India Genetic Testing Market Size, Share, Trends and Forecast by Type, Technology, Application, and Region, 2025-2033

India Genetic Testing Market Size and Share:

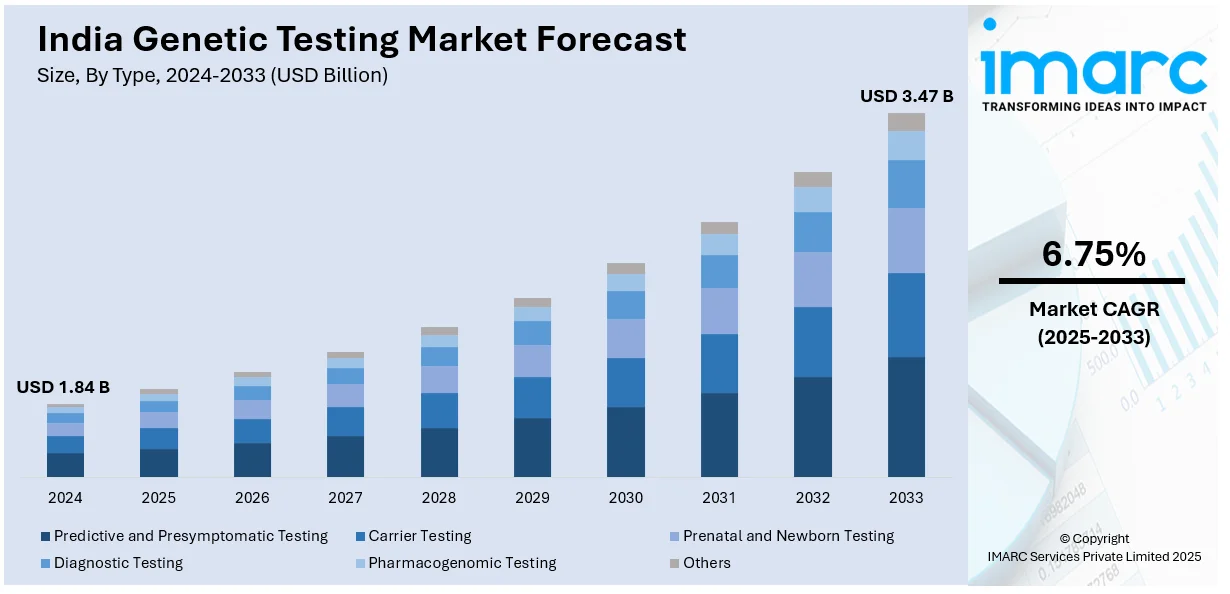

The India genetic testing market size was valued at USD 1.84 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.47 Billion by 2033, exhibiting a CAGR of 6.75% from 2025-2033. The growth is propelled by speedy developments in genetic testing technology, higher incidences of hereditary and uncommon conditions, and growing awareness of early disease identification. Government-initiated genome sequencing projects and the use of genetic findings in personalized medicine also stimulate demand. Increasing clinical applications and better accessibility are major contributors to growth, favorably influencing the India genetic testing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.84 Billion |

| Market Forecast in 2033 | USD 3.47 Billion |

| Market Growth Rate (2025-2033) | 6.75% |

Technological developments have been instrumental in fueling the development of the genetic testing market in India. Advancements like next-generation sequencing and sophisticated polymerase chain reaction technologies have highly enhanced the reliability, pace, and affordability of genetic testing methods. According to the sources, in January 2025, India's Indian Genomic Data Set and IBDC Portals opened up global access to 10,000 whole genome samples, accelerating genomics research and the India Genetic Testing Market. Moreover, these advances in technology have made it possible for medical practitioners to provide expansive genetic examinations at reduced prices, which has made testing accessible to larger numbers of people. The adoption of advanced bioinformatics tools enables the efficient interpretation of large genetic data, improving diagnostic accuracy. Moreover, laboratory equipment automation and miniaturization have simplified testing protocols, which shorten turnaround times and enhance efficiency. These advances enable various clinical applications such as prenatal screening, oncology diagnostics, and rare disease identification. Consequently, the increased availability and affordability of sophisticated genetic testing technologies are facilitating their increased use in both clinical and research environments, and hence significantly fueling India genetic testing market growth.

