heart failure, with a focus on accessibility and patient convenience.

- November 2024: Aurobindo Pharma's US-based subsidiary entered into an agreement with a multinational pharma company for developing and selling respiratory products through a cost-sharing arrangement of USD 90 Million. The agreement comprises an upfront payment of USD 25 Million and has the objective of increasing its presence globally. The partnership enhances the Indian market of generic drugs through rising international alliances, improved capabilities in drug development, and greater exports.

- March 2024: The Indian government announced 27 Greenfield Bulk Drug Park projects and 13 new medical device manufacturing facilities under the PLI scheme to increase local production. It is an attempt to cut the dependence on foreign APIs and promote the country's pharmaceutical industry. By providing a stable supply of raw materials, it facilitates India generic drugs market growth through growing affordability and global competitiveness.

India Generic Drugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Therapy Areas Covered | Central Nervous System, Cardiovascular, Dermatology, Genitourinary/Hormonal, Respiratory, Rheumatology, Diabetes, Oncology, Others |

| Drug Deliveries Covered | Oral, Injectables, Dermal/Topical, Inhalers |

| Distribution Channels Covered | Retail Pharmacies, Hospital Pharmacies |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India generic drugs market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India generic drugs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India generic drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The generic drugs market in India was valued at USD 28.06 Billion in 2024.

The India generic drugs market is projected to exhibit a CAGR of 6.97% during 2025-2033, reaching a value of USD 51.47 Billion by 2033.

As the burden of chronic and lifestyle-related diseases continues to grow, there is a greater need for cost-effective treatment options, which generic drugs provide. India's large population and expanding healthcare coverage under government schemes are also boosting the utilization of generics. The country’s well-established pharmaceutical industry, supported by skilled professionals and advanced manufacturing infrastructure, is enabling mass production of high-quality generics at low costs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)