To get more information on this market, Request Sample

Rising awareness of healthcare and the focus on early disease diagnosis are crucial drivers of the growth of the genetic testing market in India. Rising awareness among patients, doctors, and policymakers of the advantages of genetic screening for the identification of hereditary diseases has boosted demand for these services. For instance, in March 2024, Xcode Life released the "Genes and Caffeine" test, providing individualized information on caffeine sensitivity and metabolism through DNA, assisting users in optimizing health and performance. Furthermore, educational efforts and wider media dissemination have heightened awareness of the place of genetic testing in personalized medicine and preventive care. The early detection of genetic diseases allows for timely and specific intervention, enhancing patient outcomes and lowering long-term healthcare expenditures. Furthermore, the implementation of prenatal and newborn screening programs demonstrates a heightened level of societal investment in active health management. The application of genetic testing to assess and manage cancer risk is also increasingly prevalent. This combined emphasis on early diagnosis and individualized treatment enables the sustained demand and growth of the Indian genetic testing market.

India Genetic Testing Market Trends:

Government Policies and Technological Advances

The India genetic testing market is growing fast because of high-tech advances and forward-looking government policies. Advances in testing technologies have ensured genetic screening to be more accurate, cost-effective, and convenient. The advances are bolstered by the Ministry of Science & Technology's ambitious target of 2025 to sequence 10 million genomes, reflecting increased governmental support for genomics studies and targeted medicine. This project would develop an enormous genomic database to understand more about genetic diseases, enhance early detection, and customize medical treatment to genetic profiles. India's huge burden of rare genetic diseases involving an estimated 70 million individuals makes large-scale genome sequencing an important step in improving healthcare outcomes. The interplay of advancing technology and state-supported initiatives is gaining traction in the use of genetic testing in both public and private healthcare settings, fueling intense India genetic testing market forecast. This development also fosters innovation and cooperation among research institutions, pharmaceutical firms, and diagnostic facilities.

Increasing Disease Burden and Awareness of Early Detection

The growth of India's genetic testing industry is significantly fueled by the rising incidence of genetic diseases as well as growing awareness regarding early detection of diseases. With millions of people suffering from rare hereditary diseases, demand for genetic screening and diagnostic tests has grown. Both patients and healthcare providers are getting more educated on the value of genetic testing in detecting risks before symptoms develop, allowing for early intervention and preventive measures. Awareness campaigns and educational programs are making genetic testing more acceptable and normal as part of standard health checkups, particularly among at-risk populations. Additionally, inclusion of genetic testing as part of regular healthcare procedures makes diagnosis more accurate, minimizing misdiagnosis and wasteful treatment. Early identification by genetic information can greatly enhance patient outcomes and decrease long-term healthcare expenditure. As these advantages become apparent to insurers and healthcare systems, genetic testing is increasingly being covered, further driving market penetration and stimulating use in a variety of healthcare environments.

Personalized Medicine, DTC Services, and Industry Collaboration

Increased focus on individualized medicine is one of the key driving factors for India genetic testing market outlook. Genetic information enables doctors to create tailored treatment strategies according to unique DNA profiles, enhancing efficacy, particularly in cancer therapy, prenatal diagnosis, and the management of chronic diseases. Direct-to-consumer (DTC) genetic testing facilities have also gained immense popularity, providing people with direct access to health and ancestry data. This consumer-centric strategy is underpinned by growing digital health platforms and rising public interest in anticipatory health management. At the same time, cooperation between research centers, pharmaceutical firms, and diagnostic labs creates an environment for research in testing technologies and bioinformatics tools. These collaborations expedite the advancement of new genetic tests and data models of interpretation. Moreover, regulatory frameworks are shifting to provide guarantees of quality and reliability of genetic tests, thereby building consumer confidence. Cumulatively, these elements are transforming India's healthcare system with genetic testing playing a central role in personalized healthcare plans and enhanced patient outcomes.

India Genetic Testing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India genetic testing market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, technology, and application.

Analysis by Type:

- Predictive and Presymptomatic Testing

- Carrier Testing

- Prenatal and Newborn Testing

- Diagnostic Testing

- Pharmacogenomic Testing

- Others

Diagnostic testing had the biggest market share in the India genetic testing market in 2024 at 44.7% due to its crucial role in establishing the presence of genetic conditions in symptomatic patients. Diagnostic testing is essential in most areas of medical specialties such as oncology, cardiology, pediatrics, and neurology. In India, awareness of genetic diseases, increasing prevalence of rare and chronic conditions, and growing embrace of precision medicine have all played a key role in the predominance of diagnostic testing. Specialty clinics and hospitals are increasingly incorporating genetic diagnostics into standard clinical workstreams, backed by enhanced laboratory facilities and trained genetic counselors. In addition, growth in government health initiatives and public-private collaborations to enhance early diagnosis is driving widespread adoption of diagnostic testing. As both clinicians and patients increasingly prioritize correct disease identification and individually oriented treatment options, diagnostic testing leads the market with robust adoption momentum.

Analysis by Technology:

- Cytogenetic Testing and Chromosome Analysis

- Biochemical Testing

- Molecular Testing

- DNA Sequencing

- Others

Molecular testing had the largest percentage of 53.7% in India's genetic testing market in 2024 due to its widespread applicability, high sensitivity, and growing affordability. This category comprises sophisticated methods like DNA sequencing, PCR, and microarray technologies that allow for the detection of targeted mutations and genetic variations at the molecular level. Molecular testing has emerged as the backbone of contemporary genetic diagnostics in India with applications ranging from rare genetic disorders to complicated diseases such as cancer and cardiovascular disease. The growth of the market is anchored by decreasing prices of sequencing technologies, easier availability of high-throughput laboratories, and expanding clinical recognition of the utility of genetic information. Furthermore, molecular testing has an important role to play in personalized medicine, making it possible to customize treatment according to the genetic makeup of a patient. Its accuracy, scalability, and versatility over a large number of diagnostic uses place molecular testing at the heart of India's developing precision healthcare system.

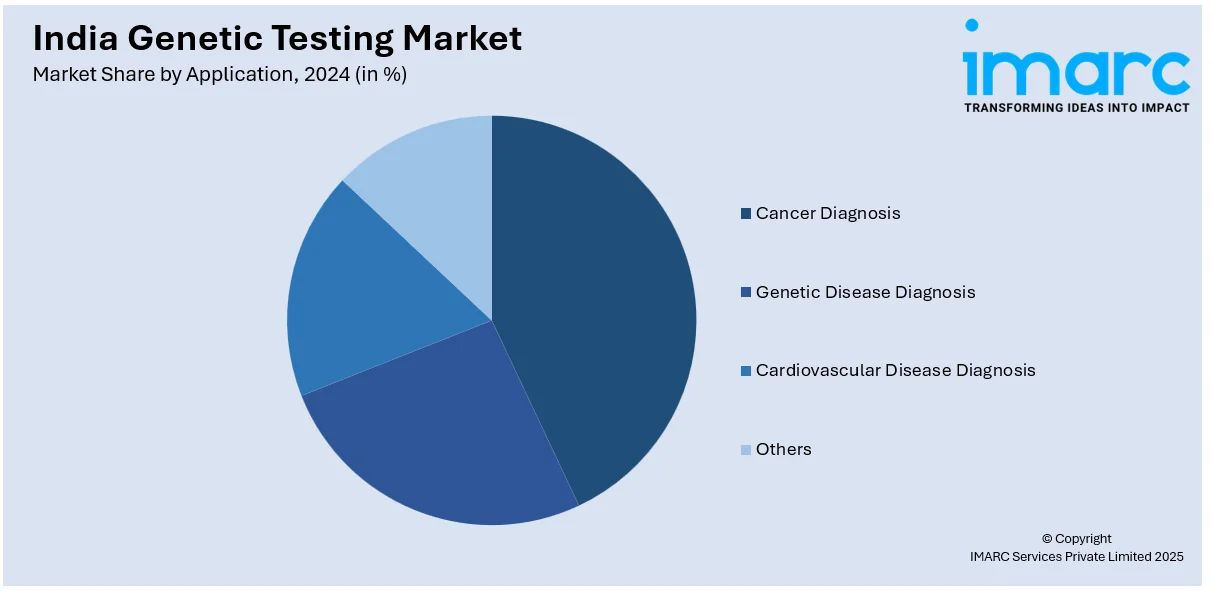

Analysis by Application:

- Cancer Diagnosis

- Genetic Disease Diagnosis

- Cardiovascular Disease Diagnosis

- Others

Cancer diagnosis became the top segment of application in India's genetic testing market in 2024, at 37.6% market share. The growing incidence of cancer cases in the country has resulted in greater dependence on genetic testing for disease detection at an early stage, risk stratification, and individualized treatment planning. Genetic cancer testing identifies inherited mutations like BRCA1/2 and guides targeted treatments for enhanced treatment outcomes and patient benefits. India's integration of oncology and genomics is picking up momentum, especially in city centers that are well-equipped with advanced diagnostic and research centers. As oncologists increasingly adopt genetic tests into everyday cancer treatment, clinical need, patient awareness, and widening availability of genetic counseling services are driving demand. Additionally, national cancer control programs and public health programs have started acknowledging the role of genomic tools in cancer prevention and control, thus further cementing this category's market-leading status.

Regional Analysis:

- North India

- West and Central India

- South India

- East and Northeast India

North India is the leader in genetic testing services with a high density of hospitals, laboratories, and research centers. Delhi and other urban cities are hotspots for high-end diagnostics. Support from regional governments and public health consciousness are fueling increased usage of genetic services among healthcare sectors here.

West and Central India are becoming vibrant markets for genetic testing, enabled by infrastructure development and rising healthcare expenditure. Urban areas such as Mumbai and Ahmedabad are witnessing increasing demand for genetic diagnostics, fostered by research collaborations, medical tourism, and incorporation of sophisticated testing facilities in healthcare establishments.

South India is in the vanguard of India's genetic testing industry, boasting developed medical establishments and a healthcare culture that fosters innovation. Bengaluru, Hyderabad, and Chennai are genetic testing and biotech centers, supported by trained professionals, digital health embracement, and a solid base for medical research and diagnostics.

East and Northeast India are slowly embracing genetic testing, driven by enhanced access to healthcare and outreach efforts by the government. Although presently constrained by infrastructure, initiatives to develop diagnostic capability and enhance genetic literacy are opening the door to wider usage, particularly in maternal care, rare disorders, and preventive medicine.

Competitive Landscape:

The India genetic testing industry is marked by rising competition fueled by ongoing innovation and widening service lines. Industry participants are competing on improving the accuracy, turnaround time, and price of genetic tests to reach more customers. Differentiation by way of high-technology integration, including next-generation sequencing and machine learning (ML) enabled data interpretation, has emerged as a critical competitive parameter. Providers also diversify their portfolio to encompass a variety of applications such as prenatal screening, oncology, and rare disease testing to address increasing demand. Strategic collaborations with healthcare providers, research centers, and diagnostic labs are prevalent to leverage service reach and credibility. Moreover, the growing popularity of direct-to-consumer (D2C) genetic testing has brought in new entrants with convenience and personalized wellness insights as their focus. With increasing awareness and acceptance of genetic tests, market participants constantly evolve in response to regulatory conditions and consumer needs to drive leadership through innovation, quality, and accessibility. This healthy competitive landscape promotes competition, fueling market growth and technological advancements in India's genetic testing industry.

The report provides a comprehensive analysis of the competitive landscape in the India genetic testing market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Fortis Healthcare launched the Fortis Institute of Genomic Medicine to advance personalized, gene-targeted care for diseases like cancer, heart conditions, and neurological disorders. The institute integrates genomics with specialties, such as oncology and cardiology, to enhance diagnosis, treatment precision, and early detection of complex and inherited conditions.

- February 2025: Metropolis Healthcare partnered with Roche Diagnostics to launch a self-sampling HPV DNA test for cervical cancer screening in India. The test aims to improve early detection and expand access nationwide, especially in tier 2 and tier 3 cities, aligning with WHO recommendations for cost-effective, long-term genetic screening.

- February 2025: MedGenome launched the #CarefortheRare campaign ahead of Rare Disease Day 2025, emphasizing genomic testing’s role in diagnosing and managing rare diseases. Through a documentary, the initiative highlighted patient stories, promoted early detection, and showcased how advances like NGS and AI integration enabled faster, cost-effective solutions for rare genetic conditions.

- February 2025: Miltenyi Biotec inaugurated a cell and gene therapy center-of-excellence in Hyderabad, enhancing the country’s biotech capabilities. Spanning 1,800 sqm in Genome Valley, the MITC integrated cutting-edge tools and training platforms to support research in oncology and immunology, fostering collaboration and innovation in advanced therapeutic development and personalized medicine.

- January 2025: Agilus Diagnostics launched rapid, personalized assays for cancer and myeloid disorders. Utilizing NGS, it delivers myeloid malignancy reports in three days and liquid biopsy results in two, enabling faster clinical decisions, enhancing precision oncology, and setting new industry benchmarks for speed, accuracy, and patient-centric care.

India Genetic Testing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Predictive and Presymptomatic Testing, Carrier Testing, Prenatal and Newborn Testing, Diagnostic Testing, Pharmacogenomic Testing, Others |

| Technologies Covered |

|

| Applications Covered | Cancer Diagnosis, Genetic Disease Diagnosis, Cardiovascular Disease Diagnosis, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India genetic testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India genetic testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India genetic testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The genetic testing market in the India was valued at USD 1.84 Billion in 2024.

The India genetic testing market is projected to exhibit a CAGR of 6.75% during 2025-2033, reaching a value of USD 3.47 Billion by 2033.

The major drivers for the India genetic testing market are rising incidence of genetic and chronic illnesses, enhanced awareness of early diagnosis, and technological advancements in testing. Increased government support for genomics, increased usage of personalized medicine, and increasing access to direct-to-consumer services also drive the market. Joint ventures between healthcare professionals and research organizations also boost innovation and service offerings.

The diagnostic testing segment held the largest proportion of the India genetic testing market at 44.7%. This is due to its extensive use in the identification of genetic disorders to aid in early and correct diagnosis. Increased demand for targeted treatments as well as regular screening further substantiates the leading role of the segment in the India Genetic Testing Market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)